Equipment distribution company Alta Equipment Group (NYSE: ALTG) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 5.8% year on year to $422.6 million. Its non-GAAP loss of $0.35 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Alta? Find out by accessing our full research report, it’s free for active Edge members.

Alta (ALTG) Q3 CY2025 Highlights:

- Revenue: $422.6 million vs analyst estimates of $461.6 million (5.8% year-on-year decline, 8.4% miss)

- Adjusted EPS: -$0.35 vs analyst estimates of -$0.17 (significant miss)

- Adjusted EBITDA: $41.7 million vs analyst estimates of $46.1 million (9.9% margin, 9.5% miss)

- EBITDA guidance for the full year is $170 million at the midpoint, below analyst estimates of $173.8 million

- Operating Margin: 1.1%, in line with the same quarter last year

- Free Cash Flow was -$13.2 million, down from $23.9 million in the same quarter last year

- Market Capitalization: $194.5 million

LIVONIA, Mich., Nov. 06, 2025 (GLOBE NEWSWIRE) -- Alta Equipment Group Inc. (NYSE: ALTG) (“Alta”, "we", "our" or the “Company”), a leading provider of premium material handling, construction and environmental processing equipment and related services, today announced financial results for the third quarter ended September 30, 2025.

Company Overview

Founded in 1984, Alta Equipment Group (NYSE: ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Revenue Growth

