Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at F5 (NASDAQ: FFIV) and its peers.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was 0.7% above.

In light of this news, share prices of the companies have held steady as they are up 4.4% on average since the latest earnings results.

F5 (NASDAQ: FFIV)

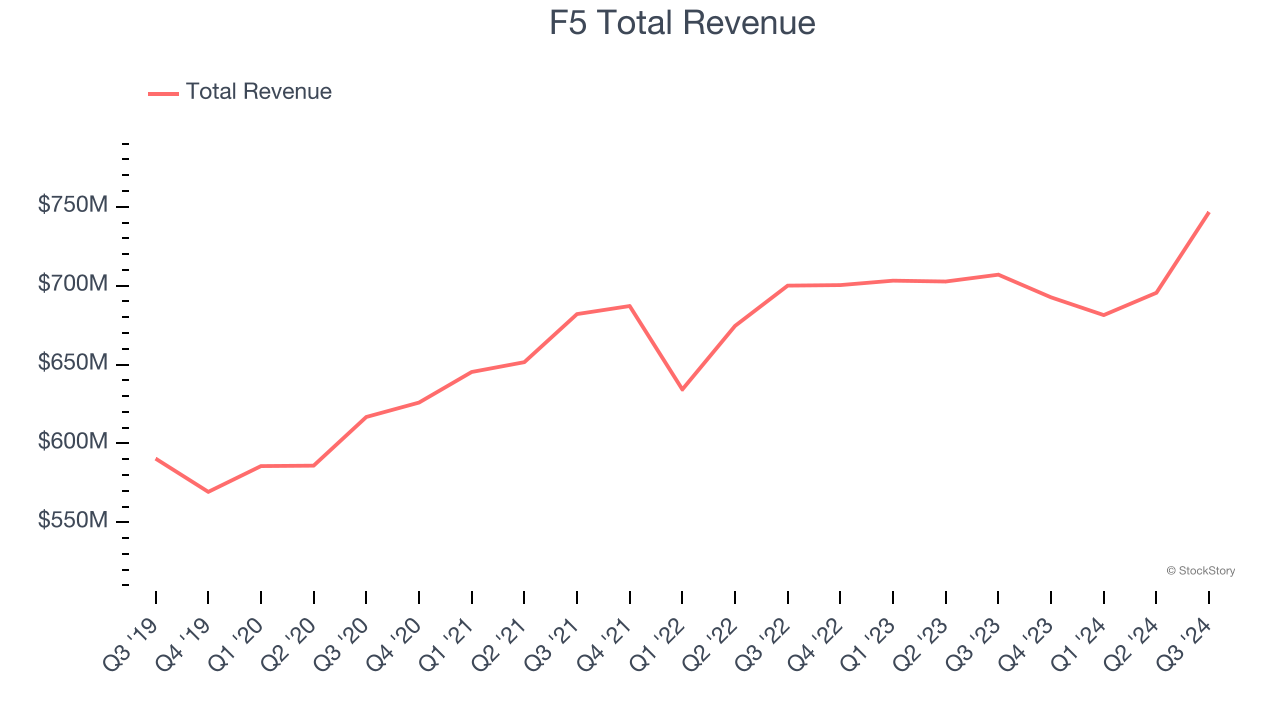

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ: FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

F5 reported revenues of $746.7 million, up 5.6% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ billings estimates and revenue guidance for next quarter slightly topping analysts’ expectations.

“Our fourth quarter revenue of $747 million reflects 6% growth year over year and includes a 19% increase in software revenue from the fourth quarter of fiscal year 2023,” said François Locoh-Donou, F5’s President and CEO.

Interestingly, the stock is up 15.6% since reporting and currently trades at $252.44.

Is now the time to buy F5? Access our full analysis of the earnings results here, it’s free.

Best Q3: JFrog (NASDAQ: FROG)

