Over the past six months, Trinity’s stock price fell to $26.88. Shareholders have lost 6% of their capital, which is disappointing considering the S&P 500 has climbed by 9.9%. This may have investors wondering how to approach the situation.

Is now the time to buy Trinity, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Trinity Will Underperform?

Even with the cheaper entry price, we're cautious about Trinity. Here are three reasons there are better opportunities than TRN and a stock we'd rather own.

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Trinity struggled to consistently generate demand over the last five years as its sales dropped at a 2.2% annual rate. This was below our standards and signals it’s a low quality business.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Trinity’s revenue to stall. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

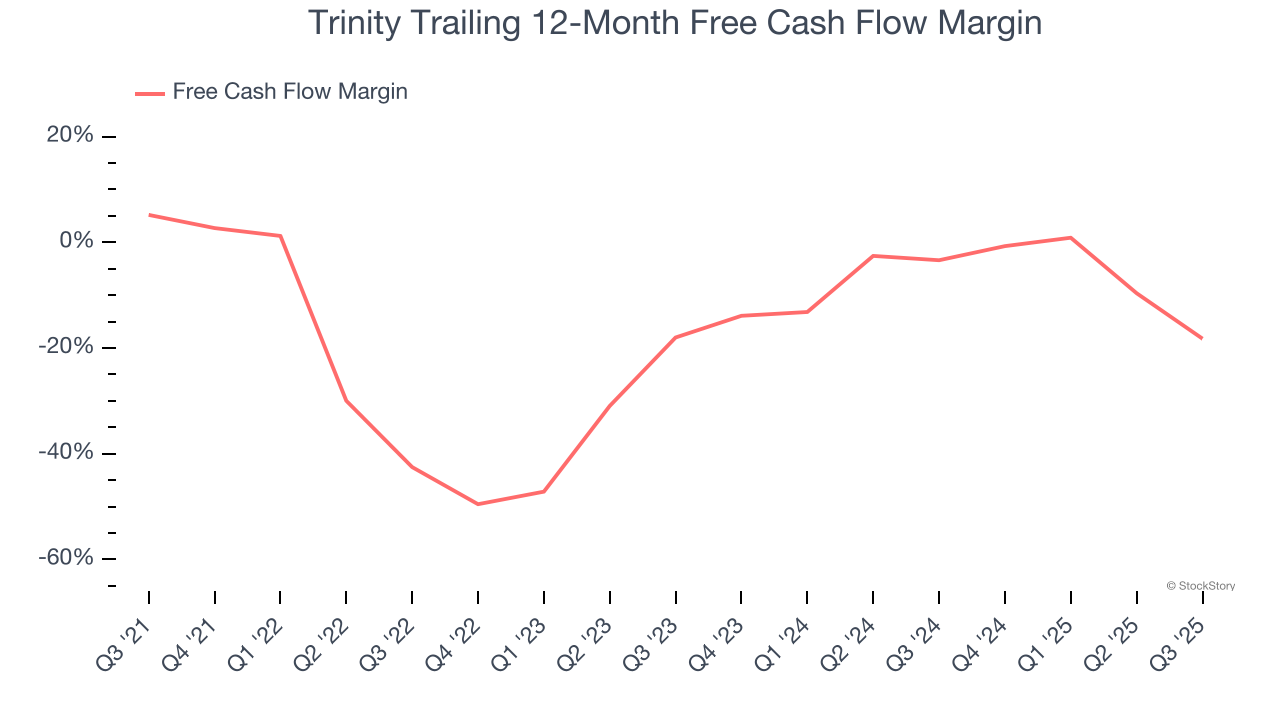

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Trinity’s margin dropped by 23.4 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business. Trinity’s free cash flow margin for the trailing 12 months was negative 18.2%.

Final Judgment

Trinity doesn’t pass our quality test. After the recent drawdown, the stock trades at 14.7× forward P/E (or $26.88 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere. We’d recommend looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.