What a fantastic six months it’s been for Fastly. Shares of the company have skyrocketed 42.6%, hitting $10.05. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Fastly, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Fastly Will Underperform?

We’re glad investors have benefited from the price increase, but we don't have much confidence in Fastly. Here are three reasons why FSLY doesn't excite us and a stock we'd rather own.

1. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

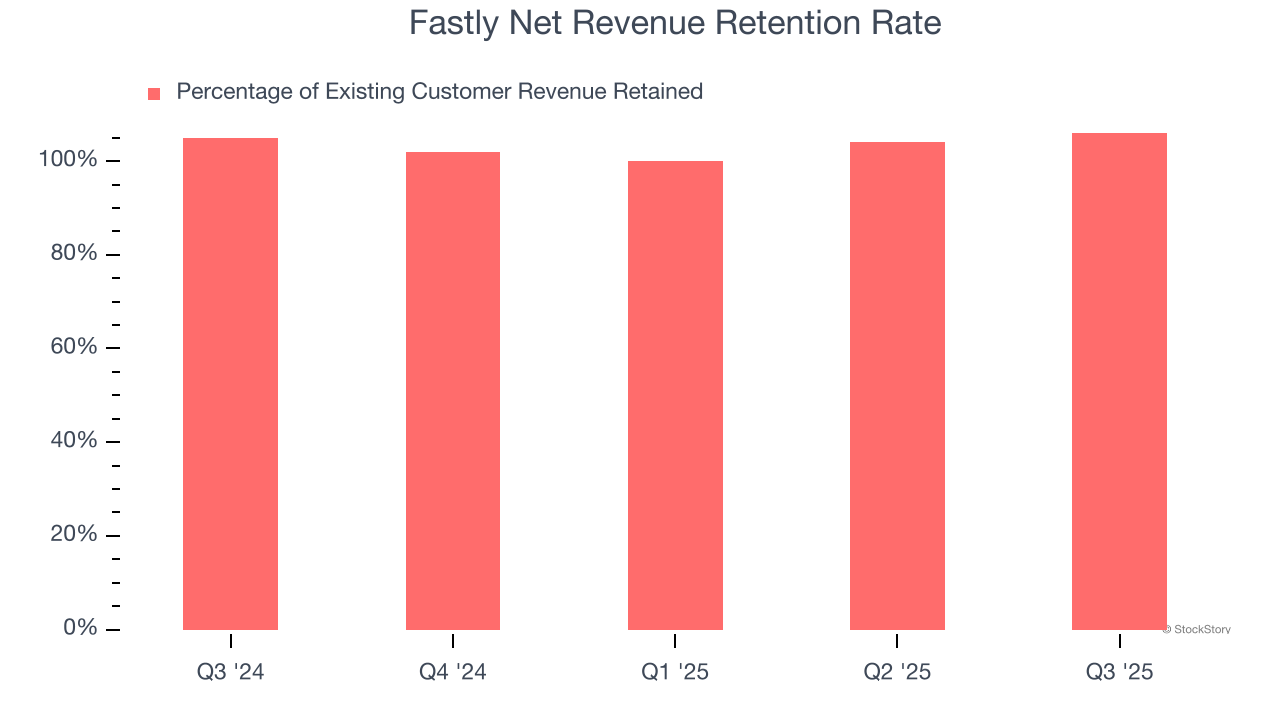

Fastly’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 103% in Q3. This means Fastly would’ve grown its revenue by 3% even if it didn’t win any new customers over the last 12 months.

Fastly has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

2. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Fastly, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

