Egg company Cal-Maine Foods (NASDAQ: CALM) fell short of the market’s revenue expectations in Q1 CY2025, but sales rose 102% year on year to $1.42 billion. Its GAAP profit of $10.38 per share was 4.8% below analysts’ consensus estimates.

Is now the time to buy Cal-Maine? Find out by accessing our full research report, it’s free.

Cal-Maine (CALM) Q1 CY2025 Highlights:

- Revenue: $1.42 billion vs analyst estimates of $1.43 billion (102% year-on-year growth, 0.8% miss)

- EPS (GAAP): $10.38 vs analyst expectations of $10.91 (4.8% miss)

- Operating Margin: 44.8%, up from 21.7% in the same quarter last year

- Market Capitalization: $4.58 billion

Company Overview

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ: CALM) produces, packages, and distributes eggs.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $3.80 billion in revenue over the past 12 months, Cal-Maine carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

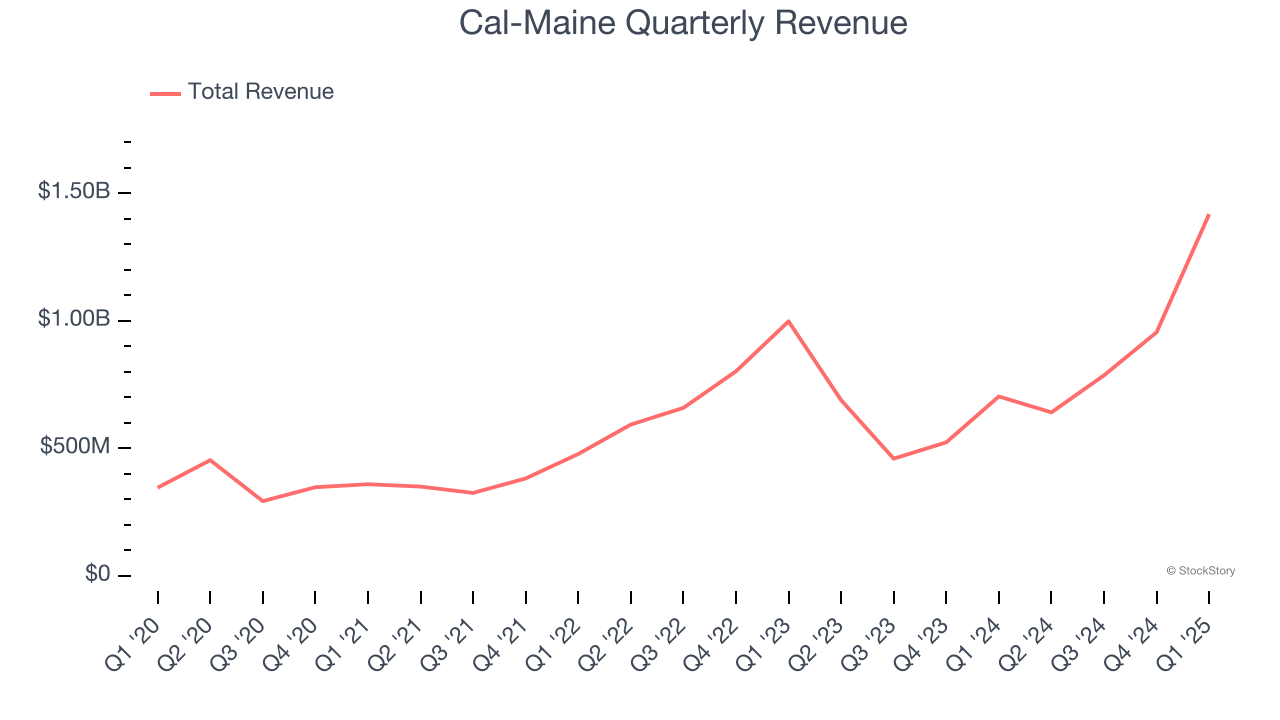

As you can see below, Cal-Maine’s 35.3% annualized revenue growth over the last three years was incredible. This is an encouraging starting point for our analysis because it shows Cal-Maine’s demand was higher than many consumer staples companies.

