The rapid rise of AI hyperscalers has shaken confidence across the enterprise software landscape, sparking fears that traditional platforms could be disrupted or commoditized as generative AI becomes more powerful and widely accessible. In recent months, those concerns have weighed heavily on software stocks, driving sharp pullbacks even among companies with long track records of growth, sticky customers, and recurring revenue models. For many investors, the question has shifted from how fast these businesses can grow to whether they can remain relevant at all in an AI-dominated world.

Wall Street analysts, however, are pushing back on the most bearish narratives. For example, BNP Paribas argues that some enterprise software leaders are far more resilient than the market gives them credit for. “We view our January survey results as cautionary for the software sector, reinforcing recent negative sentiment,” BNP Paribas analyst Stefan Slowinski said in a note. “Hyperscalers continue to be winners with relatively resilient spend scores reported for Microsoft, AWS, and GCP, and increasing demand for public cloud. SAP and ServiceNow stood out positively with improving demand.”

In this article, we will take a closer look at two “resilient” software stocks highlighted by BNP Paribas: ServiceNow (NOW) and SAP SE (SAP).

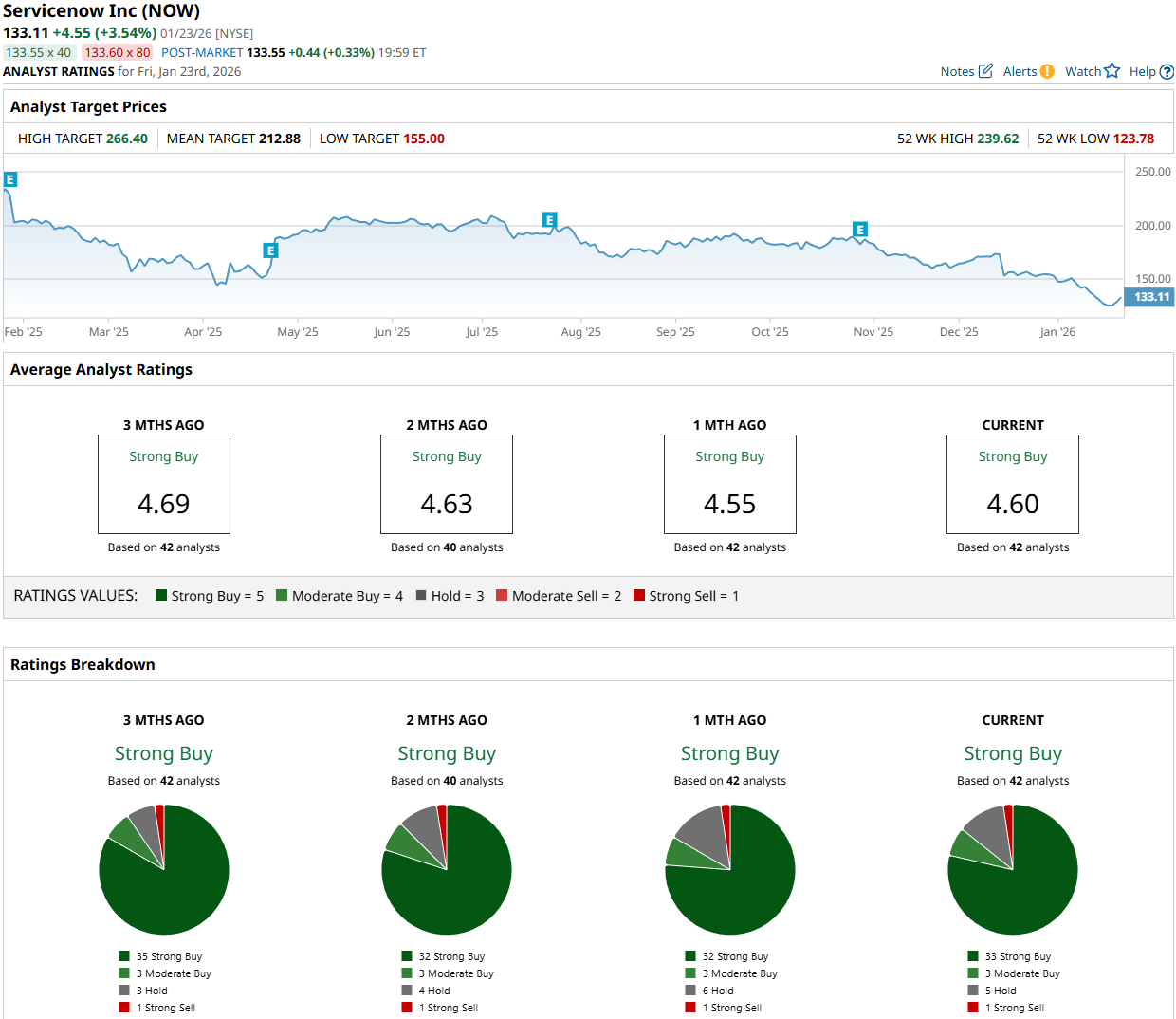

“Resilient” Software Stock #1: ServiceNow (NOW)

ServiceNow is a prominent provider of cloud-based digital workflow solutions. The company operates the ServiceNow AI Platform, which integrates with any cloud, model, or data source to orchestrate workflows across the enterprise. It offers a broad suite of products across areas such as IT service management, customer service management, operational technology management, and security operations. ServiceNow’s customer base includes more than 85% of the Fortune 500 and nearly 60% of the Global 2000. It has a market cap of $138.1 billion.

Shares of the enterprise software firm started the new year on a downbeat note, down 12% on a year-to-date (YTD) basis, extending a slide that weighed on the stock throughout 2025 amid concerns that AI could devastate its business model.

Despite describing ServiceNow as a “resilient” software company, BNP Paribas Exane’s Slowinski cut his price target on the stock to $120 from $186, implying moderate downside from current levels, while maintaining a “Neutral” rating.

ServiceNow shares have been in a steep decline over the past few months as investors continue to worry about potential disruption from AI-focused competitors. The selloff intensified this month after Anthropic unveiled Claude Cowork, a tool built to tackle complex tasks such as coding, enterprise workflows, and advanced reasoning. Some analysts believe that some of ServiceNow’s offerings could be disrupted as AI models continue to advance.

