Medical device company Globus Medical (NYSE: GMED) announced better-than-expected revenue in Q3 CY2025, with sales up 22.9% year on year to $769 million. The company’s full-year revenue guidance of $2.88 billion at the midpoint came in 0.8% above analysts’ estimates. Its non-GAAP profit of $1.18 per share was 53.4% above analysts’ consensus estimates.

Is now the time to buy Globus Medical? Find out by accessing our full research report, it’s free for active Edge members.

Globus Medical (GMED) Q3 CY2025 Highlights:

- Revenue: $769 million vs analyst estimates of $734.8 million (22.9% year-on-year growth, 4.7% beat)

- Adjusted EPS: $1.18 vs analyst estimates of $0.77 (53.4% beat)

- Adjusted EBITDA: $252.6 million vs analyst estimates of $198.4 million (32.8% margin, 27.3% beat)

- The company lifted its revenue guidance for the full year to $2.88 billion at the midpoint from $2.85 billion, a 1.1% increase

- Management raised its full-year Adjusted EPS guidance to $3.80 at the midpoint, a 20.6% increase

- Operating Margin: 17.9%, up from 7.7% in the same quarter last year

- Free Cash Flow Margin: 27.8%, up from 25.8% in the same quarter last year

- Constant Currency Revenue rose 22.3% year on year (63.4% in the same quarter last year)

- Market Capitalization: $8.31 billion

“We are pleased with the strength of our overall results and continued progress throughout the company,” commented Keith Pfeil, President and Chief Executive Officer.

Company Overview

With operations spanning 64 countries and a portfolio of over 10 new products launched in 2023 alone, Globus Medical (NYSE: GMED) develops and sells implantable devices, surgical instruments, and technology solutions for spine, orthopedic, and neurosurgical procedures.

