Vail Resorts currently trades at $178.88 per share and has shown little upside over the past six months, posting a middling return of 3.7%. This is close to the S&P 500’s 6.4% gain during that period.

Is there a buying opportunity in Vail Resorts, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're swiping left on Vail Resorts for now. Here are three reasons why we avoid MTN and a stock we'd rather own.

Why Is Vail Resorts Not Exciting?

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE: MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

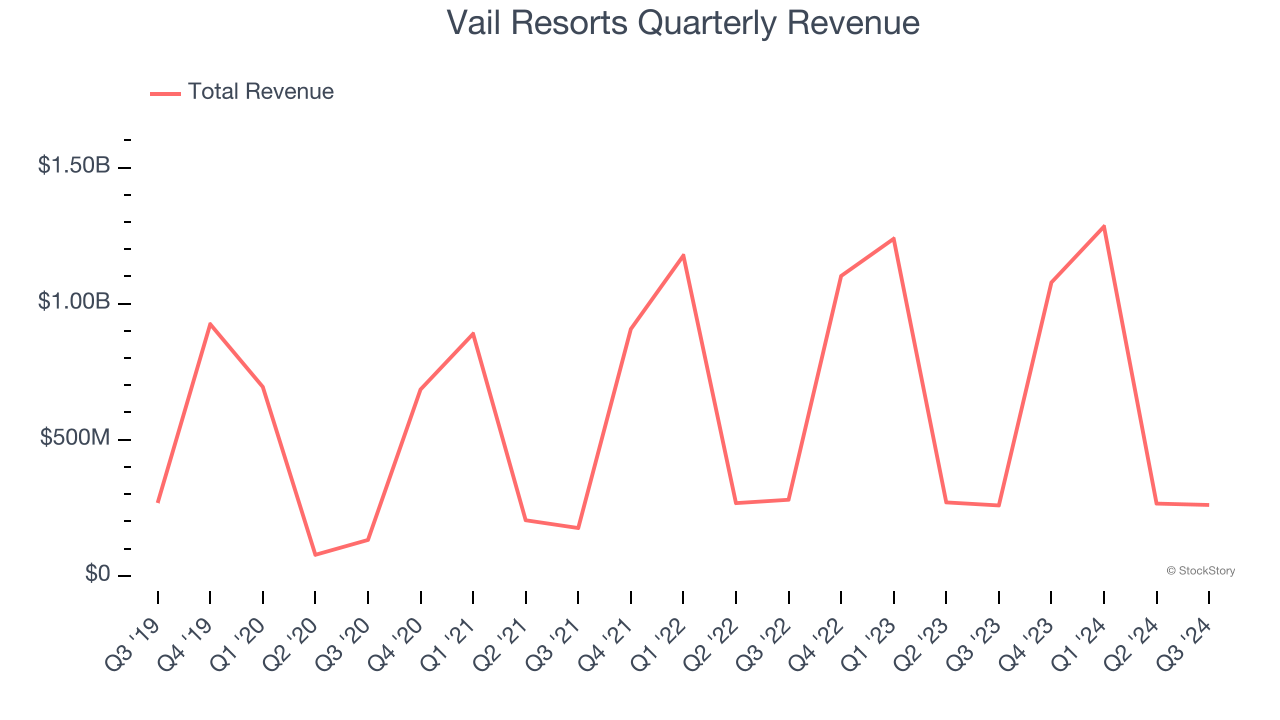

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Vail Resorts grew its sales at a sluggish 4.5% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector.

