Full Year 2023 Highlights

- Year-over-year deposit growth of 6%, totaling 9% organic growth after eliminating brokered deposits. Cost of funds at year end was 1.73%, which compared favorably to peers.

- There were no borrowings at year-end 2023 compared to $26.9 million at year-end 2022.

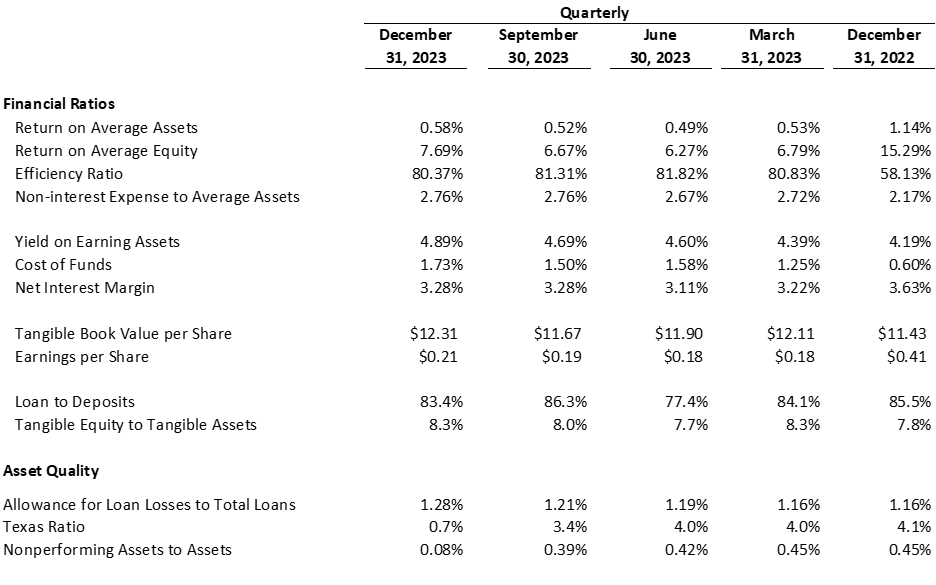

- Non-performing assets to total assets were .08%, a reduction from year-end 2022 of .45%, and a representation of net recoveries of $712 thousand. The Allowance for Credit Losses ("ACL") at year-end 2023 was 1.28% compared to 1.16% the prior year.

- Tangible book value per share increased to $12.31 as of December 31, 2023.

- All capital ratios increased year-over-year. The Bank's regulatory capital ratios were all above "well-capitalized" requirements.

- Hired two well-known teams of bankers from Umpqua Bank (previously Columbia Bank) and opened fifth bank branch located in Gig Harbor, Washington.

Fourth Quarter 2023 Highlights:

- Deposit growth of 5% in fourth quarter 2023 compared to third quarter.

- Return on average assets for fourth quarter was .58% and return on average equity was 7.69%, compared to .52% and 6.67%, respectively, for third quarter 2023.

- Voted Best Local Bank for Businesses and recognized in South Sound Business Magazine.

