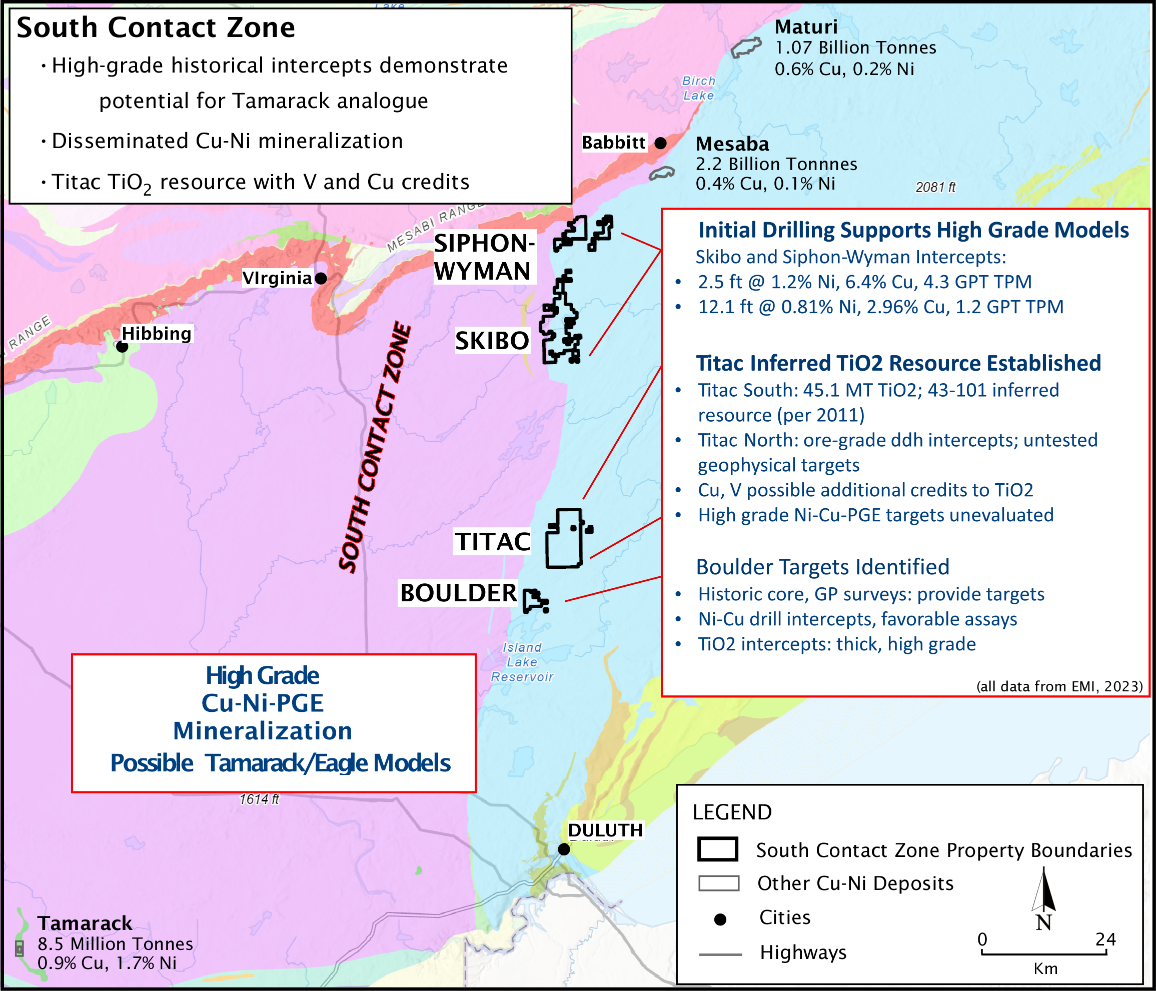

VANCOUVER, BC / ACCESSWIRE / February 6, 2024 / Green Bridge Metals Corporation (CNSX:GRBM) ("Green Bridge" or the "Company") is pleased to announce that it has entered a letter of intent (the "LOI") with Encampment Minerals Inc., dated February 5, 2024 whereby the Company has an option to earn an 80% interest in the 8,460-hectare (84.6 square kilometre (km)) South Contact Zone Project, targeting copper (Cu), nickel (Ni)-platinum group element (PGE) mineralization. The project area is located approximately 65 km north of the city of Duluth, Minnesota (Figure 1).

