American restaurant chain BJ’s Restaurants (NASDAQ: BJRI) fell short of the markets revenue expectations in Q3 CY2025 as sales only rose 1.4% year on year to $330.2 million. Its non-GAAP profit of $0.04 per share was $0.01 above analysts’ consensus estimates.

Is now the time to buy BJ's? Find out by accessing our full research report, it’s free for active Edge members.

BJ's (BJRI) Q3 CY2025 Highlights:

- Revenue: $330.2 million vs analyst estimates of $333.9 million (1.4% year-on-year growth, 1.1% miss)

- Adjusted EPS: $0.04 vs analyst estimates of $0.03 ($0.01 beat)

- Adjusted EBITDA: $21.12 million vs analyst estimates of $21.44 million (6.4% margin, 1.5% miss)

- EBITDA guidance for the full year is $136 million at the midpoint, above analyst estimates of $134.5 million

- Operating Margin: -0.3%, in line with the same quarter last year

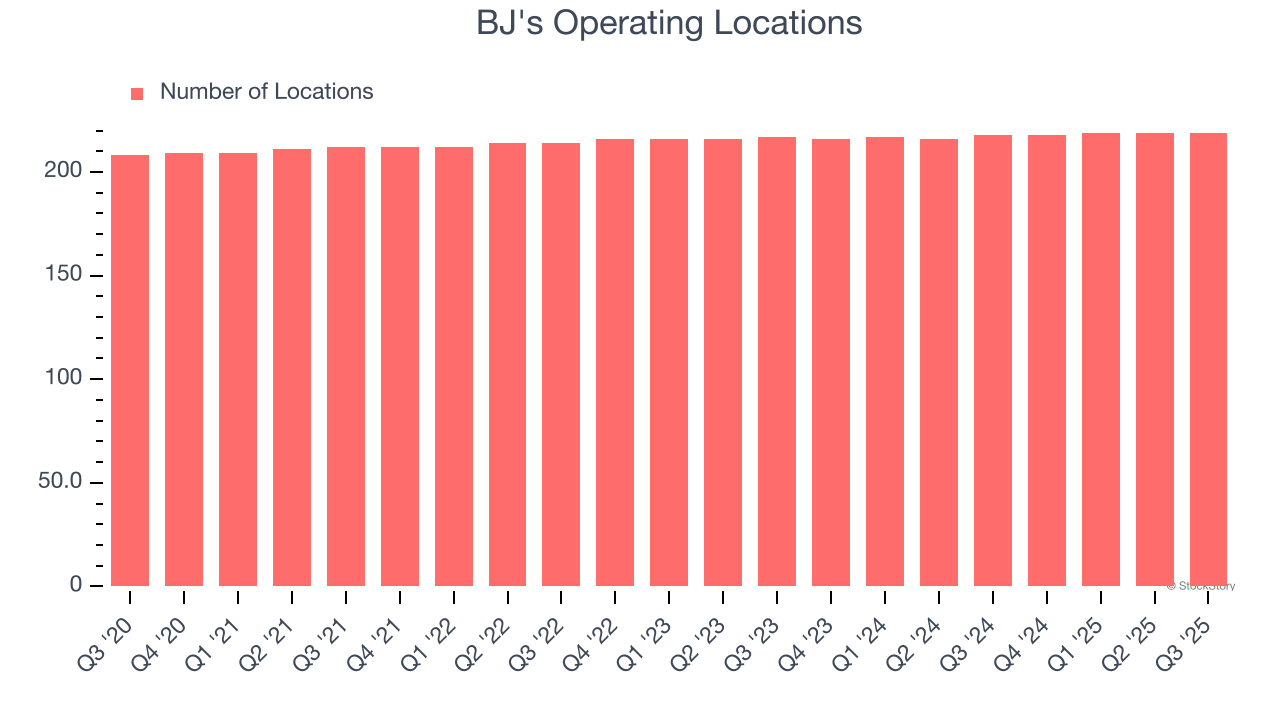

- Locations: 219 at quarter end, up from 218 in the same quarter last year

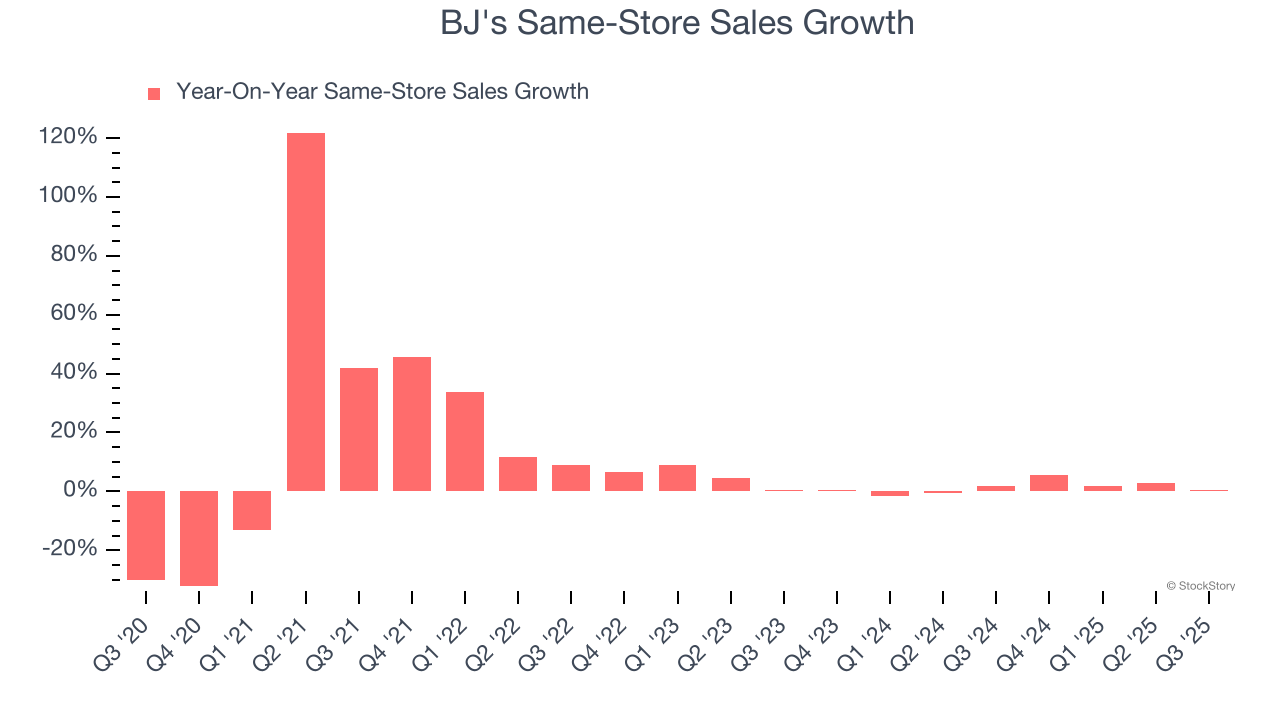

- Same-Store Sales were flat year on year (1.7% in the same quarter last year)

- Market Capitalization: $665.5 million

“We are pleased to report our 5th consecutive quarter of sales and traffic growth, along with our 4th consecutive quarter of profit expansion,” commented Lyle Tick, Chief Executive Officer and President.

Company Overview

Founded in 1978 in California, BJ’s Restaurants (NASDAQ: BJRI) is a chain of restaurants whose menu features classic American dishes, often with a twist.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.39 billion in revenue over the past 12 months, BJ's is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