This quarter, Cal-Maine achieved a magnificent 102% year-on-year revenue growth rate, but its $1.42 billion of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to decline by 24.6% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

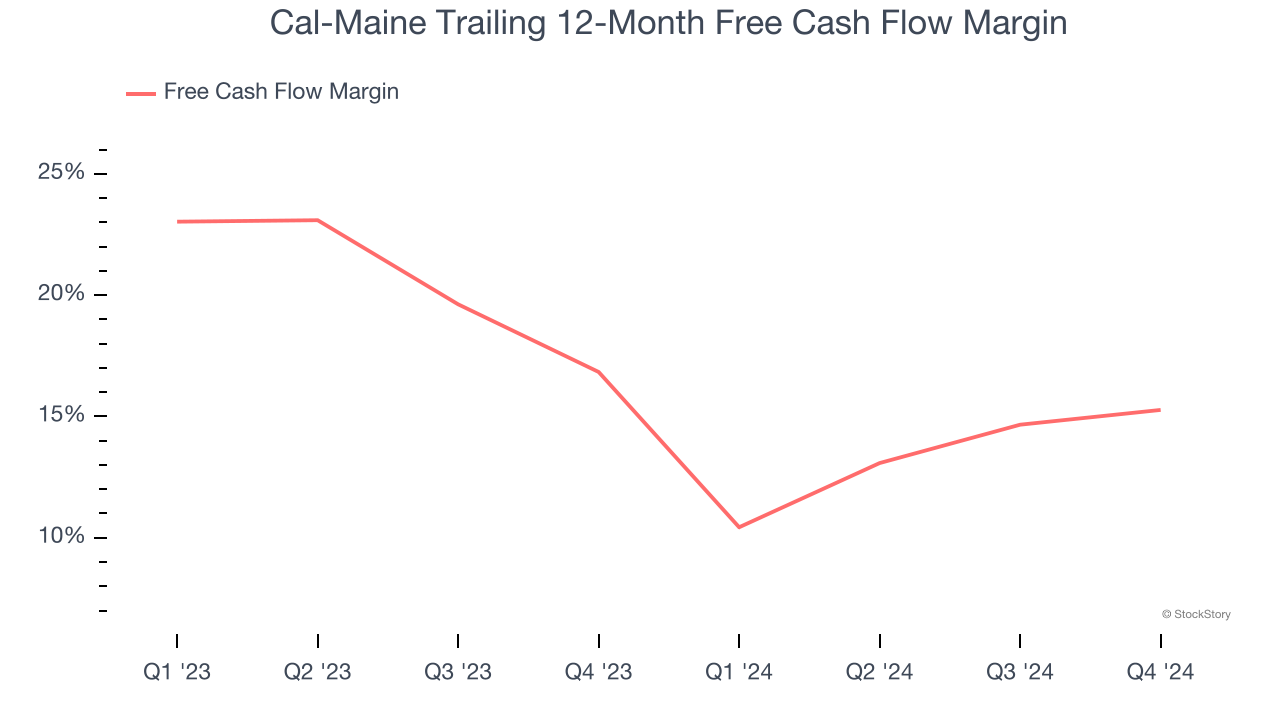

Cal-Maine has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.3% over the last two years, quite impressive for a consumer staples business.

Key Takeaways from Cal-Maine’s Q1 Results

We struggled to find many positives in these results. Its EPS fell short of Wall Street’s estimates. Also, sales missed analysts' estimates despite the strong topline growth, as expectations were likely high ahead of the announcement. Overall, this quarter could have been better. The stock traded down 5% to $86 immediately after reporting.

Cal-Maine underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.