With a market cap of $99.2 billion, NIKE, Inc. (NKE) is a global leader in the design, development, marketing, and sale of athletic and casual footwear, apparel, equipment, and accessories for men, women, and children. The company operates a powerful portfolio of brands, including Nike, Jordan, and Converse, with a strong global presence across North America, EMEA, Greater China, and the Asia Pacific.

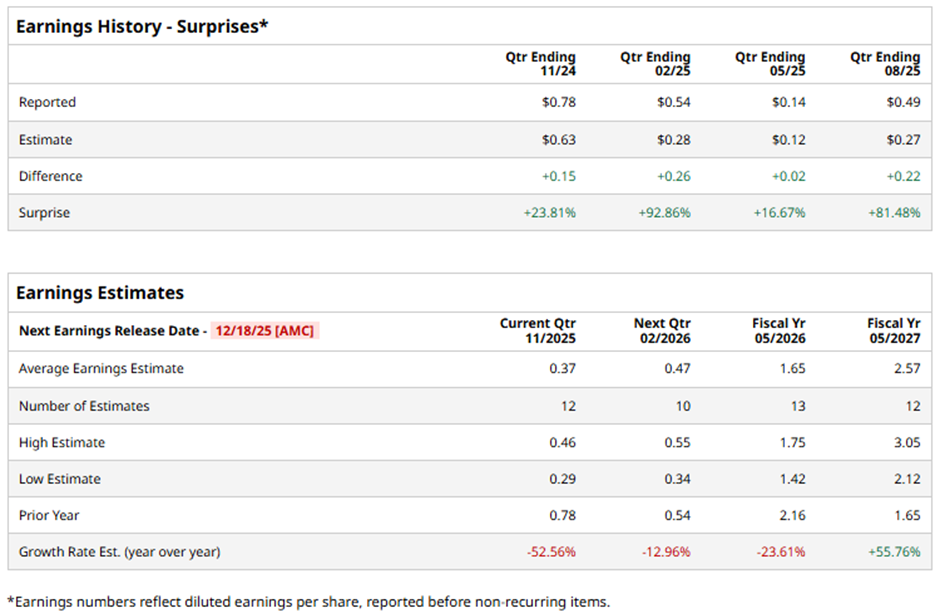

The Beaverton, Oregon-based company is set to announce its fiscal Q2 2026 results after the market closes on Thursday, Dec. 18. Analysts predict NIKE to report an adjusted EPS of $0.37, down 52.6% from $0.78 in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2026, analysts forecast NIKE to report an adjusted EPS of $1.67, a decline of 23.6% from $2.16 in fiscal 2025. Nevertheless, adjusted EPS is anticipated to surge 55.8% year-over-year to $2.57 in fiscal 2027.

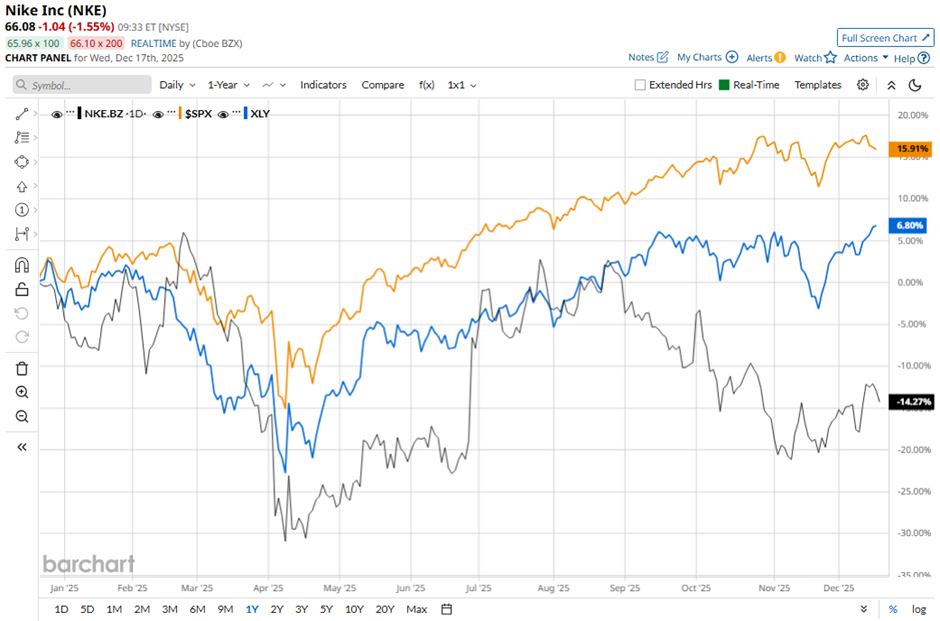

Shares of NIKE have dropped 13.8% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) nearly 12% return and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 2.1% rise over the period.

Shares of Nike climbed 6.4% following its Q1 2026 results on Sept. 30 as overall revenue of $11.7 billion rose 1% year-over-year, while footwear sales of $7.4 billion topped the consensus estimate. Investor sentiment was further lifted by strong apparel growth of 9% to $3.3 billion, well above the consensus, and wholesale revenue growth of 7%, which helped offset weaker Nike Direct sales. Additionally, gross margin of 42.2% exceeded expectations, easing concerns about discounting and tariff pressures even as net income fell 31% to $727 million.

Analysts' consensus view on NKE stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 35 analysts covering the stock, 17 recommend "Strong Buy," four give "Moderate Buy," 12 indicate “Hold,” and two advise "Strong Sell." The average analyst price target for NIKE is $82.04, suggesting a potential upside of 24.2% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?

- Is SoundHound Stock a Buy for 2026? This Analyst Thinks So.

- Netflix Says the Warner Bros’ Deal Is All About ‘Growth.’ Will NFLX Stock Keep Growing in 2026?