While the S&P 500 is up 22.9% since April 2025, McKesson (currently trading at $792.23 per share) has lagged behind, posting a return of 15.1%. This may have investors wondering how to approach the situation.

Taking into account the weaker price action, does MCK warrant a spot on your radar, or is it better left off your list? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On MCK?

With roots dating back to 1833, making it one of America's oldest continuously operating businesses, McKesson (NYSE: MCK) is a healthcare services company that distributes pharmaceuticals, medical supplies, and provides technology solutions to pharmacies, hospitals, and healthcare providers.

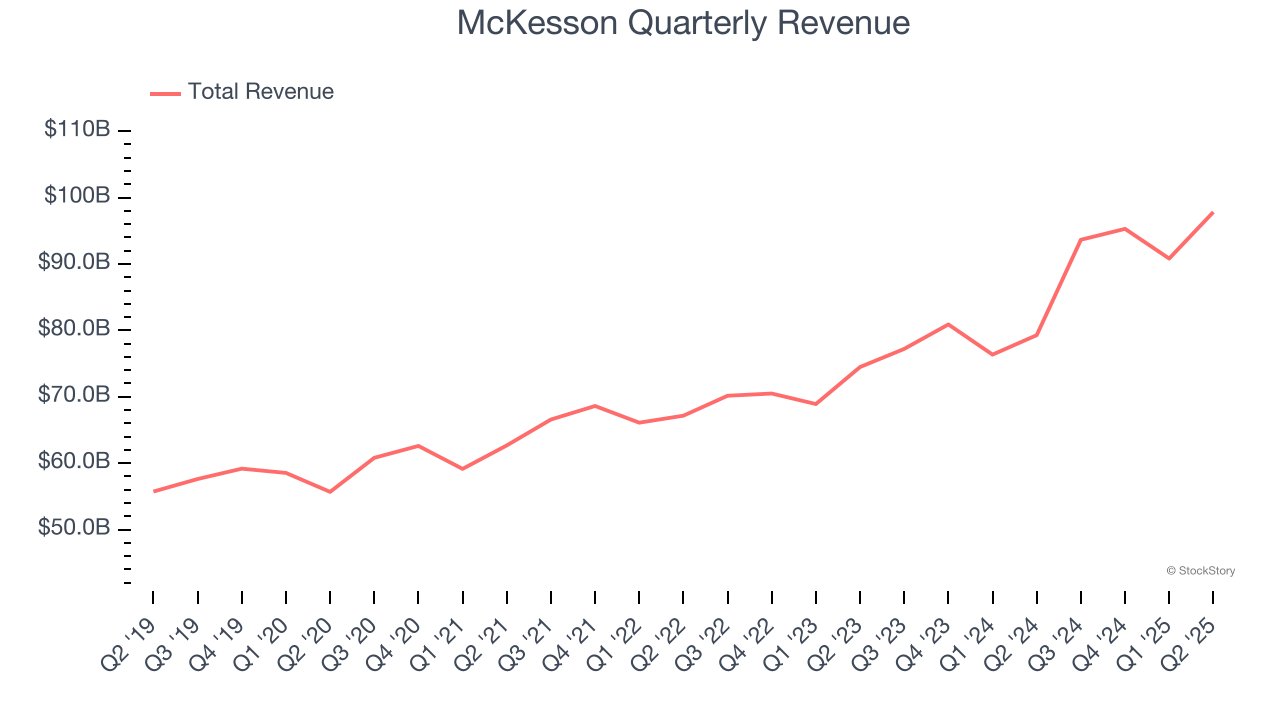

1. Long-Term Revenue Growth Shows Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, McKesson’s sales grew at a decent 10.3% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $377.6 billion in revenue over the past 12 months, McKesson is one of the most scaled enterprises in healthcare. This is particularly important because healthcare distribution & related services companies are volume-driven businesses due to their low margins.

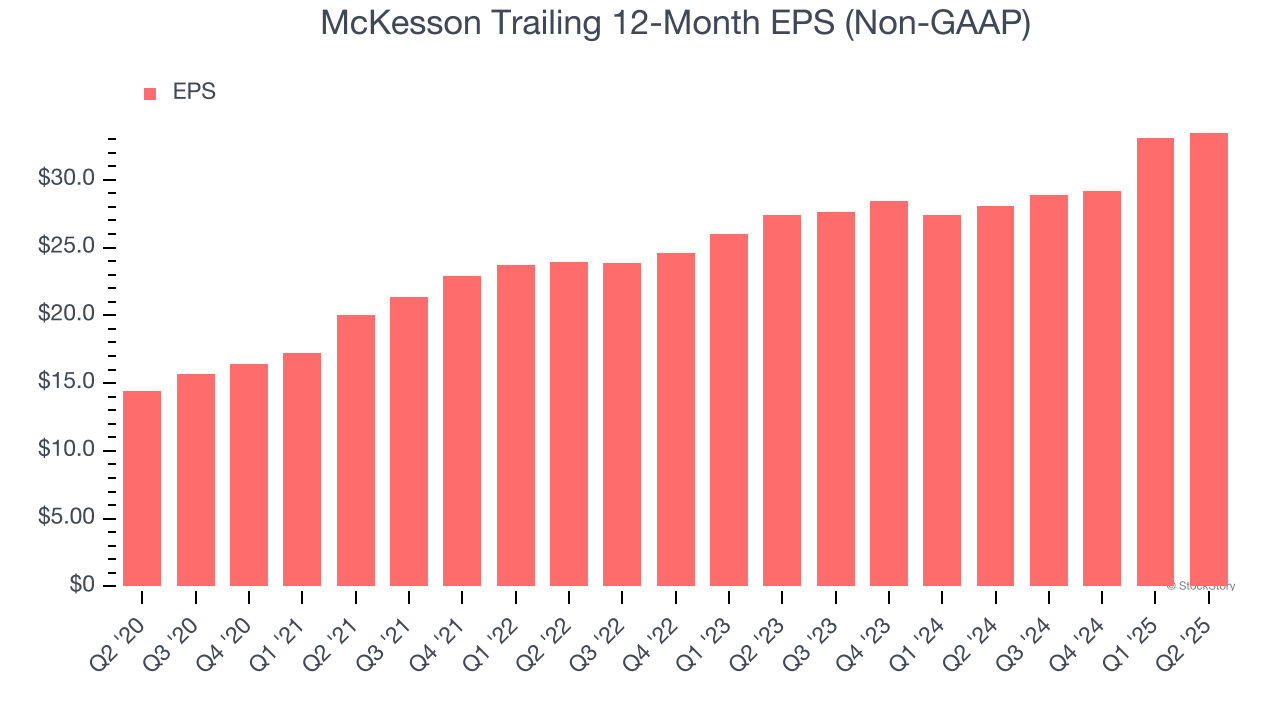

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

McKesson’s EPS grew at an astounding 18.3% compounded annual growth rate over the last five years, higher than its 10.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why McKesson ranks highly on our list. With its shares lagging the market recently, the stock trades at 19.9× forward P/E (or $792.23 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than McKesson

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.