Halfpricesoft has released ezPaycheck 2025, featuring the latest IRS federal and state tax tables, including updated tax brackets and standard deductions. Tailored for small businesses and CPAs, this software simplifies payroll processing. A free demo is available at www.halfpricesoft.com.

MIAMI - Dec. 17, 2024 - PRLog -- Halfpricesoft, a leading provider of small business payroll solutions, proudly announces the release of ezPaycheck 2025. This latest version is updated with the newest federal and state tax tables for the upcoming tax year, aligning with the IRS's recently published 2025 tax table changes. Designed to help small businesses and CPAs manage payroll seamlessly and accurately, ezPaycheck 2025 ensures compliance with the latest tax regulations.

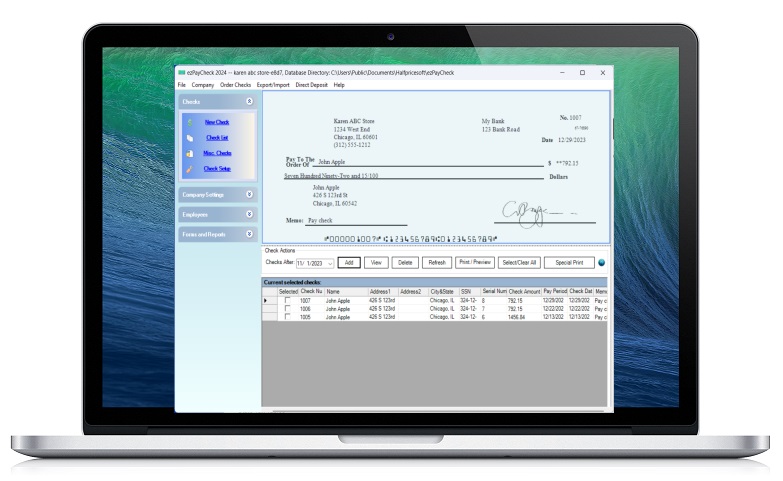

With its all-in-one functionality, ezPaycheck empowers business owners and accountants to automate payroll tasks, calculate taxes, print paychecks, and file tax forms with ease.

"We understand the challenges that small businesses and CPAs face in managing payroll during tax season," said Dr. Ge, Founder of Halfpricesoft. "ezPaycheck 2025 is designed to simplify payroll management while ensuring compliance with the latest tax regulations. Our free demo version helps new clients experience the software risk-free before making a purchase."

To support new clients, Halfpricesoft offers a free demo version of ezPaycheck 2025. New clients looking to streamline their payroll process are invited to test drive this in-house payroll software with a free, no-obligation demo at https://www.halfpricesoft.com/payroll_software_download.asp.

This desktop payroll software is compatible with both Windows and Mac. Small businesses and accountants will appreciate the unique features in ezPaycheck payroll software:

- Automatically calculates Federal, state and local taxes and deductions including Social Security tax, Medicare, employer unemployment taxes, 401K, Insurance deduction and more

- Includes built-in tax tables for federal, all 50 states and the District of Columbia

- Manually enter after-the-fact checks to override tax tables

- Prints Tax Forms 940, 943, 941, W2, and W3

- E-files 941

- Supports daily, weekly, biweekly, semimonthly, and monthly payroll periods

- Print payroll checks on blank stock and pre-printed check paper

- Supports stub-only printing

- Easily calculates salary pay, hourly pay, tip, bonus, differential pay and more

- Prints miscellaneous checks as well as payroll calculation checks

- Supports employees PTO plan

- Creates and maintains payroll for multiple companies simultaneously with one flat rate

- Supports network access

Priced at $169 per installation and released each per calendar year ($199.00 for the 2024-2025 single installation bundle version), ezPaycheck payroll software is affordable for any size business. To start the no obligation 30-day test drive today, please visit https://www.halfpricesoft.com/index.asp.

https://www.youtube.com/watch?v=sLyvwZ_MrVU

Contact

Casey Yang

***@halfpricesoft.com

Photos: (Click photo to enlarge)![]()

Source: halfpricesoft

Read Full Story - ezPaycheck 2025 Released with Latest Federal and State Tax Tables, Incorporating IRS 2025 Updates | More news from this source

Press release distribution by PRLog

ezPaycheck 2025 Released with Latest Federal and State Tax Tables, Incorporating IRS 2025 Updates

December 17, 2024 at 10:19 AM EST