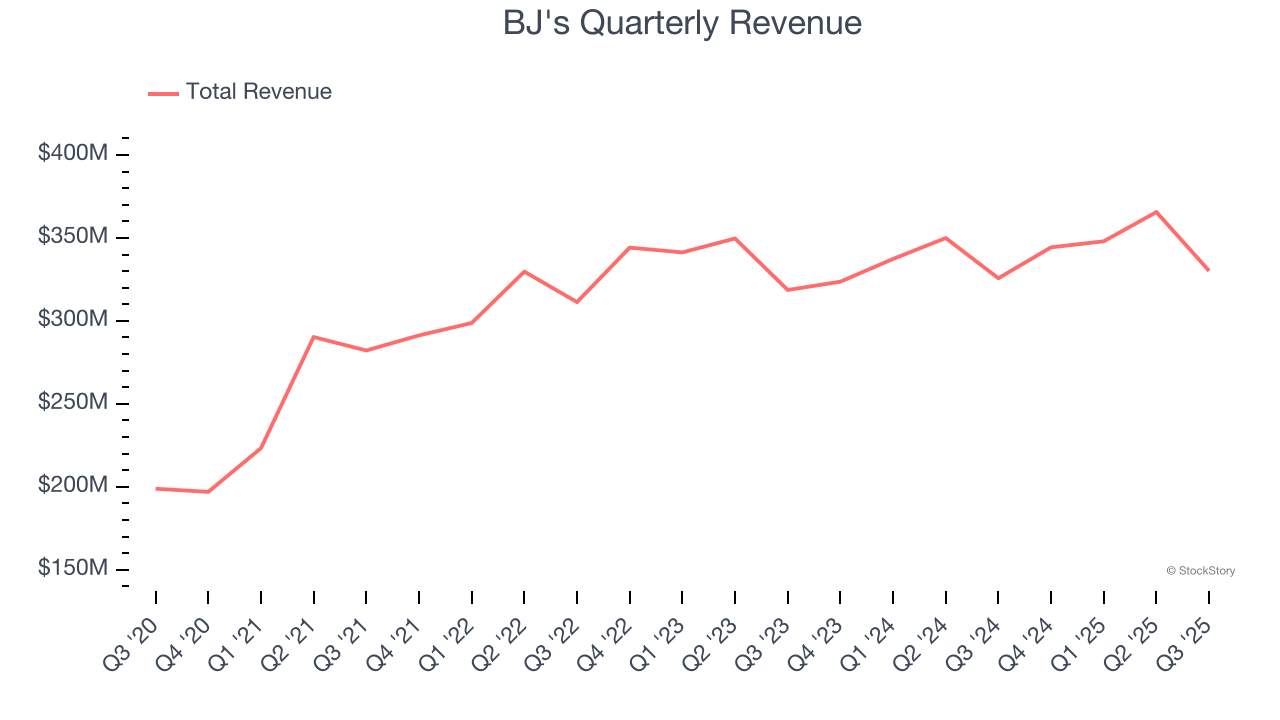

As you can see below, BJ's grew its sales at a sluggish 3.2% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as its restaurant footprint remained unchanged and it barely increased sales at existing, established dining locations.

This quarter, BJ’s revenue grew by 1.4% year on year to $330.2 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, similar to its six-year rate. This projection is underwhelming and suggests its newer menu offerings will not lead to better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

BJ's operated 219 locations in the latest quarter, and over the last two years, has kept its restaurant count flat while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

BJ’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.3% per year. Given its flat restaurant base over the same period, this performance stems from a mixture of higher prices and increased foot traffic at existing locations.

In the latest quarter, BJ’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if BJ's can reaccelerate growth.

Key Takeaways from BJ’s Q3 Results

It was good to see BJ's beat analysts’ EPS expectations this quarter. We were also glad its full-year EBITDA guidance slightly exceeded Wall Street’s estimates. On the other hand, its revenue slightly missed and its EBITDA fell slightly short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $28.60 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.