The Trump administration's tariff policies have kept the economy on tenterhooks. Fears of a rise in inflation remain widely prevalent, and to some extent, they are not misplaced. Yet, the economy continues to chug along at a healthy tick. The reason? The K-shaped nature of it. While the higher-income cohort remains mostly indifferent to the vagaries of their relatively less well-off brethren, people belonging to the middle class and below are finding it difficult to navigate their daily lives due to the rise in prices of everyday essentials. This is quite evident from this report from the Federal Reserve Bank of Cleveland.

The study confirmed that low-income households faced a consistently higher effective inflation rate because they spend a disproportionate amount of their income on rent and food. These are categories where prices remained "sticky" and high, while high earners benefited more from softening prices in discretionary goods.

However, financial services major Bernstein believes there may be something to cheer for the middle class and lower middle class at last in the form of tax refunds due to the One Big Beautiful Bill Act. Notably, the firm expects the refunds to add about “$1.0k–$2.0k per household.”

Thus, with an increase in disposable income, which stocks can see an upside from this expected rise in spending? Bernstein believes these three are the best-placed (spoiler: they are all retailers).

Winning Stock 1: Costco (COST)

Founded in 1983, Costco (COST) operates a membership-only wholesale club model where customers pay an annual fee to shop in bulk at low prices across a wide range of categories, such as groceries, electronics, perishables, etc. Notably, it is a global leader in membership warehouse retailing with hundreds of locations worldwide.

Valued at a market cap of $436.4 billion, the COST stock is up 5% over the past year. Meanwhile, the stock's current dividend yield is at 0.53%, and the company has been raising dividends consecutively over the past 21 years. Further, with a payout ratio of just under 30%, the scope for growth remains.

In terms of financials, Costco's record has been nothing remarkable, but it has been steady. Over the past 10 years, Costco's revenue and earnings have grown at CAGRs of 9.18% and 13.26%, respectively. Notably, the most recent quarter saw the company reporting a beat on both revenue and earnings.

For the first quarter ended Nov. 23, 2025, Costco's total revenue stood at $67.3 billion, up 8.3% from the previous year. Earnings of $4.50 per share were up from $4.04 per share in the year-ago period, also coming in higher than the expectations of an EPS of $4.27. Notably, this was the third consecutive quarter of earnings beat from the company.

Net cash from operating activities also increased to $4.7 billion from $3.3 billion in the prior year as the company closed the quarter with a cash balance of $16.2 billion with no short-term debt on its balance sheet.

However, the stock trades at punchy valuations. Its forward P/E, P/S, and P/CF at 48.48, 1.47, and 39.35 are all higher than the sector medians of 16.25, 1.12, and 12.22, respectively.