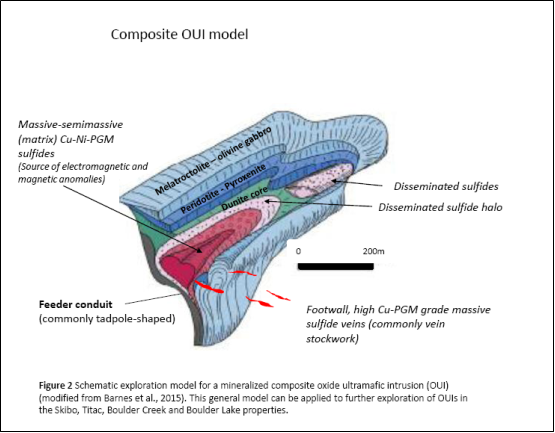

The South Contact Zone (SCZ) project is located along the southern basal contact of the Duluth Complex (Complex) which hosts several world-class Cu-Ni deposits. The SCZ is located immediately south of the Mesabi Range iron ore district. It is estimated that the northwestern margin of the Complex contains 4.4 billion tons of sulfide mineralization grading 0.66% Cu and 0.20% Ni1. The Complex is part of the Midcontinent Rift System, a region characterized by mafic and ultramafic hosted Cu-Ni-PGE mineralization, including multi-million-ton deposits such as Eagle (4.1 million tonnes @ 2.9% Cu, 3.6% Ni)2, Tamarack (8.5 million tonnes @ 0.9% Cu, 1.7% Ni3, and Mesaba (2.2 billion tonnes 0.4% Cu, 0.1% Ni, 0.5 ppm PGE)4 (Figure 1). In addition, the SCZ is a prime locality for Oxide Ultramafic Intrusions (OUI) which host high-grade iron (Fe) -titanium (Ti) - vanadium (V) deposits that commonly contain significant disseminated Cu-Ni sulfide mineralization (Figure 2) and are associated high grade Cu-Ni targets. Green Bridge is optioning the project from Encampment Minerals Inc., (EMI) a privately owned U.S. corporation.

SCZ Project Highlights:

- Located in the Duluth Complex, host to world class copper - nickel deposits.

- Four separate projects with known copper-nickel and/or titanium-vanadium-copper mineralization

- Historical drilling and geophysical surveys provide clear drill ready targets across the underexplored portfolio.

- Plans to initiate drill program within first year of the agreement.

A Message from David Suda, CEO of Green Bridge Metals

"Green Bridge is focused on creating shareholder value by bringing forward exploration and development opportunities to supply critical and strategic minerals to the rapidly growing green economies and power grids of North America and the world beyond. We are pleased to have secured a rare portfolio of assets with clear mineralization in an underexplored world class region within the Duluth Complex of Minnesota. We plan to advance these underexplored properties by leveraging historical exploration data by drilling in the coming 12 months. We would like to thank EMI for the opportunity to advance upon the fine work they have completed to date."

