Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Health Catalyst (NASDAQ: HCAT) and the best and worst performers in the data analytics industry.

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

The 7 data analytics stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 16.4% since the latest earnings results.

Weakest Q3: Health Catalyst (NASDAQ: HCAT)

Built on its "Health Catalyst Flywheel" methodology that emphasizes measurable outcomes, Health Catalyst (NASDAQ: HCAT) provides data and analytics technology and services that help healthcare organizations manage their data and drive measurable clinical, financial, and operational improvements.

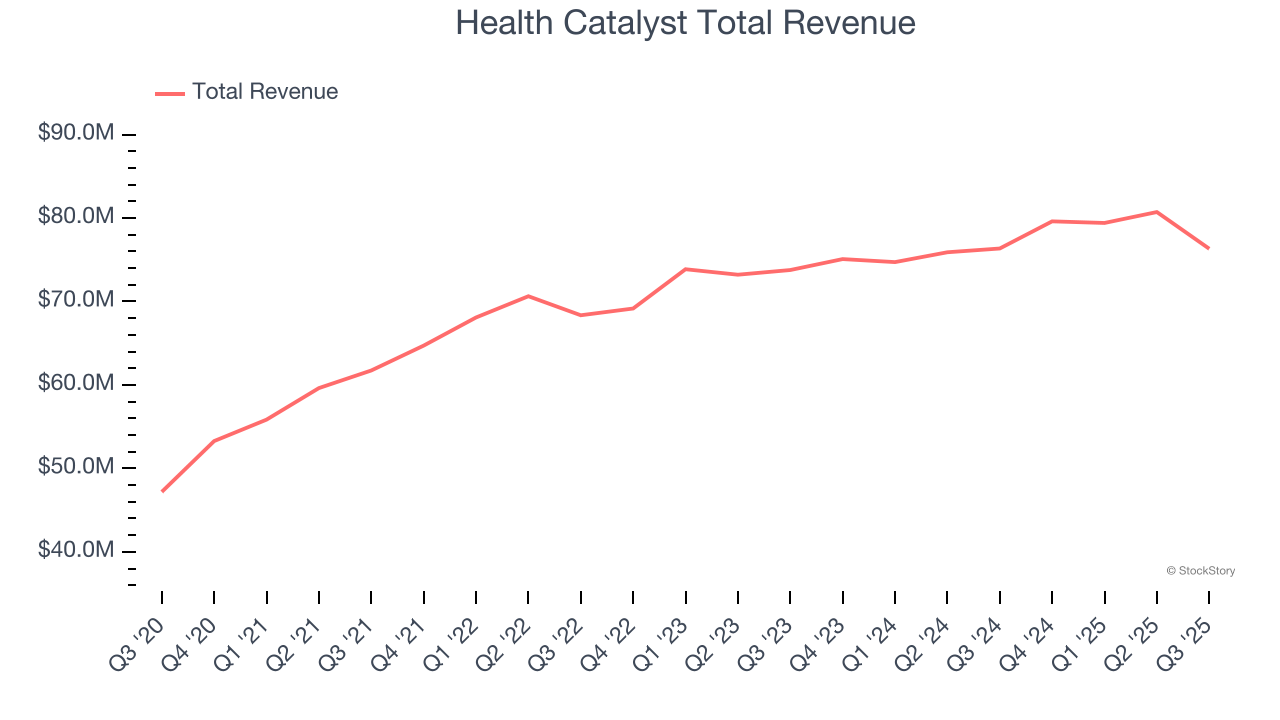

Health Catalyst reported revenues of $76.32 million, flat year on year. This print exceeded analysts’ expectations by 1.7%. Despite the top-line beat, it was still a slower quarter for the company with revenue guidance for next quarter missing analysts’ expectations and EBITDA guidance for next quarter missing analysts’ expectations.

“For the third quarter of 2025, I am pleased by our financial results, including total revenue of $76.3 million and Adjusted EBITDA of $12.0 million, with these results beating our quarterly guidance on each measure,” said Dan Burton, CEO of Health Catalyst.

Unsurprisingly, the stock is down 19.7% since reporting and currently trades at $2.33.

Read our full report on Health Catalyst here, it’s free.

Best Q3: Strategy (NASDAQ: MSTR)

Once a traditional business intelligence software provider, Strategy (NASDAQ: MSTR) develops AI-powered enterprise analytics software while also functioning as a major corporate holder of Bitcoin cryptocurrency.

