Let’s dig into the relative performance of Laureate Education (NASDAQ: LAUR) and its peers as we unravel the now-completed Q3 education services earnings season.

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

The 7 education services stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.4% on average since the latest earnings results.

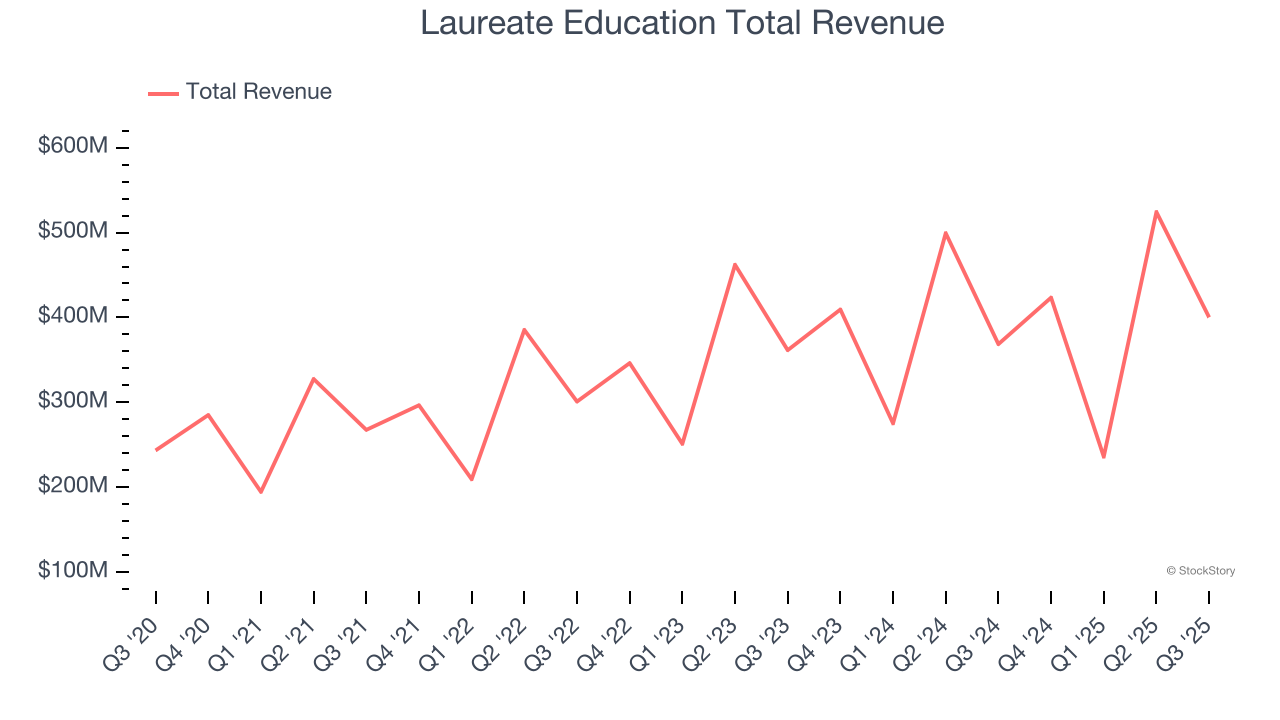

Laureate Education (NASDAQ: LAUR)

Founded in 1998 by Douglas L. Becker and based in Miami, Laureate Education (NASDAQ: LAUR) is a global network of higher education institutions.

Laureate Education reported revenues of $400.2 million, up 8.6% year on year. This print exceeded analysts’ expectations by 3.7%. Overall, it was a very strong quarter for the company with full-year revenue guidance exceeding analysts’ expectations and a solid beat of analysts’ revenue estimates.

Eilif Serck-Hanssen, President and Chief Executive Officer, said “We are pleased to report another strong quarter, driven by favorable operating performance as well as a weaker U.S. dollar. We were especially encouraged by our continued ability to scale our fully online offerings in Peru through our industry-leading digital portfolio and to deliver continued growth in Mexico despite a softer macroeconomic environment. The results from the intake cycles, combined with favorable foreign currency trends, give us the confidence to increase our full-year outlook for 2025.”

Interestingly, the stock is up 15.3% since reporting and currently trades at $33.31.

Is now the time to buy Laureate Education? Access our full analysis of the earnings results here, it’s free for active Edge members.