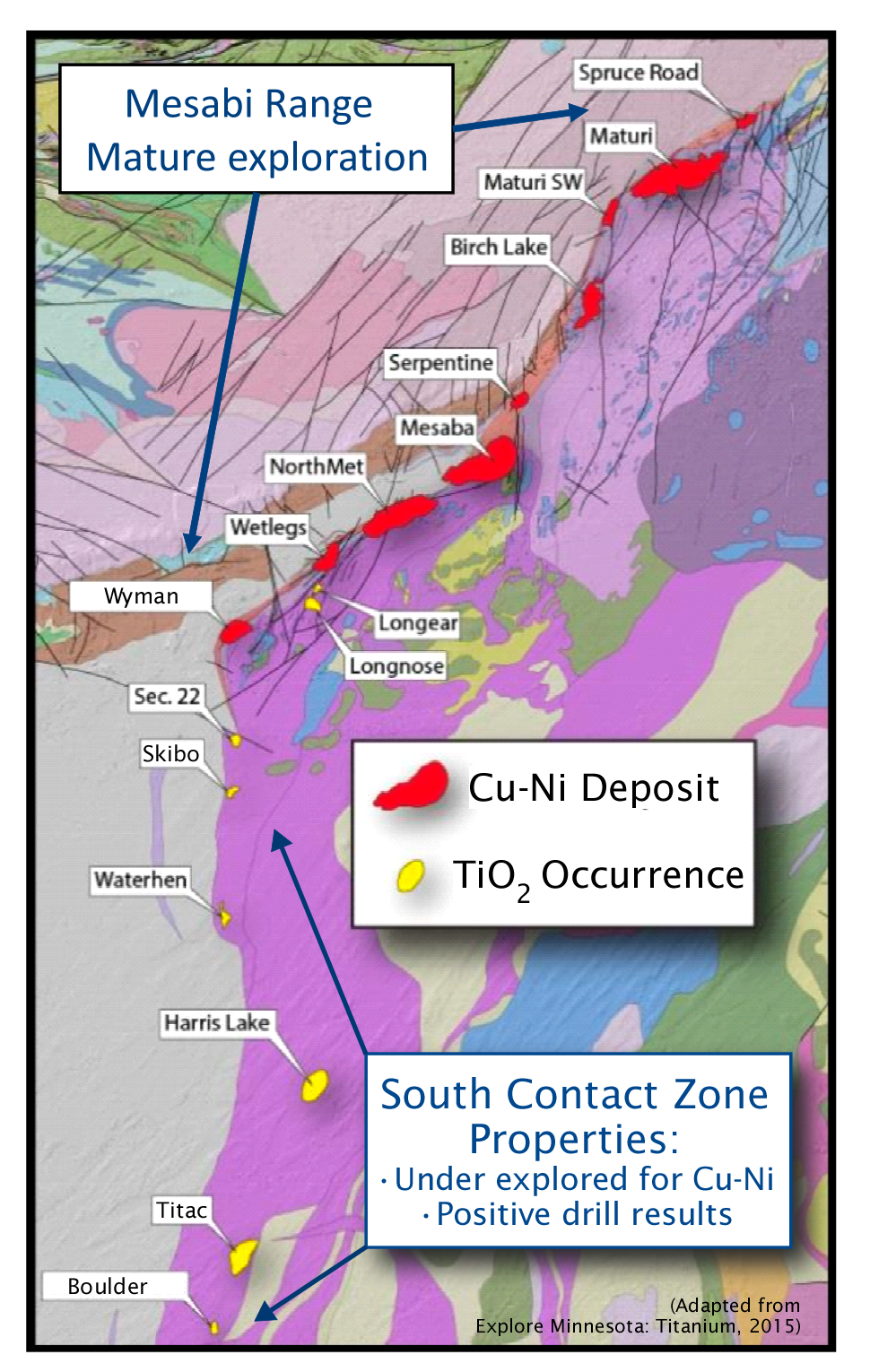

The SCZ project is comprised of multiple properties; Siphon-Wyman, Skibo, Titac, Boulder Creek, and Boulder Lake North, all with previously identified Cu-Ni-PGE, or Ti-V mineralized bodies through historical drilling (Figure 3). Most properties in the SCZ are early stage and have had limited historical exploration, however, EMI completed a VTEM (Versatile Time Domain Electromagnetic) airborne geophysical survey from which numerous undrilled conductors have been interpreted across several of the properties. In addition to recent VTEM, historical airborne electromagnetic and magnetic surveys (AEM) provide detailed geophysical data across the whole region. These geophysical surveys provide useful targeting data for exploration by the Company. Several properties, including the highly prospective Skibo area, are drill-ready with the Company expected to begin drilling within the first year of the agreement.

The SCZ project is host to multiple styles of mineralization:

- Disseminated Cu-Ni sulfide mineralization at the Siphon-Wyman property is similar to that at the Maturi and Mesaba deposits.

- High-grade magmatic Cu-Ni mineralization at Skibo is generally similar to mineralization at the Tamarack deposit.

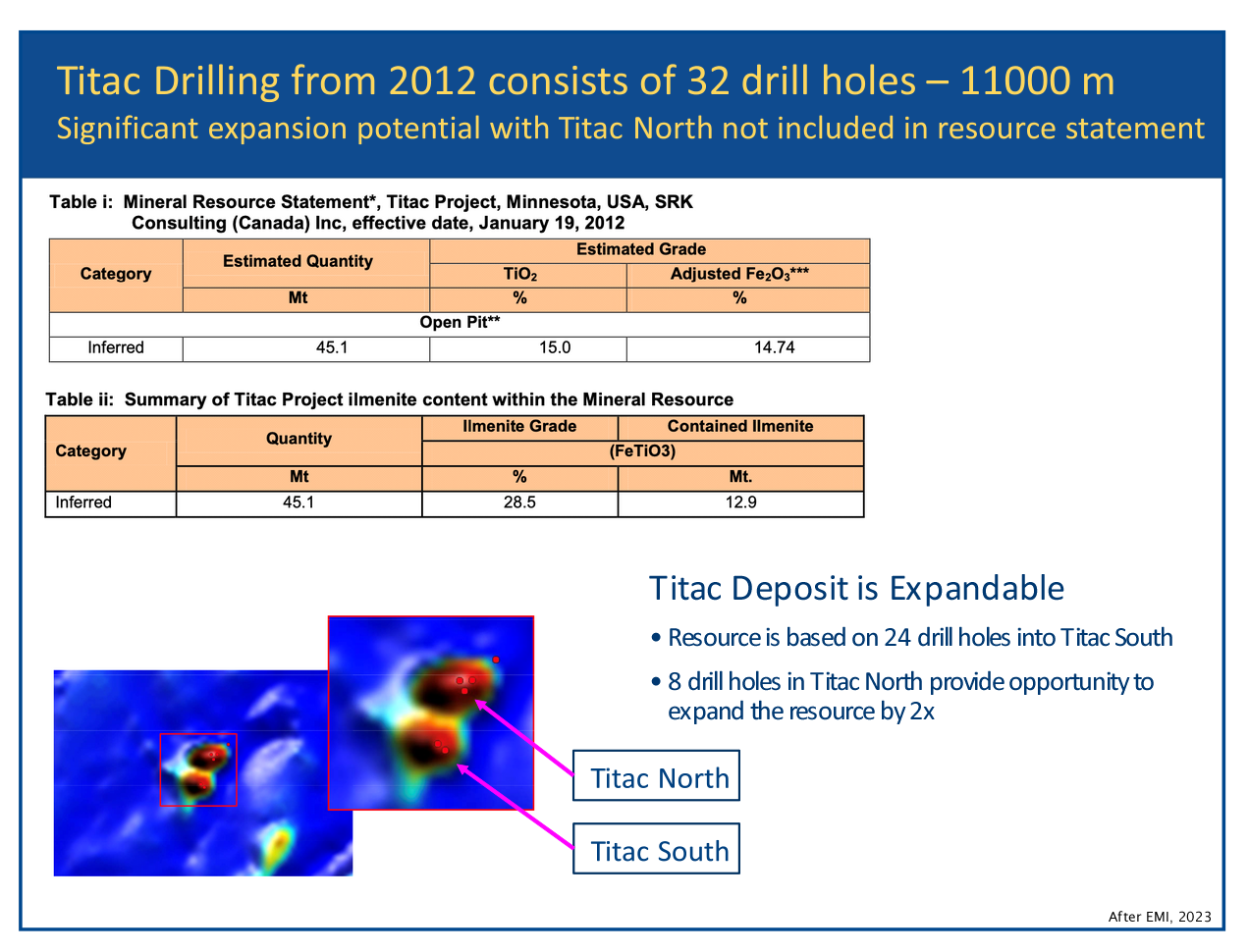

- Ti-V-Cu mineralization associated with oxidized ultramafic intrusions (OUI) at the Titac area with a NI 43-101 inferred resource of 45.1 million tonnes at 15% TiO25.

