The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how ground transportation stocks fared in Q3, starting with Covenant Logistics (NYSE: CVLG).

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 16 ground transportation stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

Luckily, ground transportation stocks have performed well with share prices up 15.9% on average since the latest earnings results.

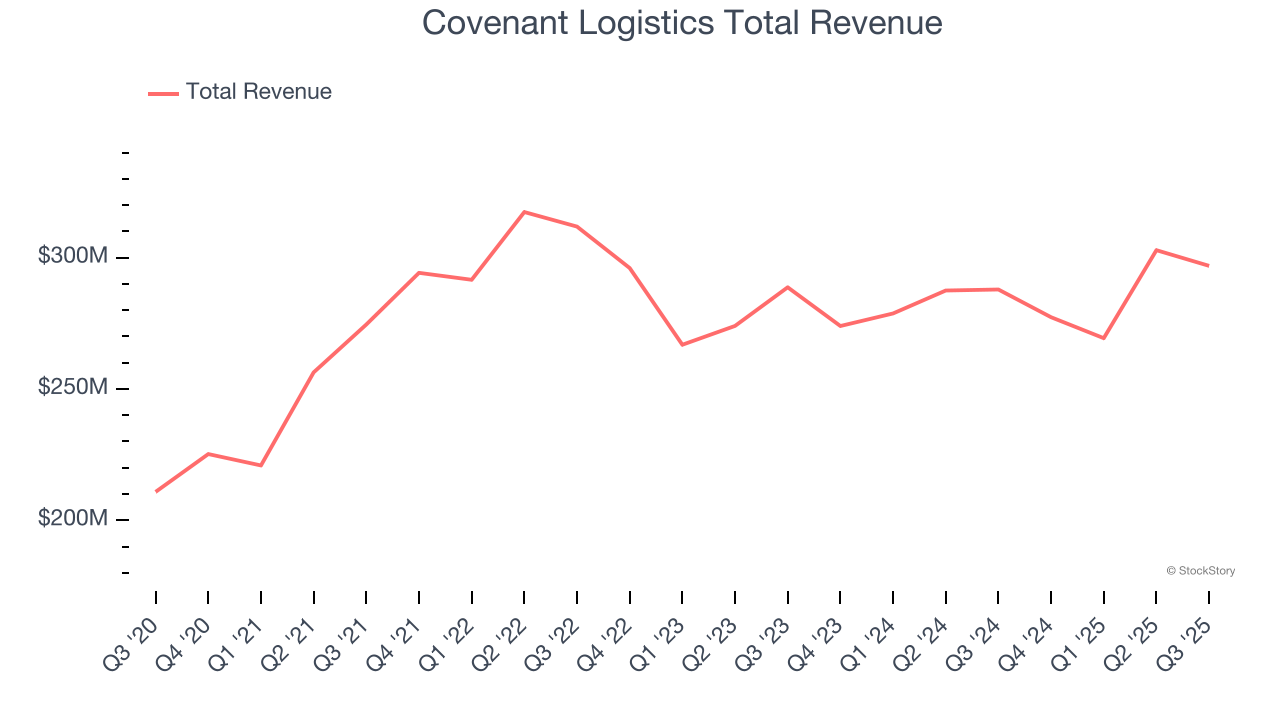

Covenant Logistics (NYSE: CVLG)

Started with 25 trucks and 50 trailers, Covenant Logistics (NASDAQ: CVLG) is a provider of expedited long haul freight services, offering a range of logistics solutions.

Covenant Logistics reported revenues of $296.9 million, up 3.1% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates and a decent beat of analysts’ EBITDA estimates.

Chairman and Chief Executive Officer, David R. Parker, commented: “Our third quarter results of $0.35 per diluted share, or $0.44 per diluted share on a non-GAAP adjusted basis, reflect essentially flat year-over-year performance in our asset-light business units and lower performance in our Truckload business units, mainly attributable to higher costs and under-utilized equipment. It was a busy quarter internally as we continued to invest in the future while managing costs during a prolonged period of overcapacity and muted demand.

Interestingly, the stock is up 18.4% since reporting and currently trades at $25.90.

Is now the time to buy Covenant Logistics? Access our full analysis of the earnings results here, it’s free.

