Texas-based financial institution Cullen/Frost Bankers (NYSE: CFR) met Wall Streets revenue expectations in Q4 CY2025, with sales up 8.3% year on year to $580.9 million. Its GAAP profit of $2.56 per share was 3.8% above analysts’ consensus estimates.

Is now the time to buy Frost Bank? Find out by accessing our full research report, it’s free.

Frost Bank (CFR) Q4 CY2025 Highlights:

- Net Interest Income: $448.7 million vs analyst estimates of $462.1 million (8.5% year-on-year growth, 2.9% miss)

- Net Interest Margin: 3.7% vs analyst estimates of 3.7% (3.7 basis point miss)

- Revenue: $580.9 million vs analyst estimates of $580.6 million (8.3% year-on-year growth, in line)

- EPS (GAAP): $2.56 vs analyst estimates of $2.47 (3.8% beat)

- Market Capitalization: $8.64 billion

"We carry great momentum with us as we enter 2026 and continue executing on a number of strategic growth initiatives," said Cullen/Frost Chairman and CEO, Phil Green.

Company Overview

Tracing its roots back to 1868 when it was founded during Texas's post-Civil War reconstruction era, Cullen/Frost Bankers (NYSE: CFR) operates Frost Bank, a Texas-based financial institution providing commercial and consumer banking, wealth management, and insurance services.