Within the SCZ project area are a number of untested OUIs. Previous exploration suggests a spatial and genetic relationship between OUI and magmatic massive Cu-Ni-PGE mineralization. With a mix of mineralization styles spanning multiple properties, the SCZ holds significant potential for mineral resources deemed as critical by the U.S. Department of the Interior in 2022. Importantly, the SCZ project is located to the south and outside of the Boundary Waters Wilderness area and watershed and no access or permitting issues of consequence have been experienced to date.

Siphon-Wyman (Disseminated Cu-Ni) Target:

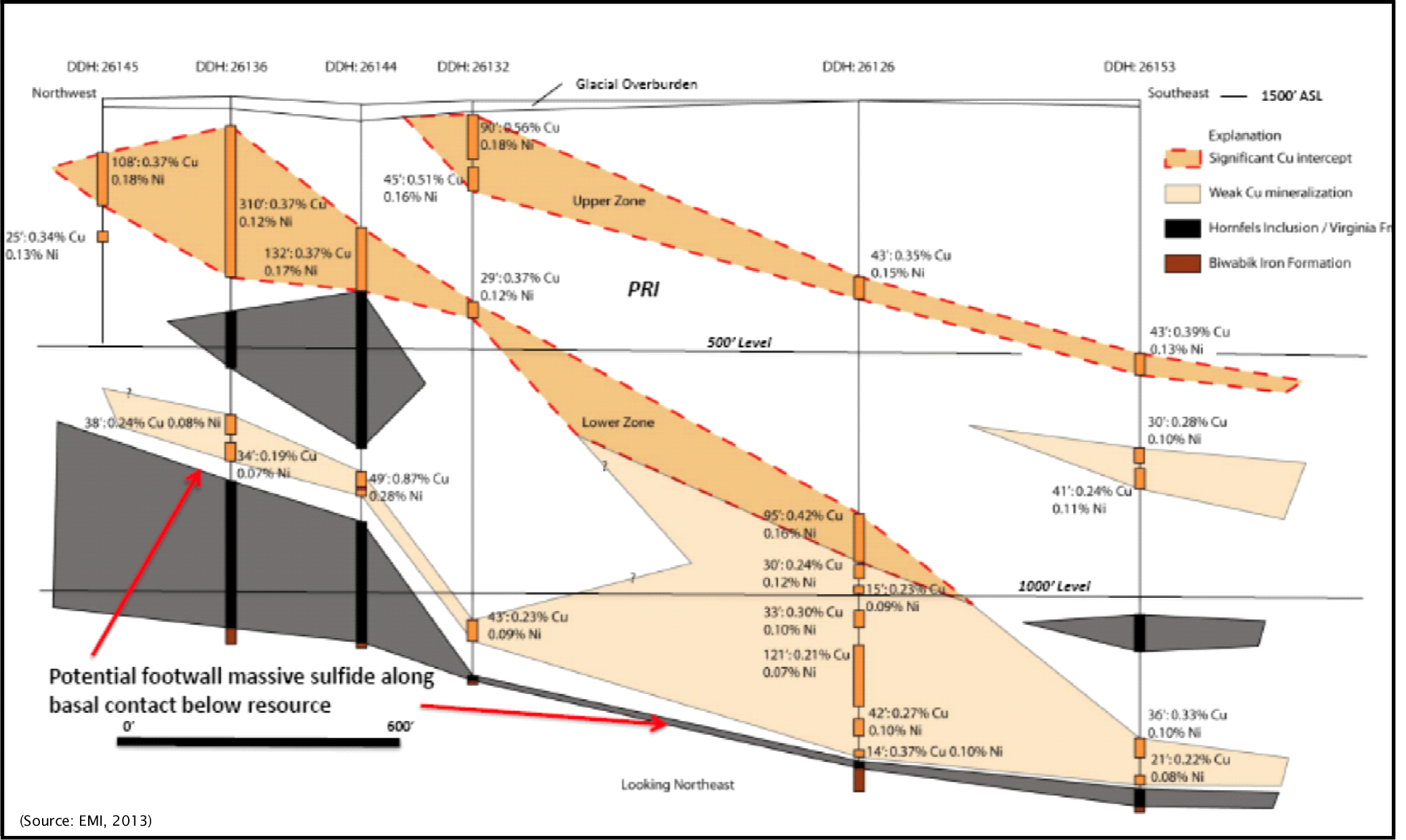

This property spans approximately 1,360 hectares with historical drilling identifying disseminated Cu-Ni mineralization at Wyman Creek (Wyman Creek resource) and structurally controlled massive sulfide mineralization within the associated Siphon Fault Zone (Figure 4, Table 1). The property lies along the basal contact of the Partridge River Intrusion. A number of untested high-priority geophysical electromagnetic conductors have been detected within the fault zone and Wyman Creek resource area

Table 1. Historic significant intercepts drilled by EMI and previous operators from the Siphon-Wyman property6

