Over the past six months, Hershey’s stock price fell to $167.86. Shareholders have lost 9.1% of their capital, which is disappointing considering the S&P 500 has climbed by 6.3%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Following the drawdown, is now a good time to buy HSY? Find out in our full research report, it’s free.

Why Does HSY Stock Spark Debate?

Best known for its milk chocolate bar and Hershey's Kisses, Hershey (NYSE: HSY) is an iconic company known for its chocolate products.

Two Things to Like:

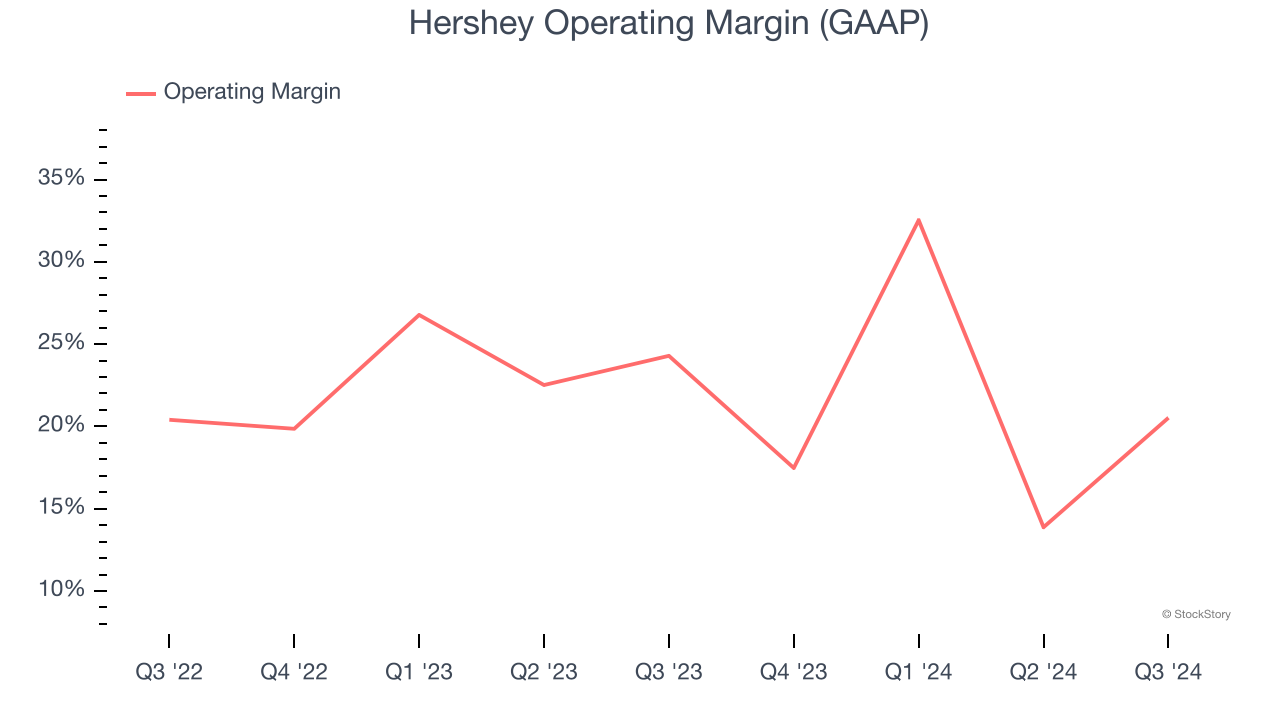

1. Operating Margin Reveals a Well-Run Organization

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

Hershey has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 22.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

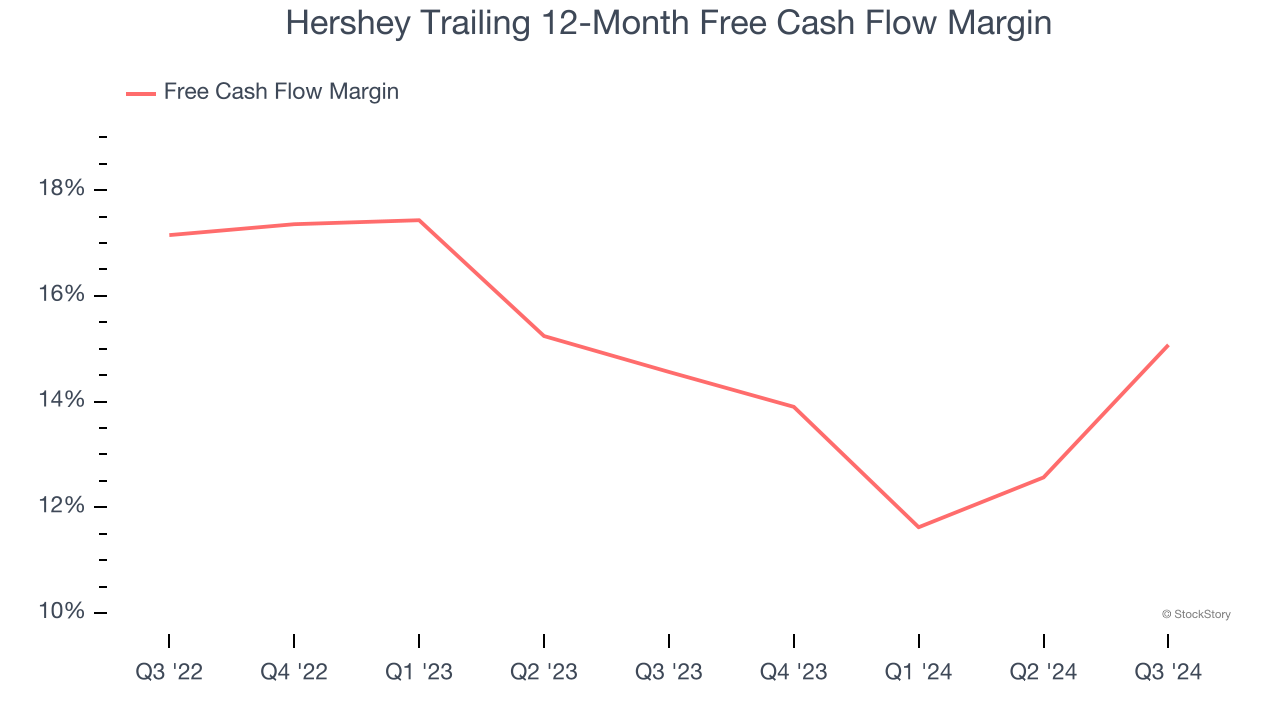

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Hershey has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 14.8% over the last two years.

One Reason to be Careful:

Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Hershey’s average quarterly sales volumes have shrunk by 2.6% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

Final Judgment

Hershey has huge potential even though it has some open questions. With the recent decline, the stock trades at 18.2× forward price-to-earnings (or $167.86 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Hershey

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.