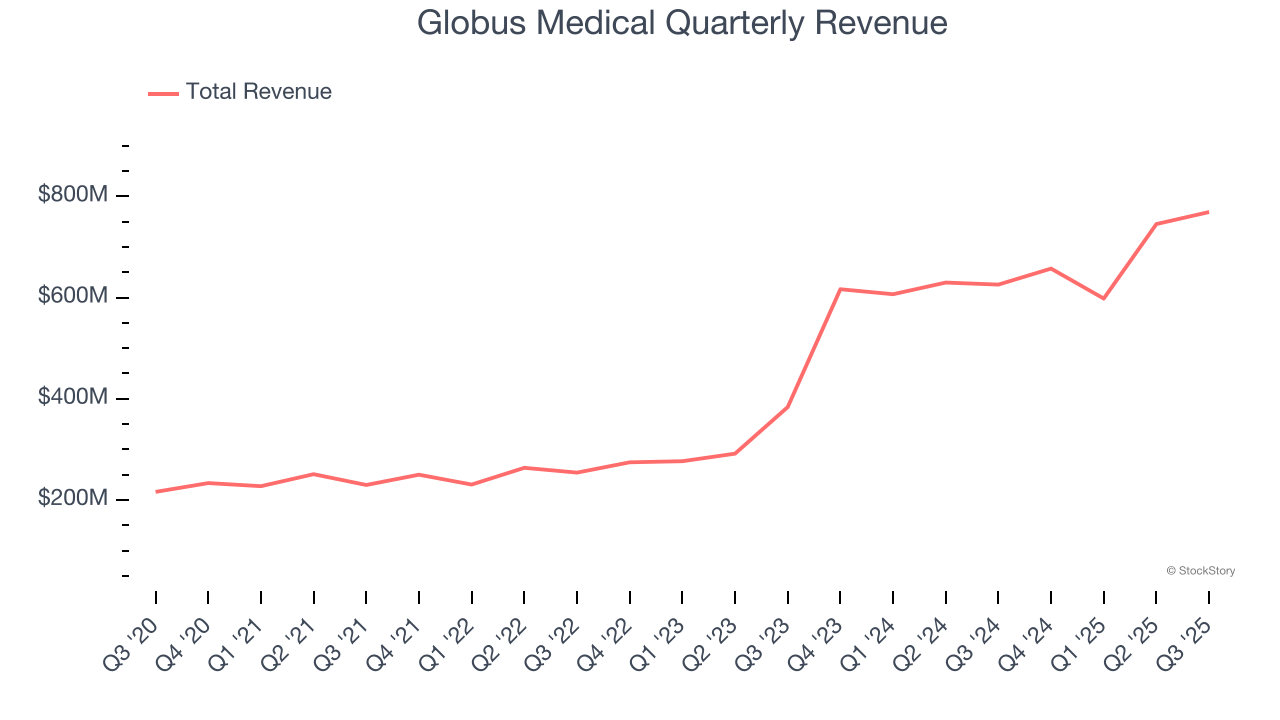

Revenue Growth

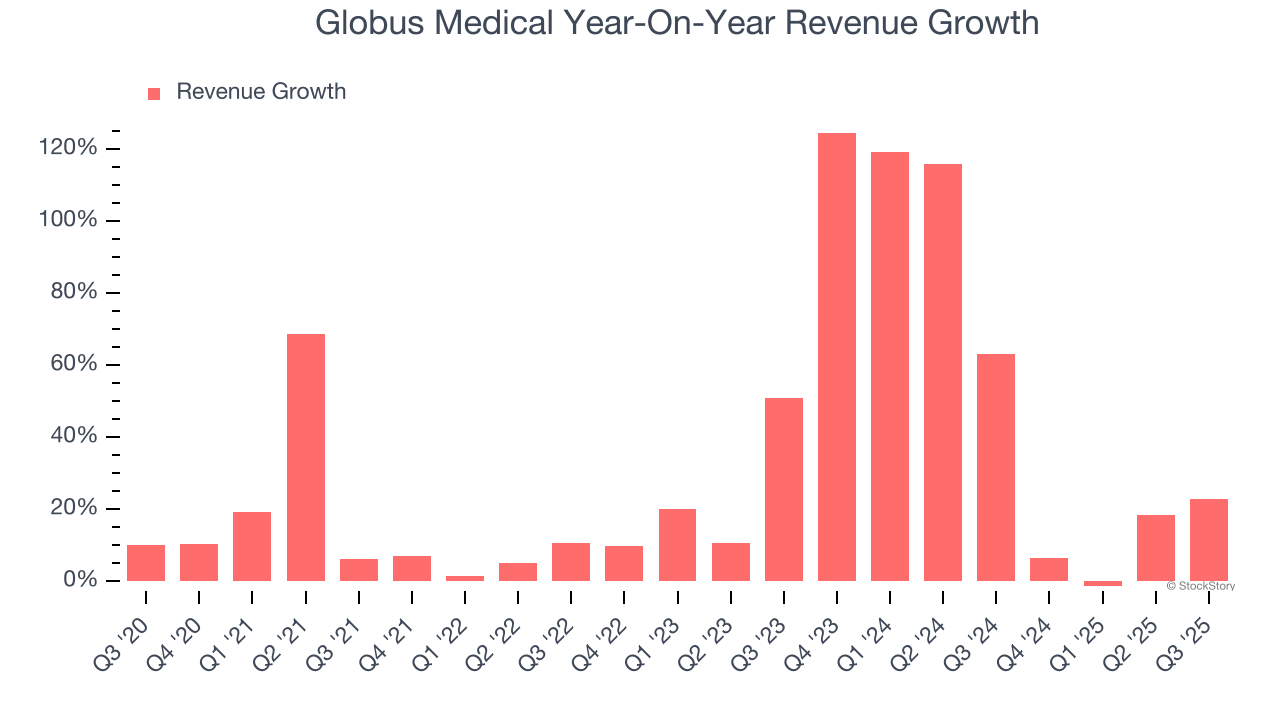

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Globus Medical’s sales grew at an exceptional 29.3% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Globus Medical’s annualized revenue growth of 50.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

