Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Kratos (NASDAQ: KTOS) and its peers.

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

The 15 defense contractors stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 2.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.8% since the latest earnings results.

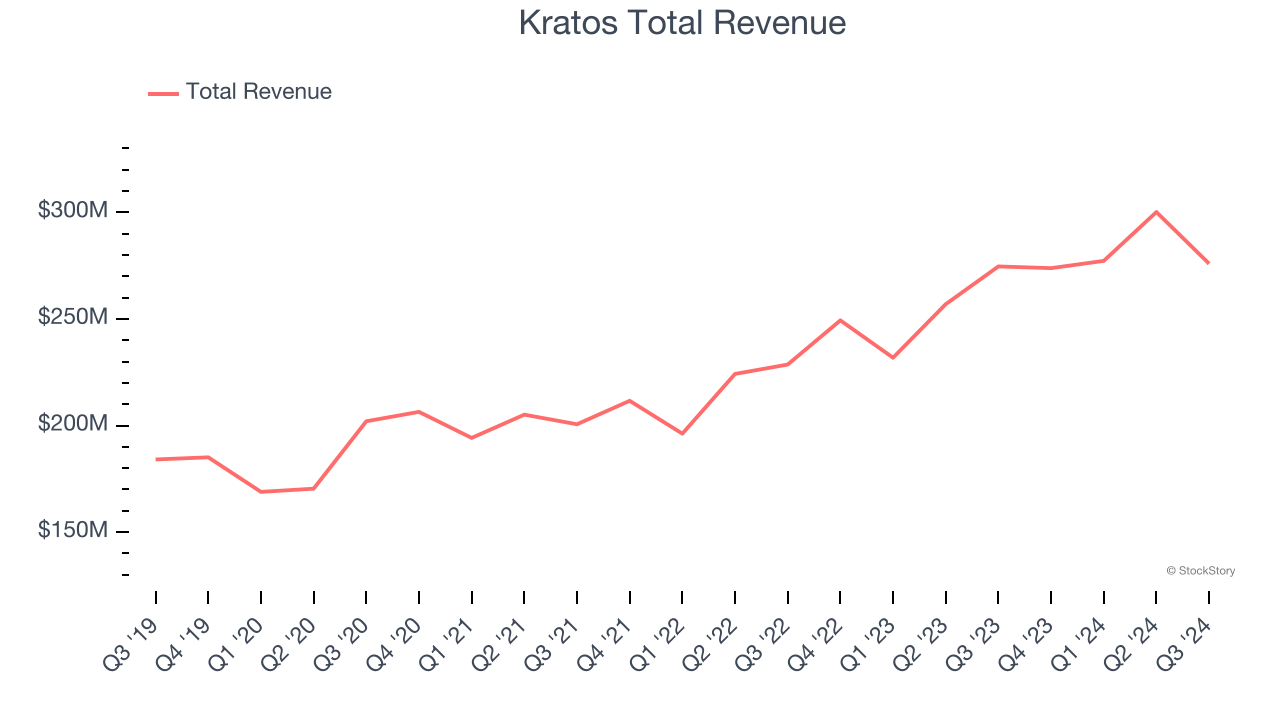

Kratos (NASDAQ: KTOS)

Established with a commitment to supporting national security, Kratos (NASDAQ: KTOS) is a provider of advanced engineering, technology, and security solutions tailored for critical national security applications.

Kratos reported revenues of $275.9 million, flat year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with an impressive beat of analysts’ EPS estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

Eric DeMarco, Kratos’ President and CEO, said, “Kratos’ strategy of making internally funded investments, to be first to market with relevant hardware, software and systems, in coordination with our partners and customers is working, as reflected in our financial results and our $12 billion opportunity pipeline. A recent representative example of this success is the successful flight of Kratos’ Zeus 1 and Zeus 2 system solid rocket motor stack with our customer’s payload, positioning Kratos for potential growth above our current future revenue year over year 10% target beginning in 2026.”

Interestingly, the stock is up 12.4% since reporting and currently trades at $26.91.

Is now the time to buy Kratos? Access our full analysis of the earnings results here, it’s free.

