Healthcare product and device company Abbott Laboratories (NYSE: ABT) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 4% year on year to $10.36 billion. Its non-GAAP profit of $1.09 per share was 1.7% above analysts’ consensus estimates.

Is now the time to buy Abbott Laboratories? Find out by accessing our full research report, it’s free.

Abbott Laboratories (ABT) Q1 CY2025 Highlights:

- Revenue: $10.36 billion vs analyst estimates of $10.4 billion (4% year-on-year growth, in line)

- Adjusted EPS: $1.09 vs analyst estimates of $1.07 (1.7% beat)

- Adjusted EPS guidance for the full year is $5.15 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 16.3%, up from 13.9% in the same quarter last year

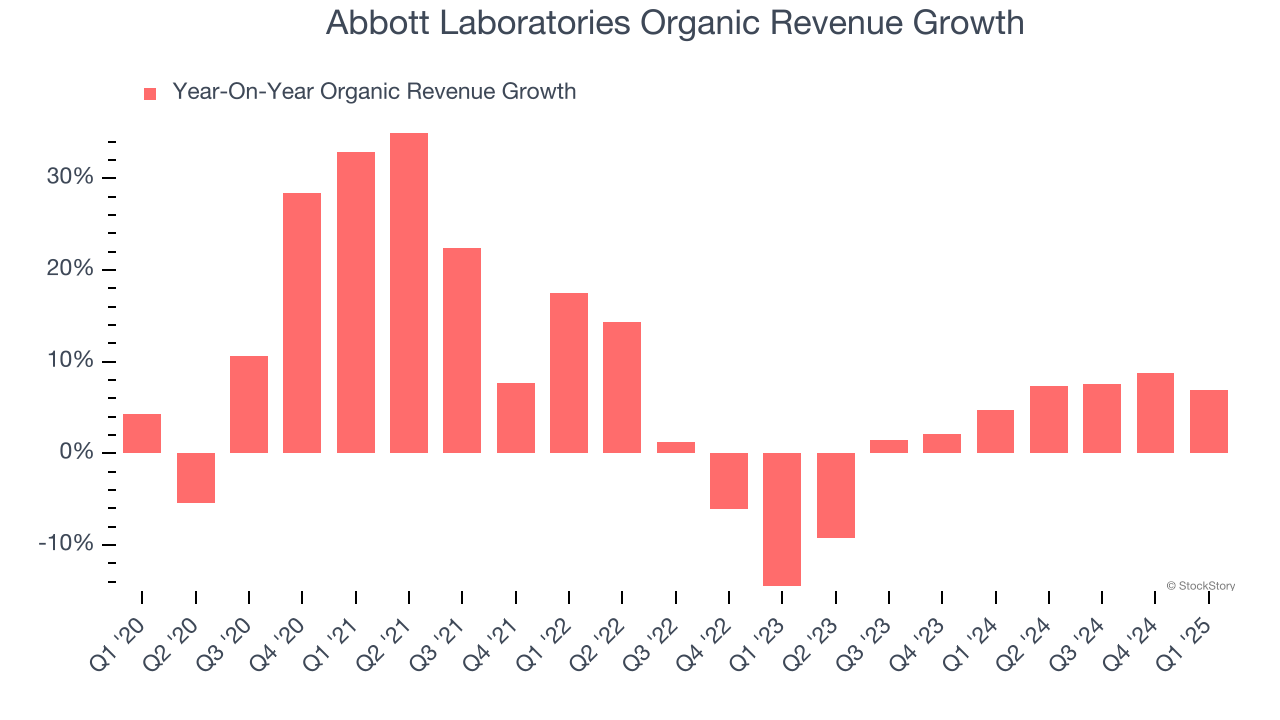

- Organic Revenue rose 6.9% year on year (4.7% in the same quarter last year)

- Market Capitalization: $218.9 billion

Company Overview

With roots dating back to 1888 when founder Dr. Wallace Abbott began producing precise, dosage-form medications, Abbott Laboratories (NYSE: ABT) develops and sells a diverse range of healthcare products including medical devices, diagnostics, nutrition products, and branded generic pharmaceuticals.

