Over the last six months, Amtech’s shares have sunk to $4.59, producing a disappointing 8.2% loss - a stark contrast to the S&P 500’s 5.7% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Amtech, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Amtech Will Underperform?

Even though the stock has become cheaper, we're swiping left on Amtech for now. Here are three reasons why you should be careful with ASYS and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

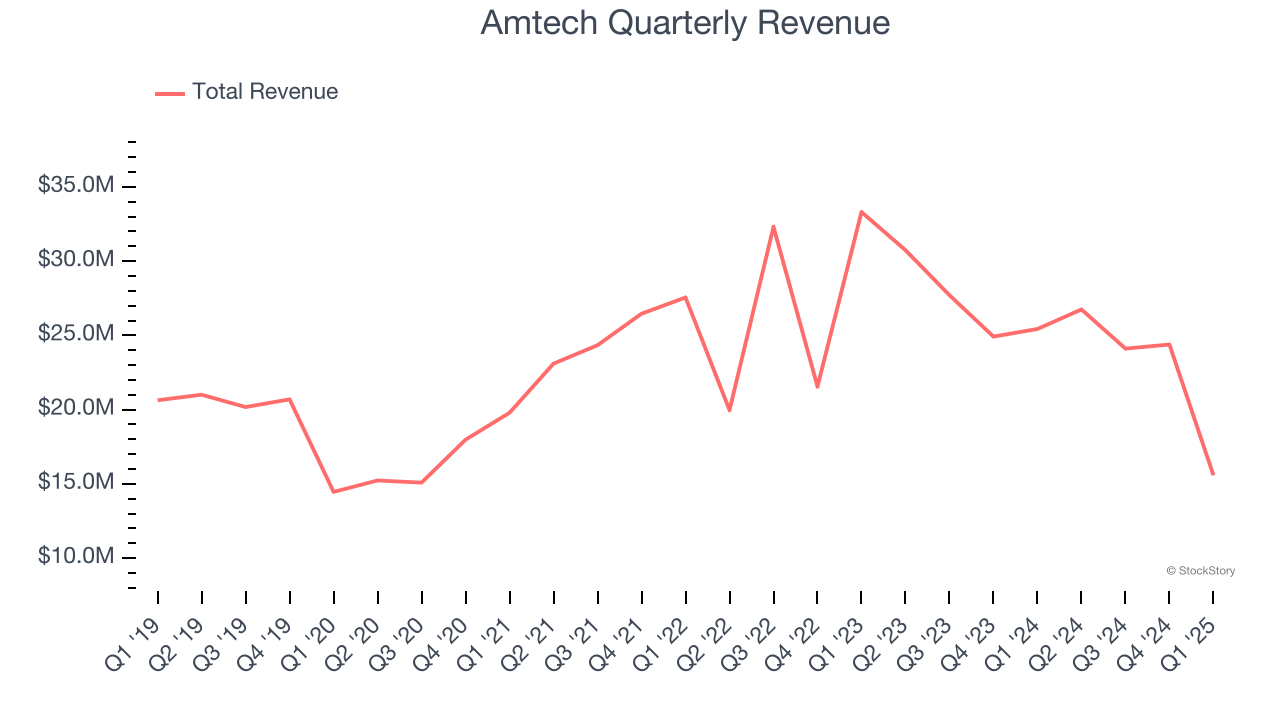

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Amtech’s sales grew at a sluggish 3.5% compounded annual growth rate over the last five years. This was below our standard for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Operating Losses Sound the Alarms