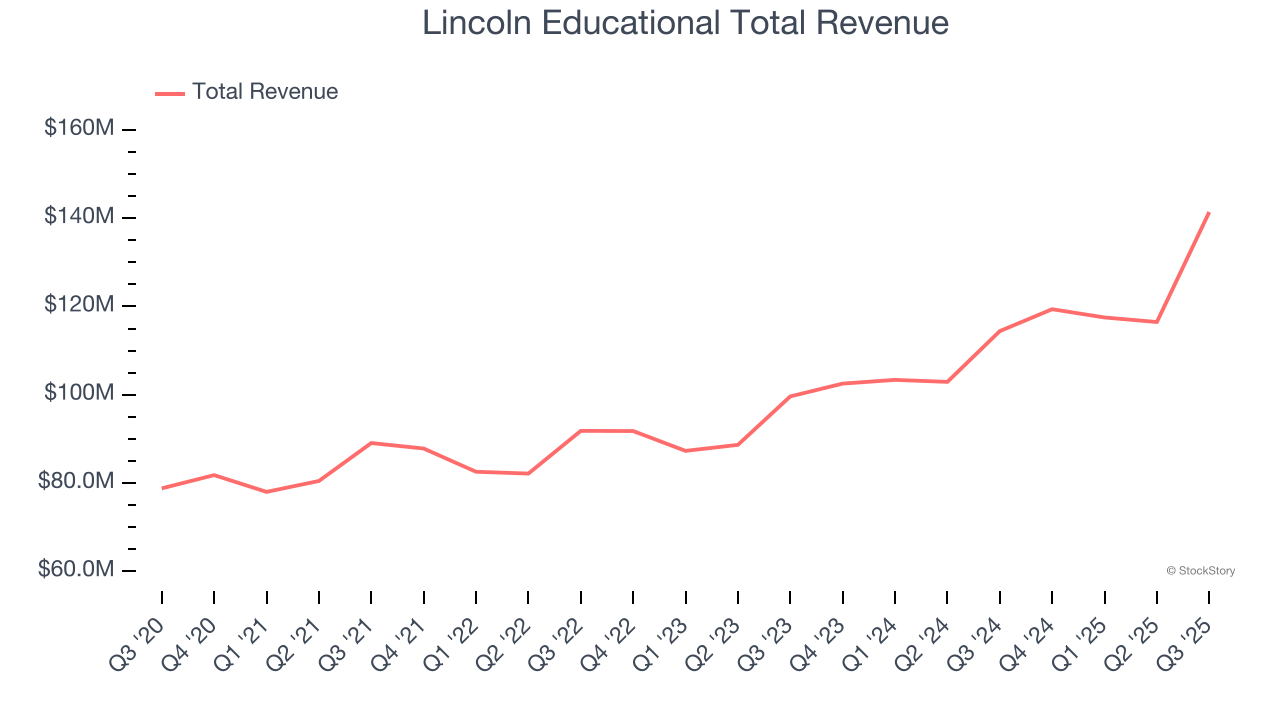

Best Q3: Lincoln Educational (NASDAQ: LINC)

Established in 1946, Lincoln Educational (NASDAQ: LINC) is a provider of specialized technical training in the United States, offering career-oriented programs to provide practical skills required in the workforce.

Lincoln Educational reported revenues of $141.4 million, up 23.6% year on year, outperforming analysts’ expectations by 7.5%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

Lincoln Educational pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 31.1% since reporting. It currently trades at $23.34.

Is now the time to buy Lincoln Educational? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Grand Canyon Education (NASDAQ: LOPE)

Founded in 1949, Grand Canyon Education (NASDAQ: LOPE) is an educational services provider known for its operation at Grand Canyon University.

Grand Canyon Education reported revenues of $261.1 million, up 9.6% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

Grand Canyon Education delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 7.2% since the results and currently trades at $165.39.

Read our full analysis of Grand Canyon Education’s results here.

Universal Technical Institute (NYSE: UTI)

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

Universal Technical Institute reported revenues of $222.4 million, up 13.3% year on year. This number beat analysts’ expectations by 1.3%. It was a strong quarter as it also put up a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Universal Technical Institute delivered the highest full-year guidance raise among its peers. The stock is down 15.8% since reporting and currently trades at $24.84.

Adtalem (NYSE: ATGE)

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE: ATGE) is a global provider of workforce solutions and educational services.

Adtalem reported revenues of $462.3 million, up 10.8% year on year. This print surpassed analysts’ expectations by 2%. More broadly, it was a mixed quarter as it also recorded a beat of analysts’ EPS estimates but full-year revenue guidance meeting analysts’ expectations.

Adtalem had the weakest full-year guidance update among its peers. The stock is down 26.4% since reporting and currently trades at $104.44.

Read our full, actionable report on Adtalem here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.