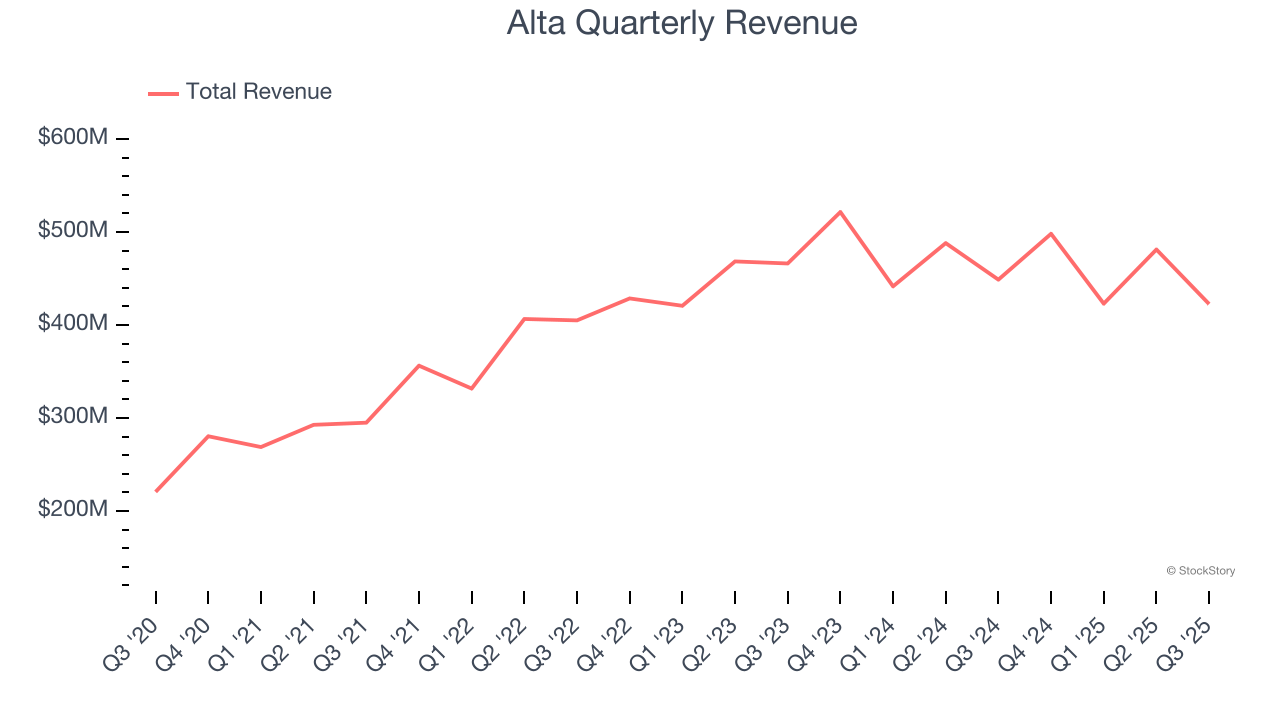

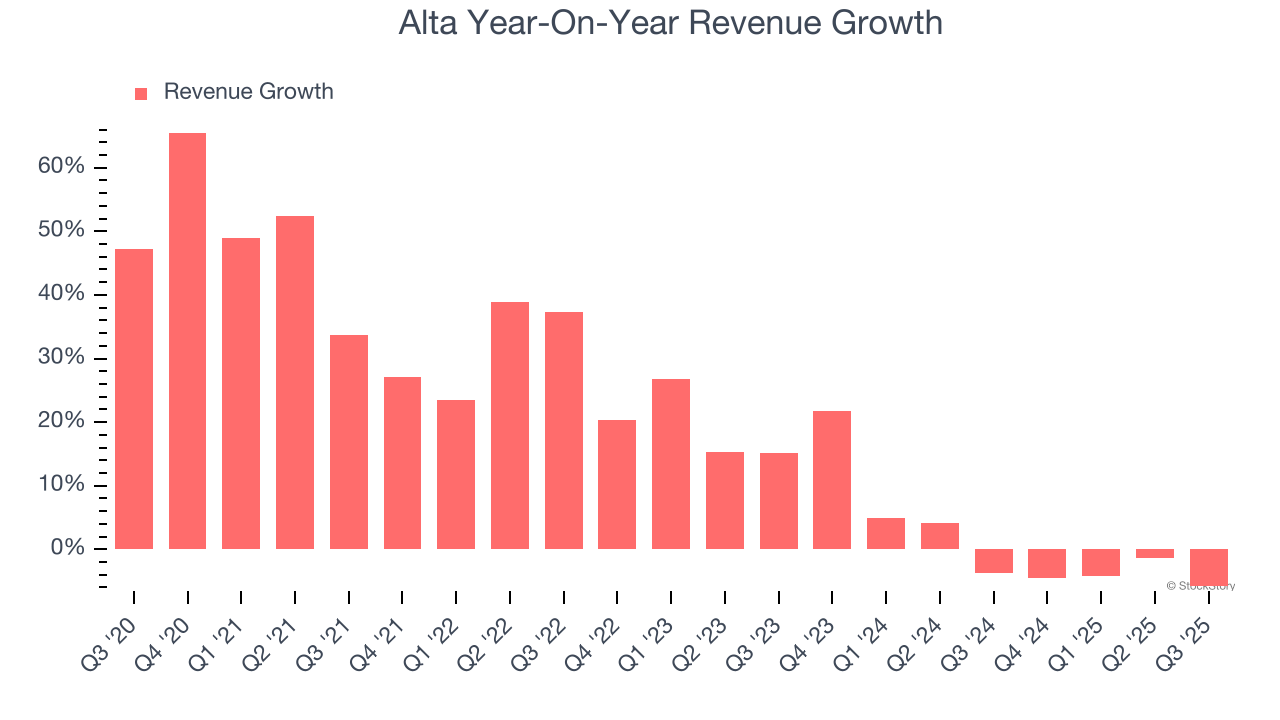

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Alta’s sales grew at an incredible 19.1% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Alta’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.1% over the last two years was well below its five-year trend.