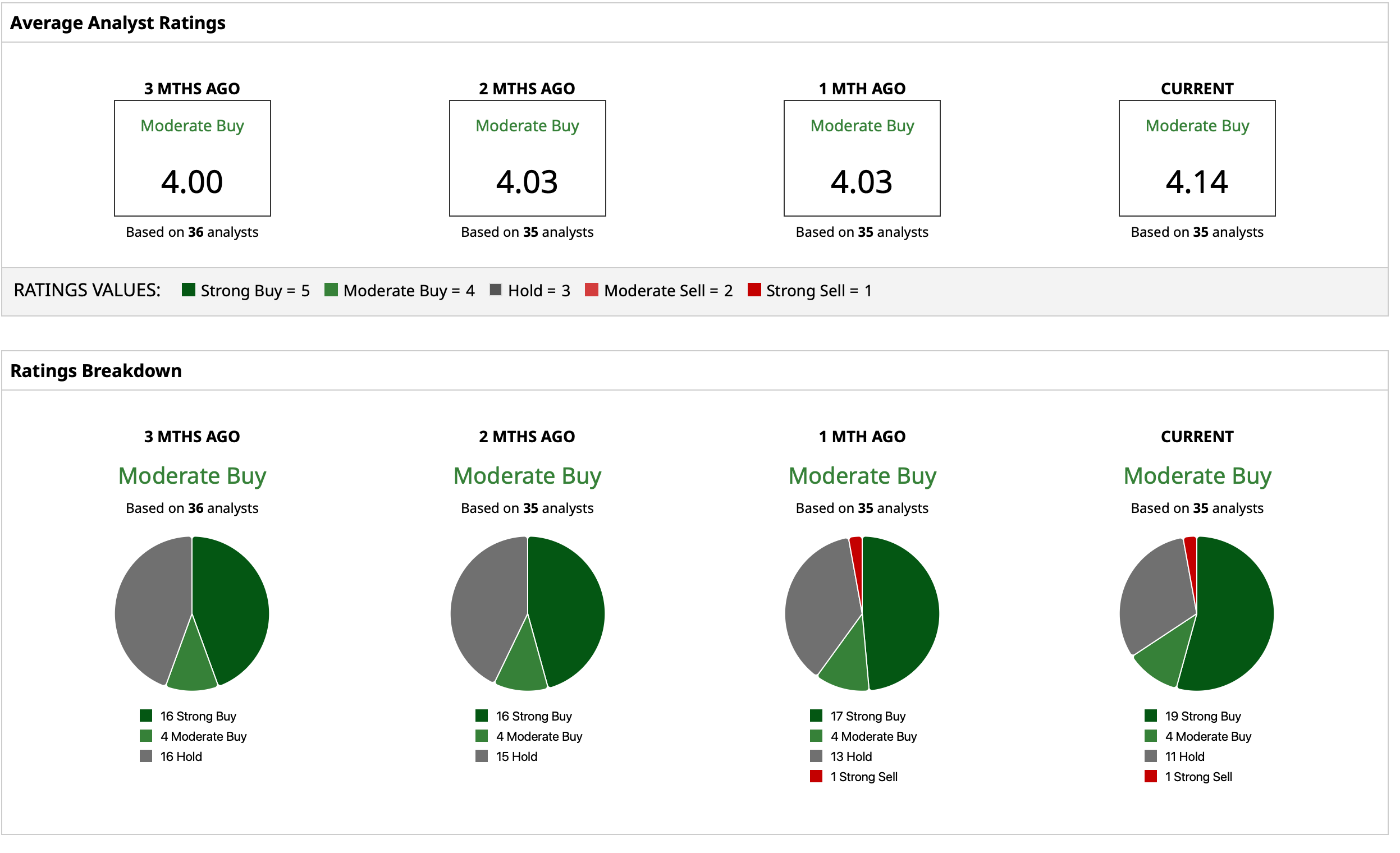

Considering all this, analysts have attributed a consensus rating of “Moderate Buy” to COST stock, with a mean target price of $1,043.32. This indicates an upside potential of about 6.1% from current levels. Out of 35 analysts covering the stock, 19 have a “Strong Buy” rating, four have a “Moderate Buy” rating, 11 have a “Hold” rating, and one has a “Strong Sell” rating.

Winning Stock 2: TJX Companies (TJX)

TJX Companies (TJX) has its roots in the off-price retail model, with the first T.J. Maxx stores opening in 1977. It is the largest off-price retailer in the U.S. and a major global player in off-price apparel, home fashions, and accessories. Its business model centers on offering a rapidly changing assortment of quality, fashionable, brand-name merchandise at prices typically below those of full-price retailers.

