VANCOUVER, BC / ACCESSWIRE / July 24, 2024 / Omega Pacific Resources Inc. (CSE:OMGA)(OTCQB:OMGPF)(FSE:Q0F) ("Omega Pacific" or the "Company") is pleased to announce initial drill results from its 2024 drill program at the Williams Property in British Columbia's Golden Horseshoe. These intervals from the Phase 1 program confirm the potential of high-grade and bulk-tonnage gold mineralization on the Property (Figure 1).

Highlights

-

Drill hole WM24-01 intersected the highest grades at Williams so far within bulk-tonnage mineralization including:

6.22 g/t Au over 18.98 m, within

3.16 g/t Au over 44.32 m, within

1.69 g/t Au over 104.08 m (Table 1 and Figure 2)

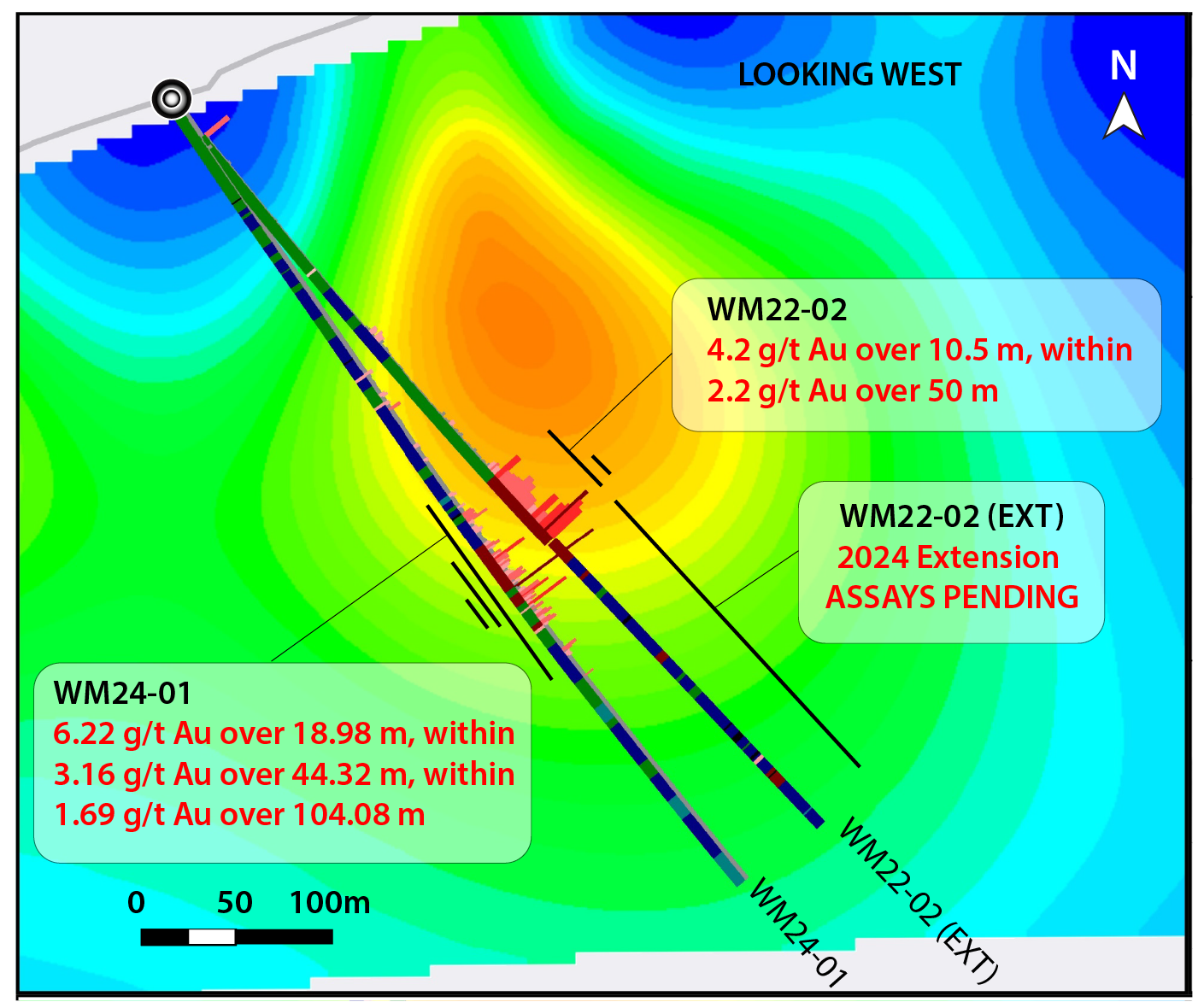

WM24-01 successfully undercut and extended the mineralization noted in hole WM22-02 (CopAur Minerals Inc Press Release August 16, 2022)

WM22-02, which historically reported 2.2 g/t Au over 50m ending in mineralization, has been re-entered and extended - assays are pending