Medical Devices & Supplies - Diversified

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Sales Growth

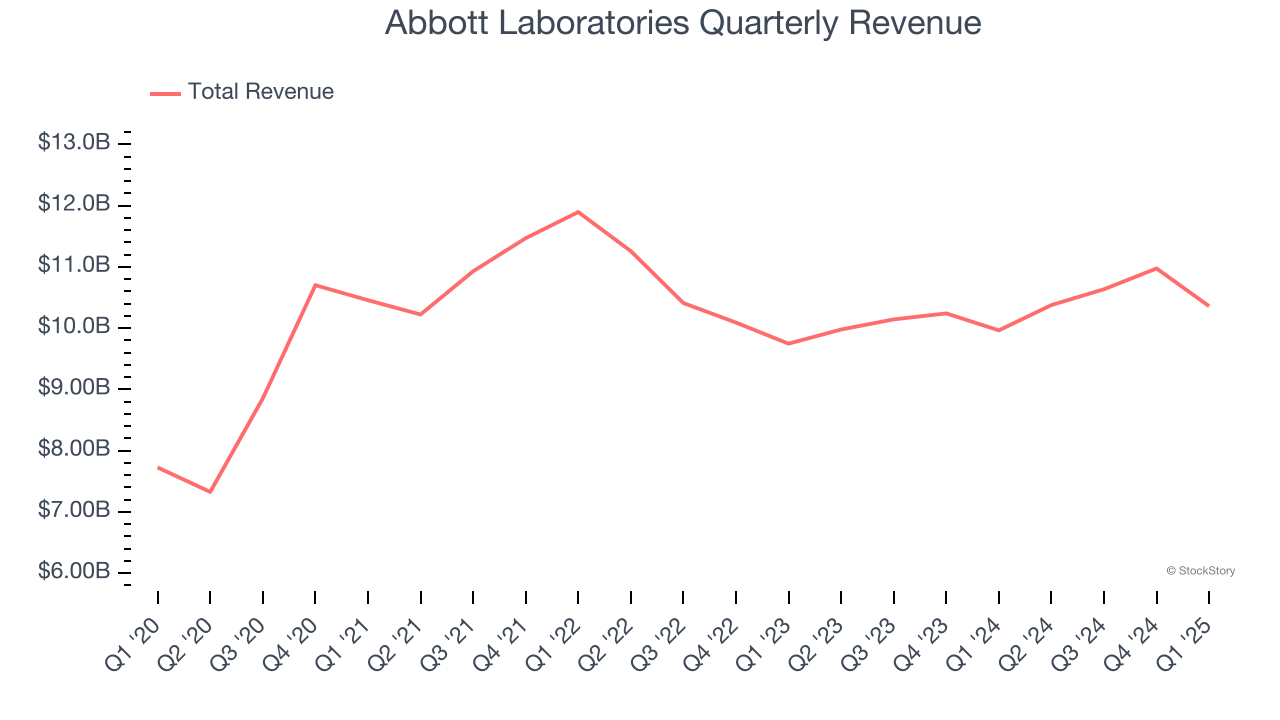

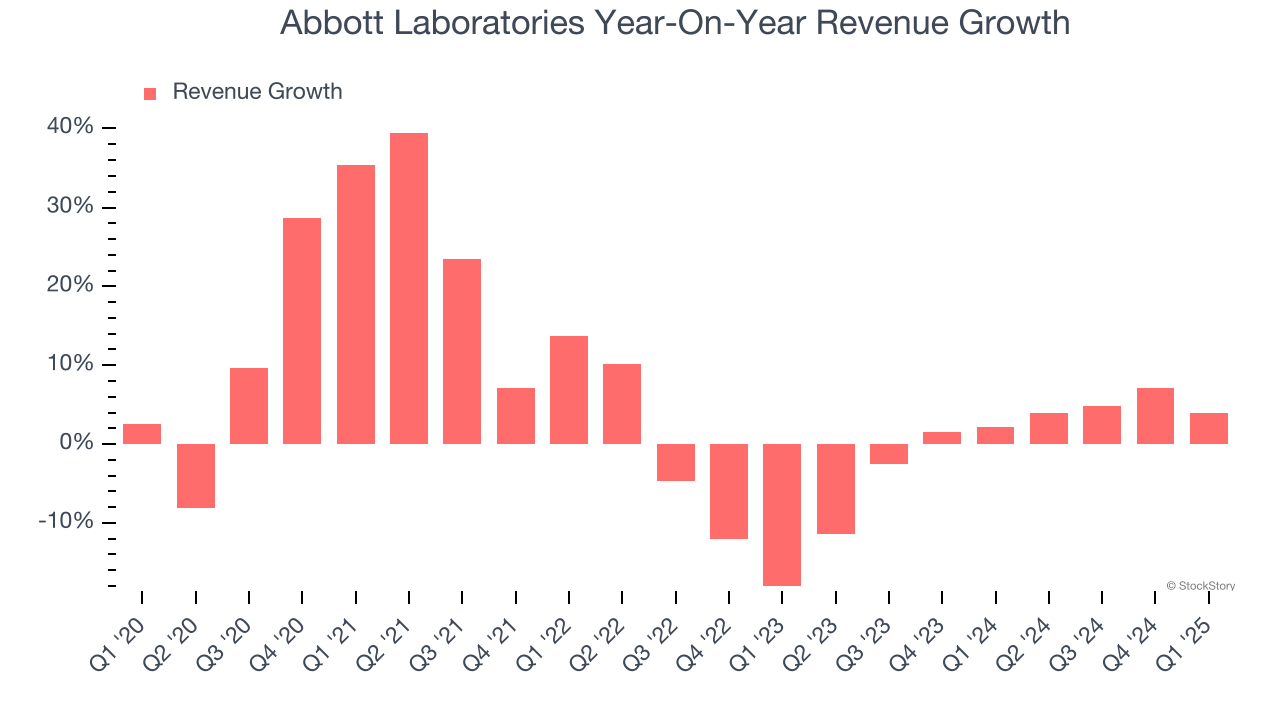

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Abbott Laboratories’s 5.7% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Abbott Laboratories’s recent performance shows its demand has slowed as its annualized revenue growth of 1% over the last two years was below its five-year trend.

Abbott Laboratories also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Abbott Laboratories’s organic revenue averaged 3.7% year-on-year growth. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, Abbott Laboratories grew its revenue by 4% year on year, and its $10.36 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and indicates its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