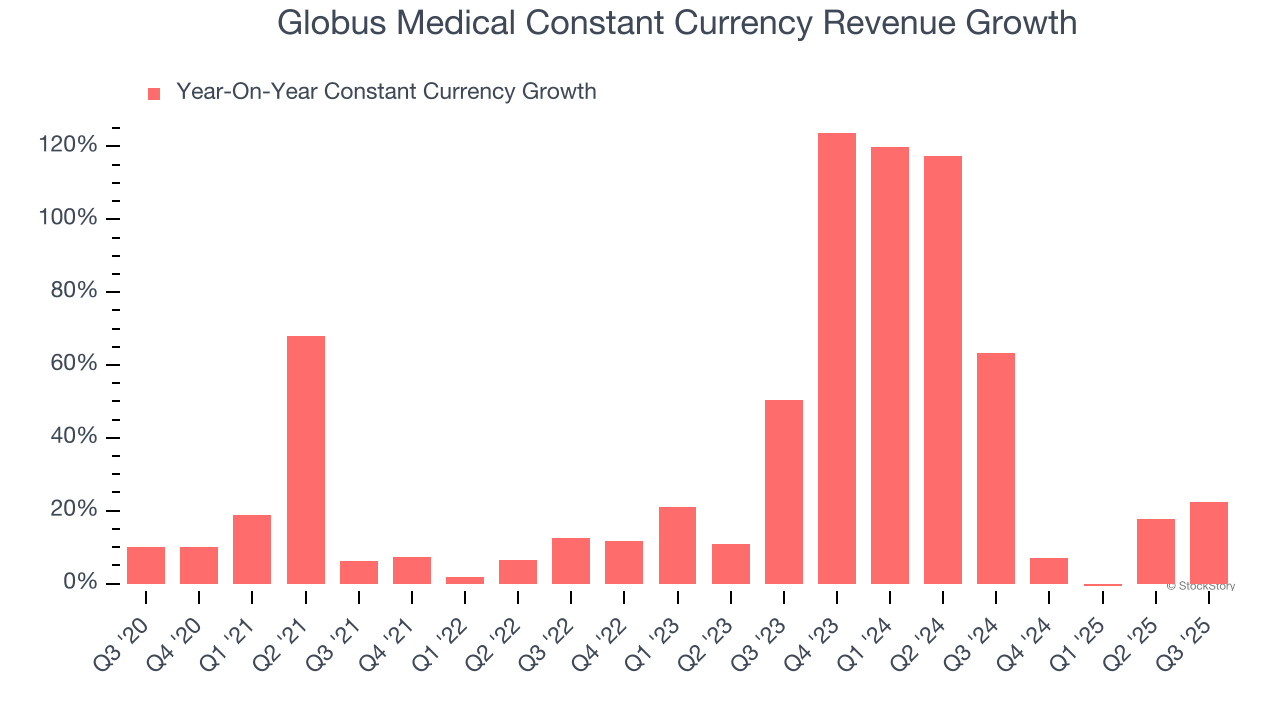

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 58.8% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Globus Medical.

This quarter, Globus Medical reported robust year-on-year revenue growth of 22.9%, and its $769 million of revenue topped Wall Street estimates by 4.7%.

Looking ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is commendable and indicates the market sees success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