Hole ID |

Length (m) | Cu % | Ni % |

Wyman |

Upper Zone | ||

26145 |

32.9 |

0.37 |

0.18 |

7.6 |

0.34 |

0.13 |

|

26132 |

27.4 |

0.56 |

0.18 |

13.7 |

0.51 |

0.16 |

|

26126 |

13.1 |

0.35 |

0.15 |

26153 |

13.1 |

1.39 |

0.13 |

| Lower Zone | |||

26136 |

94.5 |

0.37 |

0.12 |

26144 |

40.2 |

0.37 |

0.17 |

26132 |

8.8 |

0.37 |

0.12 |

26126 |

29.0 |

0.42 |

0.16 |

Skibo Property (Massive and Disseminated Cu-Ni):

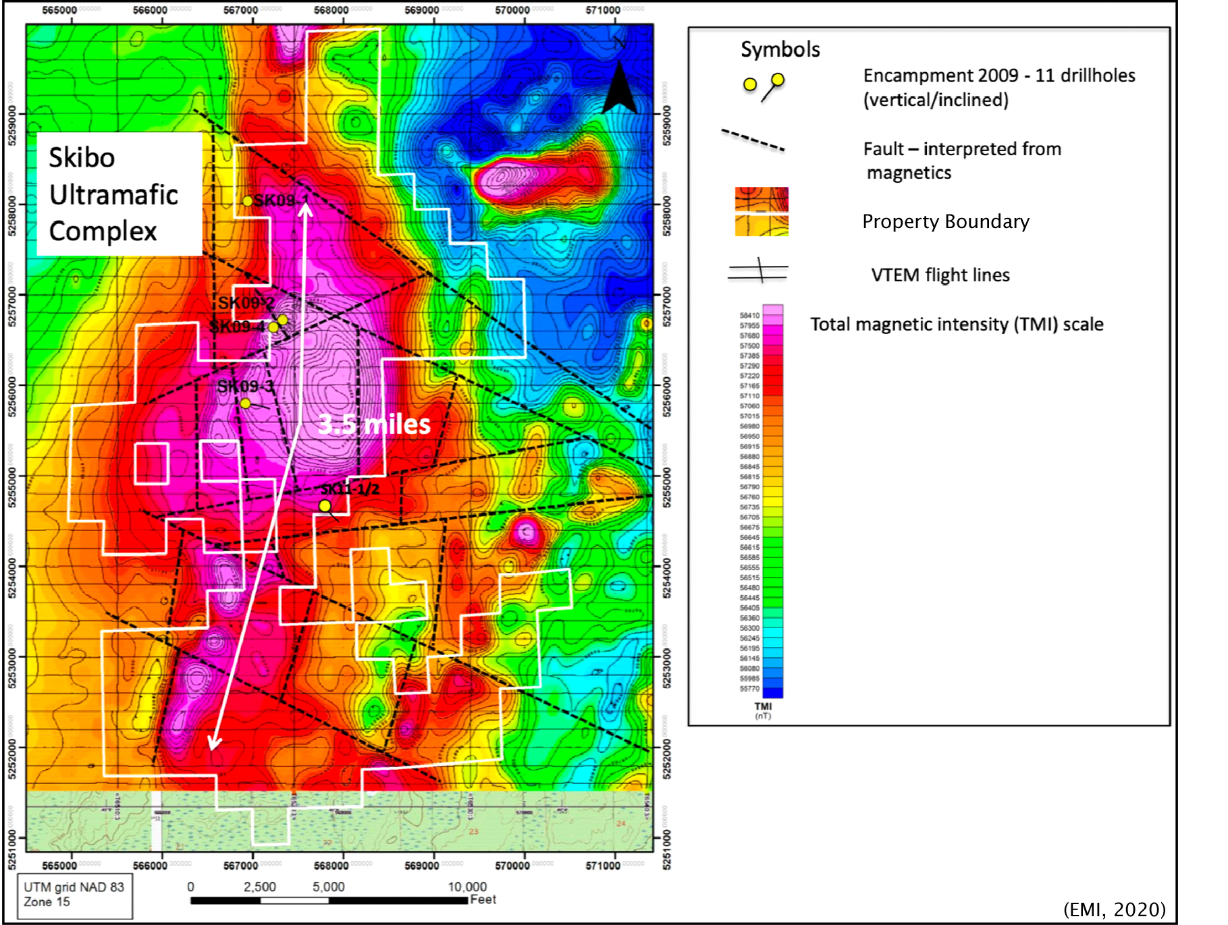

Skibo comprises 3,108 hectares and is characterized by a magnetic anomaly striking over 3.5 km north to south along with multiple, untested, geophysical electromagnetic conductors within the property associated with OUIs and providing drill-ready targets (Figure 5). Skibo OUIs are host to significant disseminated Cu-Ni mineralization that has not been assayed systematically for either Ti or V (Figure 6). Two important footwall high Cu-Ni-PGE grade massive sulfide vein stockwork zones have been identified that are related to the OUIs. These zones are considered high-priority targets. Massive sulfide veins in the northern stockwork zone (DDH-SK09-2) is shown in Figure 7. Table 2 below provides a summary of the historical intercepts.

Table 2. Historic significant intercepts drilled by EMI and previous operators from the Skibo property7.