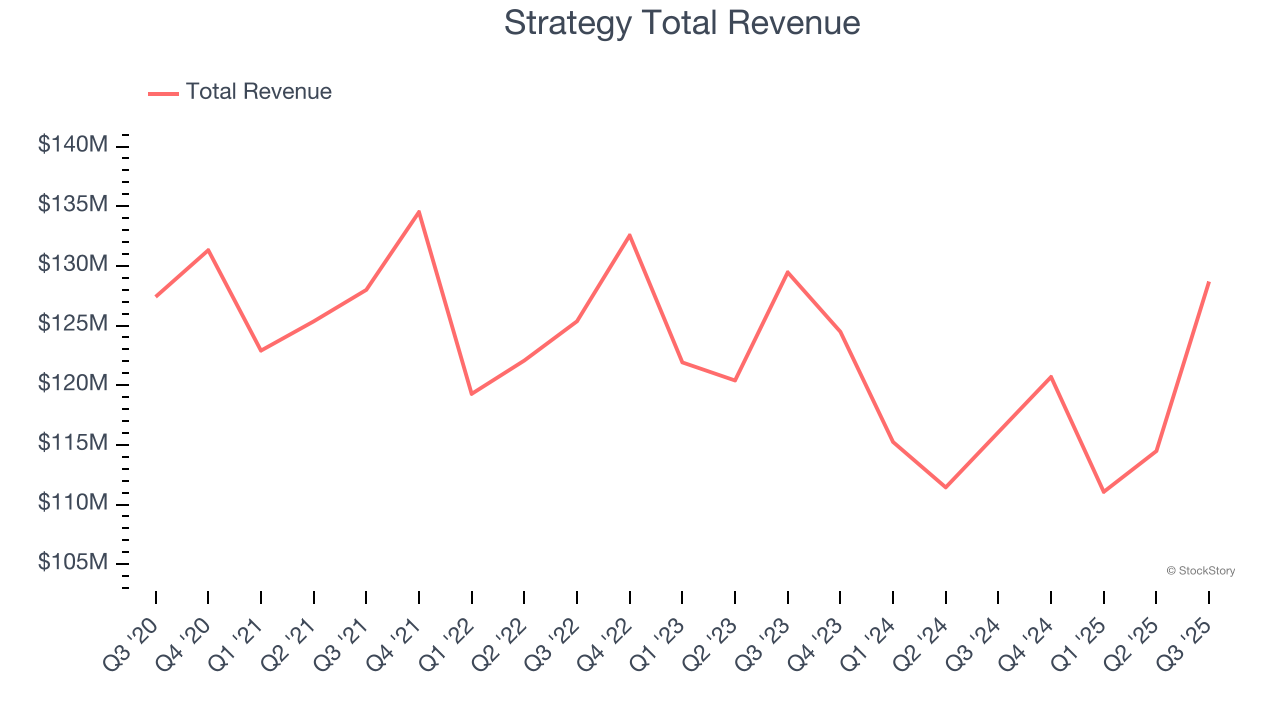

Strategy reported revenues of $128.7 million, up 10.9% year on year, outperforming analysts’ expectations by 9.1%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Strategy achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 31.7% since reporting. It currently trades at $174.27.

Is now the time to buy Strategy? Access our full analysis of the earnings results here, it’s free.

Domo (NASDAQ: DOMO)

Named for the Japanese word meaning "thank you very much," Domo (NASDAQ: DOMO) provides a cloud-based business intelligence platform that connects people with real-time data and insights across organizations.

Domo reported revenues of $79.4 million, flat year on year, in line with analysts’ expectations. Still, it was a satisfactory quarter as it posted EPS guidance for next quarter exceeding analysts’ expectations.

Domo delivered the highest full-year guidance raise but had the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 45.9% since the results and currently trades at $6.25.

Read our full analysis of Domo’s results here.

Samsara (NYSE: IOT)

From sensors on vehicles to AI-powered cameras that help prevent accidents, Samsara (NYSE: IOT) is a cloud-based Internet of Things platform that helps businesses improve the safety, efficiency, and sustainability of their physical operations.

Samsara reported revenues of $416 million, up 29.2% year on year. This print beat analysts’ expectations by 4.1%. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

The company added 219 enterprise customers paying more than $100,000 annually to reach a total of 2,990. The stock is down 14.4% since reporting and currently trades at $34.88.

Read our full, actionable report on Samsara here, it’s free.

Amplitude (NASDAQ: AMPL)

Born from the realization that companies were flying blind when it came to understanding user behavior in their digital products, Amplitude (NASDAQ: AMPL) provides a digital analytics platform that helps businesses understand how people use their digital products to improve user experiences and drive revenue growth.

Amplitude reported revenues of $88.56 million, up 17.7% year on year. This result surpassed analysts’ expectations by 2.6%. It was a strong quarter as it also put up a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

The company added 19 enterprise customers paying more than $100,000 annually to reach a total of 653. The stock is up 4.4% since reporting and currently trades at $10.07.

Read our full, actionable report on Amplitude here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.