XPO’s 25.8% return over the past six months has outpaced the S&P 500 by 18%, and its stock price has climbed to $132.59 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in XPO, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re glad investors have benefited from the price increase, but we don't have much confidence in XPO. Here are three reasons why you should be careful with XPO and a stock we'd rather own.

Why Do We Think XPO Will Underperform?

Owning a mobile game simulating freight operations for the Tour de France, XPO (NYSE: XPO) is a transportation company specializing in expedited shipping services.

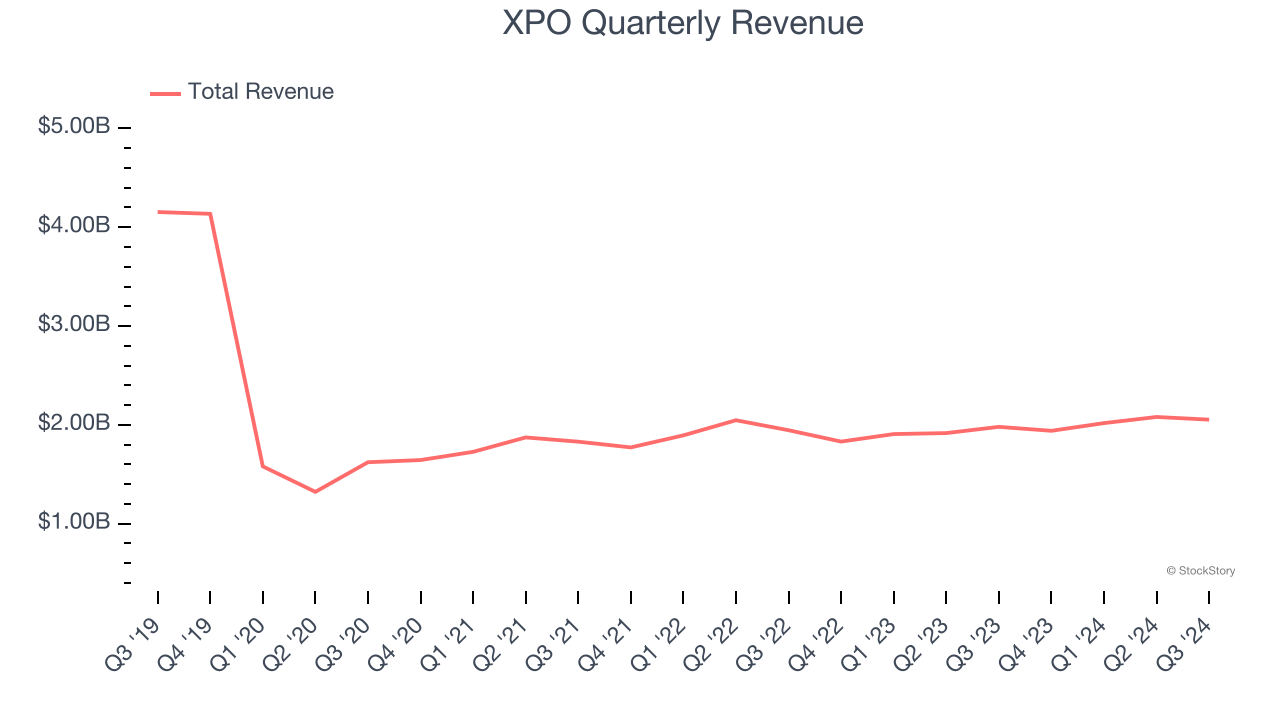

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. XPO struggled to consistently generate demand over the last five years as its sales dropped at a 13.7% annual rate. This fell short of our benchmarks and signals it’s a low quality business.

2. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

XPO has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 7.1% gross margin over the last five years. That means XPO paid its suppliers a lot of money ($92.92 for every $100 in revenue) to run its business.

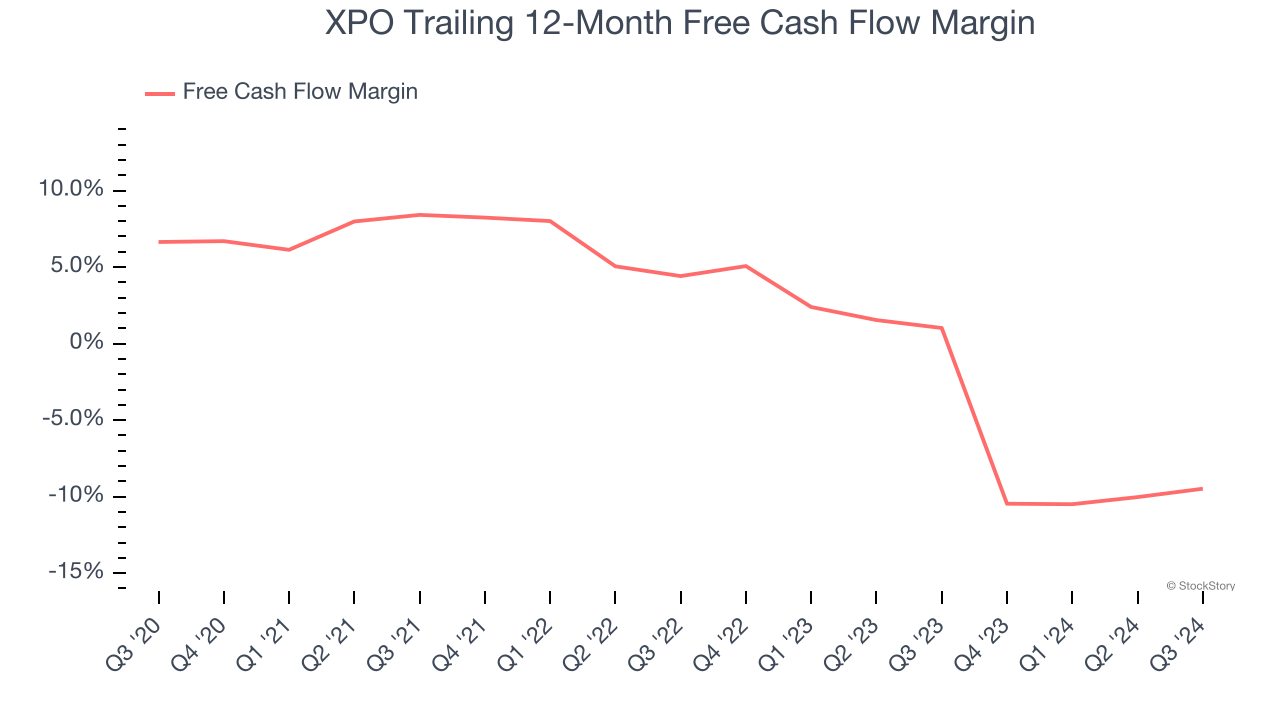

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, XPO’s margin dropped by 16.1 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. XPO’s free cash flow margin for the trailing 12 months was negative 9.5%.

Final Judgment

We see the value of companies helping their customers, but in the case of XPO, we’re out. With its shares topping the market in recent months, the stock trades at 32.4× forward price-to-earnings (or $132.59 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than XPO

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.