The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how electronic components & manufacturing stocks fared in Q4, starting with Knowles (NYSE: KN).

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

The 9 electronic components & manufacturing stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 1.9% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 16.4% since the latest earnings results.

Weakest Q4: Knowles (NYSE: KN)

With roots dating back to 1946 and a focus on components that must perform flawlessly in critical situations, Knowles (NYSE: KN) designs and manufactures specialized electronic components like high-performance capacitors, microphones, and speakers for medical technology, defense, and industrial applications.

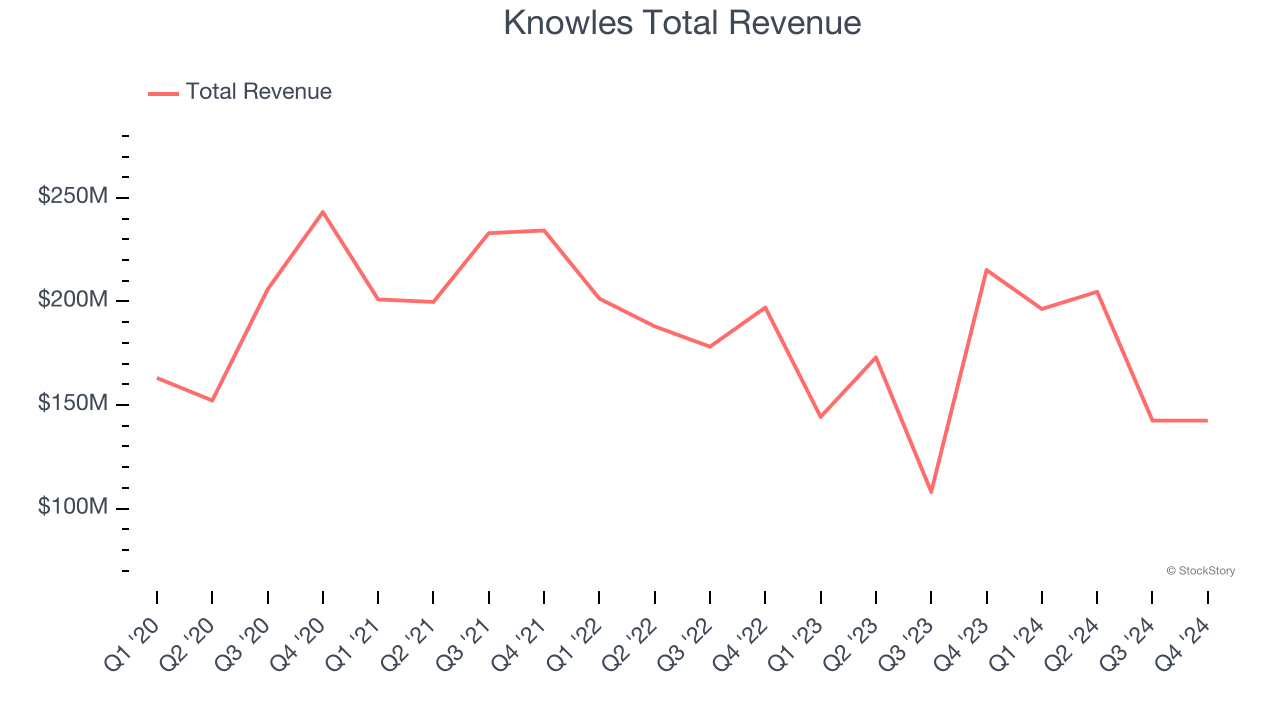

Knowles reported revenues of $142.5 million, down 33.8% year on year. This print fell short of analysts’ expectations by 2.4%. Overall, it was a disappointing quarter for the company with revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ EPS guidance for next quarter estimates.

“With the successful completion of the divestiture of the Consumer MEMS Microphone business at the end of 2024, we took another significant step to further the Company’s strategic transformation into a premier industrial technology company focusing on higher value markets,” said Jeffrey Niew, President and CEO of Knowles.

Knowles delivered the slowest revenue growth of the whole group. The stock is down 18.9% since reporting and currently trades at $14.80.

Read our full report on Knowles here, it’s free.

Best Q4: Flex (NASDAQ: FLEX)

Originally known as Flextronics until its 2016 rebranding, Flex (NASDAQ: FLEX) is a global manufacturing partner that designs, engineers, and builds products for companies across industries from medical devices to solar trackers.

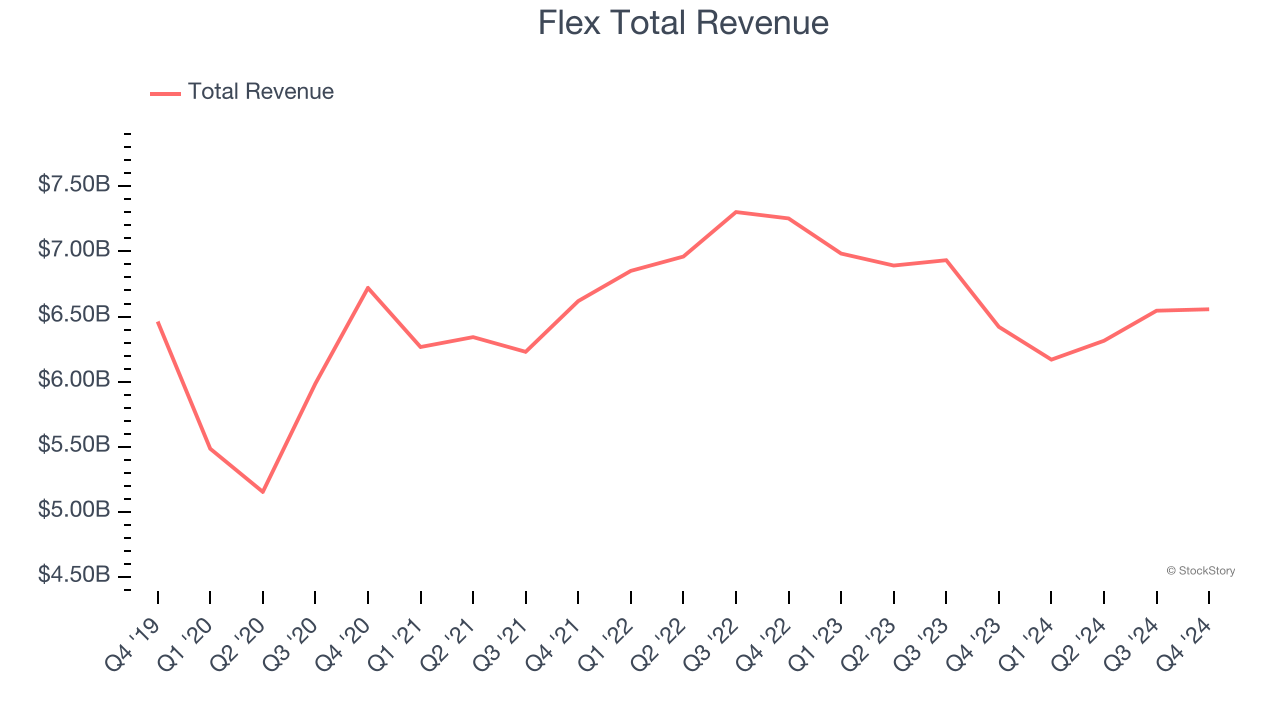

Flex reported revenues of $6.56 billion, up 2.1% year on year, outperforming analysts’ expectations by 5.7%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 19.7% since reporting. It currently trades at $32.65.

Is now the time to buy Flex? Access our full analysis of the earnings results here, it’s free.

CTS (NYSE: CTS)

With roots dating back to 1896 and a global manufacturing footprint, CTS (NYSE: CTS) designs and manufactures sensors, connectivity components, and actuators for aerospace, defense, industrial, medical, and transportation markets.

CTS reported revenues of $127.4 million, up 2.2% year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

CTS delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 16.4% since the results and currently trades at $41.10.

Read our full analysis of CTS’s results here.

Benchmark (NYSE: BHE)

Operating as a critical behind-the-scenes partner for complex technology products since 1979, Benchmark Electronics (NYSE: BHE) provides advanced manufacturing, engineering, and technology solutions for original equipment manufacturers across aerospace, medical, industrial, and technology sectors.

Benchmark reported revenues of $656.9 million, down 5% year on year. This print was in line with analysts’ expectations. It was a strong quarter as it also produced an impressive beat of analysts’ EPS estimates.

The stock is down 13.2% since reporting and currently trades at $37.88.

Read our full, actionable report on Benchmark here, it’s free.

Rogers (NYSE: ROG)

With roots dating back to 1832, making it one of America's oldest continuously operating companies, Rogers (NYSE: ROG) designs and manufactures specialized engineered materials and components used in electric vehicles, telecommunications, renewable energy, and other high-performance applications.

Rogers reported revenues of $192.2 million, down 6.1% year on year. This result met analysts’ expectations. Aside from that, it was a softer quarter as it logged revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ EPS guidance for next quarter estimates.

The stock is down 25.1% since reporting and currently trades at $67.03.

Read our full, actionable report on Rogers here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.