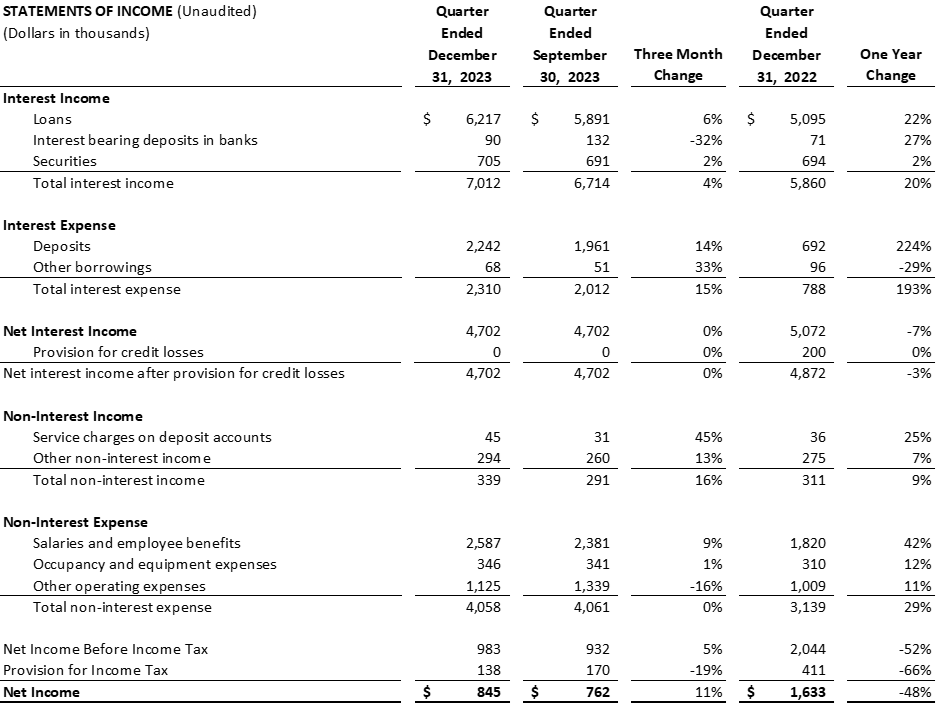

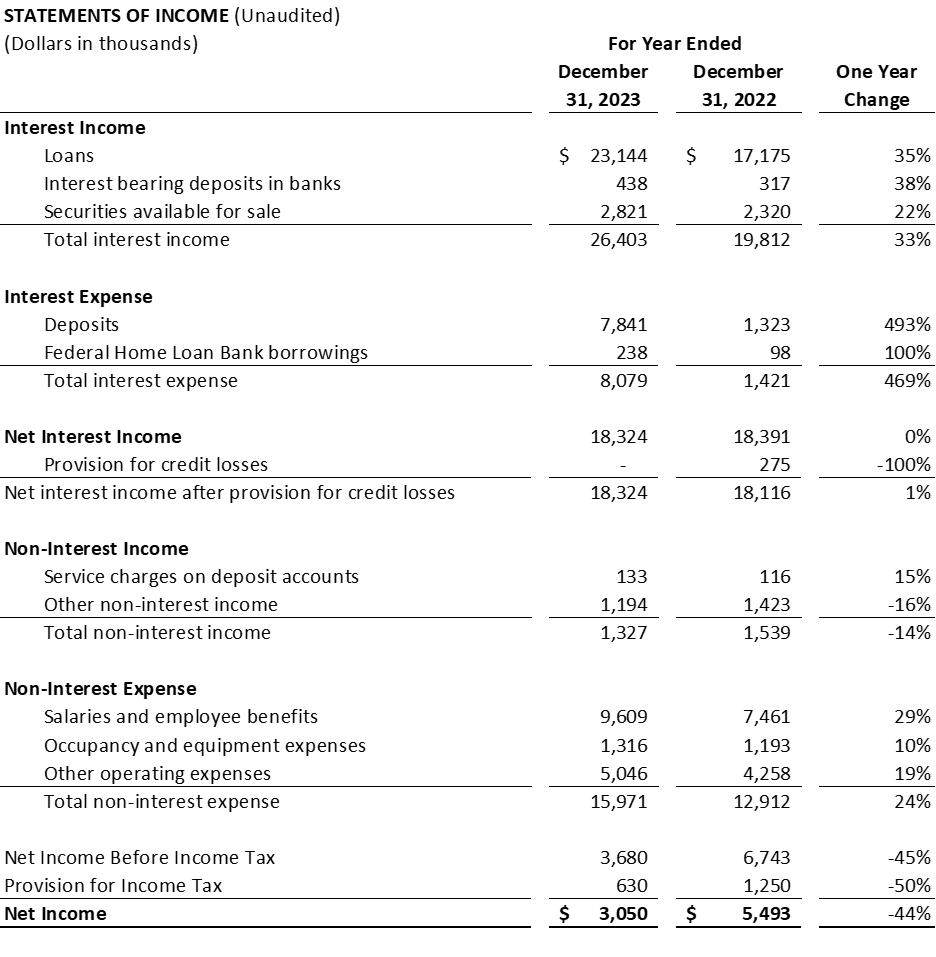

TACOMA, WA / ACCESSWIRE / February 12, 2024 / Commencement Bancorp, Inc. (OTCQX:CBWA) reported 2023 net income of $3.1 million, or $0.77 per share, for the year ending December 31, 2023, compared to $5.5 million, or $1.37 per share for 2022. Fourth quarter 2023 net income was $845 thousand, or $0.21 per share, compared to third quarter 2023, an 11% improvement quarter-over-quarter. The year-over-year change in net income was a result of the Federal Reserve rate increases and their direct effect on cost of funds, in addition to one-time Bank expenses related to a core systems upgrade, new employee hires, and branch expansion costs. Interest income on loans for 2023 was 35% higher than the previous year and the result of variable rate loans adjusting to higher interest rates. The increased interest income was offset by a higher cost of deposits resulting in lower earnings for the year.

Total non-interest income was $1.3 million for the year, compared to $1.5 million for 2022. Non-interest expense increased to $15.9 million for 2023, compared to $12.9 million for 2022. This increase was due to additional staffing and non-recurring expenses related to a core and digital banking upgrade and branch expansion costs.