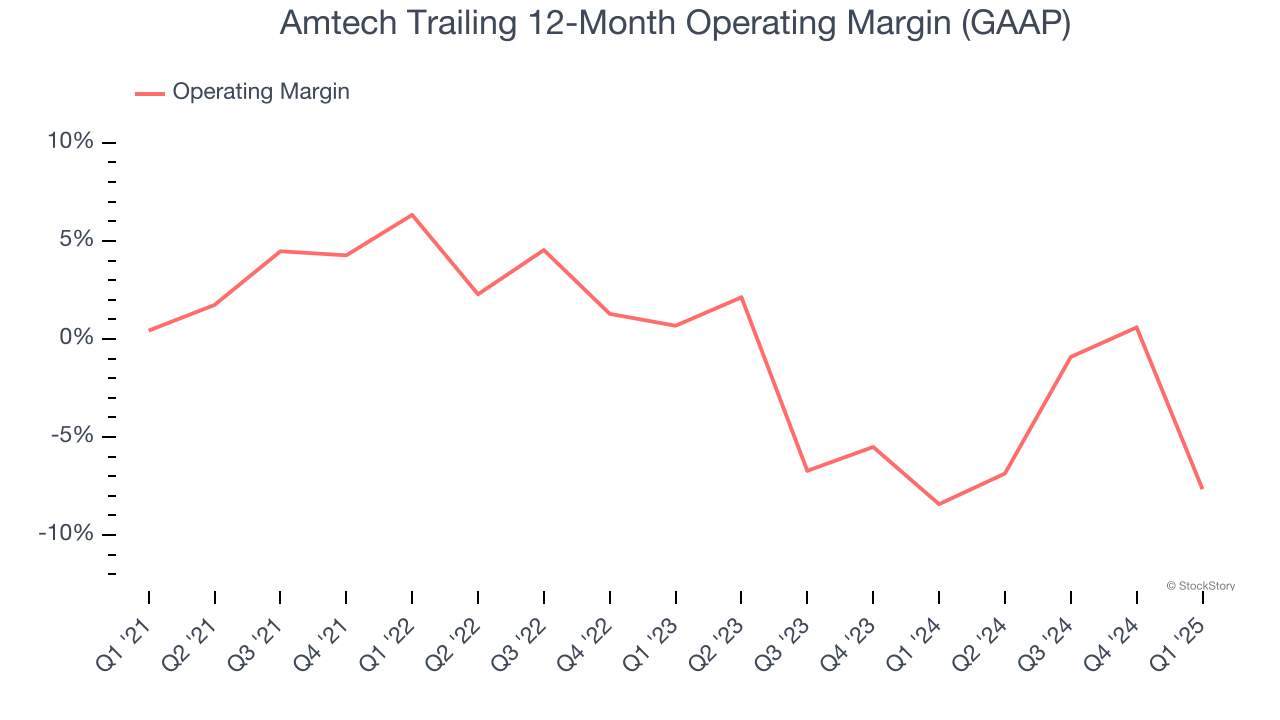

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Amtech’s high expenses have contributed to an average operating margin of negative 8.1% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

3. Previous Growth Initiatives Have Lost Money

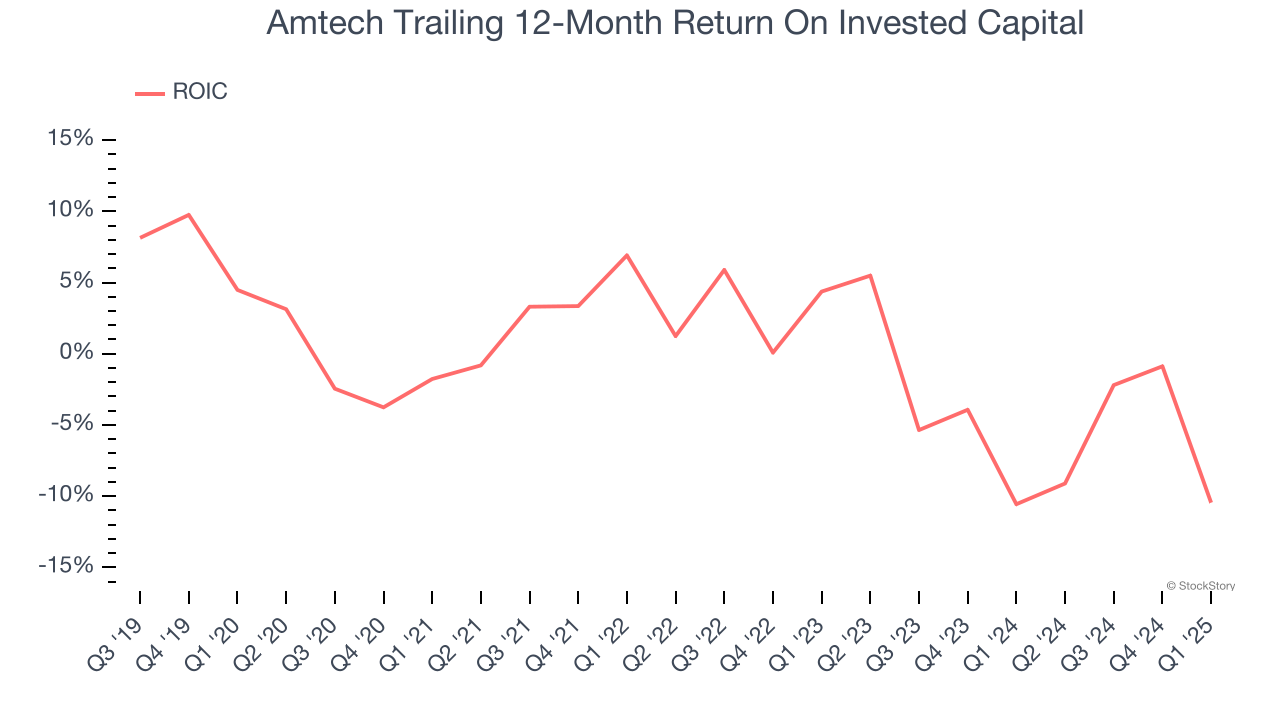

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Amtech’s five-year average ROIC was negative 2.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the semiconductor sector.

Final Judgment

Amtech doesn’t pass our quality test. After the recent drawdown, the stock trades at 17.8× forward EV-to-EBITDA (or $4.59 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Amtech

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.