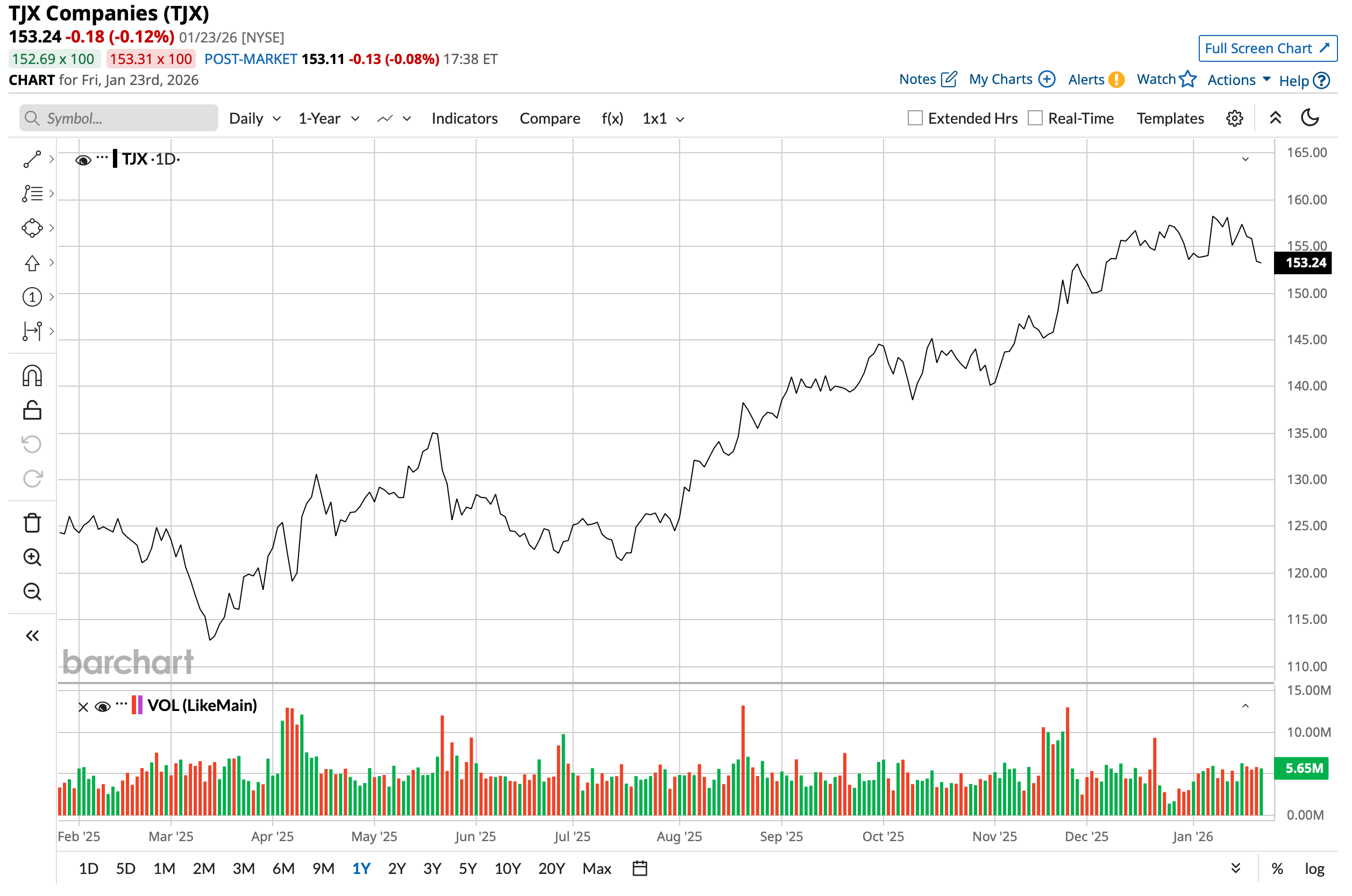

With a market cap of $170.2 billion, the TJX stock is up 23% over the past year. Further, the stock offers a dividend yield of 1.11%, which is higher than the sector median of 1.013%. The company has been raising dividends consecutively for almost 30 years now, making it a “Dividend Aristocrat.”

Dividend raises have been accompanied by reasonable CAGRs in revenue and earnings at 6.89% and 8.52%, respectively. Notably, the latest results for Q3 2025 were impressive as well, with both revenue and earnings topping estimates.

Net sales grew by 7% from the previous year to $15.1 billion as gross margins improved by 100 bps to 32.6% in the same period. Earnings went up by 12.3% on a year-over-year (YoY) basis to $1.28 per share, surpassing the Street estimates of $1.23 per share. Encouragingly, this was the ninth straight quarter of earnings beats from the company.

Coming to cash flows, for the first nine months ended Nov. 1, 2025, TJX reported net cash from operating activities of $3.7 billion, up from $3.4 billion in the prior year. Overall, the company closed the quarter with a cash balance of $4.6 billion. Although this was higher than the short-term debt levels of $2.7 billion, the quantum of short-term debt increased by 68.8% from the previous year.

The stock's valuation also remains above sector medians with a forward P/E, P/S, and P/CF at 32.76, 2.84, and 25.02, all higher than the sector medians of 17.89, 0.98, and 12.19, respectively.