Sales Growth

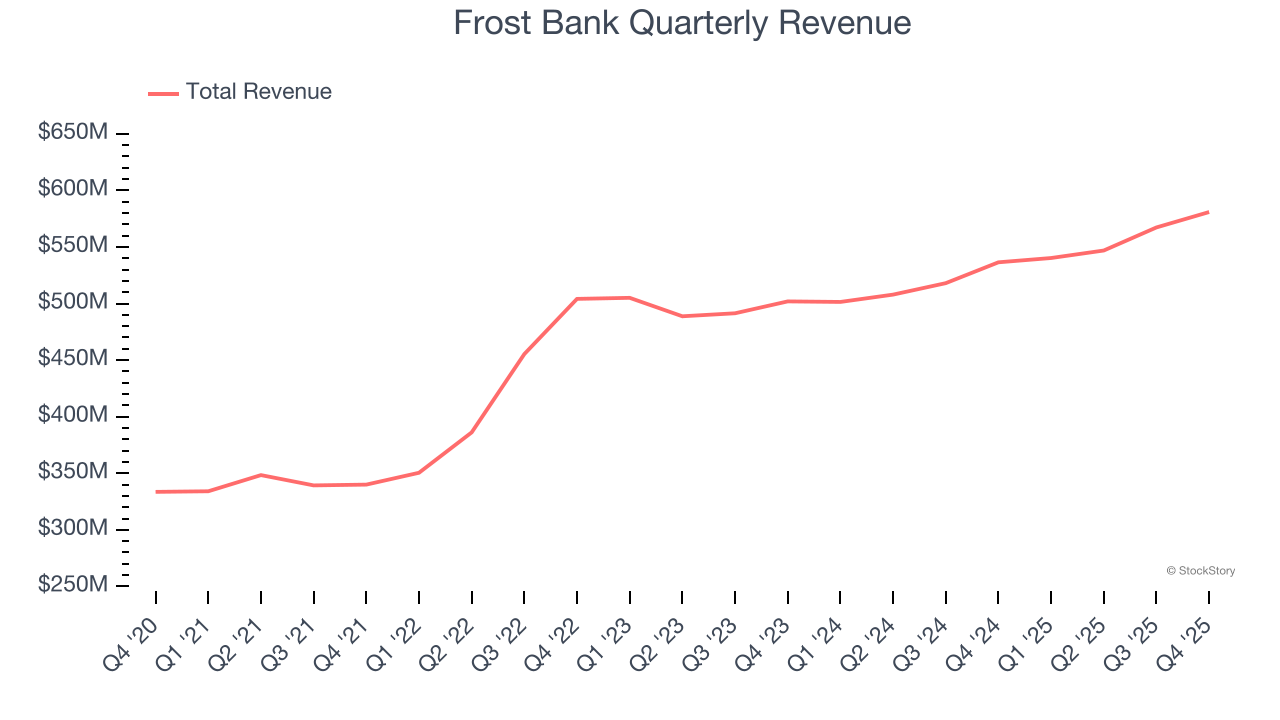

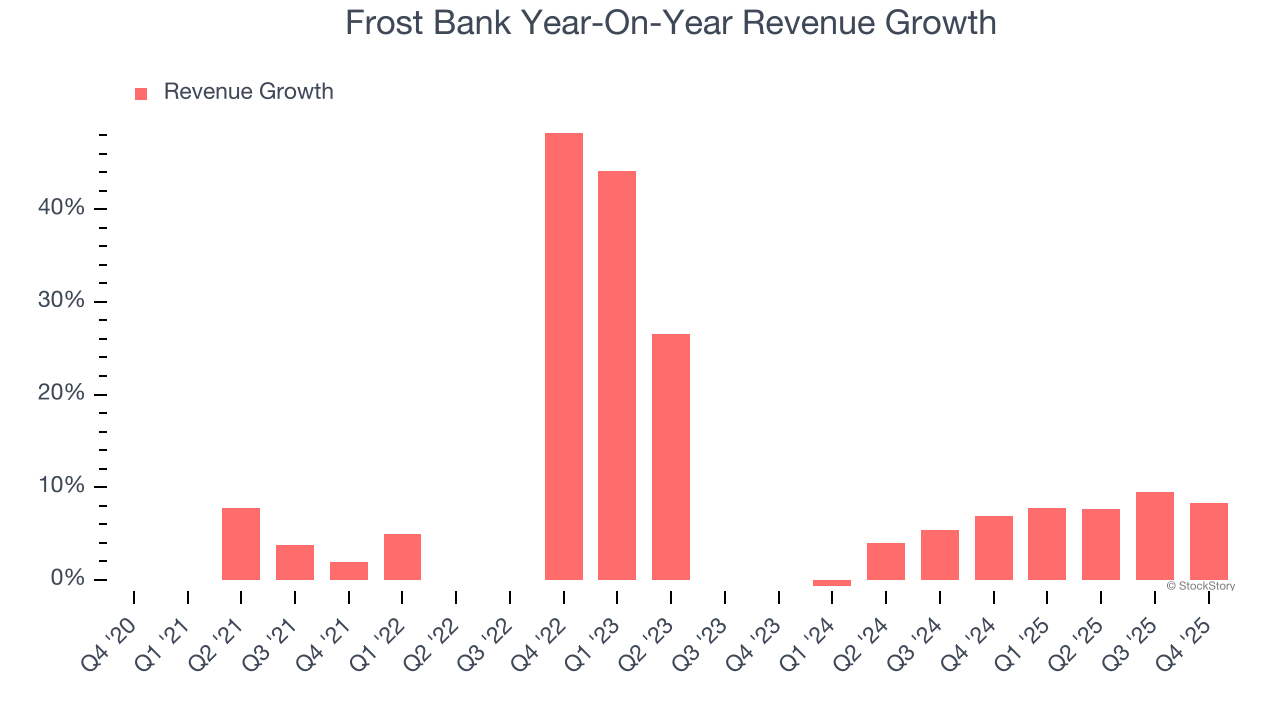

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income. Thankfully, Frost Bank’s 11% annualized revenue growth over the last five years was decent. Its growth was slightly above the average banking company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Frost Bank’s recent performance shows its demand has slowed as its annualized revenue growth of 6.1% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Frost Bank grew its revenue by 8.3% year on year, and its $580.9 million of revenue was in line with Wall Street’s estimates.

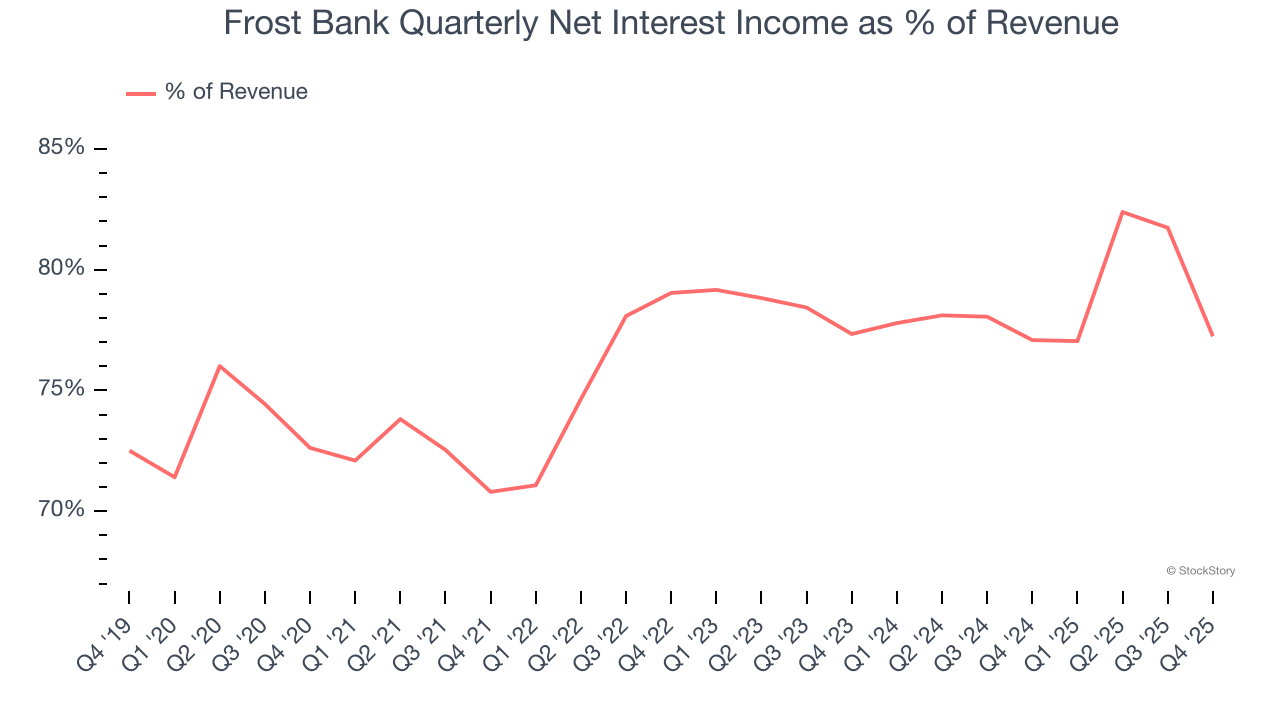

Net interest income made up 76.8% of the company’s total revenue during the last five years, meaning lending operations are Frost Bank’s largest source of revenue.

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Frost Bank’s Q4 Results

We struggled to find many positives in these results. Its net interest income missed and its EPS slightly exceeded Wall Street’s estimates. Overall, this quarter could have been better. The stock traded up 3.9% to $140.42 immediately following the results.

Is Frost Bank an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).