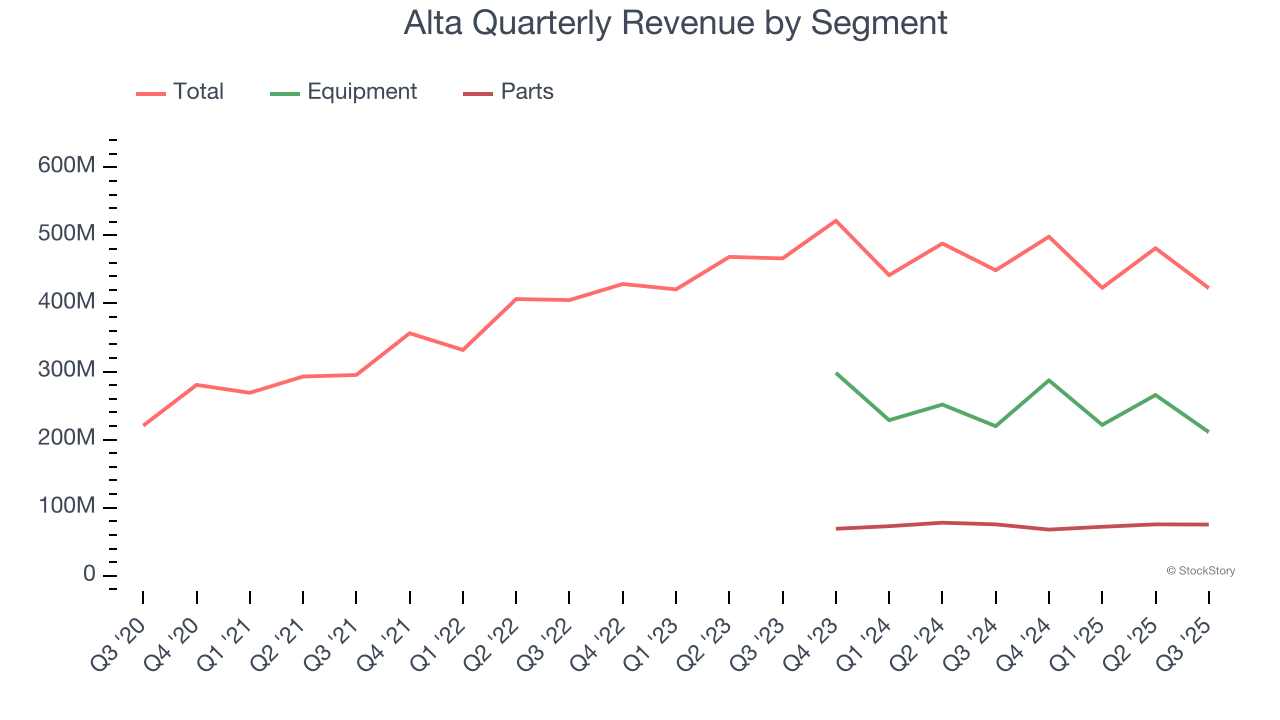

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Equipment and Parts, which are 50% and 17.8% of revenue. Over the last two years, Alta’s Equipment revenue (new and used) averaged 1.3% year-on-year declines while its Parts revenue (maintenance and repair products) averaged 1.6% declines.

This quarter, Alta missed Wall Street’s estimates and reported a rather uninspiring 5.8% year-on-year revenue decline, generating $422.6 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