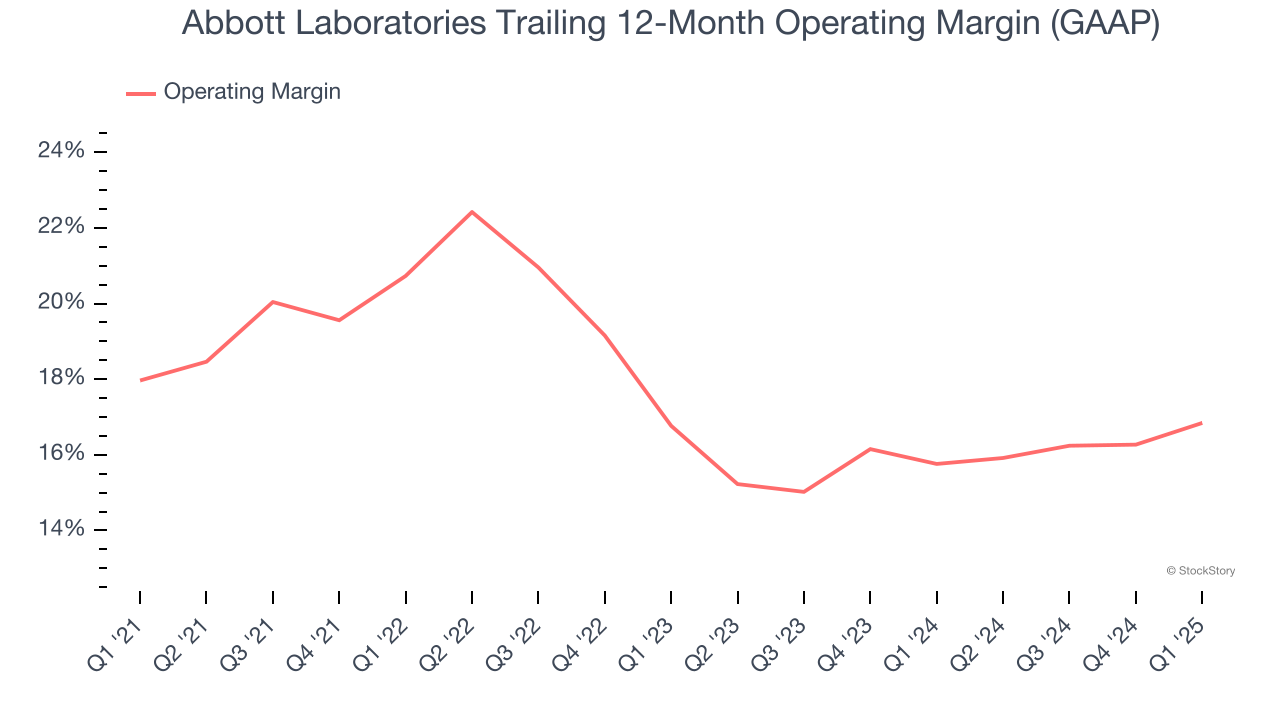

Abbott Laboratories has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 17.7%.

Looking at the trend in its profitability, Abbott Laboratories’s operating margin decreased by 1.1 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. We like Abbott Laboratories and hope it can right the ship.

In Q1, Abbott Laboratories generated an operating profit margin of 16.3%, up 2.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

