Wyndham’s 38.8% return over the past six months has outpaced the S&P 500 by 31.5%, and its stock price has climbed to $100.79 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Wyndham, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we're swiping left on Wyndham for now. Here are three reasons why you should be careful with WH and a stock we'd rather own.

Why Is Wyndham Not Exciting?

Established in 1981, Wyndham (NYSE: WH) is a global hotel franchising company with over 9,000 hotels across nearly 95 countries on six continents.

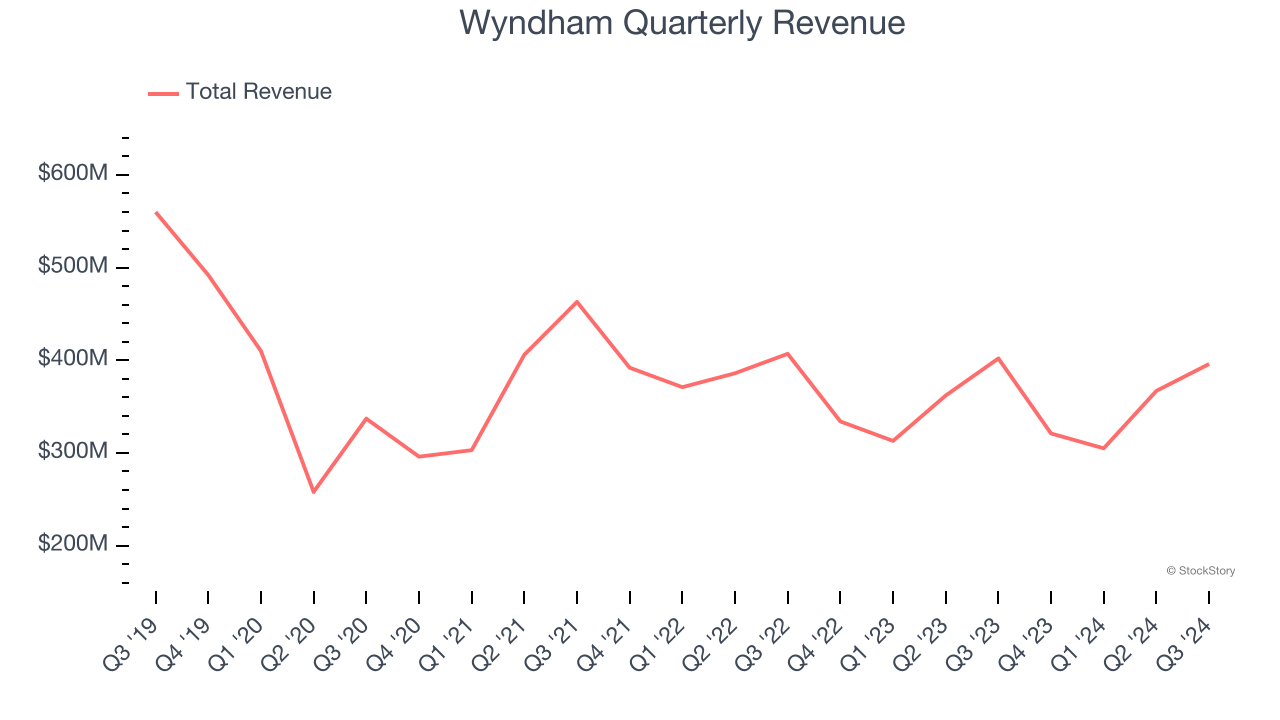

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Wyndham’s demand was weak over the last five years as its sales fell at a 7.8% annual rate. This was below our standards and signals it’s a lower quality business.

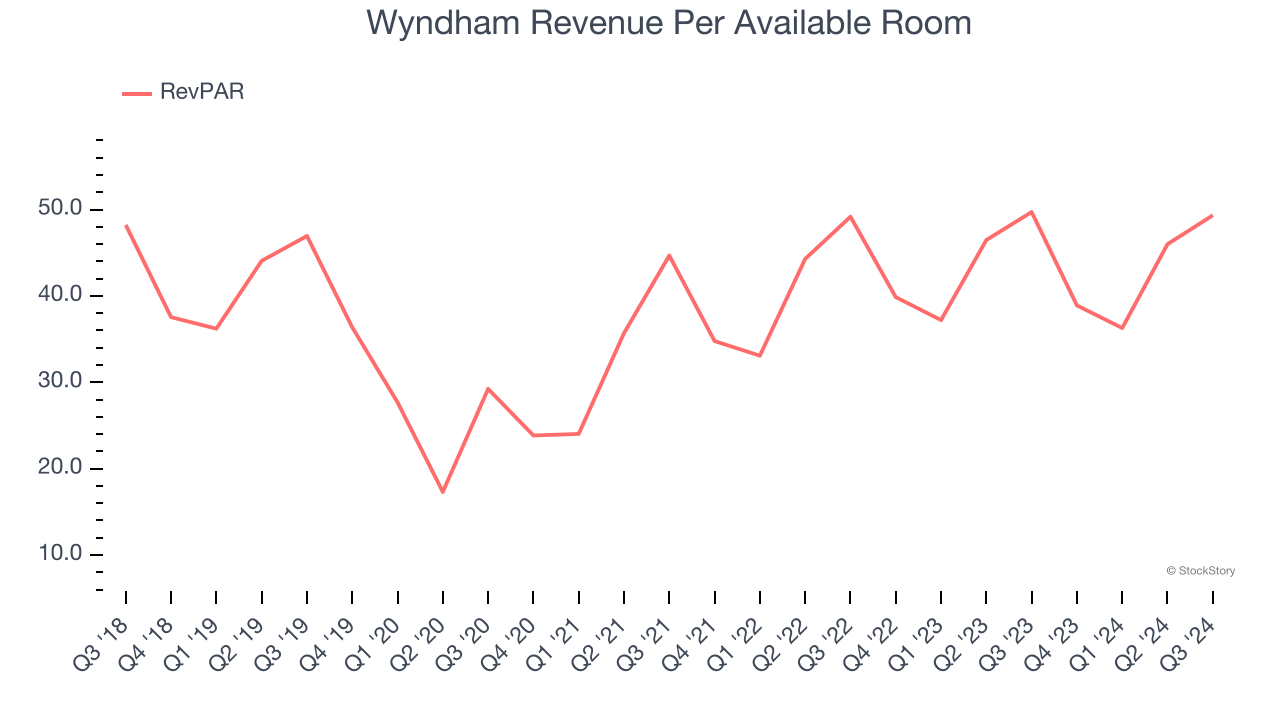

2. Weak RevPAR Growth Points to Soft Demand

In addition to reported revenue, RevPAR (revenue per available room) is a useful data point for analyzing Travel and Vacation Providers companies. This metric accounts for daily rates and occupancy levels, painting a holistic picture of Wyndham’s demand characteristics.

Wyndham’s RevPAR came in at $49.33 in the latest quarter, and over the last two years, its year-on-year growth averaged 3.3%. This performance was underwhelming and suggests it might have to invest in new amenities such as restaurants and bars to attract customers - this isn’t ideal because expansions can complicate operations and be quite expensive (i.e., renovations and increased overhead).

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Wyndham historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.7%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

Wyndham’s business quality ultimately falls short of our standards. With its shares outperforming the market lately, the stock trades at 21.8× forward price-to-earnings (or $100.79 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward Microsoft, the most dominant software business in the world.

Stocks We Like More Than Wyndham

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.