IonQ (IONQ) shares ended in the red today after announcing a $1.8 billion acquisition of SkyWater Technology (SKYT) to become industry’s first vertically integrated quantum computing platform.

The quantum-tech specialist plans on using $770 million of its cash to fund this deal, while the rest will be paid in IONQ stock.

In other words, IonQ is burning over two-thirds of a billion dollars on SKYT while simultaneously diluting its current shareholders, which, of course, is a hard pill for the market to swallow.

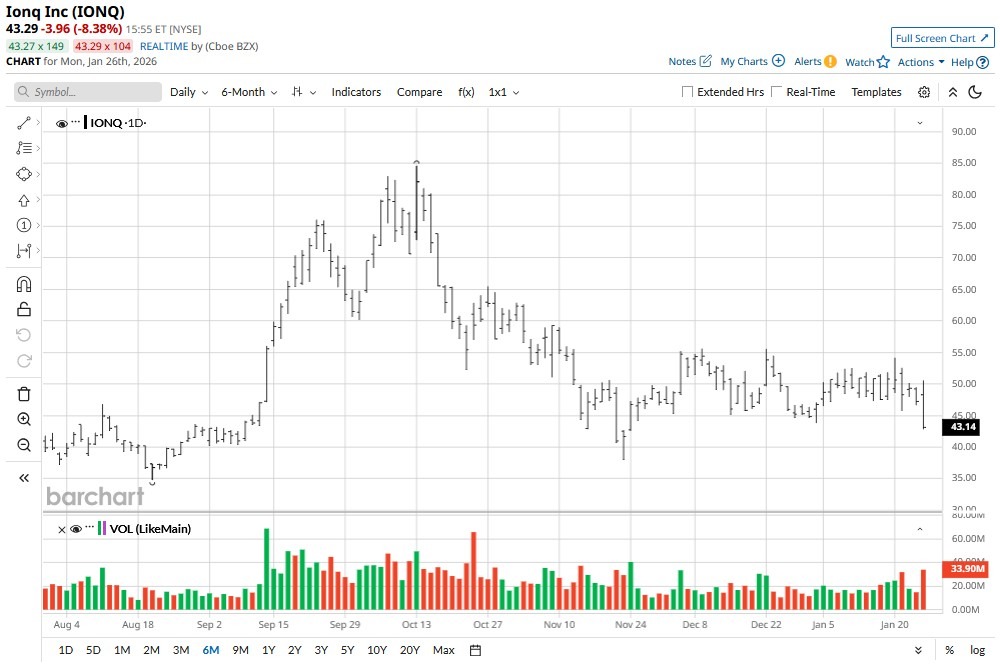

For long-term investors, however, the pullback may be an opportunity to load up on IONQ shares that are now trading at nearly half their price in October of 2025.

Should You Buy IonQ Stock on SkyWater Acquisition?

Internalizing chip production through SkyWater’s facilities helps IonQ “accelerate” its roadmap to achieve functional testing of 200,000-qubit processors by 2028.

Over time, the acquisition may enable “over 8,000 logical qubits” while compressing development timelines through reduced wafer iteration cycles.

Additionally, federal tailwinds support this buyout as well — since the Trump administration wants America to lead in quantum computing and prioritizes domestic semiconductor production.

SkyWater manufactures in the U.S. and holds “DMEA Category 1A Trust Foundry” accreditation, which align it perfectly with national security initiatives to strengthen supply chain resilience and technological sovereignty.

What Options Data Suggests Lies Ahead for IONQ Shares

In the near term, IonQ’s upcoming earnings could prove a catalyst that drives its stock higher.

Consensus is for the quantum technology company to lose $0.48 a share in its fiscal Q4 — nearly half of what it lost in the same quarter last year.

Note that IONQ shares’ 14-day relative strength index (RSI) slipped below 40 on Jan. 26, signaling the bearish momentum is near exhaustion.

More importantly, options traders are pricing in a rally to $56 in this quantum computing stock over the next three months, indicating potential upside of roughly 30% from here.

Wall Street Remains Bullish On IonQ

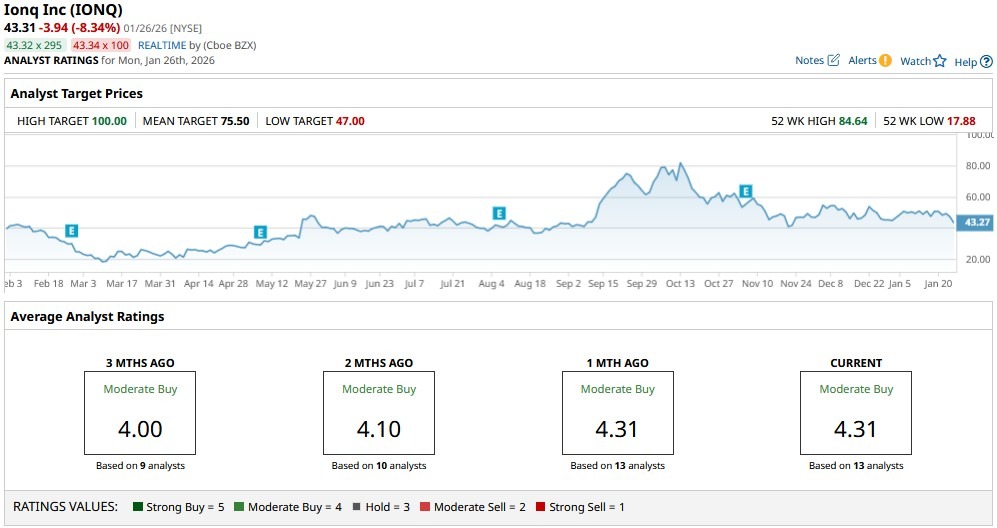

Wall Street analysts seem to agree with derivatives data for IonQ stock.

According to Barchart, the consensus rating on IONQ remains a “Moderate Buy,” with the mean target of about $75 suggesting potential upside of nearly 80% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Microsoft Reports Q2 Earnings Jan. 28. Is MSFT Stock a Buy Before Then?

- As IonQ Snaps Up SkyWater Technology for $1.8B, Should You Buy the Quantum Computing Stock Here?

- What's Next for Sandisk Stock After a 1,000% Rally?

- USAR Stock Is Solidly in Overbought Territory as Trump Invests in USA Rare Earth. Can You Still Chase the Rally Here?