Document technology company Xerox (NASDAQ: XRX) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 25.7% year on year to $2.03 billion. The company’s full-year revenue guidance of $7.5 billion at the midpoint came in 5.1% below analysts’ estimates. Its non-GAAP loss of $0.10 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Xerox? Find out by accessing our full research report, it’s free.

Xerox (XRX) Q4 CY2025 Highlights:

- Revenue: $2.03 billion vs analyst estimates of $2.05 billion (25.7% year-on-year growth, 0.9% miss)

- Adjusted EPS: -$0.10 vs analyst estimates of $0.10 (significant miss)

- Adjusted EBITDA: $58 million vs analyst estimates of $179.8 million (2.9% margin, 67.7% miss)

- Operating Margin: -3%, down from 2.1% in the same quarter last year

- Free Cash Flow Margin: 9.1%, down from 20.7% in the same quarter last year

- Market Capitalization: $298.3 million

Company Overview

Pioneering the modern office copier and inventing technologies like Ethernet and the laser printer, Xerox (NASDAQ: XRX) provides document management systems, printing technology, and workplace solutions to businesses of all sizes across the globe.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $7.02 billion in revenue over the past 12 months, Xerox is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To accelerate sales, Xerox likely needs to optimize its pricing or lean into new offerings and international expansion.

