Personal care company Edgewell Personal Care (NYSE: EPC) fell short of the market’s revenue expectations in Q2 CY2025, with sales falling 3.2% year on year to $627.2 million. Its non-GAAP profit of $0.92 per share was 7.5% below analysts’ consensus estimates.

Is now the time to buy Edgewell Personal Care? Find out by accessing our full research report, it’s free.

Edgewell Personal Care (EPC) Q2 CY2025 Highlights:

- Revenue: $627.2 million vs analyst estimates of $654.6 million (3.2% year-on-year decline, 4.2% miss)

- Adjusted EPS: $0.92 vs analyst expectations of $0.99 (7.5% miss)

- Adjusted EBITDA: $96.4 million vs analyst estimates of $102.4 million (15.4% margin, 5.8% miss)

- Management lowered its full-year Adjusted EPS guidance to $2.65 at the midpoint, a 10.2% decrease

- EBITDA guidance for the full year is $312 million at the midpoint, below analyst estimates of $335.5 million

- Operating Margin: 8.6%, down from 12.8% in the same quarter last year

- Organic Revenue fell 4.2% year on year (0.6% in the same quarter last year)

- Market Capitalization: $1.18 billion

"This was a challenging quarter, with our top and bottom-line performance falling below expectations, significantly impacted by very weak Sun Care seasons in North America and certain Latin American markets. Furthermore, the operating environment remains challenging with both tariffs and foreign exchange contributing to full-year profit headwinds," said Rod Little, Edgewell's President and Chief Executive Officer.

Company Overview

Boasting brands such as Banana Boat, Schick, and Skintimate, Edgewell Personal Care (NYSE: EPC) sells personal care products in the skin and sun care, shave, and feminine care categories.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.20 billion in revenue over the past 12 months, Edgewell Personal Care is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

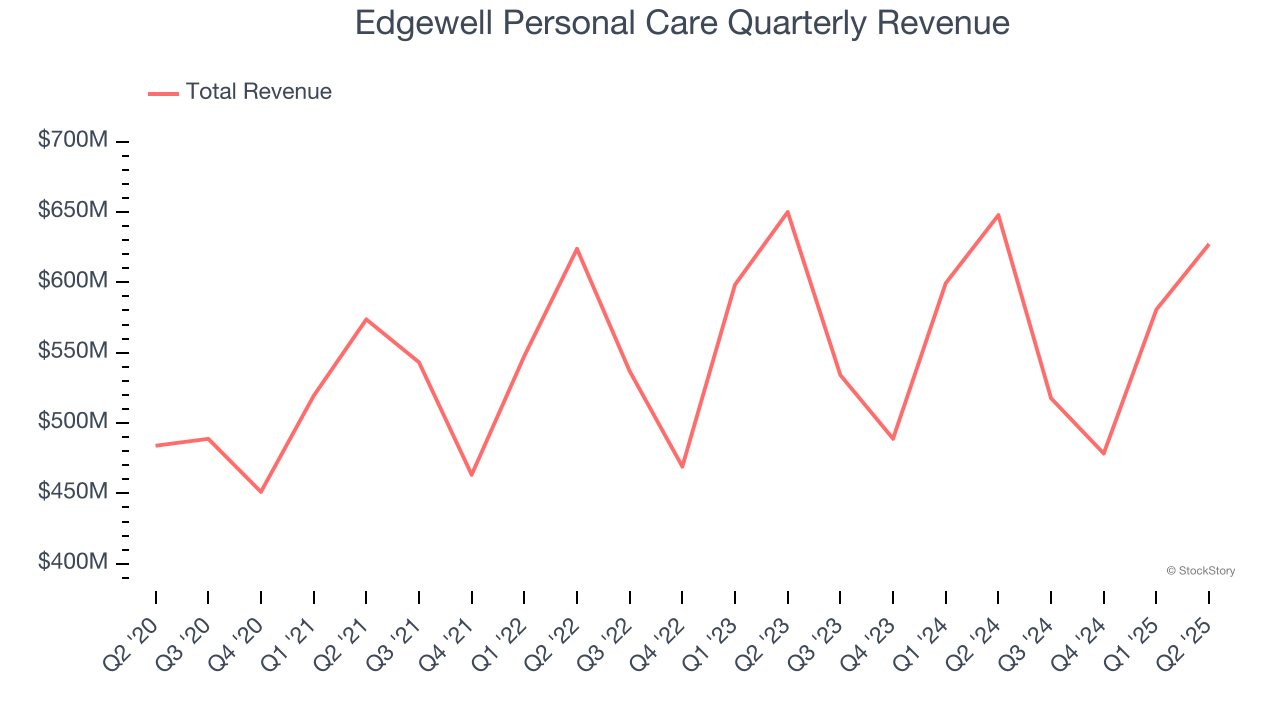

As you can see below, Edgewell Personal Care struggled to increase demand as its $2.20 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a rough starting point for our analysis.