Despite fears of AI-driven disruption, the company’s latest earnings report indicated that the business continues to grow at a double-digit pace. ServiceNow posted third-quarter total revenue of $3.41 billion, up 21.8% year-over-year (YoY) and beating Wall Street’s expectations by $50 million. Of that total, $3.3 billion came from subscriptions, a 21.5% increase from a year earlier, driven mainly by increased purchases by new and existing customers. Its quarterly GAAP earnings stood at $2.40 a share, beating expectations by $0.20.

Meanwhile, ServiceNow’s current remaining performance obligations (cRPO), revenue expected to be recognized over the next 12 months, totaled $11.35 billion as of Q3, representing 21% YoY growth. The company also deepened its customer relationships, recording 103 deals exceeding $1 million in net new annual contract value (ACV) during Q3 and finishing the quarter with 553 customers with more than $5 million in ACV, an 18% YoY increase.

Looking ahead, ServiceNow raised its full-year guidance for subscription revenue, operating margin, and free cash flow. The company said it now expects subscription revenue of $12.84 billion to $12.85 billion, up from its previous forecast of $12.78 billion to $12.8 billion.

Investor attention now shifts to the company’s Q4 results, which are set to be released on Wednesday after the market closes. Analysts tracking the company expect its GAAP EPS to rise 23.08% YoY to $0.48 in Q4, while revenue is forecast to increase 19.35% YoY to $3.53 billion. Oppenheimer said it sees a favorable earnings setup for ServiceNow in Q4, with solid performance and positive commentary against subdued investor expectations.

It’s also worth noting that the recent pullback in NOW shares has made the company’s valuation more attractive, after years of trading at an incredible premium. The stock is currently trading at a forward non-GAAP P/E of 38.25x, well below its five-year average of 67.56x, though still above the sector median of 25.35x.

Many Wall Street analysts disagree with investor concerns about AI disrupting ServiceNow’s business. Of the 42 analysts covering the stock, 33 recommend a “Strong Buy,” three suggest a “Moderate Buy,” five advise holding, and one assigns a “Strong Sell” rating. This translates to a top-tier “Strong Buy” consensus rating. The average price target for NOW stock is $212.88, indicating a 59.9% upside potential from Friday’s closing price.