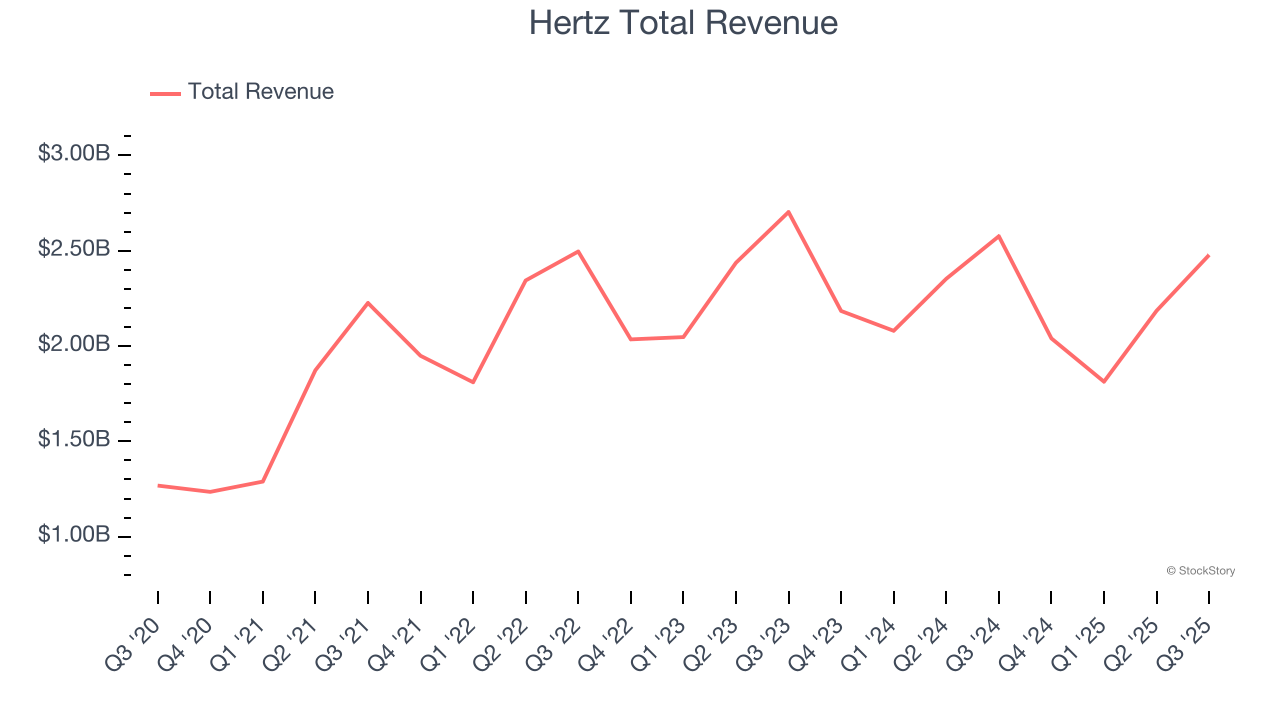

Best Q3: Hertz (NASDAQ: HTZ)

Started with a dozen Model T Fords, Hertz (NASDAQ: HTZ) is a global car rental company providing vehicle rental services to leisure and business travelers.

Hertz reported revenues of $2.48 billion, down 3.8% year on year, outperforming analysts’ expectations by 3.1%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

Hertz achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 12.1% since reporting. It currently trades at $5.56.

Is now the time to buy Hertz? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Universal Logistics (NASDAQ: ULH)

Founded in 1932, Universal Logistics (NASDAQ: ULH) is a provider of customized transportation and logistics solutions operating throughout the United States and in Mexico, Canada, and Colombia.

Universal Logistics reported revenues of $396.8 million, down 7% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Interestingly, the stock is up 15% since the results and currently trades at $17.62.

Read our full analysis of Universal Logistics’s results here.

Heartland Express (NASDAQ: HTLD)

Founded by the son of a trucker, Heartland Express (NASDAQ: HTLD) offers full-truckload deliveries across the United States and Mexico.

Heartland Express reported revenues of $196.5 million, down 24.4% year on year. This result missed analysts’ expectations by 4.4%. It was a slower quarter as it also produced a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EBITDA estimates.

Heartland Express had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 37.5% since reporting and currently trades at $10.40.

Read our full, actionable report on Heartland Express here, it’s free.

Old Dominion Freight Line (NASDAQ: ODFL)

With its name deriving from the Commonwealth of Virginia’s nickname, Old Dominion (NASDAQ: ODFL) delivers less-than-truckload (LTL) and full-container load freight.

Old Dominion Freight Line reported revenues of $1.41 billion, down 4.3% year on year. This number met analysts’ expectations. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 29.5% since reporting and currently trades at $176.29.

Read our full, actionable report on Old Dominion Freight Line here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.