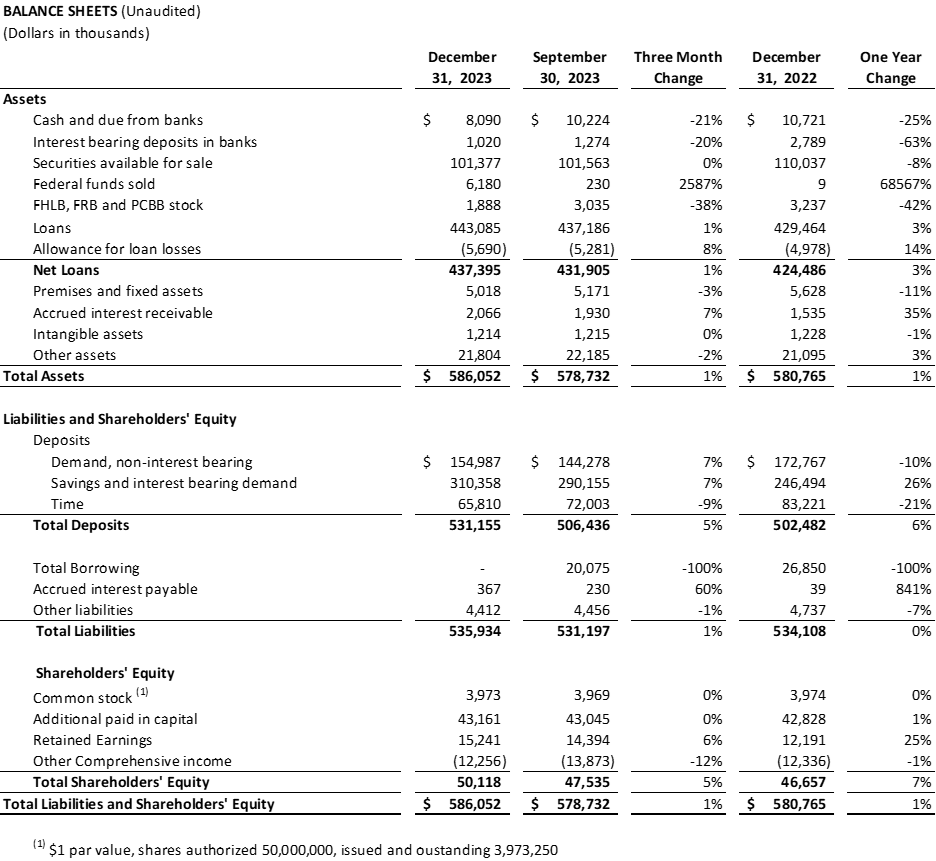

Total assets ended the year at $586.1 million, an increase of 1% from 2022. Total loan balances were $443.1 million at year end, an increase of 3% compared to 2022, and 1% quarter-over-quarter. Most of the loan growth was centered in commercial and industrial relationships, while commercial real estate remained flat. Asset quality improved based on net recoveries totaling $712 thousand, which resulted in an improved Texas ratio (a measurement of problem loans and bank-owned properties to capital) of 0.7% at year-end 2023 compared to 4.1% the prior year.

Total deposits increased 6% to $531.2 million, or $28.7 million, when compared to one year prior at $502.5 million. At year-end, the Bank eliminated all brokered deposits. Overnight borrowings were also eliminated which improved overall liquidity. Coupled with core deposit growth, this resulted in overall organic funding growth of 15%.

Total shareholders' equity was $50.1 million on December 31, 2023, an increase of $3.4 million, or 7%, from the prior year. The increase in retained earnings was a result of net income and a slight improvement to the market value of the securities portfolio. The Bank's regulatory capital ratios all remained above "well-capitalized" requirements.

"Our dedicated bankers persevered in one of the most challenging interest rate environments in recent years, by both retaining existing clients and cultivating new relationships. The impact of rate increases when combined with implementing long-term strategic objectives, led to reduced earnings for the Bank. Executing on market opportunities and strategically investing in technology upgrades will support our growth plan and help us to scale our operations and run efficiently," said John E. Manolides, Chief Executive Officer.

"The new team members who joined our organization in 2023 exceeded our expectations and, together with our entire banking team, are laying the foundation for continued success in attracting new client relationships. We continue to successfully execute on our strategic plan as evidenced by the increase in new relationships, investment in technology to support growth, and expansion into Gig Harbor. We are looking forward to the challenge of continuing and furthering this work to gain even more trust, confidence, and support from our community," said Nigel L. English, President and Chief Operating Officer.

###

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For information related to the trading of CBWA, please visit www.otcmarkets.com.

For further discussion, please contact the following:

John E. Manolides, Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Thomas L. Dhamers, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc. undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bank (WA)

View the original press release on accesswire.com