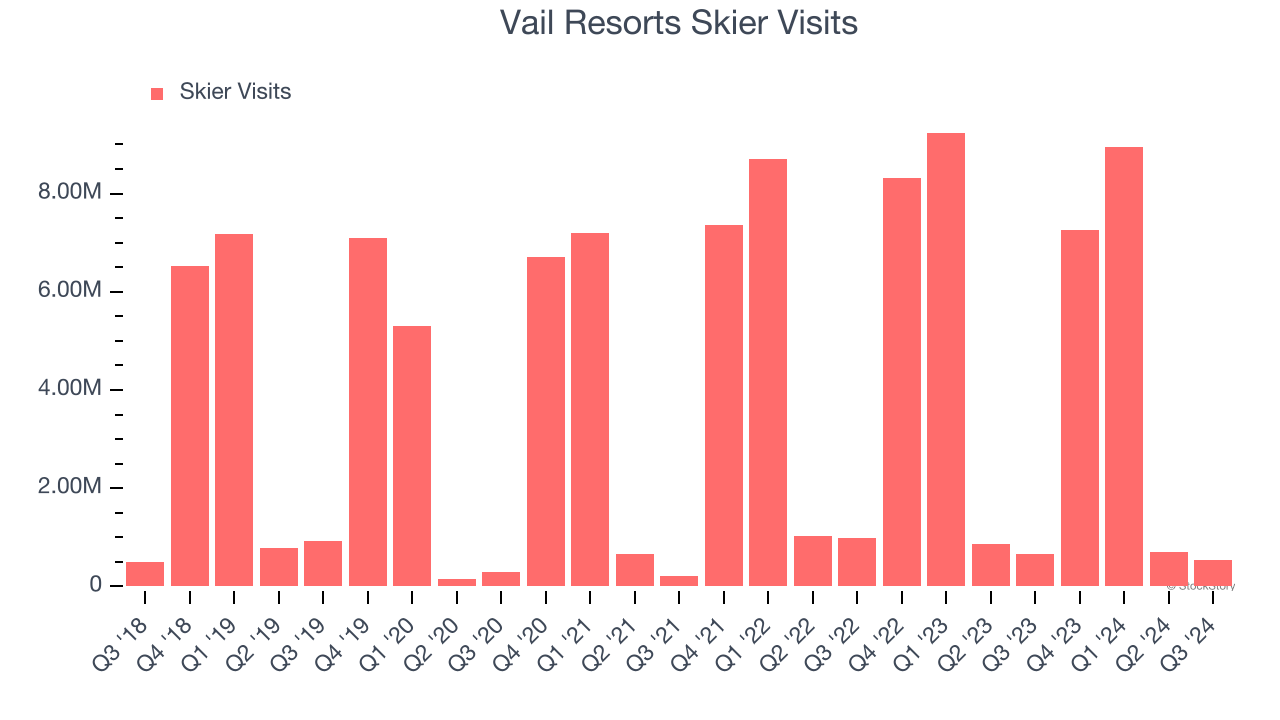

2. Decline in Skier Visits Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Vail Resorts, our preferred volume metric is skier visits). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Vail Resorts’s skier visits came in at 548,000 in the latest quarter, and over the last two years, averaged 10.2% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Vail Resorts might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

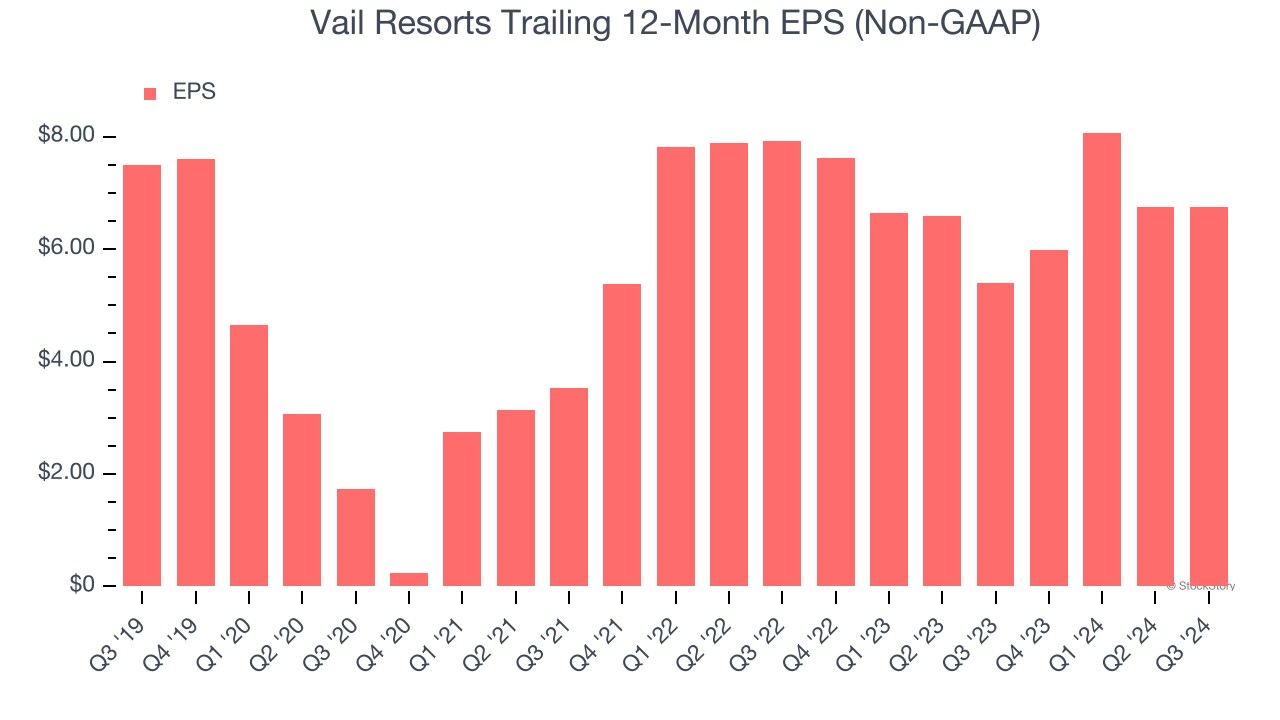

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Vail Resorts, its EPS declined by 2.1% annually over the last five years while its revenue grew by 4.5%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Vail Resorts’s business quality ultimately falls short of our standards. That said, the stock currently trades at 23.8× forward price-to-earnings (or $178.88 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at CrowdStrike, the most entrenched endpoint security platform.

Stocks We Would Buy Instead of Vail Resorts

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.