This quarter, Edgewell Personal Care missed Wall Street’s estimates and reported a rather uninspiring 3.2% year-on-year revenue decline, generating $627.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months. Although this projection suggests its newer products will fuel better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Organic Revenue Growth

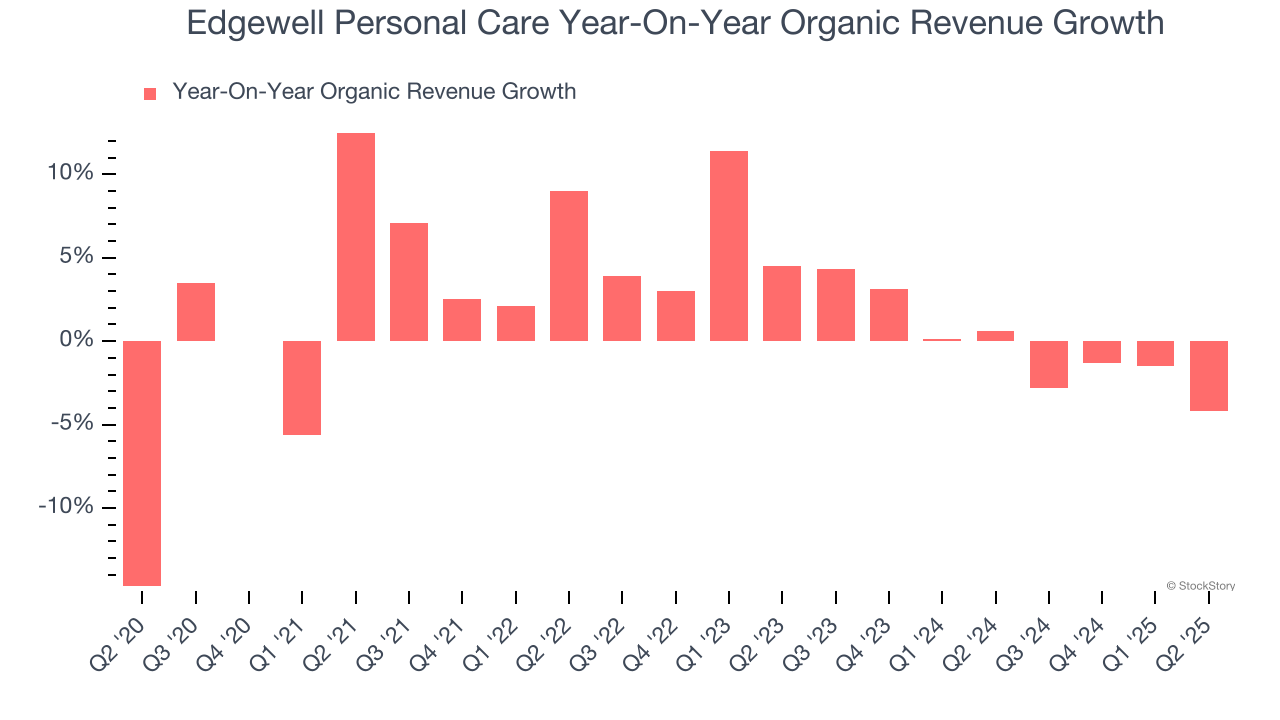

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Edgewell Personal Care’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

In the latest quarter, Edgewell Personal Care’s organic sales fell by 4.2% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Edgewell Personal Care’s Q2 Results

We struggled to find many positives in these results. Its revenue missed and its organic revenue fell short of Wall Street’s estimates. Overall, this was was mediocre. The stock traded down 8.6% to $22.87 immediately following the results.

Edgewell Personal Care underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.