Costco Wholesale Corp (COST) stock has rebounded from lows at the end of last month. I wrote two Barchart articles arguing COST stock is worth over $1,038 per share and several ways to play it. How have they done?

COST stock is at $979.29 in midday trading on Monday, Jan. 26. That's up +12.13% from $873.35 on Dec. 28, when I wrote the Barchart article, “Costco Has Tumbled Despite Higher FCF and FCF Margins - Time to Buy COST Stock?”

I showed that, based on its strong free cash flow (FCF) and FCF margins (including implied higher operating leverage), Costco could generate $10.68 billion in FCF over the next 12 months (NTM).

Using a 2.32% FCF yield metric, this implied that its future value could be worth as much as $460 billion (i.e., $10.68b/0.0232). Today, Yahoo! Finance reports that COST stock now has a market cap of $435 billion.

In other words, there is still +5.75% upside available (i.e., $460b/$435b-1). That implies that a new stock price target (PT):

$979.29 x 1.0575 = $1,035.60 PT

But is that enough for investors? Has most of the potential upside in value already been achieved? That might occur, leaving the stock with potential downside risk.

For example, has it moved too far, too fast? Will investors beat COST down ahead of earnings?

As a result, what is the best way to play this ahead of Costco's expected earnings release on March 5?

Returns from Using Options to Play COST Stock

I discussed 3 ways to play COST stock last month in a follow-up, separate Barchart article on Dec. 9, 2025, ("A Less-Costly Way to Buy Costco to Gain Leveraged Upside in COST Stock."). How did they do?

I discussed three plays: buying in-the-money (ITM) calls in long-dated (over one-year away) expiry periods, shorting out-of-the-money (OTM) covered calls one-month away, and shorting out-of-the-money (OTM) puts in a one-month expiry period.

These have all worked out well, although the OTM covered calls ($915 strike price) with a $6.38 call premium received (i.e., $921.38 all-in) will be exercised on or before Jan. 30. The investor will have made a total return of 5.5%, vs. 12.13% holding COST shares.

Moreover, the short-put OTM play ($830 strike price also expiring Jan. 30) will likely result in the investor collecting just $5.28, or 0.636%, as the put will likely expire worthless.

However, the in-the-money (ITM) $850.00 call option expiring Jan. 15, 2027, is now worth $191.80 at the midpoint, vs. $111.03 paid on Dec. 29. That represents a potential return of +72.75% vs. holding COST shares return of +12.13% (see above).

Altogether, the investor who could afford to put up the capital to invest in all three plays would have made a good income. That could vary depending on the investor's margin and equity balances. Clearly, the best return would have been to buy in-the-money (ITM) calls.

However, COST stock may be nearing a peak here. What is a conservative play here?

Shorting Out-of-the-Money Puts and Calls

Two defensive plays here are to sell short one-month expiry puts and calls in out-of-the-money (OTM) strike prices.

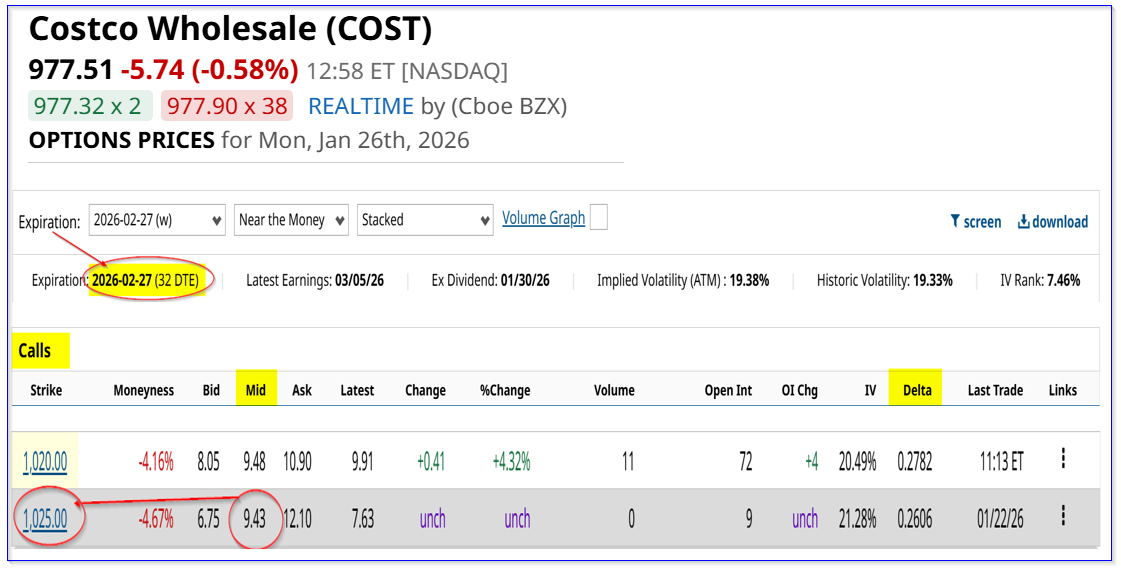

For example, using a covered call OTM call strategy (i.e., assuming COST won't rise much further over the next month), an investor could short the Feb. 27, 2026, $1,025 call option at the midpoint of $9.43.