Hole ID |

Interval (m) |

Cu% |

Ni% |

Co% |

PGE (ppm) |

11547 |

86.5 |

0.32 |

0.27 |

||

SK09-2 |

101 |

0.31 |

0.18 |

||

3.7 |

2.96 |

0.81 |

1.19 |

||

0.4 |

9.85 |

0.36 |

3.93 |

||

0.6 |

6.91 |

2.38 |

1.24 |

||

SK15-1 |

2.3 |

6.38 |

1.55 |

4.31 |

|

SK09-3 |

2.3 |

1.87 |

0.75 |

0.15 |

0.31 |

0.4 |

1.4 |

0.67 |

0.13 |

0.3 |

|

0.3 |

1.41 |

0.78 |

0.15 |

0.33 |

|

0.2 |

1.26 |

1.29 |

0.12 |

0.41 |

|

0.2 |

1.19 |

1.1 |

0.12 |

0.39 |

|

0.3 |

1.01 |

1.21 |

0.09 |

0.59 |

|

0.1 |

1.19 |

1.72 |

0.14 |

0.58 |

|

SK19-1 |

34.3 |

0.14 |

0.05 |

0.01 |

0.09 |

2.3 |

2.06 |

1.06 |

0.13 |

0.45 |

|

SK19-2 |

33.2 |

0.22 |

0.11 |

0.02 |

0.12 |

0.4 |

1.39 |

0.88 |

0.1 |

0.35 |

|

0.1 |

0.79 |

1.01 |

0.09 |

0.3 |

Titac- Boulder- Boulder North Properties (TiO2 - V2O5, Disseminated Cu-Ni):

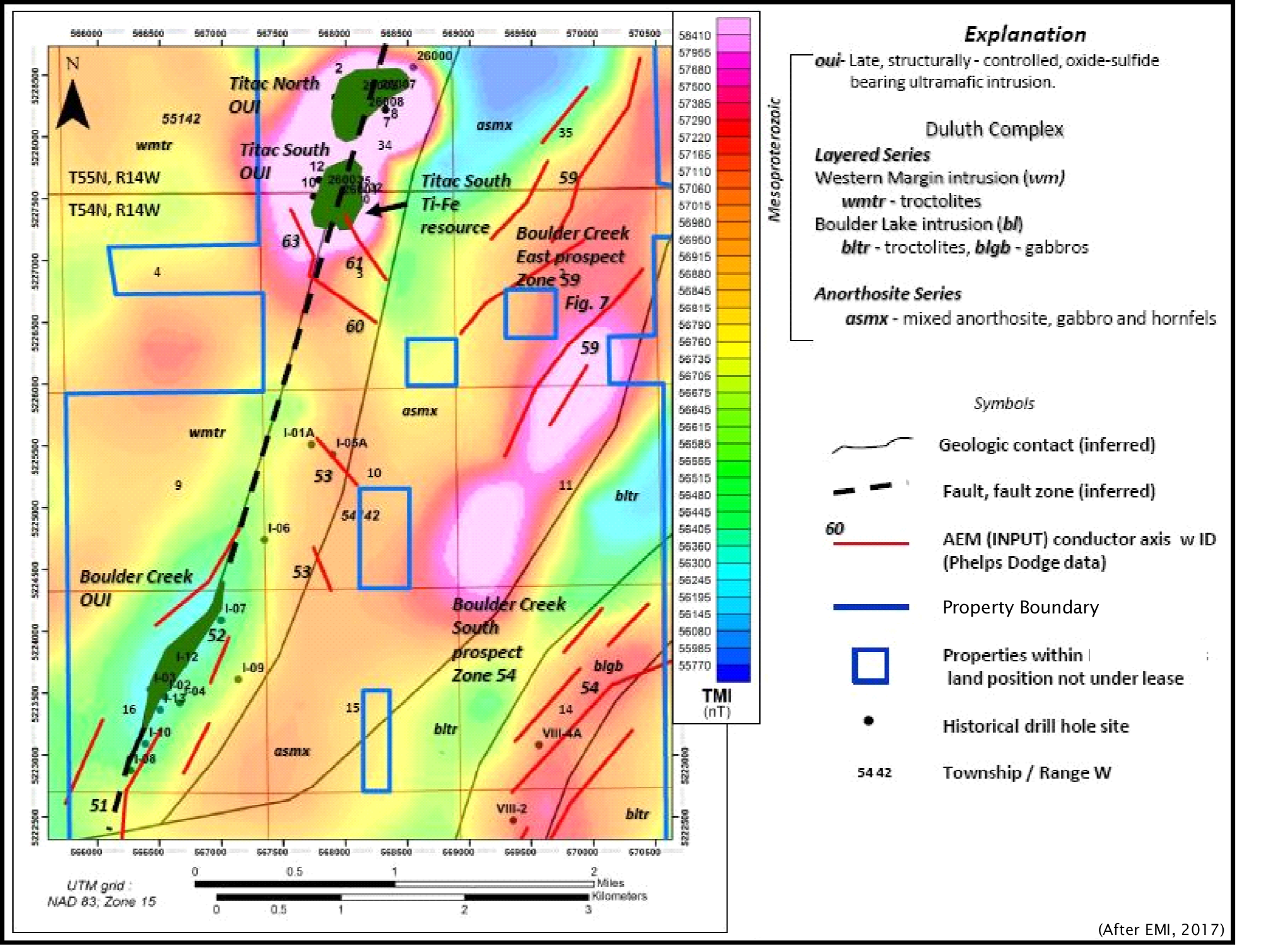

Several properties lie along the southern portion of the SCZ project: Titac, Boulder, and Boulder North (Figure 8) comprising approximately 3,992 hectares. Titac has the most advanced exploration with a NI 43-101, inferred resource of 45.1 million tonnes averaging 15% TiO25. This resource correlates directly with a discrete magnetic anomaly and has excellent potential to grow to the north where there is a second similar magnetic anomaly with historical drilling demonstrating Ti-V mineralization (Figure 8). A similar magnetic anomaly is present to the southeast of Titac that has not yet been drilled. In addition, the TiO2 mineralization at Titac contains significant disseminated Cu mineralization with the historical drill results assaying for copper presented below in Table 3. Importantly, there are three prominent electromagnetic conductors that are considered highly prospective for high-grade Cu-Ni mineralization that have not been drill tested.