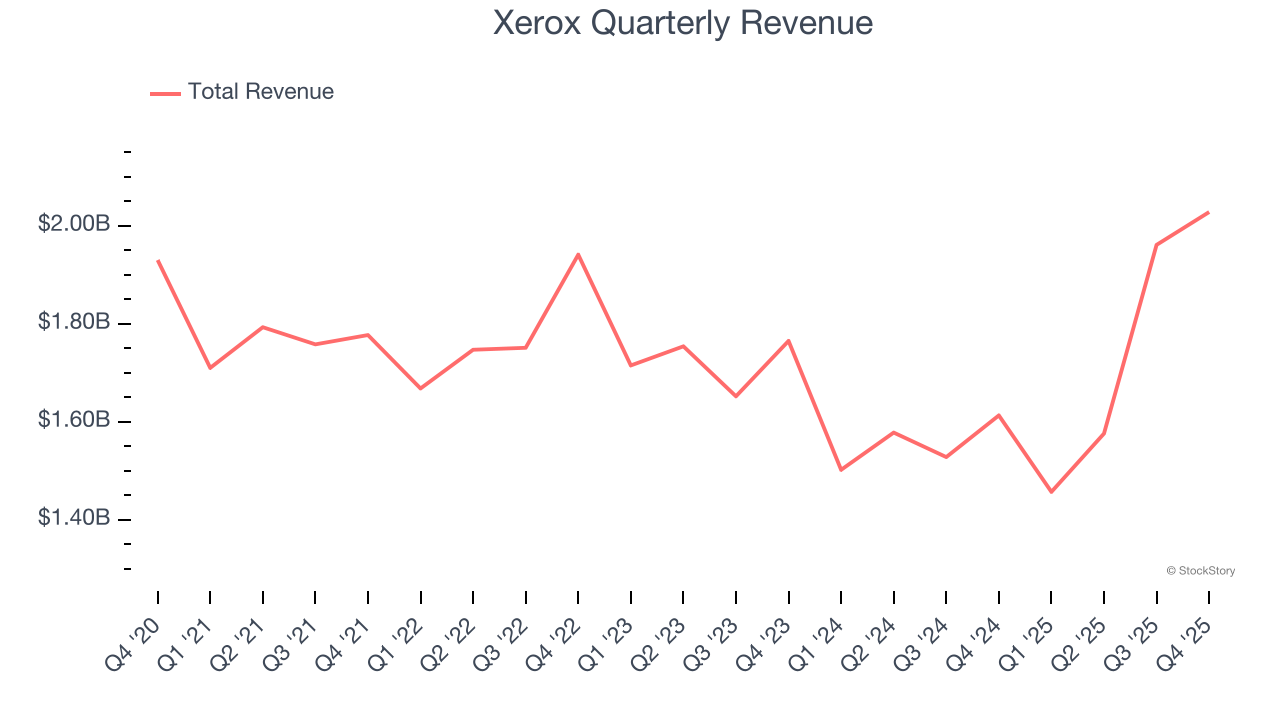

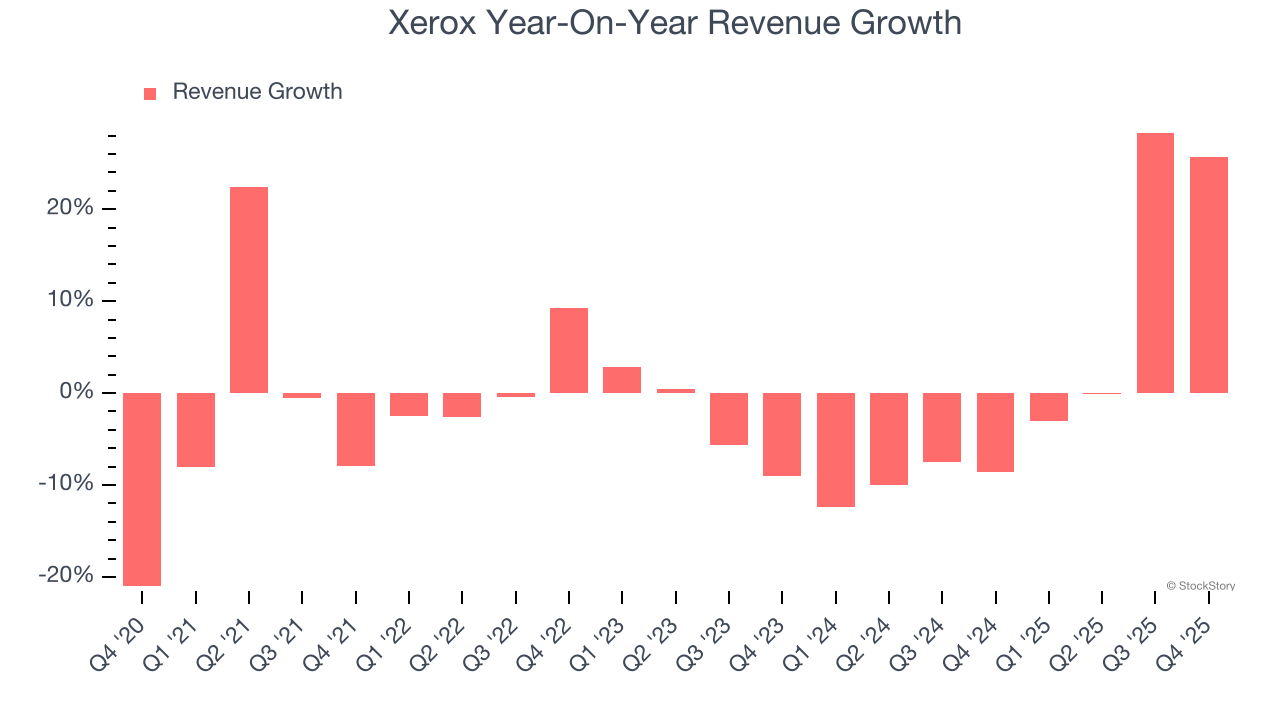

As you can see below, Xerox struggled to increase demand as its $7.02 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Just like its five-year trend, Xerox’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, Xerox generated an excellent 25.7% year-on-year revenue growth rate, but its $2.03 billion of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 12.1% over the next 12 months, an improvement versus the last two years. This projection is admirable and suggests its newer products and services will spur better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