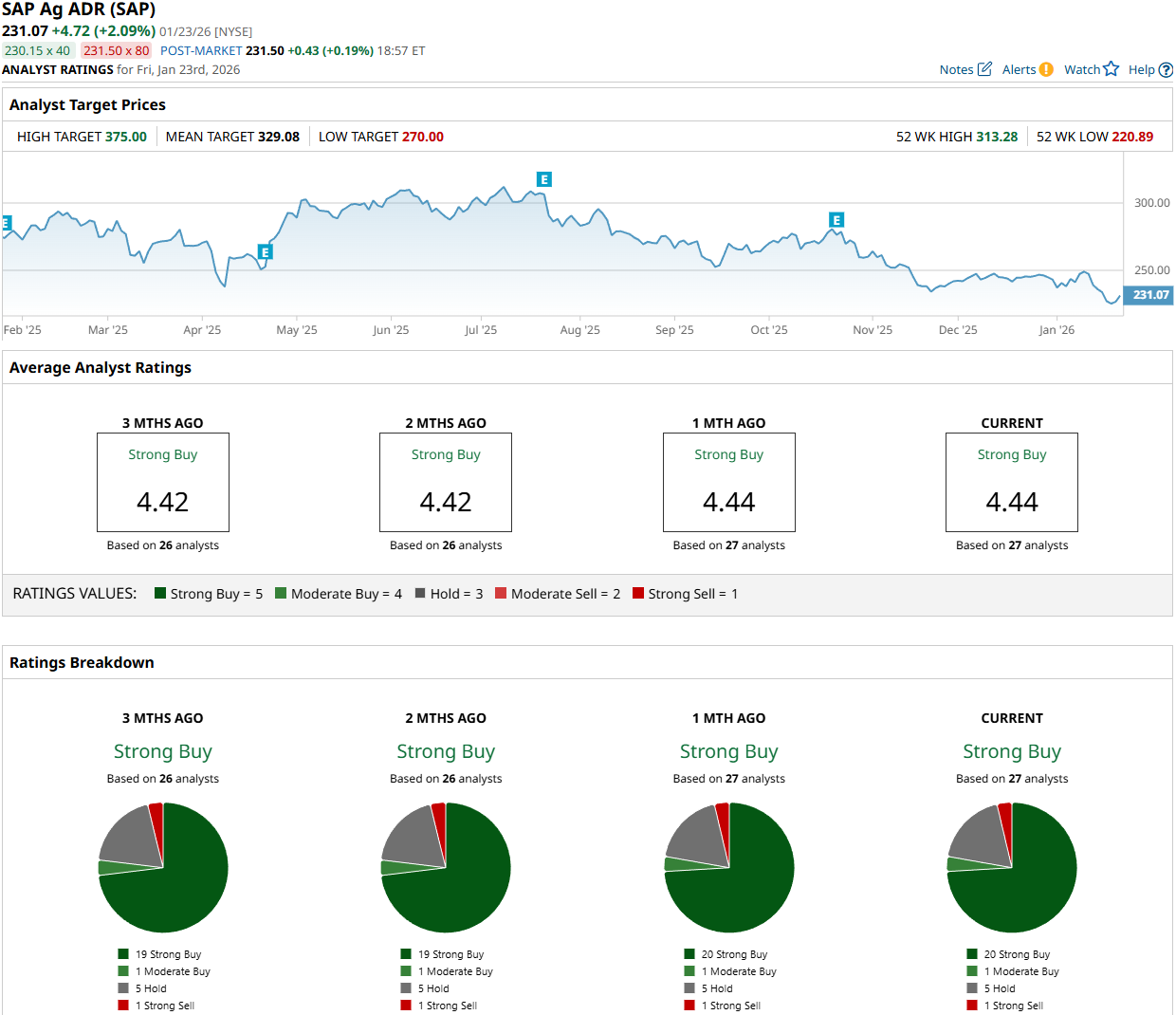

"Resilient" Software Stock #2: SAP SE (SAP)

SAP SE is a German-based software corporation and the global leader in Enterprise Resource Planning (ERP) software. The company specializes in software that centralizes data management, allowing businesses to manage complex processes through a single “intelligent suite” on a digital platform. Its flagship product, SAP S/4HANA, uses in-memory computing and AI to process vast amounts of data in real-time. Beyond ERP, SAP offers 100+ solutions covering finance, human resources, supply chain, customer experience (CRM), and spend management. SAP’s market cap currently stands at $272.5 billion.

