eBay trades at $87.03 per share and has stayed right on track with the overall market, gaining 14.6% over the last six months. At the same time, the S&P 500 has returned 9.9%.

Is now the time to buy eBay, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is eBay Not Exciting?

We're cautious about eBay. Here are three reasons we avoid EBAY and a stock we'd rather own.

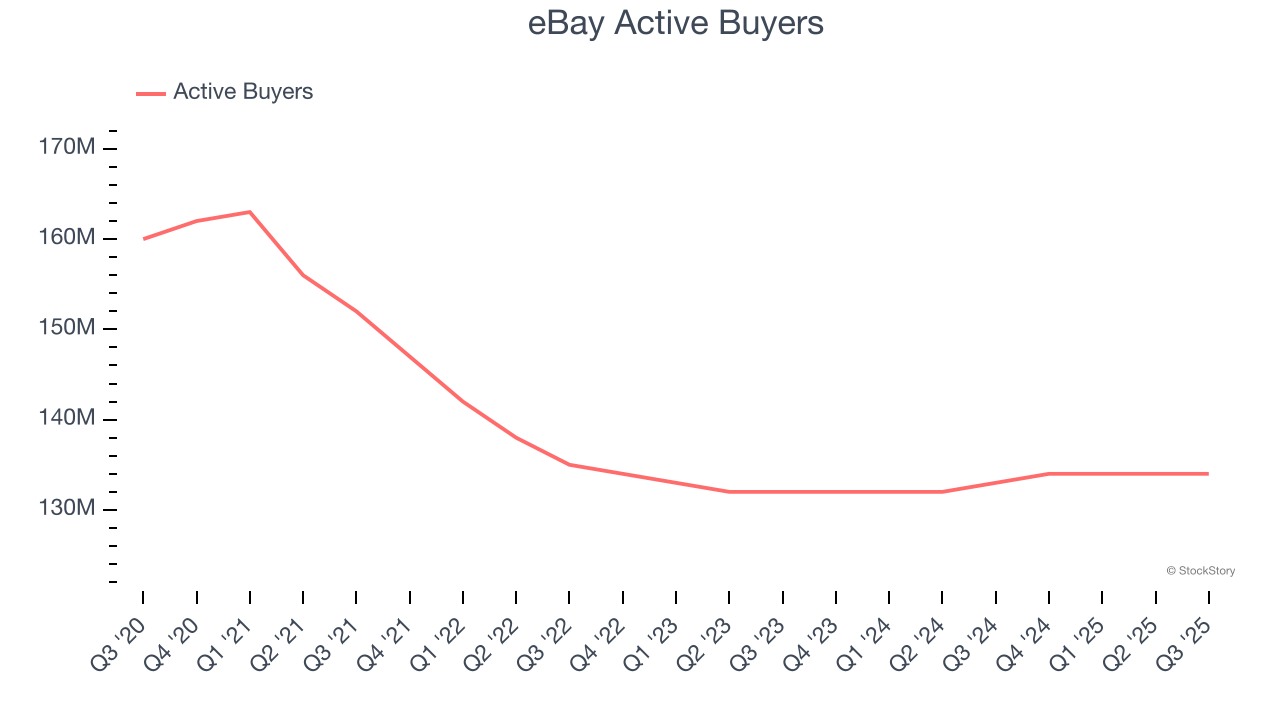

1. Active Buyers Hit a Plateau

As an online marketplace, eBay generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

eBay struggled with new customer acquisition over the last two years as its active buyers were flat at 134 million. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If eBay wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect eBay’s revenue to rise by 6.5%. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

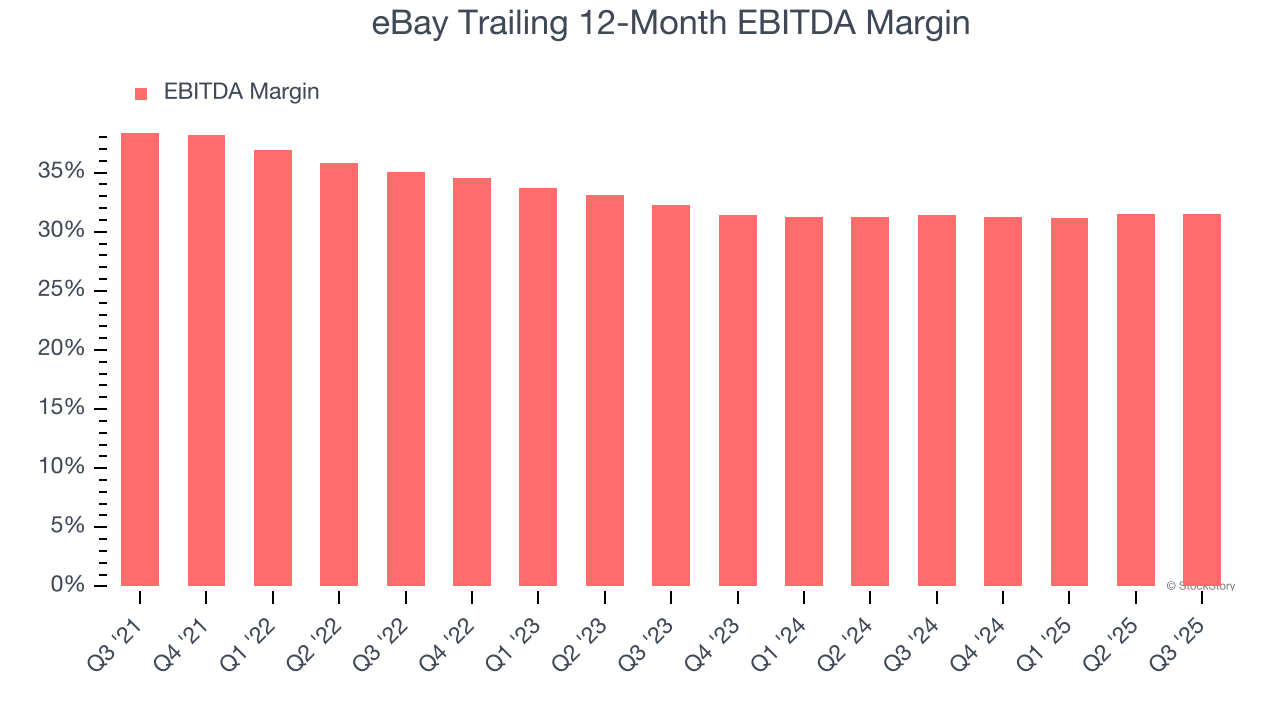

3. Shrinking EBITDA Margin

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Looking at the trend in its profitability, eBay’s EBITDA margin decreased by 3.5 percentage points over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its EBITDA margin for the trailing 12 months was 31.5%.

Final Judgment

eBay’s business quality ultimately falls short of our standards. That said, the stock currently trades at 12.5× forward EV/EBITDA (or $87.03 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than eBay

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.