What a fantastic six months it’s been for Primoris. Shares of the company have skyrocketed 61.3%, hitting $76.80. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy PRIM? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Primoris Spark Debate?

Listed on the NASDAQ in 2008, Primoris (NYSE: PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Primoris’s 14% annualized revenue growth over the last five years was exceptional. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

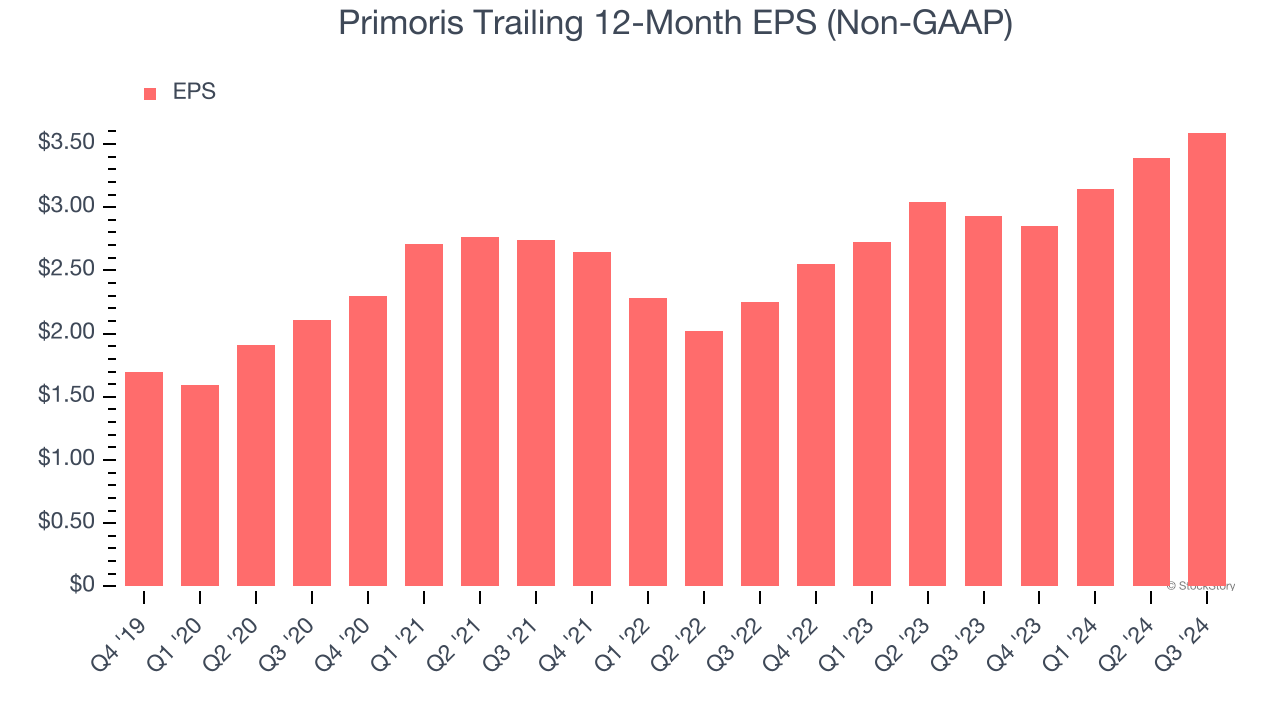

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Primoris’s EPS grew at an astounding 18.9% compounded annual growth rate over the last five years, higher than its 14% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

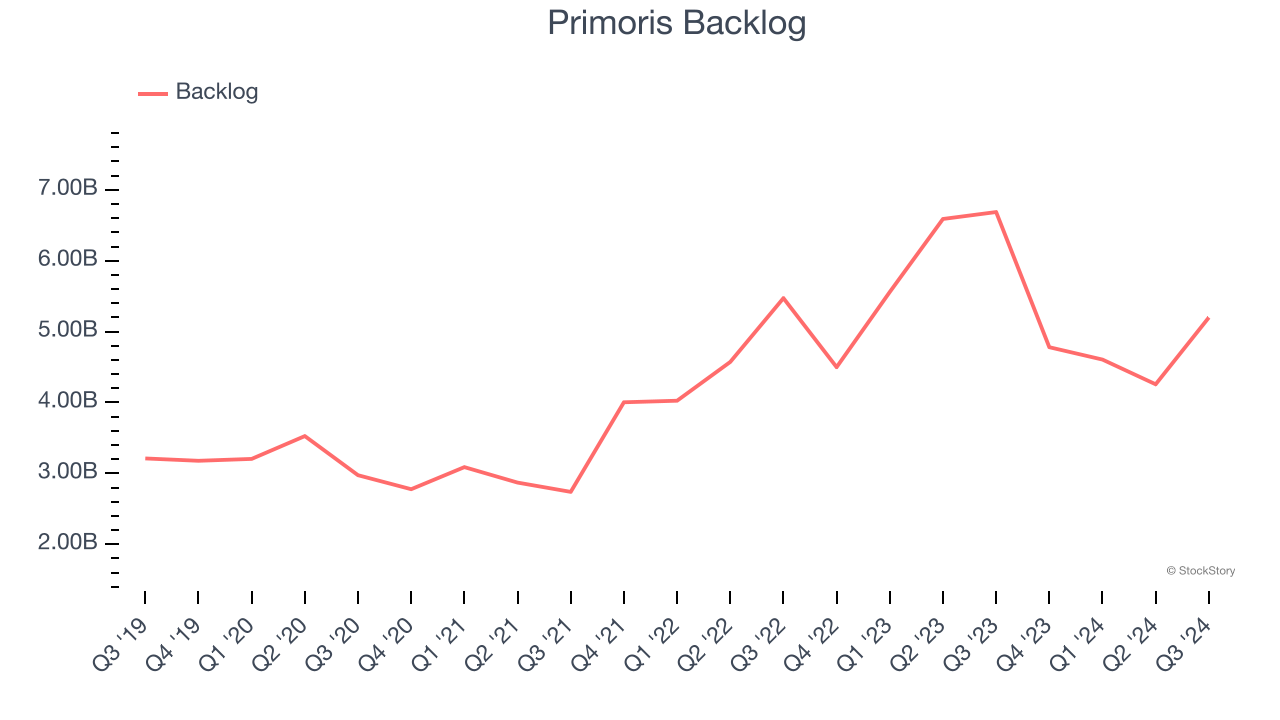

Weak Backlog Growth Points to Soft Demand

In addition to reported revenue, backlog is a useful data point for analyzing Construction and Maintenance Services companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Primoris’s future revenue streams.

Primoris’s backlog came in at $5.20 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 6%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in winning new orders.

Final Judgment

Primoris’s positive characteristics outweigh the negatives, and after the recent surge, the stock trades at 21× forward price-to-earnings (or $76.80 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Primoris

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.