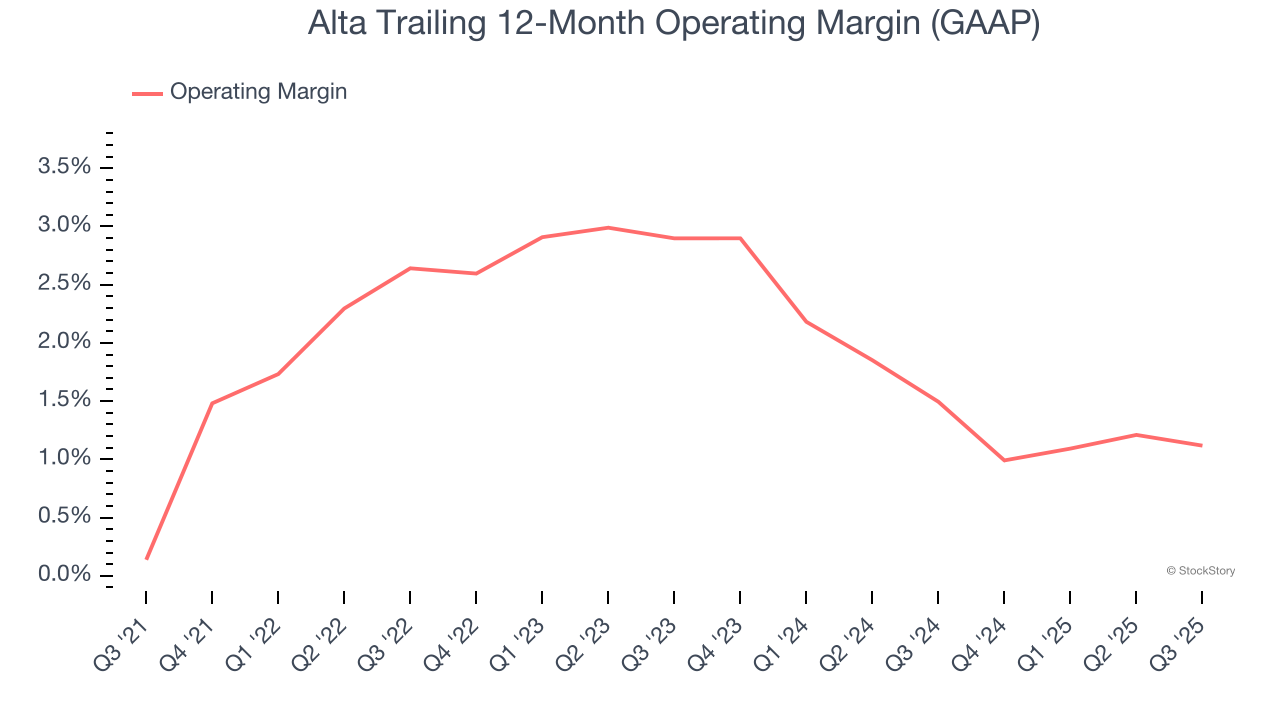

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Alta’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 1.7% over the last five years. This profitability was lousy for an industrials business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Alta’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Alta generated an operating margin profit margin of 1.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

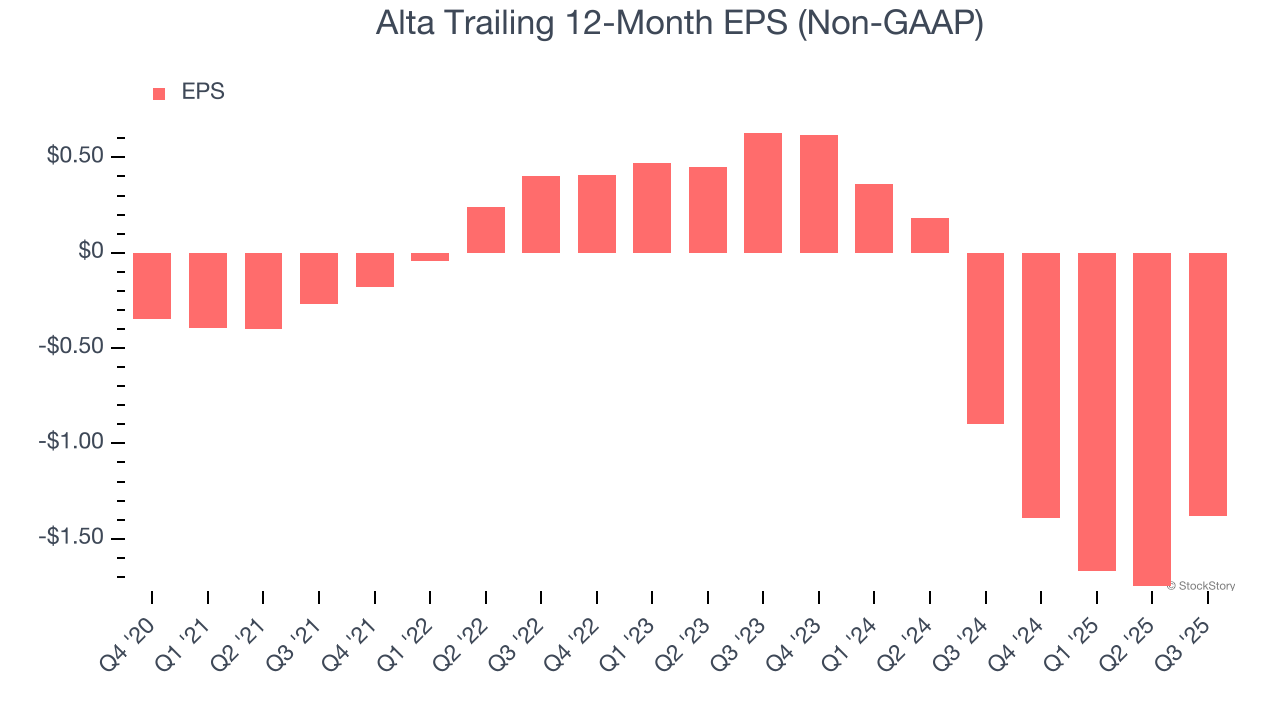

Alta’s earnings losses deepened over the last five years as its EPS dropped 26.1% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Alta’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Alta, its EPS declined by 105% annually over the last two years while its revenue grew by 1.1%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Alta’s earnings can give us a better understanding of its performance. While we mentioned earlier that Alta’s operating margin was flat this quarter, a two-year view shows its margin has declined. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Alta reported adjusted EPS of negative $0.35, up from negative $0.72 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Alta to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.38 will advance to negative $0.56.

Key Takeaways from Alta’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.9% to $5.54 immediately after reporting.

Alta underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.