The Boulder/Boulder North properties have limited drill testing but contain numerous magnetic anomalies and conductors that are proposed for drilling (Figure 9). Importantly, the Boulder properties have both Ti-V and Cu-Ni exploration potential based on limited historical drilling and geophysics. This area is considered highly prospective and will be the focus of an updated VTEM survey by the Company as historical airborne surveys are from the 1960's.

Table 3. Historic significant drill intercepts from the Boulder and Titac properties. Note that in some cases, elements of interest were not analyzed (Boulder drill results from EMI Internal Report, 2017, Titac results from Cardero Ni 43-101)8.

HOLE ID |

Interval (m) |

Cu % |

Ni % |

TiO2 % |

V2O5 % |

|

Boulder |

||||||

IV-1 |

57.0 |

0.22 |

0.3 |

23.2 |

0.42 |

|

36.6 |

0.19 |

low |

26.8 |

0.52 |

||

IV-6 |

15.8 |

0.28 |

0.06 |

16.1 |

0.19 |

|

IV-8 |

32.2 |

0.25 |

0.03 |

21.8 |

0.27 |

|

18.3 |

0.24 |

low |

25.8 |

0.3 |

||

Titac |

||||||

TTC-14 |

571.5 |

0.19 |

14.3 |

0.075 |

||

including |

145.1 |

0.4 |

14.9 |

0.073 |

||

TTC-15 |

199.3 |

0.21 |

10.2 |

0.048 |

||

TTC-19 |

461.9 |

0.37 |

20.6 |

*N/A |

||

TTC-29 |

247.2 |

0.15 |

17.5 |

*N/A |

||

| *N/A indicates "Not Analyzed" | ||||||

The above mineralization estimates are not current and should be considered "historical estimates" under National Instrument 43-101 -Standards of Disclosure for Mineral Projects ("NI 43-101"). A Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource or reserve, and the Company is not treating these historical estimates as current mineral resources or reserves. The Company would need to conduct an exploration program (including drilling) in order to verify these historical estimates as current in accordance with NI 43-101. There can be no certainty, following further evaluation and/or exploration work, that these historical estimates can be upgraded or verified as mineral resources or mineral reserves in accordance with NI 43-101. As such, these historical estimates should not be relied upon.

Option Terms:

Encampment Minerals, Inc. (EMI) will grant the Company a sole and exclusive option to acquire up to an 80% interest in the SCZ Properties as follows:

- 60% Interest Earn in. Green Bridge shall become vested with a 60% interest in the SCZ Properties (the "60% Earn In") by funding Expenditures on the SCZ Properties totaling $12,650,000 over a maximum 4 year period commencing from the Closing Date. These expenditures can be accelerated at the Company's election such that the 60% earn-in can be gained prior to the four year period.

|

- 80% Interest Earn In. After completing the 60% earn-in Green Bridge will have a period of 60 days provide notice of intent to earn in to 80%. Green Bridge shall then have a period of 2 years from the date of the 60% Earn In to increase its interest in the SCZ Properties to 80% by:

(i) Funding an additional $10,000,000 of Expenditures on the SCZ Properties; and

(ii) Completing a NI 43-101 compliant resource estimate on the SCZ Properties; and

(iii) Making a cash payment of $4,000,000 to EMI.

Joint Venture Formation:

Upon completion of the 80% earn-in a Joint Venture between Green Bridge Metals and EMI a straight-line dilution formula will apply whereby the deemed contributed initial expenditures at the date of the 80% earn-in of $22,650,000 by Green Bridge Metals and $8,000,000 by EMI.

Dilution Cap and Buyout Right:

EMI's interest in the SCZ Properties may not be diluted to less than 8% interest in the SCZ Properties (the "EMI Dilution Cap"). In the event that EMI's interest in the SCZ Properties reaches 8% interest, Green Bridge shall have the right, at its sole discretion, at any time, to purchase the remainder of EMI's interest in the SCZ Properties (the "Carried Interest Buyout Right") at a purchase price equal to 8% of the undiscounted net present value of the SCZ Properties (the "NPV"). Calculation of the NPV shall be carried out by a third-party independent appraiser selected by both Green Bridge and EMI, acting reasonably, and the costs of such NPV determination shall be borne by Green Bridge and EMI equally. The purchase price may be made in 50% cash and 50% cash and/or shares at Greenbridge's election.

Figure 1. Regional location map showing geology (MGS State Map Series S-21 2011), infrastructure and analogous Cu-Ni-PGE (+/- TiO2-V2O5) deposits. The Titac area includes the Titac North and South prospects as well as the Boulder East prospect, and the Boulder area includes the Boulder North prospect.

Figure 2. Schematic exploration model for a mineralized composite oxide ultramafic intrusion (modified from Barnes et al., 2015). This general model can be applied to further exploration of OUI's in the Skibo, Titac and Boulder properties.