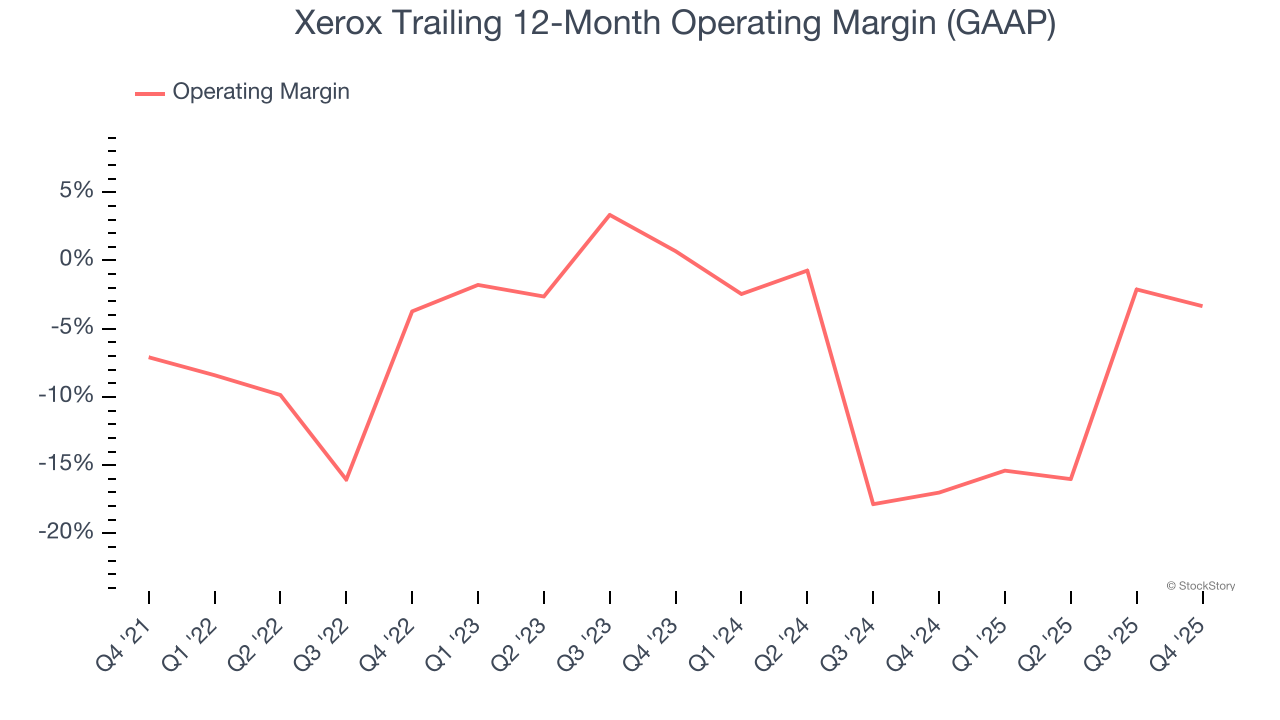

Xerox’s high expenses have contributed to an average operating margin of negative 5.9% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Xerox’s operating margin rose by 3.7 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

Xerox’s operating margin was negative 3% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

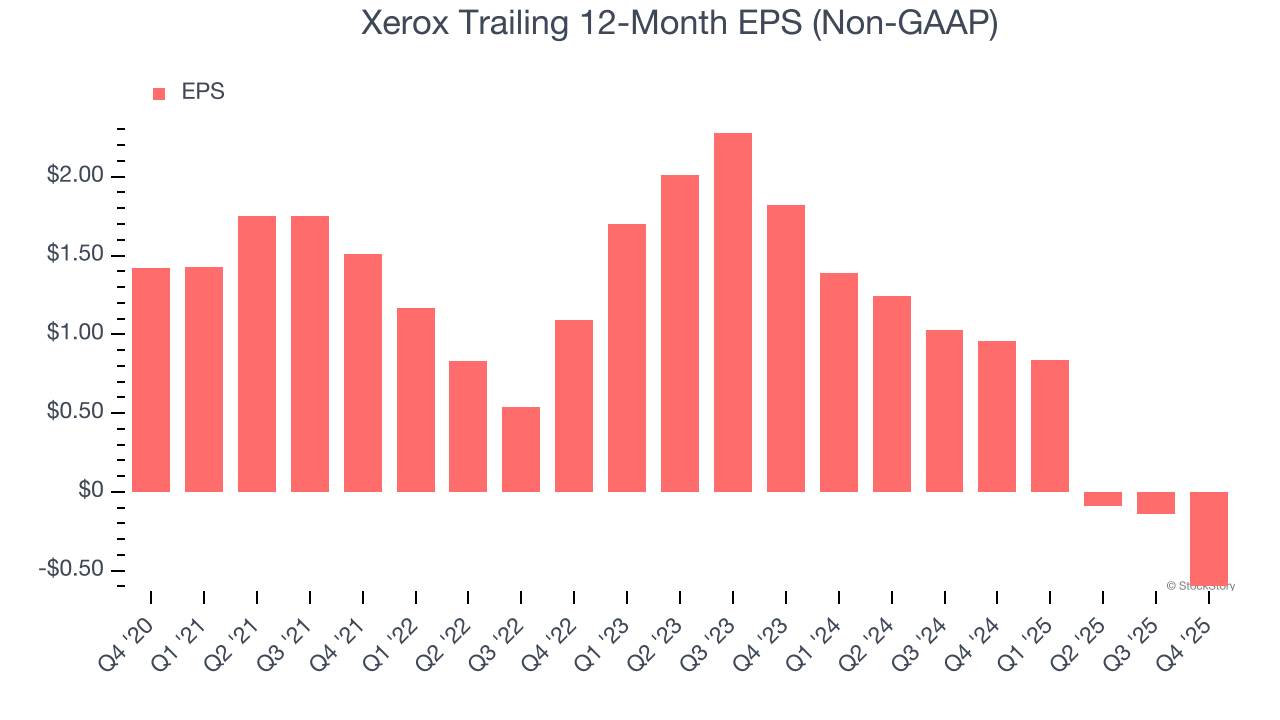

Sadly for Xerox, its EPS declined by 19.4% annually over the last five years while its revenue was flat. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Xerox, its two-year annual EPS declines of 52.6% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Xerox reported adjusted EPS of negative $0.10, down from $0.36 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Xerox’s full-year EPS of negative $0.60 will flip to positive $0.96.

Key Takeaways from Xerox’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.5% to $2.29 immediately after reporting.

Xerox may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).