Similar to ServiceNow, shares of the business software group have been pressured by AI disruption risks, falling 2% YTD and 13% in the past 52 weeks.

BNP Paribas Exane has an “Outperform” rating on SAP with a price target of 135 euros ($160). The positive sentiment from BNP Paribas points to strong confidence in SAP’s future performance and its strategic positioning in the enterprise software market.

Meanwhile, Jefferies recently reiterated its “Buy” rating on SAP and maintained a 290 euro ($345) price target. Jefferies analyst Charles Brennan said that although SAP is trading about 15% above prior trough valuations, the stock still appears to be nearing a valuation trough for a company growing recurring revenue at roughly 15%. Software sentiment “has rarely been lower, with AI casting a shadow of uncertainty for the sector,” Brennan said in a note. Jefferies believes that SAP is a “higher-quality business now than at any time in the past.”

Last week, SAP stock fell to its lowest level since August 2024, bringing the market value loss from last year’s record high to roughly $130 billion. A months-long downtrend was driven by concerns over the disruptive potential of AI. More precisely, there is concern that AI could make it easier to build and replicate existing software services, potentially putting pressure on the average selling price of services for companies like SAP.

In late October, SAP SE reported mixed third-quarter earnings results and gave a mixed outlook. The company’s total revenue grew 11% YoY at constant currencies to 9.076 billion euros, slightly missing expectations. At the same time, adjusted EPS came in at 1.59 euros, topping Wall Street’s consensus estimate of 1.49 euros and up from 1.23 euros in the year-ago quarter.

Meanwhile, SAP’s cloud segment generated 5.29 billion euros in revenue in Q3, up 27% from a year earlier on an adjusted basis. Analysts had expected revenue of 5.33 billion euros. Notably, cloud revenue made up 58% of SAP’s total sales, up from 51% a year earlier. The company’s current cloud backlog rose 27% YoY at constant currencies to 18.84 billion euros in Q3, maintaining the growth momentum seen in the second quarter. Investors have been closely monitoring SAP’s cloud sales since the company pivoted from selling traditional on-premise software licenses to subscription-based services. A subscription model allows software companies to generate more predictable cash flows. For SAP, this transition is centered on its Cloud ERP Suite, the cloud-based version of the company’s core offering.

Looking ahead, the company said it expects 2025 cloud revenue to come in near the lower end of its 21.6 billion to 21.9 billion euro range at constant currencies. At the same time, management said full-year adjusted profit is expected to land at the upper end of its 10.3 billion euros to 10.6 billion euros forecast range.

Like ServiceNow, SAP SE is set to report its Q4 results this week, with analysts forecasting adjusted EPS of $1.72, up 17.32% YoY, and revenue of $11.53 billion, an increase of 17.88% YoY. Citi analysts said the company is expected to deliver strong Q4 results and likely reaffirm its outlook for accelerating revenue growth and margin expansion next year.

In terms of valuation, the stock is currently trading at a forward non-GAAP P/E of 33.21x, close to the sector median of 25.35x and its five-year average of 28.99x.

Wall Street analysts have a consensus rating of “Strong Buy” on SAP stock. Among the 27 analysts offering recommendations for the stock, 20 call for a “Strong Buy,” one suggests a “Moderate Buy,” five recommend holding, and one gives it a “Strong Sell” rating. The mean price target for SAP stock is $329.08, which is 42.4% above Friday’s closing price.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Technologies (SOFI) is Flashing an Intriguing Quant Setup Ahead of Q4 Earnings

- Costco Stock Has Moved Up Over the Last Month - What Are the Best Plays Now?

- 2 ‘Resilient’ Software Stocks That Wall Street Thinks You Should Buy Now

- Elon Musk Says Nvidia’s New Rubin Chips ‘Will Be a Rocket Engine for AI’