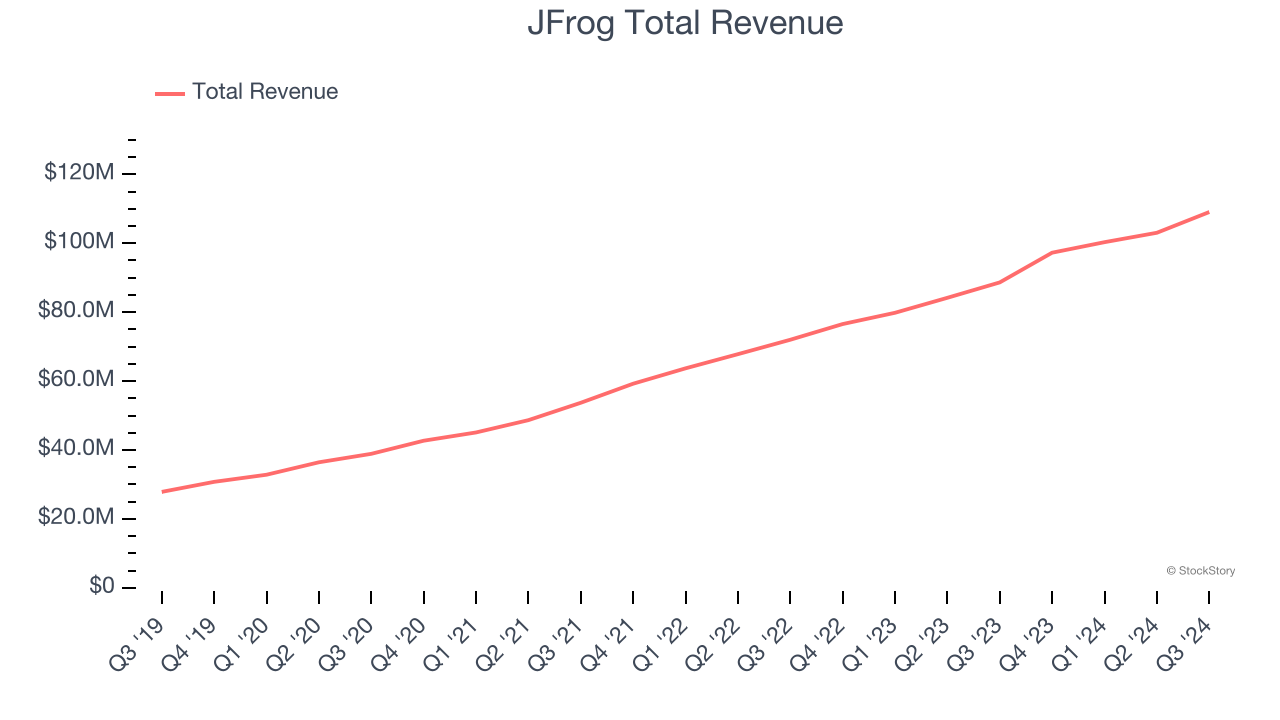

Named after the founders' affinity for frogs, JFrog (NASDAQ: FROG) provides a software-as-a-service platform that makes developing and releasing software easier and faster, especially for large teams.

JFrog reported revenues of $109.1 million, up 23% year on year, outperforming analysts’ expectations by 3.3%. The business had a very strong quarter with an impressive beat of analysts’ billings estimates and accelerating growth in large customers.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 6.6% since reporting. It currently trades at $30.70.

Is now the time to buy JFrog? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Akamai (NASDAQ: AKAM)

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ: AKAM) provides software for organizations to efficiently deliver web content to their customers.

Akamai reported revenues of $1.00 billion, up 4.1% year on year, exceeding analysts’ expectations by 0.5%. Still, it was a slower quarter as it posted revenue guidance for the next quarter below analysts’ expectations.

Akamai delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 8.6% since the results and currently trades at $95.42.

Read our full analysis of Akamai’s results here.

PagerDuty (NYSE: PD)

Started by three former Amazon engineers, PagerDuty (NYSE: PD) is a software-as-a-service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

PagerDuty reported revenues of $118.9 million, up 9.4% year on year. This print beat analysts’ expectations by 2.2%. Aside from that, it was a satisfactory quarter as it also recorded accelerating customer growth but a miss of analysts’ billings estimates.

The company added 6 customers to reach a total of 15,050. The stock is down 14.1% since reporting and currently trades at $18.

Read our full, actionable report on PagerDuty here, it’s free.

HashiCorp (NASDAQ: HCP)

Initially created as a research project at the University of Washington, HashiCorp (NASDAQ: HCP) provides software that helps companies operate their own applications in a multi-cloud environment.

HashiCorp reported revenues of $173.4 million, up 18.7% year on year. This number surpassed analysts’ expectations by 6.1%. It was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and billings in line with analysts’ estimates.

The company added 12 enterprise customers paying more than $100,000 annually to reach a total of 946. The stock is up 1.1% since reporting and currently trades at $34.

Read our full, actionable report on HashiCorp here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.