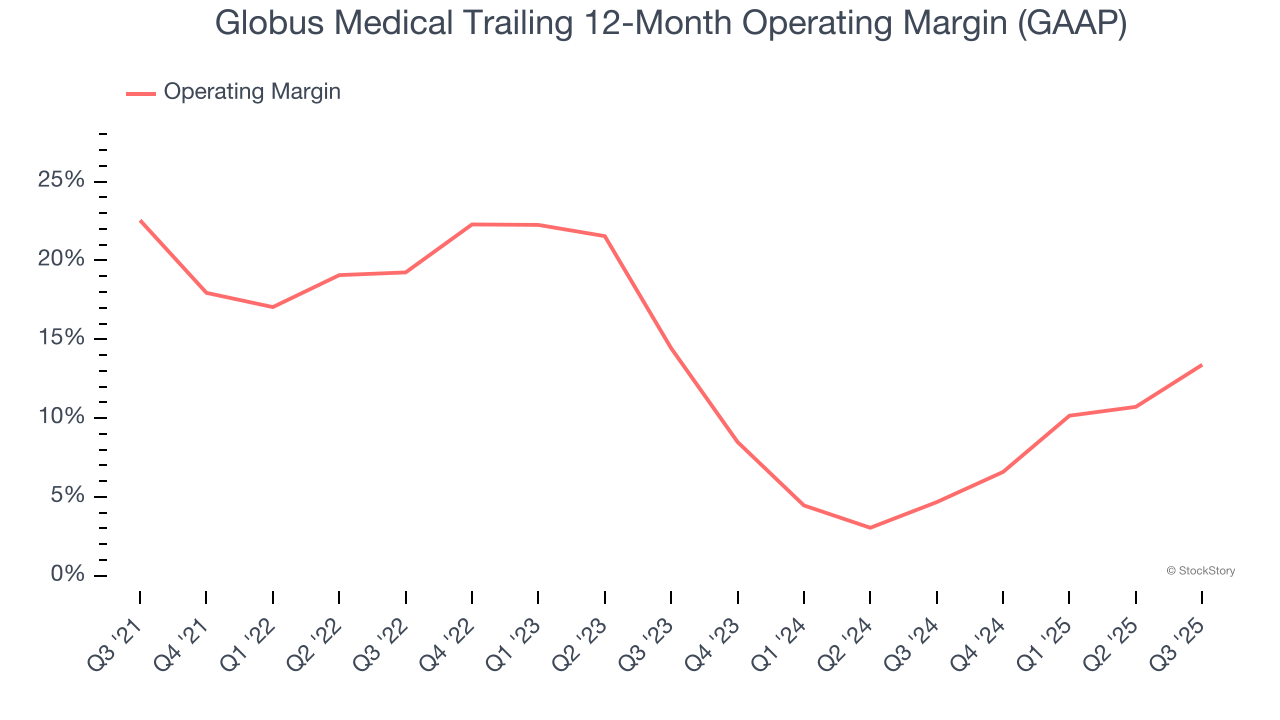

Operating Margin

Globus Medical has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 12.7%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Globus Medical’s operating margin decreased by 9.2 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 1.1 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Globus Medical generated an operating margin profit margin of 17.9%, up 10.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