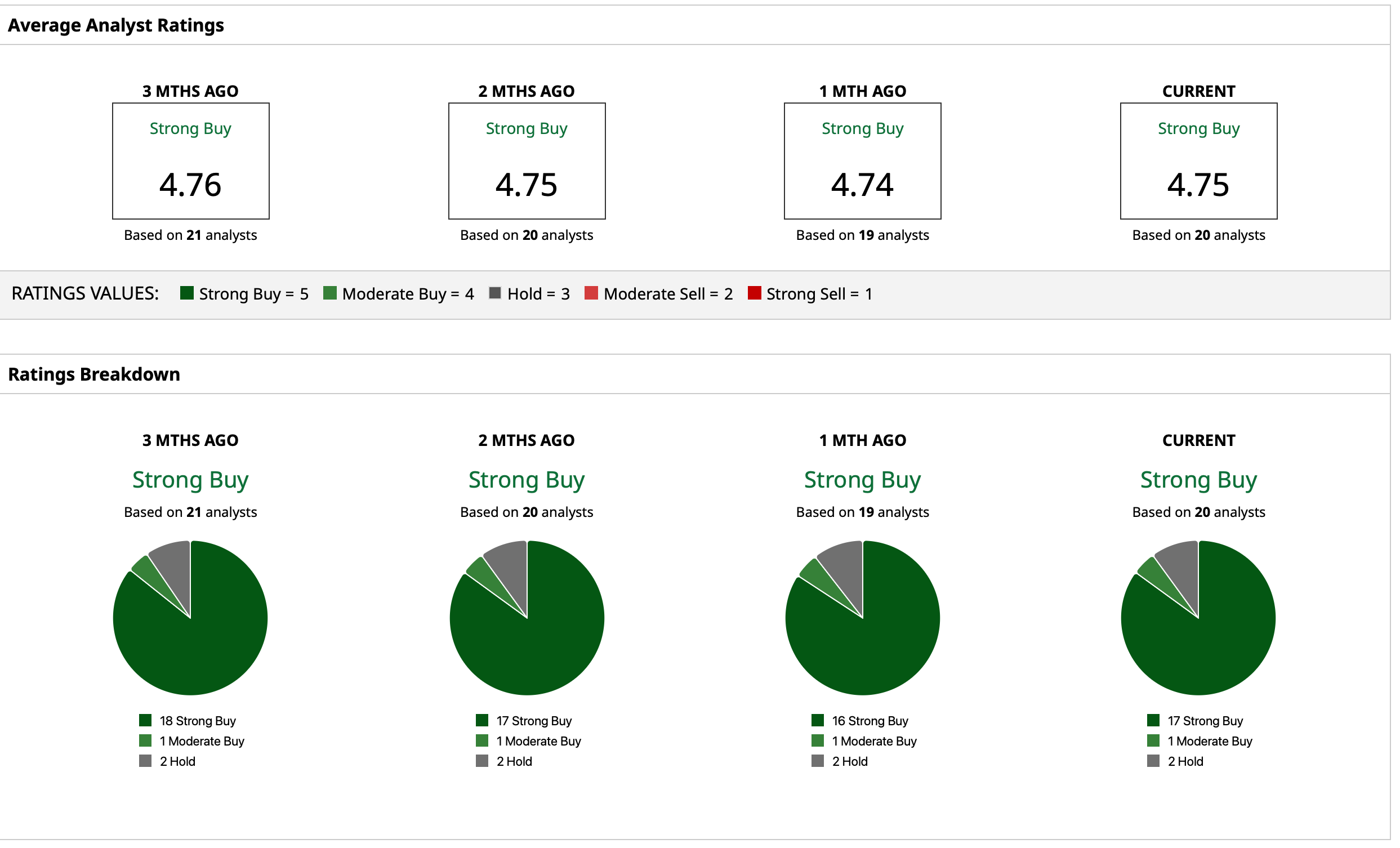

Yet, the Street has earmarked an overall consensus rating of “Strong Buy” for the stock with a mean target price of $167.26. This denotes an upside potential of about 9% from current levels. Out of 20 analysts covering the stock, 17 have a “Strong Buy” rating, one has a “Moderate Buy” rating, and two have a “Hold” rating.

Winning Stock 3: Walmart (WMT)

We conclude our list with the largest retailer in the world, Walmart (WMT). Founded in 1962, Walmart is a multichannel retail leader, serving customers through extensive physical and digital platforms. Walmart’s combination of store footprint, membership business (Sam’s Club), and online marketplace creates a uniquely diversified retail ecosystem that integrates digital convenience with physical network advantages.

With a mammoth market cap of $938.3 billion, the WMT stock is up 25% over the past year. Notably, the stock offers a dividend yield of 0.80%. It may seem modest, but Walmart has been increasing dividends every year for the past 52 years, making it a member of the coveted “Dividend King” club. And, with a payout ratio of just about 35%, the headroom for further growth remains.

Walmart's revenue and earnings have clocked CAGRs of 3.80% and 4.15%, respectively, over the past 10 years. Additionally, after a rare earnings miss in the previous quarter, Walmart is back to exceeding Street expectations, with a beat on both the top line and bottom line.

In fiscal Q3 2026, Walmart's revenues were $179.5 billion, up 5.8% from the previous year. Meanwhile, earnings rose by 6.9% from the previous year to $0.62 per share, coming in slightly ahead of the consensus estimate of $0.60 per share. Overall, over the past nine quarters, Walmart's EPS have topped expectations on eight occasions.

Net cash from operating activities increased to $27.4 billion for the nine months ended Oct. 31, 2025. This marked an annual rise of 19.8%. Overall, Walmart closed the quarter with a cash balance of $10.6 billion, which is lower than the short-term debt levels of $14.4 billion. Although this may seem concerning, Walmart's steadily growing revenues, even at such a scale, and strong cash flows from operations give Walmart a solid standing.