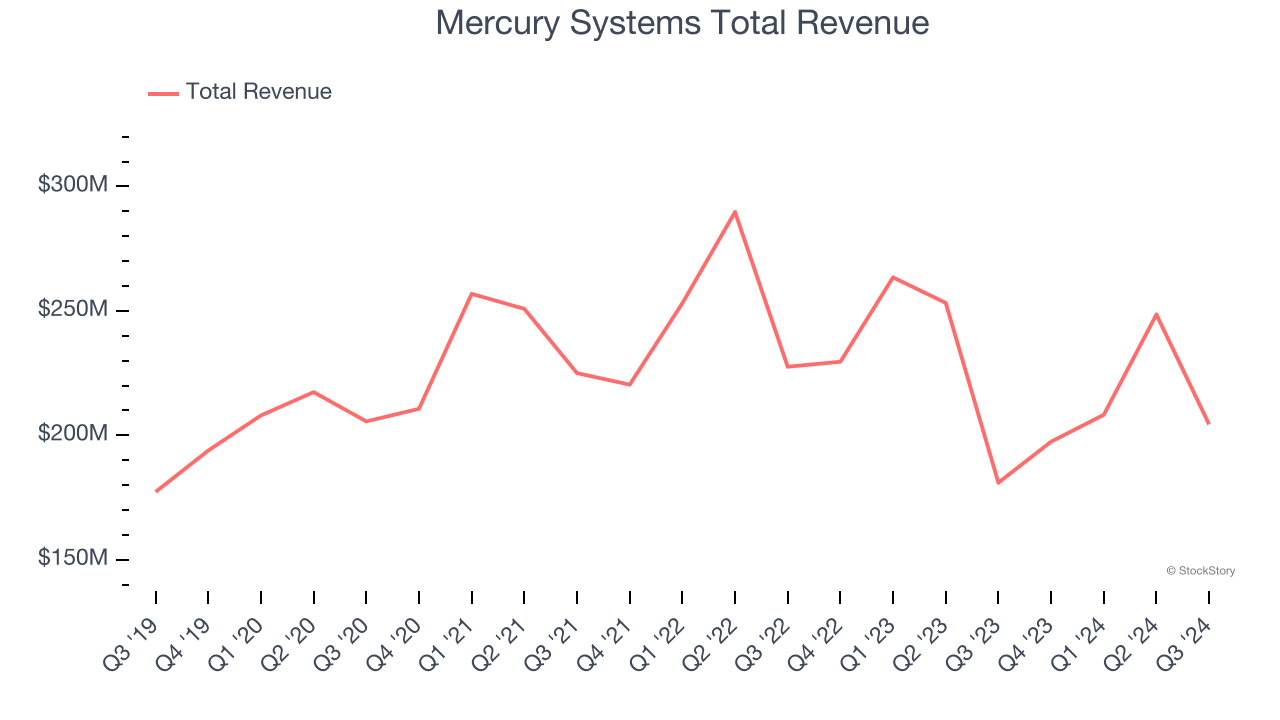

Best Q3: Mercury Systems (NASDAQ: MRCY)

Founded in 1981, Mercury Systems (NASDAQ: MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $204.4 million, up 13% year on year, outperforming analysts’ expectations by 12.5%. The business had an incredible quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.

Mercury Systems achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 23.8% since reporting. It currently trades at $42.40.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Huntington Ingalls (NYSE: HII)

Building Nimitz-class aircraft carriers used in active service, Huntington Ingalls (NYSE: HII) develops marine vessels and their mission systems and maintenance services.

Huntington Ingalls reported revenues of $2.75 billion, down 2.4% year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Huntington Ingalls delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 23.3% since the results and currently trades at $192.50.

Read our full analysis of Huntington Ingalls’s results here.

Leidos (NYSE: LDOS)

Formed through the split of IT services company SAIC, Leidos (NYSE: LDOS) offers technology and engineering solutions such as military training systems for the defense, civil, and health markets.

Leidos reported revenues of $4.19 billion, up 6.9% year on year. This result beat analysts’ expectations by 3.1%. Overall, it was a stunning quarter as it also logged an impressive beat of analysts’ backlog estimates and a solid beat of analysts’ EPS estimates.

The stock is down 14.6% since reporting and currently trades at $145.

Read our full, actionable report on Leidos here, it’s free.

CACI (NYSE: CACI)

Founded to commercialize SIMSCRIPT, CACI International (NYSE: CACI) offers defense, intelligence, and IT solutions to support national security and government transformation efforts.

CACI reported revenues of $2.06 billion, up 11.2% year on year. This print topped analysts’ expectations by 7%. It was an exceptional quarter as it also put up a solid beat of analysts’ backlog estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 20.8% since reporting and currently trades at $415.

Read our full, actionable report on CACI here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.