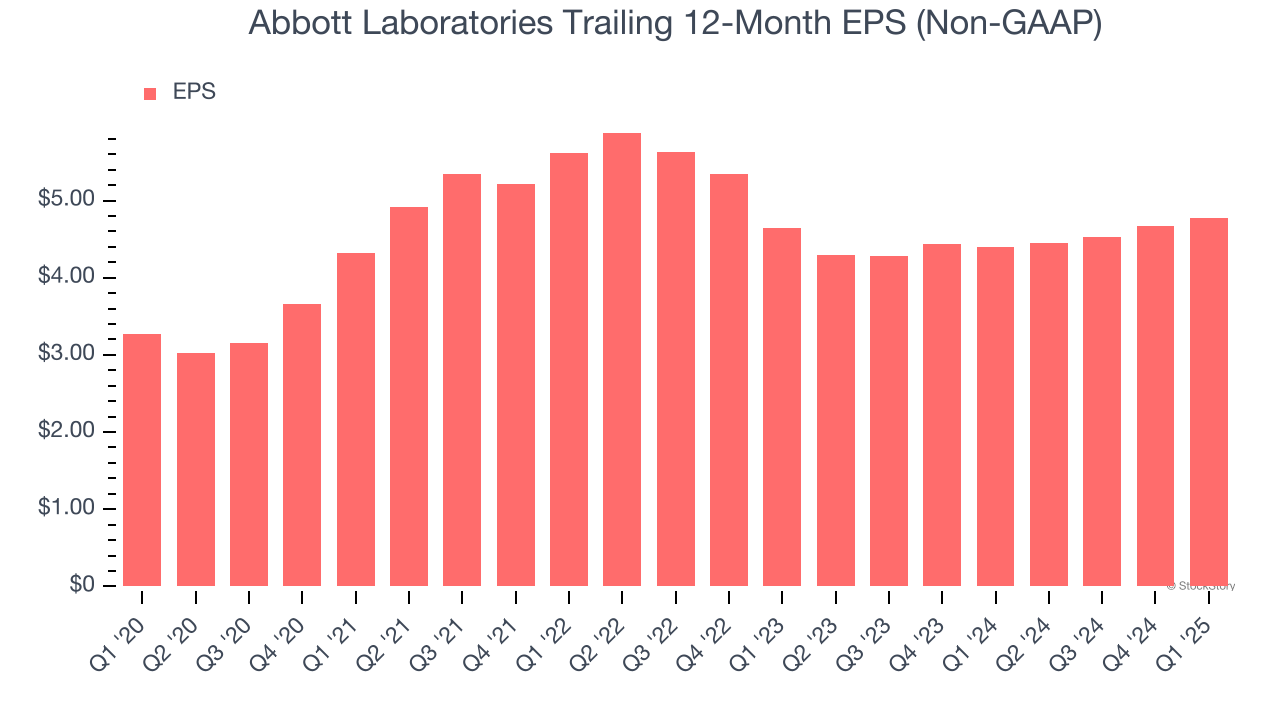

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

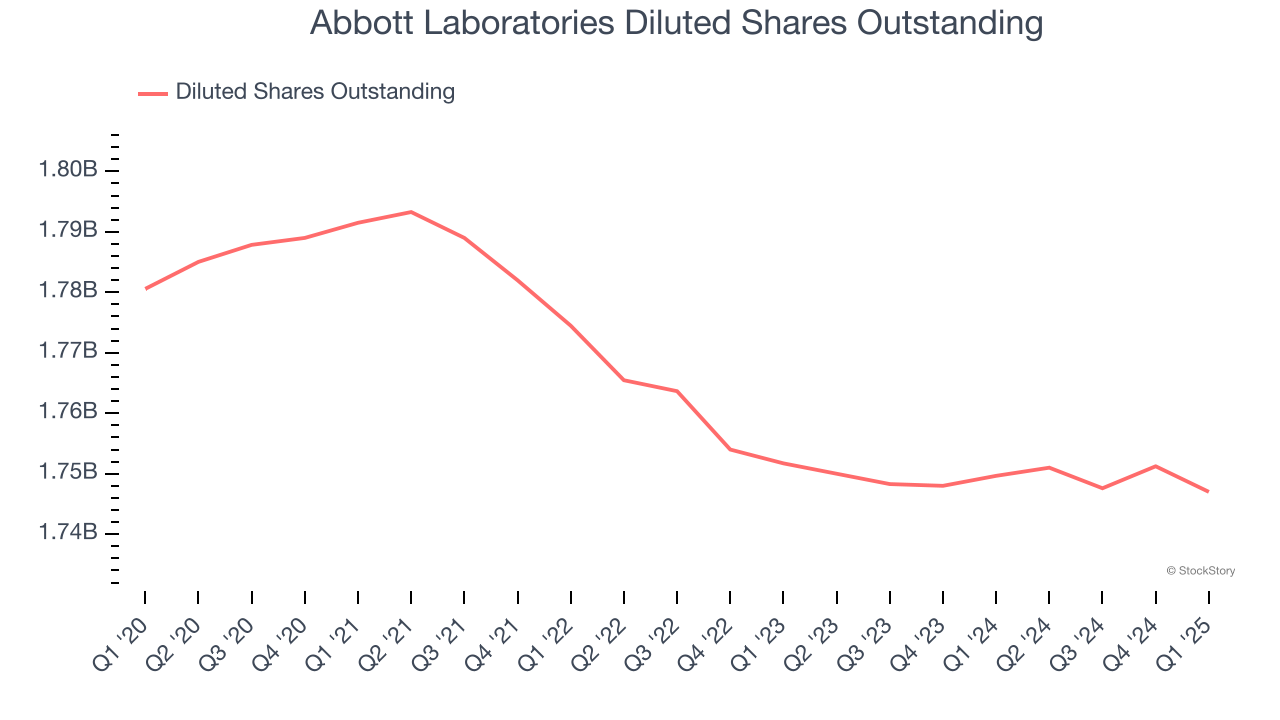

Abbott Laboratories’s EPS grew at a solid 7.9% compounded annual growth rate over the last five years, higher than its 5.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

We can take a deeper look into Abbott Laboratories’s earnings to better understand the drivers of its performance. A five-year view shows that Abbott Laboratories has repurchased its stock, shrinking its share count by 1.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, Abbott Laboratories reported EPS at $1.09, up from $0.98 in the same quarter last year. This print beat analysts’ estimates by 1.7%. Over the next 12 months, Wall Street expects Abbott Laboratories’s full-year EPS of $4.78 to grow 11.3%.

Key Takeaways from Abbott Laboratories’s Q1 Results

The company's revenue was in line although its organic revenue fell slightly short of Wall Street’s estimates. EPS in the quarter beat slightly while full-year EPS guidance met expectations. Overall, this was a quarter without many big surprises. The stock remained flat at $125.28 immediately following the results.

So do we think Abbott Laboratories is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.