However, like its peers above, Walmart's valuations remain uncomfortably high. With a forward P/E, P/S, and P/CF of 44.63, 1.33, and 24.85, the metrics are all higher than the sector medians of 6.25, 1.12, and 12.22, respectively.

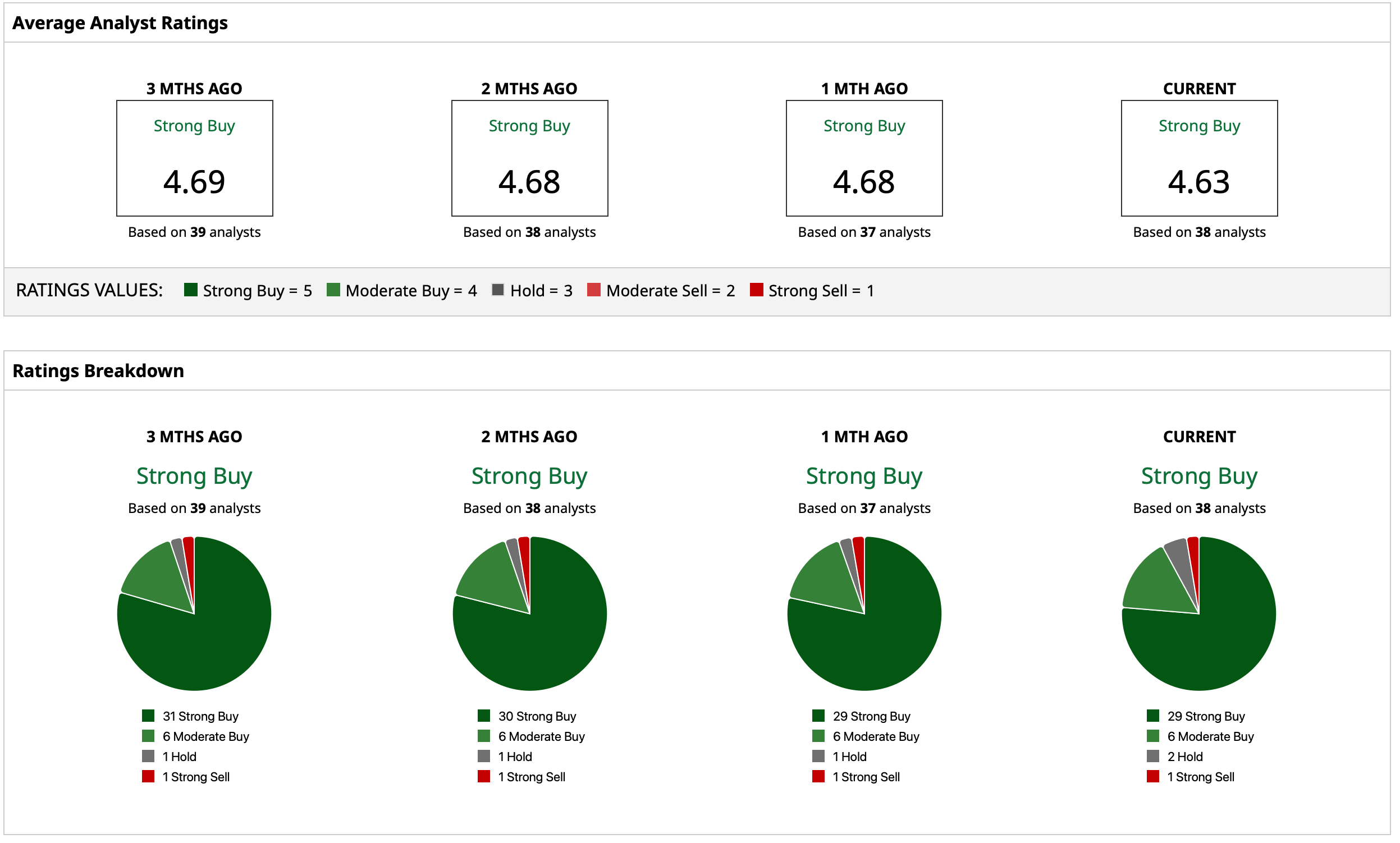

Taking all of this into account, analysts have still assigned a consensus rating of “Strong Buy” for the WMT stock, with a mean target price of $123.73, which denotes an upside potential of roughly 5.1% from current levels. Out of 38 analysts covering the stock, 29 have a “Strong Buy” rating, six have a “Moderate Buy” rating, two have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart