Thermon has been treading water for the past six months, recording a small return of 1% while holding steady at $29.48.

Is now the time to buy THR? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Does THR Stock Spark Debate?

Creating the first packaged tracing systems, Thermon (NYSE: THR) is a leading provider of engineered industrial process heating solutions for process industries.

Two Positive Attributes:

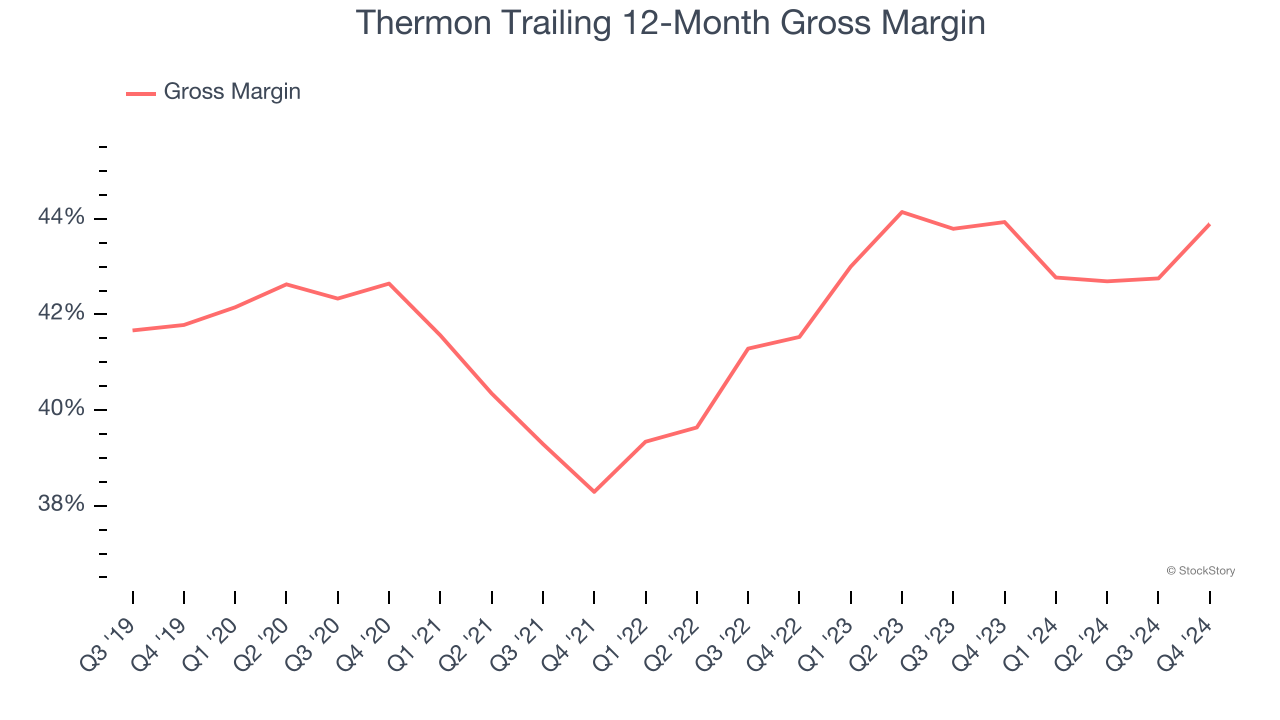

1. Elite Gross Margin Powers Best-In-Class Business Model

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Thermon has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 42.3% gross margin over the last five years. Said differently, roughly $42.32 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

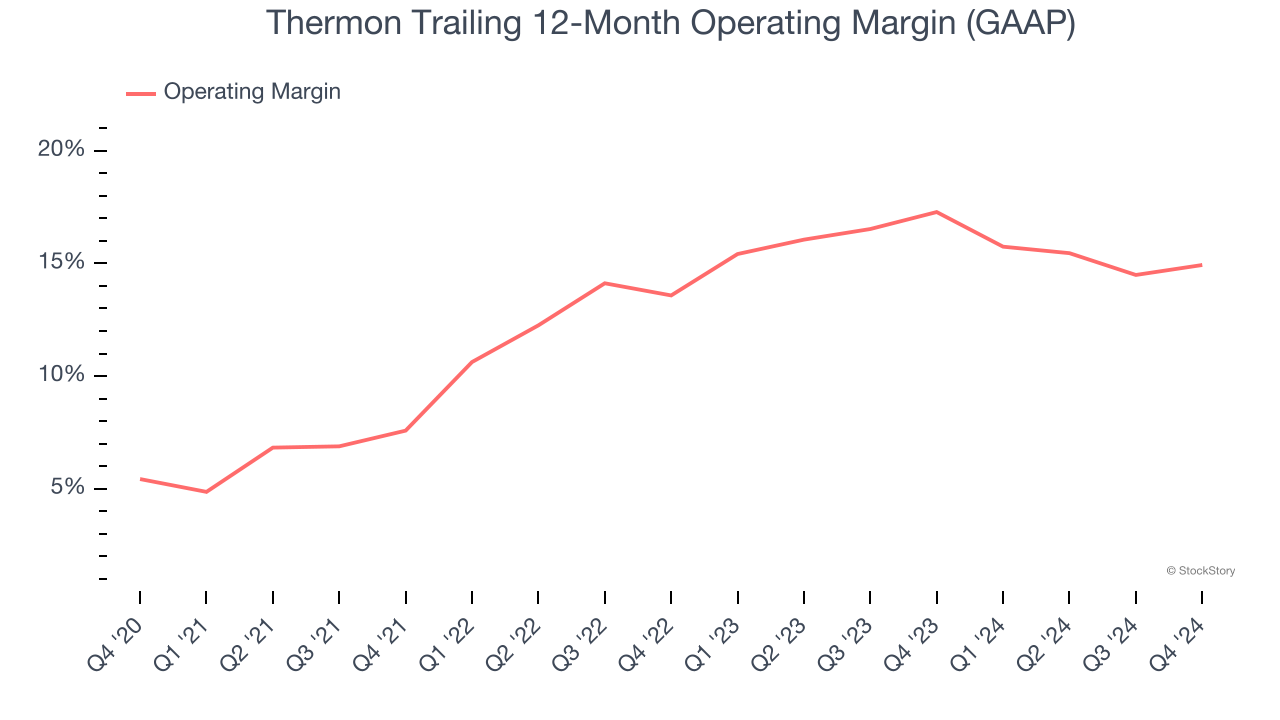

2. Operating Margin Rising, Profits Up

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Thermon’s operating margin rose by 9.5 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 14.9%.

One Reason to be Careful:

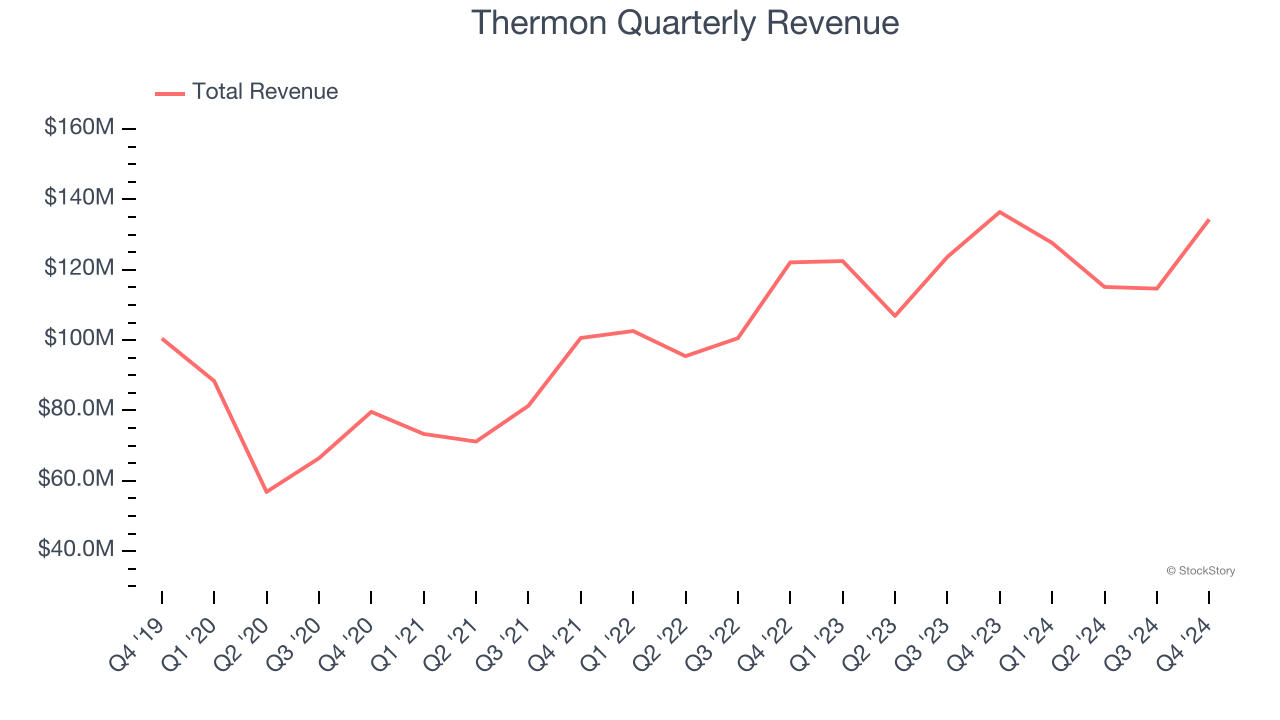

Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Thermon’s 3.7% annualized revenue growth over the last five years was sluggish. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Thermon.

Final Judgment

Thermon’s merits more than compensate for its flaws, but at $29.48 per share (or 15× forward price-to-earnings), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Thermon

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.