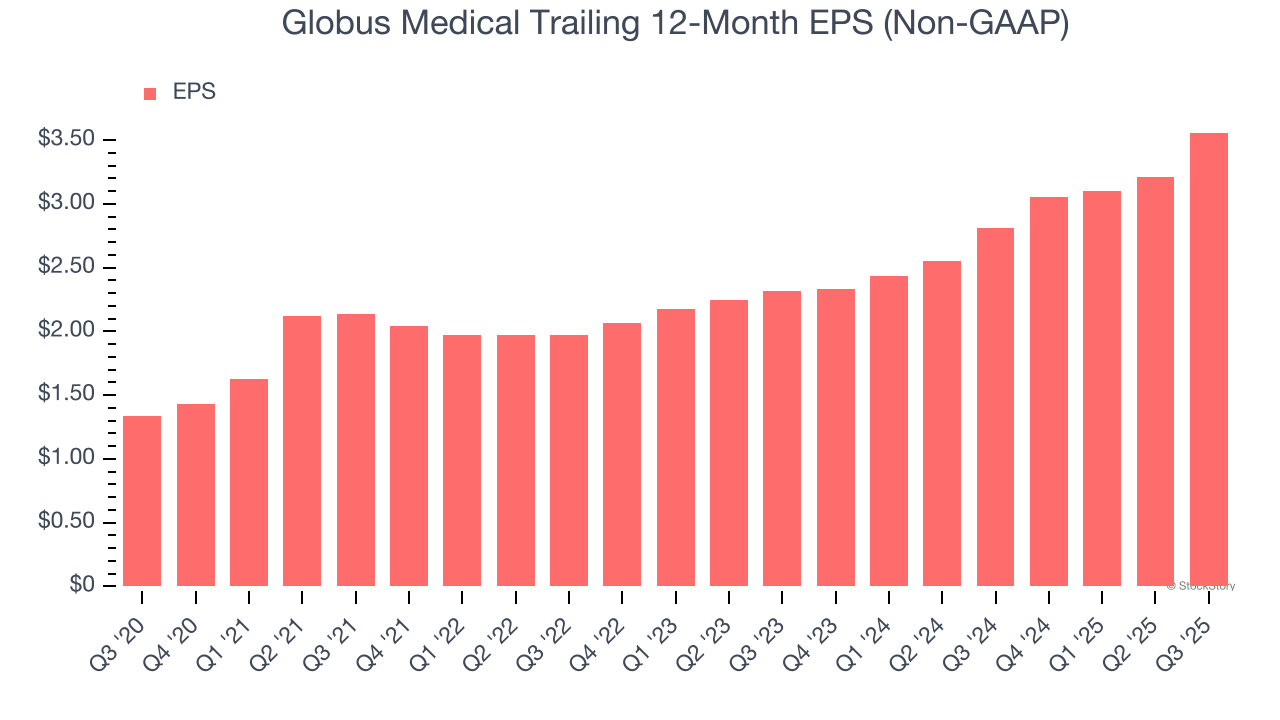

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

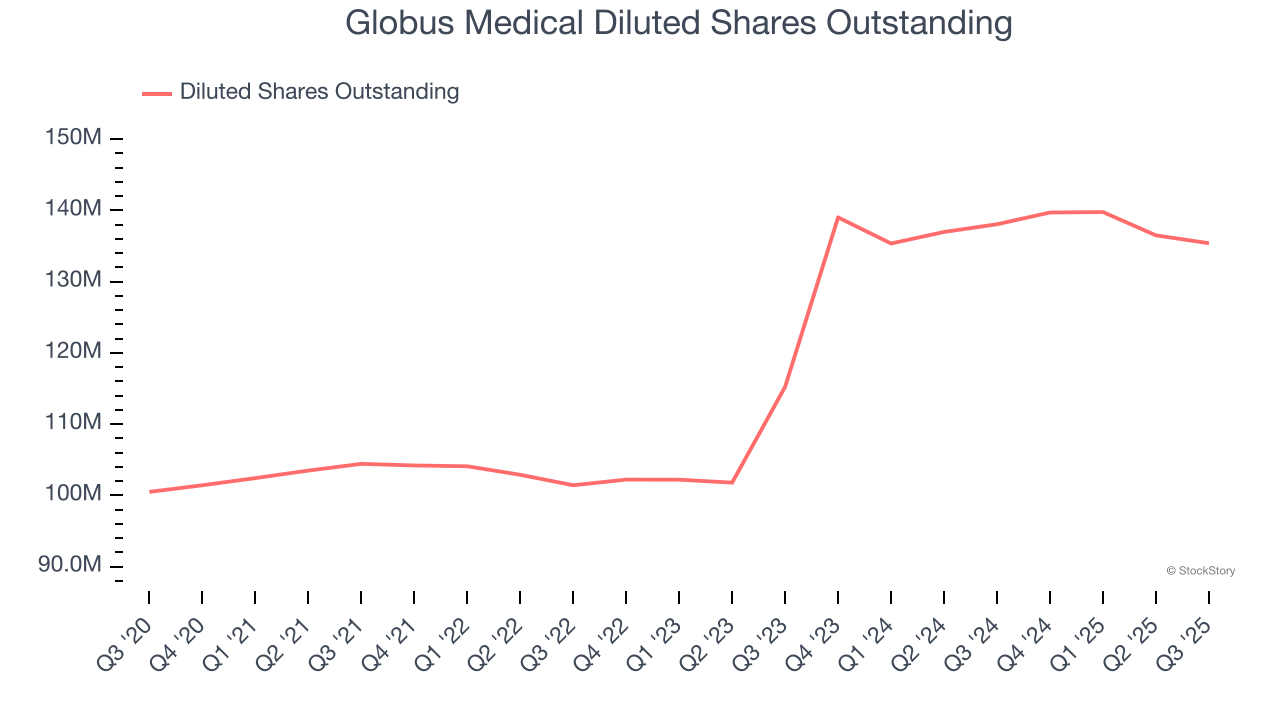

Globus Medical’s EPS grew at an astounding 21.6% compounded annual growth rate over the last five years. However, this performance was lower than its 29.3% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Globus Medical’s earnings to better understand the drivers of its performance. As we mentioned earlier, Globus Medical’s operating margin expanded this quarter but declined by 9.2 percentage points over the last five years. Its share count also grew by 34.7%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Globus Medical reported adjusted EPS of $1.18, up from $0.83 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Globus Medical’s full-year EPS of $3.56 to shrink by 3%.

Key Takeaways from Globus Medical’s Q3 Results

We were impressed by how significantly Globus Medical blew past analysts’ constant currency revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Full-year revenue and EPS guidance were both raised, which is a good sign. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 19.2% to $73.55 immediately after reporting.

Indeed, Globus Medical had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.