AMC Networks has been treading water for the past six months, recording a small return of 3.4% while holding steady at $9.70. This is close to the S&P 500’s 7.3% gain during that period.

Is there a buying opportunity in AMC Networks, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We don't have much confidence in AMC Networks. Here are three reasons why you should be careful with AMCX and a stock we'd rather own.

Why Do We Think AMC Networks Will Underperform?

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ: AMCX) is a broadcaster producing a diverse range of television shows and movies.

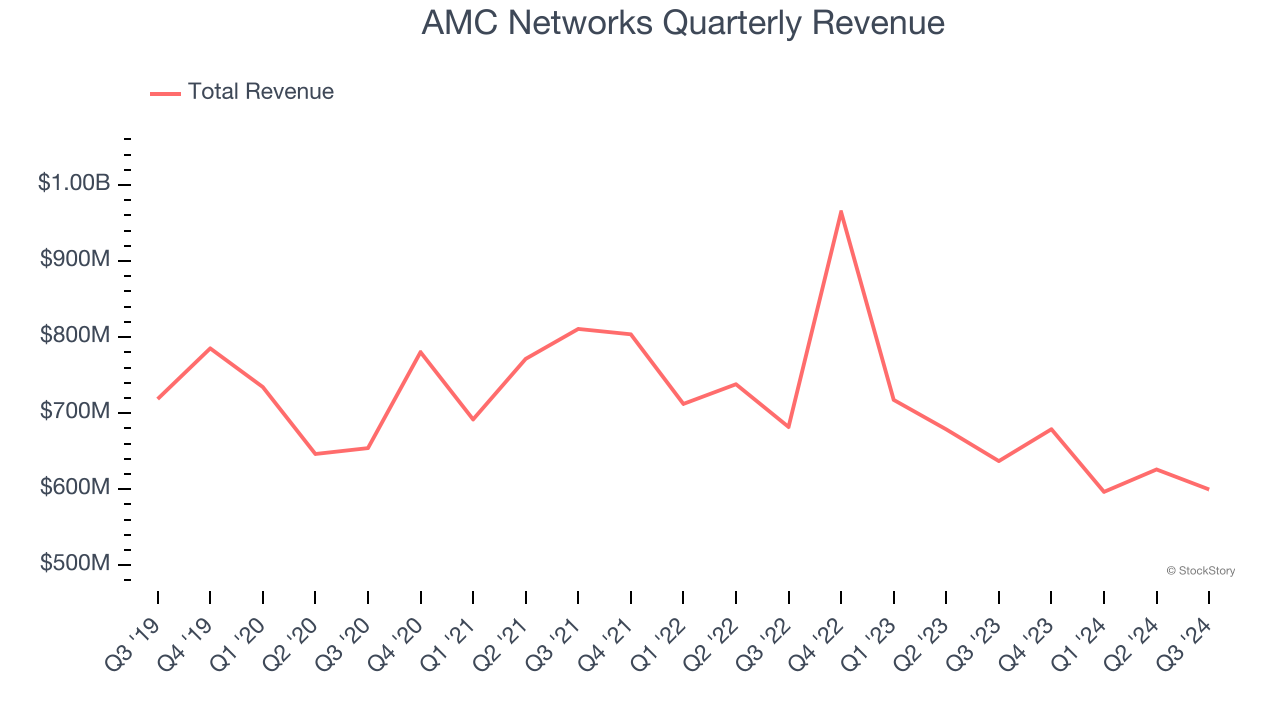

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, AMC Networks’s demand was weak and its revenue declined by 3.9% per year. This was below our standards and is a sign of poor business quality.

2. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict AMC Networks’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 14.4% for the last 12 months will decrease to 10.7%.

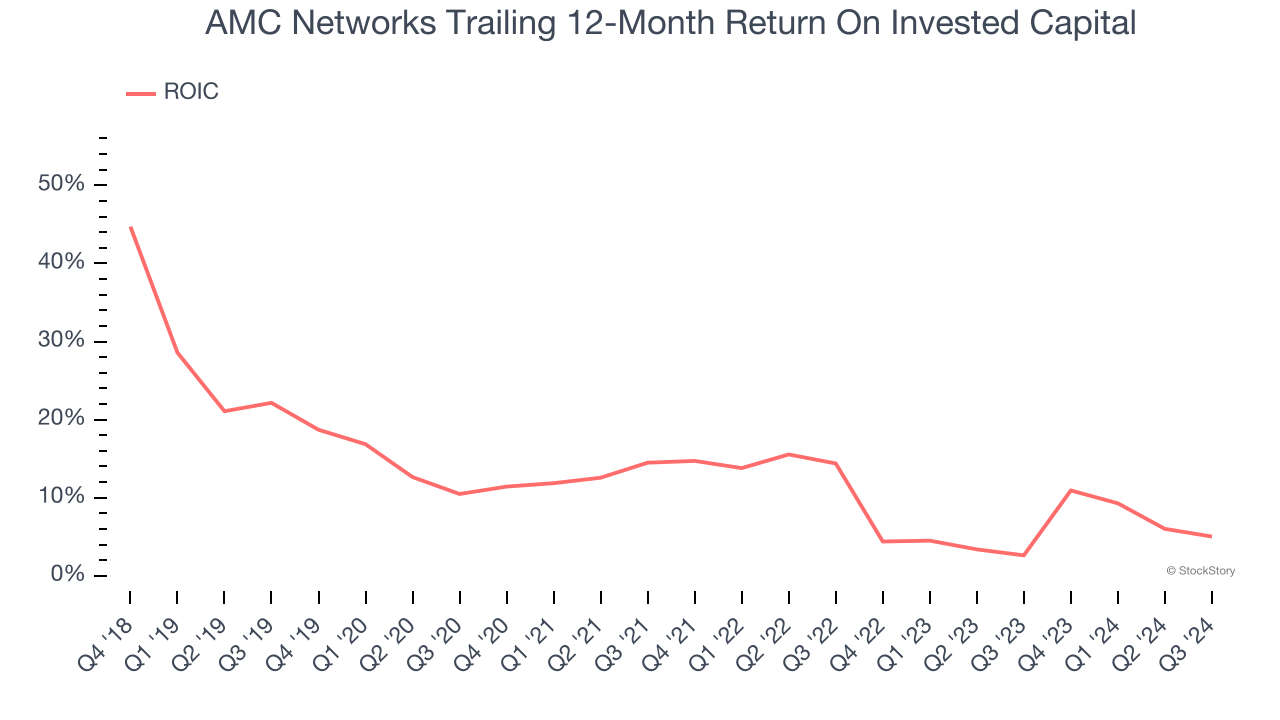

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, AMC Networks’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of AMC Networks, we’ll be cheering from the sidelines. That said, the stock currently trades at 1.8× forward price-to-earnings (or $9.70 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d suggest looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of AMC Networks

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.