Omega Pacific's CEO Jason Leikam commented, "Our Phase 1 program is off to a great start at Williams and we are thrilled to see high-grade mineralization manifest in our very first hole. The 6.22 g/t Au over 18.98 m demonstrates the presence of high-grade mineralization at the GIC Prospect, a region of our property which has demonstrated strong results during previous drill campaigns. For Phase 1, we deployed a targeted and methodical drilling strategy that focused on this region of the Property. With the impressive results from this first hole, we are excited to receive further assays throughout the summer as we continue realizing the potential of our project. Our goal has always been to drive shareholder value through strong execution, and we are thrilled to deliver this news to our committed shareholders. It's an exciting time for Omega Pacific and we are one step closer to delivering a premier asset in the heart of BC's Golden Horseshoe."

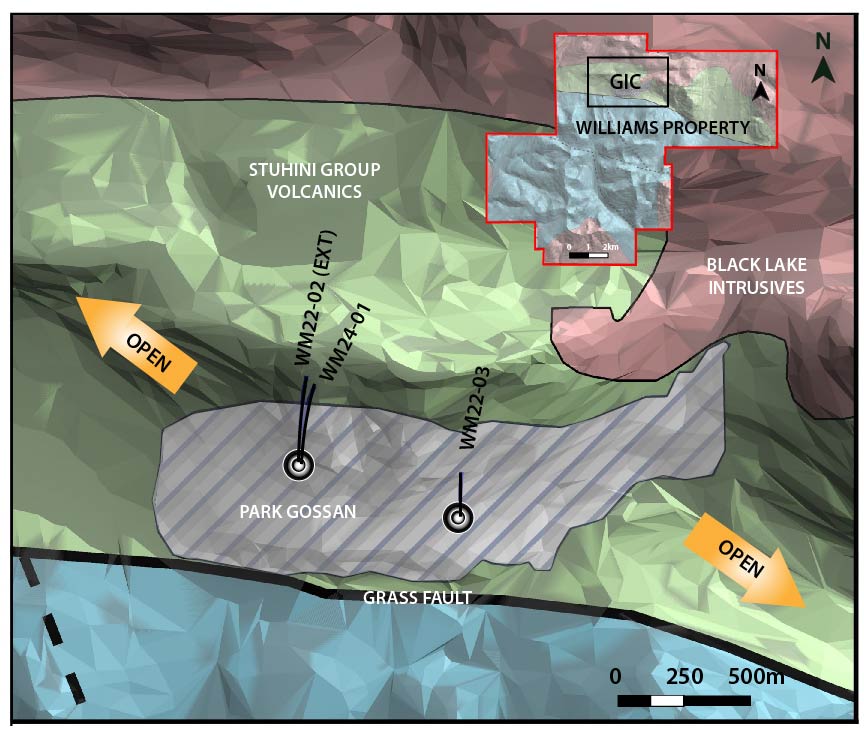

Drill Results at GIC

The GIC Prospect represents a >3 km long target with overlapping gold-copper rock and soil anomalism and chargeability/resistivity anomalies from induced-polarization (IP) geophysical surveys. This area is marked by the "Park Gossan" and occurs proximal to the contact between volcanic and intrusive rocks and large-scale faults all of which are critical to mineralization elsewhere in the Golden Horseshoe. It has seen limited historical exploration drilling of ~2,300 m.

Phase 1 of the 2024 drill program was designed to follow-up on the historical results of WM22-02. The 2024 drill holes are planned to trace that mineralization to depth and to the east and west. The first hole of the 2024 program (WM24-01) was drilled at a steeper angle to undercut the historical results by approximately 50 m with the intention of drilling deeper to get the full thickness of mineralization - WM24-01 succeeded in both of these goals.

Figure 1: Plan map of the GIC Prospect showing 2022 and 2024 drill holes on bedrock geology. Drill hole WM22-03 intersected 4.64 g/t Au over 8 m.

WM24-01 was drilled underneath WM22-02 intersecting the targeted mineralization at approximately 250 metres downhole and continuing for over 100 m. This mineralization was centered on a black basaltic unit with several phases of quartz veining and pyrite mineralization. The highest grade mineralization, 6.22 g/t Au over 18.98 m, is hosted within this unit. Gold mineralization continues above and below this basaltic unit in intermediate volcanic rocks which are highly silicified and variably pyritized. Gold mineralization continuing into these intermediate volcanic rocks helps define a bulk-tonnage target for GIC with 1.69 g/t Au over 104.08 m. The overall thickness of altered and silicified volcanic rocks exceeds 300 m suggesting a large hydrothermal system has affected the rocks at GIC which, combined with the >3 km strike length, represents a large target for continued exploration for high-grade and bulk-tonnage mineralization.

