Bernstein just came out with its top chip stocks for 2026 list, and there is hardly anything surprising. Nvidia (NVDA) and Broadcom (AVGO) continue to be the favorites, as both are instrumental in serving the global chip manufacturing needs. Analysts at Bernstein believe the valuation continues to be attractive for both these stocks, as AI spending shows no signs of slowing. Surprisingly, they rate Nvidia as a better pick over Advanced Micro Devices (AMD). At a time when AMD’s expertise in inference is leading the AMD vs. Nvidia debate, this is rather interesting. Bernstein is confident about Nvidia’s product roadmap and clearly doesn't believe Nvidia is behind Lisa Su’s firm when it comes to leading the inference race.

Valuations for some other stocks do not appear to be as attractive. Micron (MU) and Applied Materials (AMAT) are examples that have shot up recently and appear to be in bubble territory. That hasn’t stopped Bernstein from maintaining a bullish stance on them, with Applied Materials getting a special mention. The research firm rates AMAT “Outperform,” even when it is currently trading at 52-week highs.

About Applied Materials Stock

Applied Materials is the largest supplier of equipment and services for semiconductor chips and advanced display manufacturing. The company serves all the major global chipmakers and is headquartered in Santa Clara, California.

AMAT stock has posted impressive 80% returns in the last one year, four times as much as the S&P 500 Index ($SPX). It also comfortably beat the iShares Semiconductor ETF’s (SOXX) 52% returns during the same period. Bernstein continues to believe that 2026 could be similar.

Compared to its five-year average, AMAT is expensive. Its forward price-to-earnings (P/E) is 33.24x, 67% higher than the average. The price-to-sale (P/S) ratio is trading at a similar premium to historical valuations. The comparison with peers is also interesting. The 33.24x forward P/E is three times as high as that of Micron, a company benefiting from similar demand in high bandwidth memory. However, both companies trade at a similar P/S ratio.

This premium in earnings multiple is justified, as AMAT’s earnings are more stable. For example, both companies are expected to grow their earnings at around 23% in 2027. AMAT, however, is estimated to continue growing at around 8% until 2029, while Micron’s growth turns negative, expected to come in at -49% in 2029! This long-term prospect makes AMAT a better play, and the valuation reflects that.

Stretched valuations are also reflected in the 0.58% dividend yield. While still healthy for a semiconductor company, the 5-year average dividend yield is 0.81%. The current yield is therefore 28.5% below the historic levels as a result of last year’s rally. However, this is clearly not the time to play it safe, so dividend yield matters less as a valuation metric.

Applied Materials Beats Earnings Estimates

On Nov. 13, 2025, AMAT announced its Q4 earnings, posting an EPS of $2.38 against estimates of $2.06. The revenue of $8.8 billion just managed to beat Wall Street consensus by $130 million. This marks the 6th consecutive year of growth for the company. 2026 is not expected to be any different, as per the management. The accelerating adoption of AI and an increasing demand for semiconductor manufacturing mean the firm should have enough on its plate to keep it busy. Things could get busier in the latter half of the year, with the management pointing out that customers have already given the company a heads-up to be ready for increased production in the second half of 2026.

Like most other semiconductor companies, AMAT will also have to deal with geopolitical issues and export restrictions. China already is a smaller portion of the revenue, and most analysts have started discounting that market anyway. The real risk and challenge lie in how the company handles AI-related equipment ramps, as that will determine how much money it can make from the massive AI spending planned for this year.

What Are Analysts Saying About AMAT Stock?

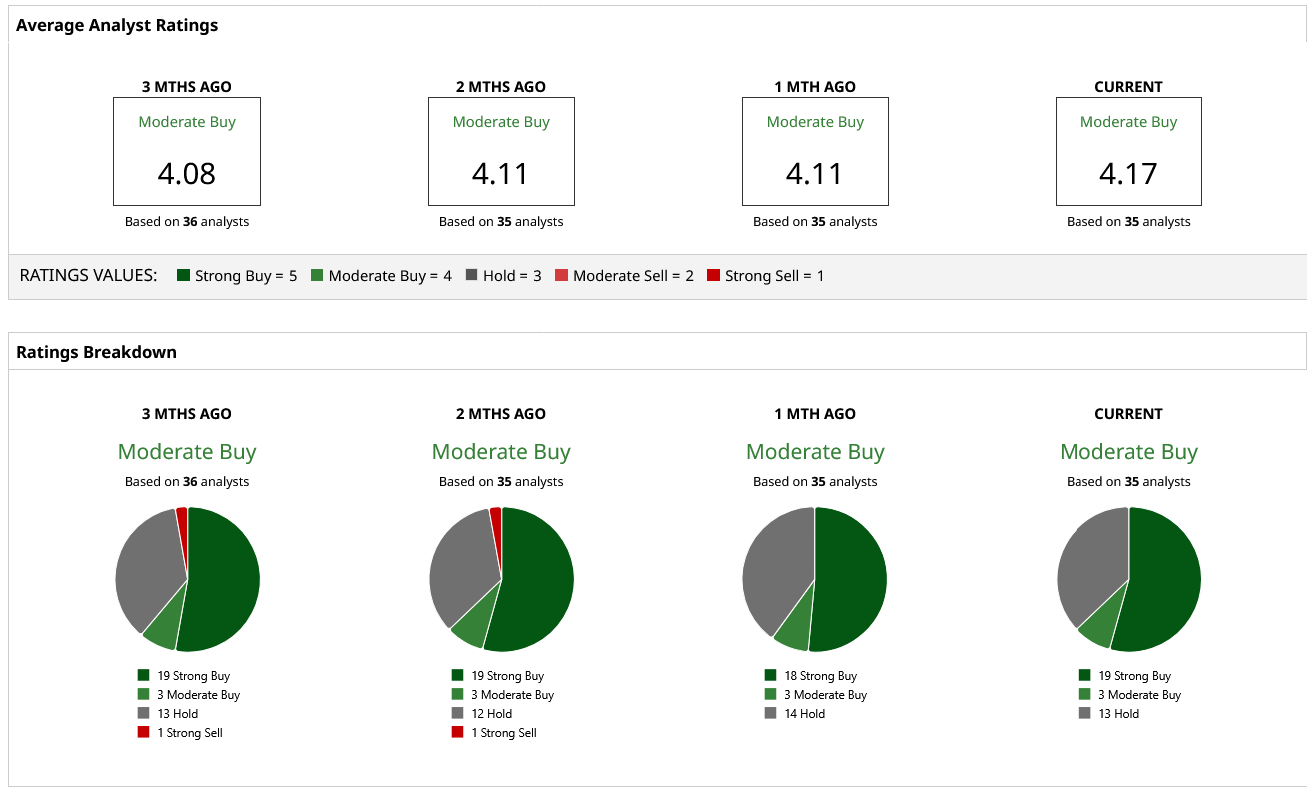

Applied Materials may not be the most flashy AI stock, but it still has healthy coverage on Wall Street. 35 analysts currently have a rating on the stock, with 19 of them calling it a “Strong Buy.” The recent bull run is likely to force some of them to reconsider their opinions, but presently, the sentiment continues to favor AMAT investors.

Just yesterday, Bernstein raised the stock’s target price from $260 to $325, though the stock is already closing in on that price level. During the last month, multiple analysts have updated their target price as the firm is poised to benefit from the increased spending on memory chips. The highest target price on the stock currently stands at $425, offering 38% upside from here on.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart