Broadcom's (AVGO) Chief Legal and Corporate Affairs Officer, Mark David Brazeal, recently sold 38,281 AVGO shares valued at $12.54 million, unloading stock in the $322.29 to $345.01 per share range.

The timing of the sale is notable as it came amid growing investor skepticism about returns on massive AI infrastructure investments, even as Broadcom reported strong quarterly results that beat analyst expectations.

The semiconductor giant's stock has experienced unusual volatility despite posting impressive numbers. Broadcom delivered fourth-quarter earnings of $1.95 per share on revenue of $18.02 billion, both exceeding Wall Street forecasts.

CEO Hock Tan projected AI chip sales would double year-over-year (YoY) to $8.2 billion in the current quarter, driven by custom chips and AI networking semiconductors. The company also disclosed a massive $73 billion backlog for custom chips and data center components over the next 18 months.

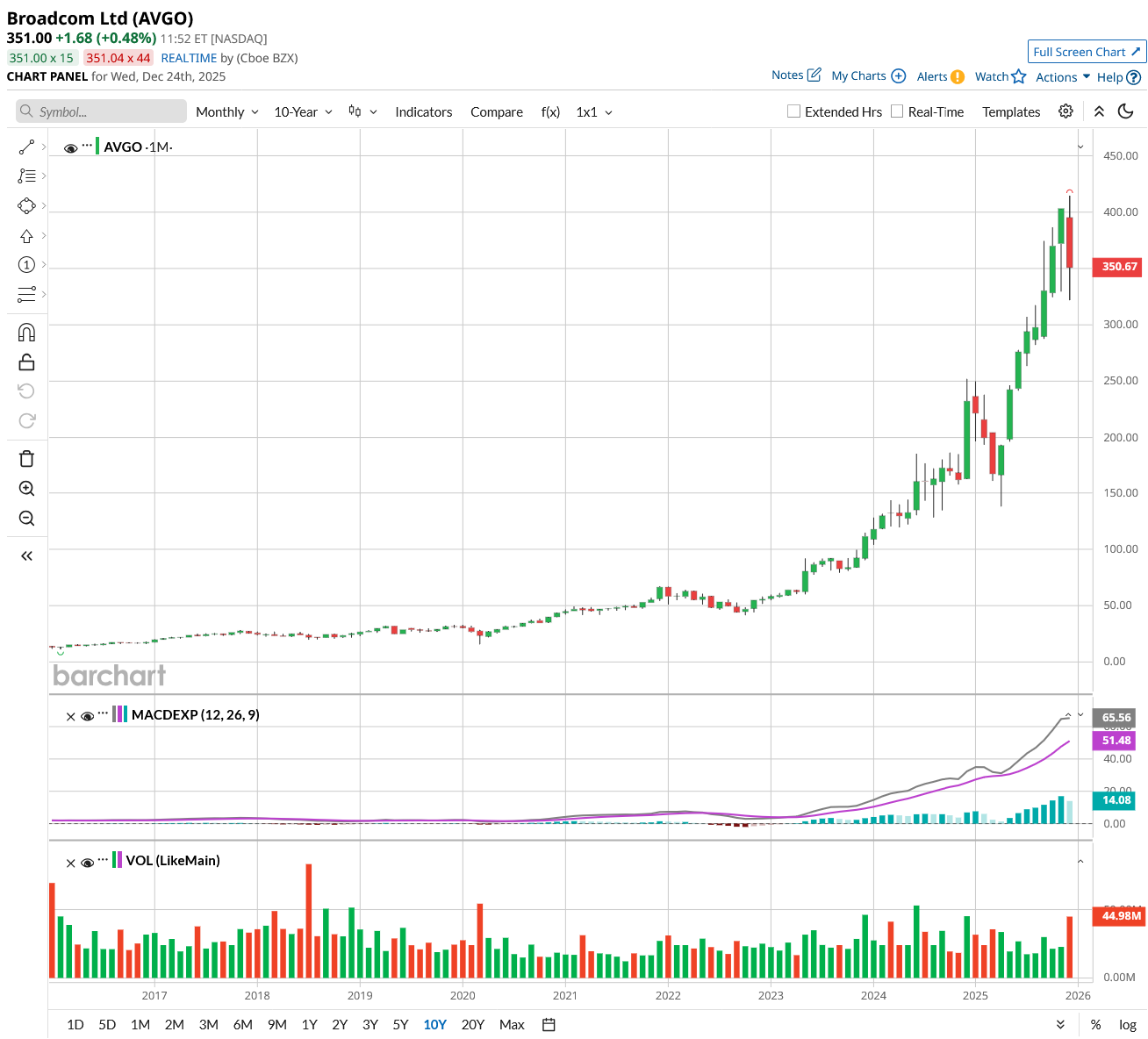

Yet shares initially climbed in after-hours trading before reversing course during the earnings call, ultimately plunging around 17% over two trading sessions. Valued at a market cap of $1.65 trillion, AVGO stock is down 18% below all-time highs.

Investors are concerned about potential margin compression as Broadcom scales production. In the recent earnings call, company CFO Kirsten Spears warned that gross margins could decline for some AI chip systems.

Let’s see if you should buy, sell, or hold AVGO stock at the current multiples.

Broadcom Stock Benefits From a Widening AI Moat

Broadcom CEO Hock Tan dropped a bombshell during a recent investor presentation, disclosing that his 2030 compensation incentives are tied to growing AI revenue to more than $120 billion. Comparatively, in fiscal 2025, Broadcom’s AI sales were around $20 billion.

Management expects explosive growth despite recent stock weakness and insider selling activity. Tan clarified that Broadcom is laser-focused on just seven customers creating large language models and dismissed the broader enterprise market as irrelevant to the company's core AI strategy.

These hyperscalers and AI labs are engaged in a race toward super intelligence, which requires massive investments in compute infrastructure that Broadcom supplies through custom accelerator chips and advanced networking equipment.

The CEO emphasized that custom ASICs and networking infrastructure represent Broadcom's competitive moat rather than merchant GPUs sold to thousands of smaller enterprises. He highlighted that networking becomes the critical bottleneck as AI clusters scale from 100,000 to potentially 1 million GPUs working simultaneously.

Broadcom's intellectual property in orchestrating these massive parallel workloads through Ethernet-based networks provides differentiation that competitors struggle to match.

Tan revealed that fiscal 2026 AI revenue growth would accelerate materially beyond the previously guided 60% rate, driven by a recently converted customer focused on inference workloads.

He confirmed Anthropic as the mystery customer who placed a $10 billion order for Google's (GOOG) (GOOGL) tensor processing units during the quarter. Broadcom now has five customers for custom chips, with two additional prospects in the pipeline.

The networking business stands to benefit as customers transition from copper-based connections to optical networking capable of 100 terabits per second bandwidth. This shift enables memory sharing across 512 or even 1,024 accelerator chips within a single rack, which improves training convergence times. Tan expects this optical transition to accelerate in 2027 as cluster sizes expand.

Despite a bullish long-term vision, Broadcom acknowledged near-term margin pressure as it scales production of AI chip systems.

Is AVGO Stock Overvalued Right Now?

Analysts tracking AVGO stock forecast revenue to increase from $64 billion in fiscal 2025 (ended in October) to $227 billion in fiscal 2030. In this period, adjusted earnings are forecast to expand from $6.82 per share to $23.37 per share.

If Broadcom stock is priced at 27x forward earnings, which is similar to its three-year average, the stock should trade around $630 in late 2028, indicating an upside potential of 70% from current levels.

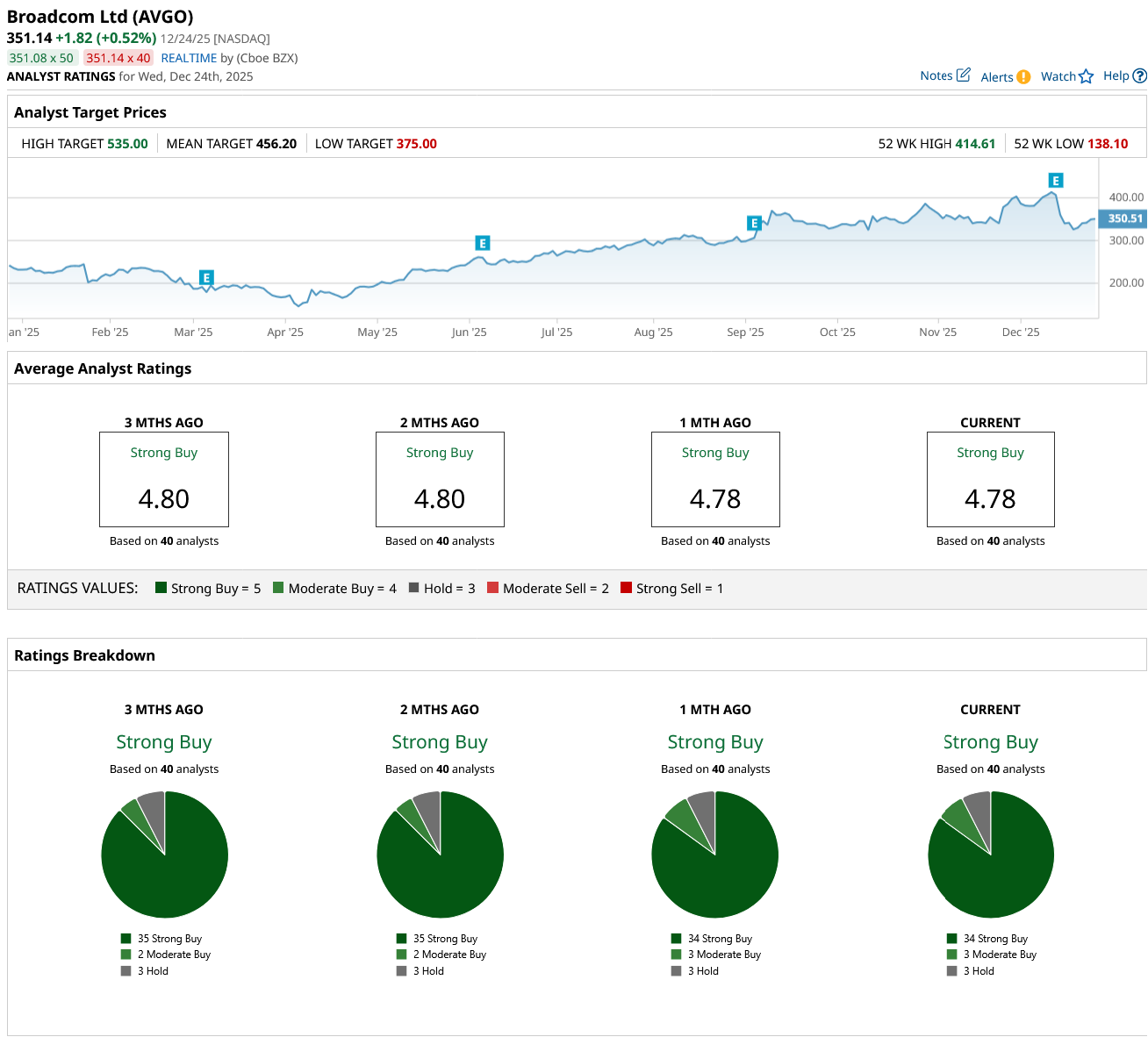

Out of the 40 analysts covering AVGO stock, 34 recommend “Strong Buy,” three recommend “Moderate Buy,” and three recommend “Hold.” The average AVGO stock price target is $456.20, above the current price of $351.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Super Micro Computer Stock Tumbles, But Investors are Piling into Its Call Options - Time to Buy SMCI?

- Chipotle Just Launched a New Protein-Packed Menu. Should You Buy CMG Stock for 2026?

- Cathie Wood Is Selling DraftKings Stock. Should You?

- Dan Ives Is Betting That Apple and Google Will Partner in 2026. Should You Buy AAPL Stock First?