A recent report indicates that the six giants of U.S. banking are poised to post their second-highest annual profit ever at $157 billion. Supported by an increase in trading activity and dealmaking, the banks are on a roll.

It’s therefore not surprising to see Citigroup (C) stock having surged by almost 60% in the past 52 weeks. However, amidst the positive outlook, reports suggest that the bank plans to cut 1,000 jobs this week.

This reduction is a part of a bigger plan to cut 20,000 roles by the end of 2026. The objective of CEO and Chair Jane Fraser is to trim costs, improve returns, and create a “more efficient organization.”

Therefore, with the expectations of strong earnings, the job cuts are unlikely to create a panic. On the contrary, it’s expected to support margins in 2026 and beyond.

It’s also worth mentioning that another rate cut appears to be due in Q1 2026. With expansionary monetary policies, credit growth is likely and will support Citigroup’s core business. At the same time, higher liquidity in the financial system is likely to ensure positive price action in various asset classes.

About Citigroup Stock

Citigroup, headquartered in New York, is a diversified financial services holding company with a physical presence in 94 markets globally.

The financial institution operates through five business segments that include Services, Markets, Banking, U.S. Personal Banking, and Wealth. Through these segments, Citigroup has more than $5 trillion in financial flows daily. It’s worth noting that Citigroup has 19,000 institutional clients that include 85% of Fortune 500 companies.

For Q4 2025, Citigroup reported revenue and net income of $19.9 billion and $2.5 billion, respectively. Further, the CET1 Capital Ratio for the period was healthy at 13.2% (160 basis points above the regulatory requirement).

Considering the healthy earnings momentum, C stock has been in an uptrend with a rally of almost 28% in the past six months.

Strong Business Momentum and 2025 Results Highlights

Citigroup has been in a transformation phase in various aspects. As an example, the banking giant has exited 14 international consumer markets. At the same time, investment in “new products, digital assets, and AI” is supporting innovation and efficiency.

For 2026, Citigroup has already indicated that dealmaking activity in the Asia Pacific region is likely to be strong. In particular, M&A is expected in China and India. This is likely to ensure steady growth momentum.

With Citigroup reporting FY25 results today, revenue touched a record of $85.2 billion. Further, the banking institution reported positive operating leverage for each of the five business segments.

Citigroup expects to maintain a positive momentum in the current financial year, with net interest income (ex-Markets) expected to grow at 5% to 6%. This momentum is likely to be supported by loan growth in cards and wealth. Additionally, deposit growth is expected in services and the wealth segment. Citigroup is targeting a 60% efficiency ratio with another year of positive operating leverage.

What Analysts Say About C Stock

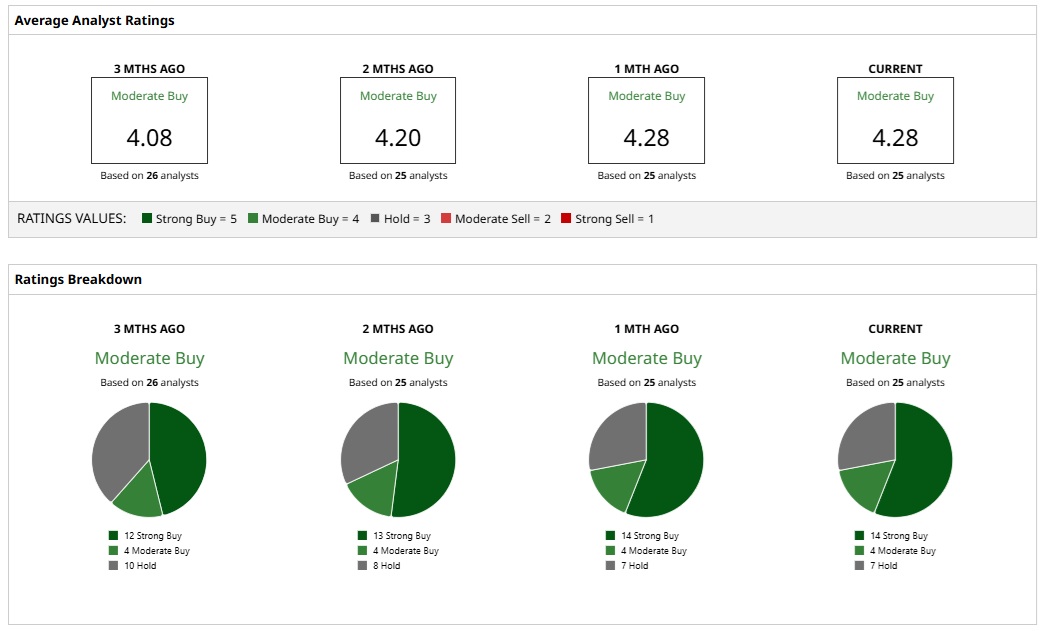

Based on the ratings of 25 analysts, C stock is a consensus “Moderate Buy.” While 14 analysts assign a “Strong Buy” rating to C stock, four and seven analysts have assigned a “Moderate Buy” and “Hold” rating, respectively.

Based on these ratings, analysts have a mean price target of $128.50 currently, which would imply an upside potential of 16%. Further, with the most bullish price target of $150, the upside potential for C stock is 35%.

It’s worth noting that C stock trades at a forward price-earnings ratio of 11.99. Further, the price-earnings-to-growth ratio of 0.47 points to attractive valuations. Citigroup's stock also offers a dividend yield of 1.98%, and that adds to the attractiveness at current levels.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Citigroup Slashes Jobs, Should You Buy, Sell, or Hold the Dividend Stock Yielding 2%?

- 2 Rock-Solid Dividend Stocks to Buy for Steady Passive Income

- UnitedHealth Just Got a Checkup, and UNH Stock Has Some Big Problems to Treat in 2026. The Bull and Bear Cases Now.

- Should You Buy Dividend-Paying Gold Stocks as Trump Makes Them ‘Great Again’?