That provides an immediate yield of almost 1% (i.e., $9.43/$977.62 = 0.00965 = 0.965%). The delta ratio is just 0.26, implying just a 26% chance that COST will rise to $1,205 by expiration.

The total potential return is higher, though, if COST rises to $1,025 or close to this price (i.e., if the investor may have to sell covered COST shares):

$1,025 / $977.51 -1 = 4.858% capital gain, plus

0.965% income return = +5.823% total potential return

The only issue here is that if COST rises over $1,025, the investor could be giving up extra return.

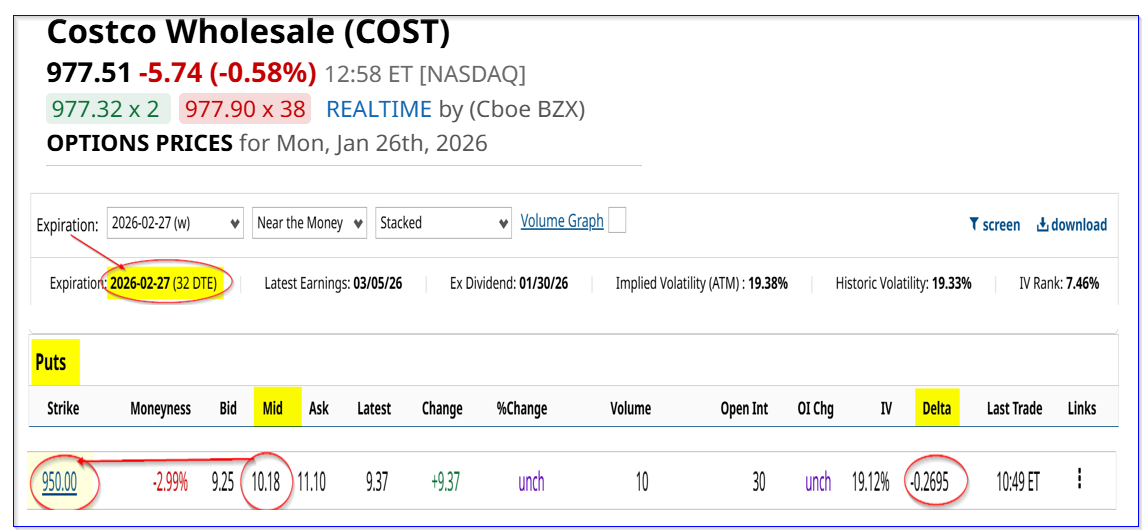

Another play is to sell short deep out-of-the-money (OTM) puts. That could be done in addition to the covered call play, but it involves securing additional collateral.

For example, the Feb. 27, 2026, expiry period shows that the $950 put strike price has a midpoint premium of $10.18. That provides a short-seller a one-month yield of 1.07% (i.e., $10.18/$950).

However, if COST falls to the $950 strike price, the investor has better downside protection. This is because the income already received lowers the breakeven point:

$950 - $10.18 = $939.82 breakeven

That is -3.86% below today's price. Moreover, it could allow an investor to lower their average cost in COST stock. Note that there is no potential upside if COST rises.

However, an investor could use this income to buy further OTM puts to potentially protect on the downside. For example, the $940 strike price put costs just $7.93, leaving a net credit of $2.25 ($10.18-$7.93).

Moreover, for even more downside protection, an investor could decide to sell short an in-the-money (ITM) put option over the next month, such as the $990 strike price for $26.90. However, unless COST rises over $990, the investor may be forced to buy shares at $990.00 by Feb. 27, which is higher than $977.51 today. After accounting for the $26.90 income, the net breakeven cost would be $963.10 (i.e., $990-$26.90), which is -1.47% lower than today's price.

The bottom line is that COST stock looks undervalued here. There are several ways to play it over the next month using out-of-the-money puts and calls that could make sense.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Technologies (SOFI) is Flashing an Intriguing Quant Setup Ahead of Q4 Earnings

- Costco Stock Has Moved Up Over the Last Month - What Are the Best Plays Now?

- A Storm Is Brewing: How To Manage Risk and Weather Financial Turbulence in 2026

- Copper Shortage Isn't a Blip! It's the New Reality for Traders