Figure 3. Detailed geologic map of South Contact Zone (SCZ) properties along with polygons representing known styles of mineralization at each locality. Many known TiO2 occurrences coincide with disseminated Cu-Ni sulfide mineralization.

Figure 4. Copper-Nickel ore zone cross section model at the Wyman property showing significant drill intercepts with grades and representative thickness.6

Figure 5. Total magnetic intensity map at the Skibo property showing historic drill hole locations (yellow circles), property boundary (white line), and interpreted fault (dashed lines)8.

Figure 6. Geologic cross-section from the Skibo property with drill holes and associated Cu-Ni assay grades through and below the OUI7.

Figure 7. Core photo showing a Cu-Ni mineralized zone in drill hole SK09-2 between 372.4 to 376.1m (3.7m) which grades 2.3% Cu. 0.8% Ni and 1189 ppb PGE. Sulfide mineral assemblages include chalcopyrite, pentlandite and pyrrhotite. Hole drilled by EMI (2009).

Figure 8. Summary of the magnetic anomalies that define the Titac North and South areas of the Titac property. Drill holes (red dots) have proven an economic TiO2 bearing OUI exists, all of which are open at depth.

Figure 9. Geologic and electromagnetic map of the Titac-Boulder property with structural trends (dashed black lines) and electromagnetic conductors (red lines) shown. Historic drill hole locations are also shown (Geology from MGS Miscellaneous Map Series, Map 119).

Completion of the transaction of The South Contact Zone remains subject to several conditions, including the satisfactory completion of due diligence, receipt of any regulatory approvals, the negotiation of definitive agreement, other documents, and the completion of a minimum $3 million in financing concurrent with the completion of the transaction.

Theodore A. DeMatties, CPG, PG, is the Qualified Person who assumes responsibility for the technical content of this press release.

About Green Bridge Metals

Green Bridge Metals Corporation (formerly Mich Resources Ltd.) is a Canadian based exploration company focused on acquiring ‘battery metal' rich mineral assets and the development of the South Contact Zone (the "Property") along the basal contact of the Duluth Intrusion, north of Duluth, Minnesota. The South Contact Zone contains bulk-tonnage copper-nickel and titanium-vanadium in ilmenite hosted in ultramafic to oxide ultramafic intrusions. The Property has exploration targets for bulk-tonnage Ni mineralization, high grade Ni-Cu-PGE magmatic sulfide mineralization and titanium.

ON BEHALF OF GREEN BRIDGE METALS,

"David Suda"

President and Chief Executive Officer

For more information, please contact:

David Suda

President and Chief Executive Officer

Tel: 604.928-3101

investors@greenbridgemetals.com

Forward Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to: the exploration and development of the South Contact Zone Properties.

Although management of the Company believe that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These risk factors include, but are not limited to: the exploration and development of the South Contact Zone Properties may not result in any commercially successful outcome for the Company; risks associated with the business of the Company; business and economic conditions in the mining industry generally; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Certain figures and references contain information supported by public and corporate references that may have been updated, changed, or modified since their referenced date. The Company has not reviewed any resources and cannot comment on their accuracy.

References:

1 Miller Jr, J.D., Green, J.C., Severson, M.J., Chandler, V.W., Hauck, S.A., Peterson, D.M. and Wahl, T.E., (2002). RI-58 geology and mineral potential of the Duluth complex and related rocks of northeastern Minnesota.

2 Ding, X., C. Li, E. M. Ripley, D. Rossell, and S. Kamo (2010), The Eagle and East Eagle sulfide ore-bearing mafic-ultramafic intrusions in the Midcontinent Rift System, upper Michigan: Geochronology and petrologic evolution, Geochem. Geophys. Geosyst., 11, Q03003, doi:10.1029/2009GC002546.

3 Thomas, B, Jackson, R, Peters, O., Pint, C. (2022). November 2022 National Instrument 43-101 Technical Report of the Tamarack North Project - Tamarack, Minnesota. WSP Golder. Talon Metals Corp. https://talonmetals.com/technical-reports/

4 Welhener, Cowie, (2022). PolyMet Mining releases NI 43-101 Technical Report on Mesaba copper-nickel-PGM deposit. Polymet Mining. Accessed on Yahoo finance. January 22, 2024. https://finance.yahoo.com/news/polymet-mining-releases-ni-43-123000618.html?fr=sycsrp_catchall

5 Farrow, D., Johnson, M., (2012), January 2012 National Instrument 43-101Technical Report on the Titac Ilmenite Exploration Project, Minnesota, USA. SRK Consulting (Canada) Inc. SRK Project Number 2CC031.004. Cardero Resources Corp.

6 DeMatties, T.A., (2013). Encampment Minerals, Inc., 2012-13 Copper-Nickel-PGM Exploration Program, Wyman Creek Cu-Ni Resource Area, St. Louis County, Minnesota. Summary Report. Encampment Minerals, Inc.

7 DeMatties, T.A., (2013). Encampment Minerals, Inc., Copper-Nickel-PGM Exploration Program Skibo Property, St. Louis County, Minnesota, Summary Report. Encampment Minerals Inc.

8 DeMatties, T.A., (2020). Encampment Minerals, Inc., 2020 Winter Drilling Program at the Skibo (North) Property, St. Louis County, Minnesota, Technical Report. Encampment Minerals Inc.

SOURCE: Green Bridge Metals Corporation

View the original press release on accesswire.com