Patrick Anderson discusses how tax planning impacts retirement income planning.

Listen to the interview on the Business Innovators Radio Network:

Patrick explained: “When it comes to tax planning for retirement income, one of the most important factors to consider is how taxes will impact the overall retirement plan. Taxes can significantly affect the amount of money someone has available for retirement and how long those funds will last. Depending on the type of investments a person makes, and when they start withdrawing from them, taxes could significantly reduce the overall net worth. It’s important to understand how different investment types are taxed when they should be, and which ones offer beneficial tax treatments so people can maximize their retirement savings while minimizing taxes.”

As someone plans for retirement, it’s essential to consider the tax implications of all their investment and withdrawal strategies. A qualified financial advisor can help understand the tax implications of various retirement options and develop a comprehensive strategy that helps minimize taxes in retirement while helping people reach their goals. Additionally, strategic decisions on when to take Social Security benefits or withdraw money from 401(k) plans can help minimize the tax burden in retirement.

In summary, when it comes to tax planning and retirement income, careful consideration must be given so that taxes do not reduce the overall net worth or consume more funds than necessary. Working with a financial professional can help ensure that a person takes advantage of any beneficial tax treatments available and creates a customized plan that meets their individual needs. Ultimately, this will enable people to maximize their savings and keep taxes in check as much as possible throughout their retirement plan.

By following these strategies, people can be sure they’re in the best possible position for a comfortable and secure retirement.

Video Link: https://www.youtube.com/embed/ZfTIznrEaBk

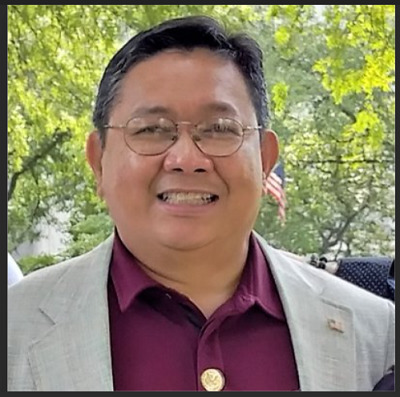

About Patrick Anderson

Patrick has more than fifteen years of strategic experience in the financial, insurance, and the tax industry.

As a Licensed Financial Strategist & Retirement Specialist, he engages in Tax-Free Financial Planning, serving the needs of American Families.

A Registered Tax Professional with the IRS, he pursued licensure in the Financial & Insurance field. Many of his clients belong to the Asian-American Communities where he came from. He made it his advocacy to be a financial educator to them as well as a resource specialist to the general public. This led him to establish the COFFEE Group, a non-profit organization, which stands for Creating Opportunities For Financial Education Empowerment. He carries a bachelor’s degree in General Education & Military Science from Asia’s premier defense institute and Certificate of Graduation in US Taxation. He has earned his designation as Certified Financial Education Professional as well as Certified College Plan Advisor. Annually, he gains Continuing Professional Education credits from various financial institutions to keep his clients updated on their taxes.

Serving affluent families and high-net-worth business owners, he partnered with Redwood Tax Specialists (RTS) Group. RTS is a national elite team of professional experts composed of CPAs, Tax & ERISA Attorneys, Certified Financial Planners, Qualified Pension Administrators, Chartered Financial Consultants & Life Underwriters, Actuaries & Third-Party Administrators. Together, they provide an excellent way of significantly reducing taxes, building a retirement income for life, and creating a legacy for the next generations.

Learn More: https://unifirstfinancialandtax.com/