Historical assays from WM22-02 included 4.2 g/t Au over 10.5 m within a broader interval of 2.2 g/t Au over 50m ending in mineralization. This hole was successfully re-entered and extended as part of the 2024 Phase 1 program (WM22-02 (ext)) allowing Omega to complete drilling of the historical intercept. The above noted basaltic unit continued beyond 300 m (original hole depth) and transitioned into heavily silicified and pyritized intermediate volcanic rocks much like WM24-01. Assays are pending for WM22-02 (ext) which will add to the historically reported 2.2 g/t Au over 50 metres.

Figure 2. Cross-section of drill holes WM24-01 and WM22-02 (ext) with current gold results on IP chargeability. Note pending assays for WM22-02 (ext).

Select Assay Results WM24-01 | ||||

Hole |

From (m) |

To (m) |

Width (m) |

Au (g/t) |

WM24-01 |

301.22 |

320.2 |

18.98 |

6.22 |

within |

276.91 |

321.23 |

44.32 |

3.16 |

within |

248.92 |

353 |

104.08 |

1.69 |

Table 1. Select assay intervals from drill hole WM24-01. True thicknesses of mineralization are not known given the early stage of exploration. A complete list of all drill results to date will be posted to the Company's website at OmegaPacific.ca.

Drill Collar Locations | ||||||

HoleID |

Easting (m) |

Northing (m) |

Elevation (m) |

Azimuth |

Dip |

Depth (m) |

WM24-01 |

572769 |

6408008 |

1655 |

0 |

-57 |

503 |

WM22-02(ext) |

572769 |

6408010 |

1655 |

0 |

-50 |

From 300-502 |

Table 2. Current drill hole information.

Omega Pacific's summer 2024 drill program is designed to drill up to 2,000 m at the GIC Prospect of the Williams Property. The company will report on additional program results over the summer season as it receives assays.

Corporate Update

Additionally, Omega Pacific has retained Machai Capital Inc. ("Machai") to provide digital marketing services (the "Engagement"). Machai will provide certain digital marketing services in compliance with the policies and guidelines of the Canadian Securities Exchange and other applicable legislation.

Machai is a marketing, advertising and public awareness firm specializing in the mining and metals, technology and special situation sectors. It assists companies in branding, content creation and data-optimization to create in-depth marketing campaigns. Machai is able to track, organize and execute its plan through Search Engine Optimization (SEO), Search Engine Marketing (SEM), Digital Marketing, Social Media Marketing, Email Marketing and Brand Marketing.

The Engagement has an initial term of up to 12-months, Machai will have a marketing budget of up to 200,000 Euros ($300K CAD) paid in cash. Machai currently owns 687,500 share purchase warrants and 150,000 common shares. Machai Capital Inc. is 100% owned by Suneal Sandhu and can be reached suneal@machaicapital.com. Machai is at arm's length to Omega Pacific Resources and has no other relationship with the company except pursuant to the Engagement.

Quality Assurance/Quality Control (QA/QC) Measures and Analytical Procedures

Omega Pacific adheres to a strict QA/QC monitoring program that includes the insertion of blanks, standards and duplicates into the sample stream, as well as the re-submission of select samples for check assays by an independent third party laboratory. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags and shipped to the laboratory and the other half retained on site. Third party laboratory checks on 5% of the samples are carried out as well. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility.

Core samples were prepared and analyzed by ALS Labs in Kamloops and Vancouver, BC using Fire Assay methods on a 30g split with an atomic absorption finish. Gold assays exceeding 10 g/t were re-assayed with a gravimetric finish. Samples were also analyzed for a 48-element suite via mass-spectrometry with a four acid digestion.

The Company adheres to CIM Best Practices Guidelines for exploration related activities conducted on its property. Quality Assurance and Quality Control (QA/QC) procedures are overseen by the Qualified Person.

Qualified Person

Robert L'Heureux (P.Geol.), Director of Omega Pacific Resources, is the "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects and has reviewed, validated and approved the scientific and technical information contained in this news release. Mr. L'Heureux oversees exploration planning and execution at the Williams Property.

About Omega Pacific

Omega Pacific is a mineral exploration company focused on the development of mineral projects containing base and precious metals. The Company recently acquired an option to earn a 100% interest in the Williams Property, located in the Toodoggone region of the Golden Horseshoe. The Golden Horseshoe is a prolific area of British Columbia known to host many gold, copper and silver deposits. The Company also holds an option on the Lekcin Property, located 120 km east of Vancouver, BC.

For more information, please contact:

Omega Pacific Resources Inc.

Jason Leikam, Chief Executive Officer & Director

Tel: +1 (778) 650 4255

Email: jason@omegapacific.ca

Cautionary Statement

Certain statements contained in this press release constitute forward-looking information under the provisions of Canadian securities laws including statements about the Company's plans. Such statements are necessarily based upon a number of beliefs, assumptions, and opinions of management on the date the statements are made and are subject to numerous risks and uncertainties that could cause actual results and future events to differ materially from those anticipated or projected. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors should change, except as required by law.

Neither the CSE nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Omega Pacific Resources Inc.

View the original press release on accesswire.com