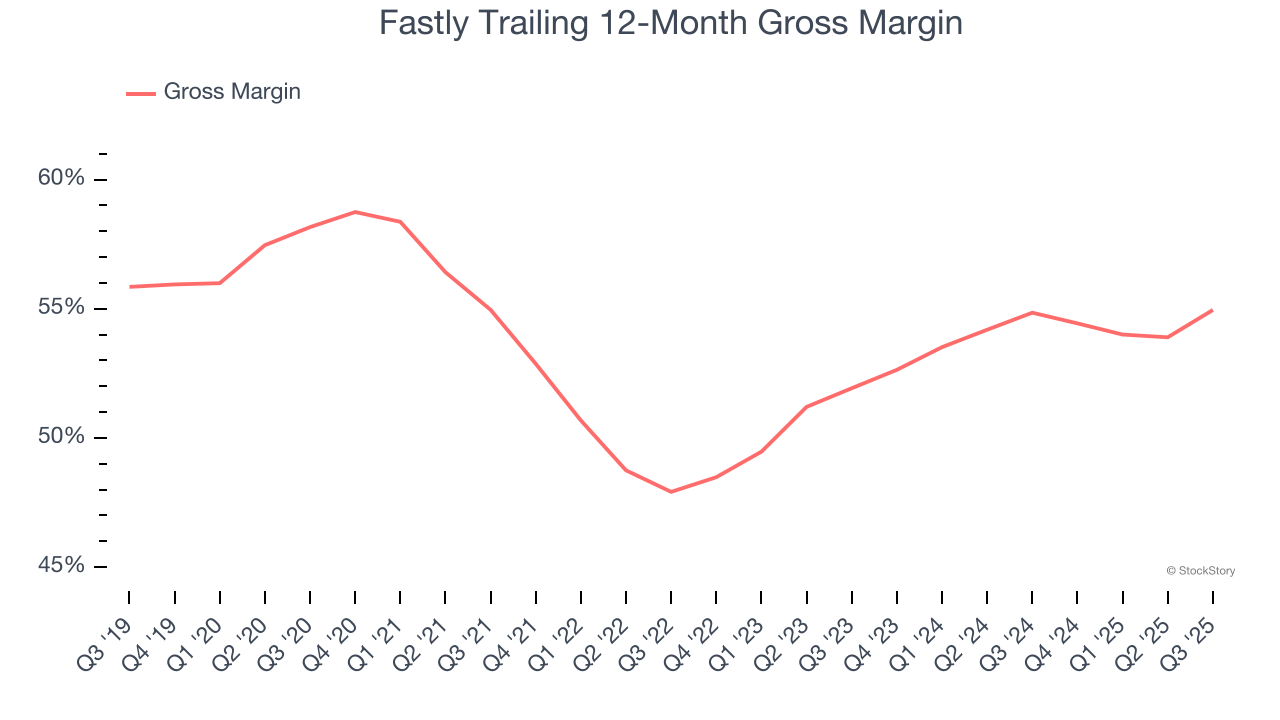

Fastly’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 55% gross margin over the last year. That means Fastly paid its providers a lot of money ($45.05 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Fastly has seen gross margins improve by 3 percentage points over the last 2 year, which is very good in the software space.

3. Operating Losses Sound the Alarms

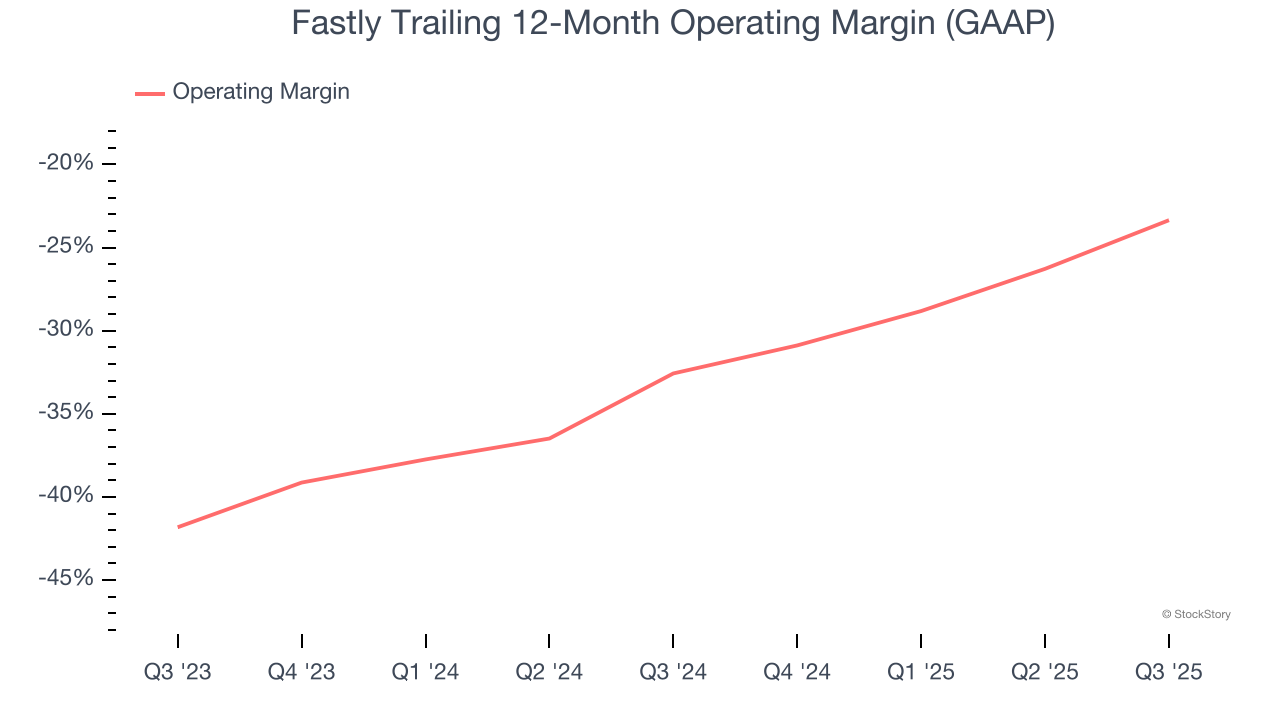

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Fastly’s expensive cost structure has contributed to an average operating margin of negative 23.4% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Fastly reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Final Judgment

We cheer for all companies solving complex business issues, but in the case of Fastly, we’ll be cheering from the sidelines. After the recent rally, the stock trades at 2.3× forward price-to-sales (or $10.05 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.