Disney’s 12.9% return over the past six months has outpaced the S&P 500 by 5.1%, and its stock price has climbed to $110.71 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Disney, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Despite the momentum, we're sitting this one out for now. Here are three reasons why we avoid DIS and a stock we'd rather own.

Why Do We Think Disney Will Underperform?

Founded by brothers Walt and Roy, Disney (NYSE: DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

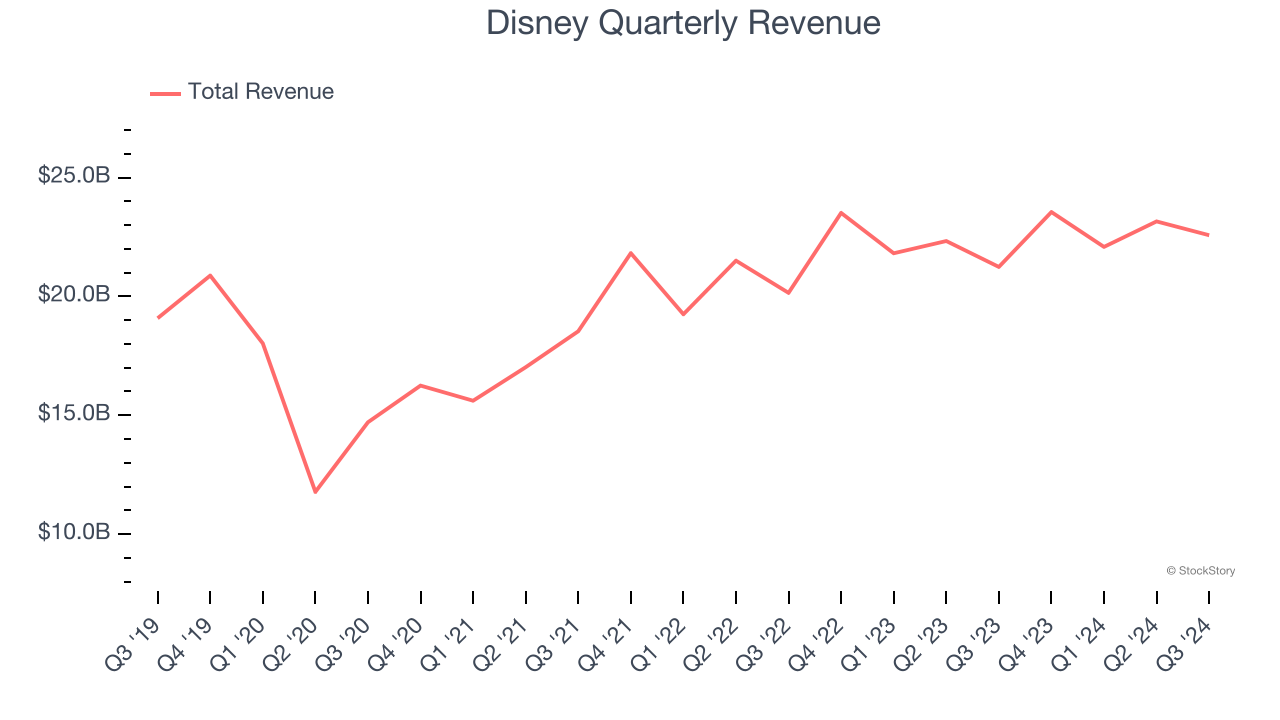

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Disney’s sales grew at a sluggish 5.6% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector.

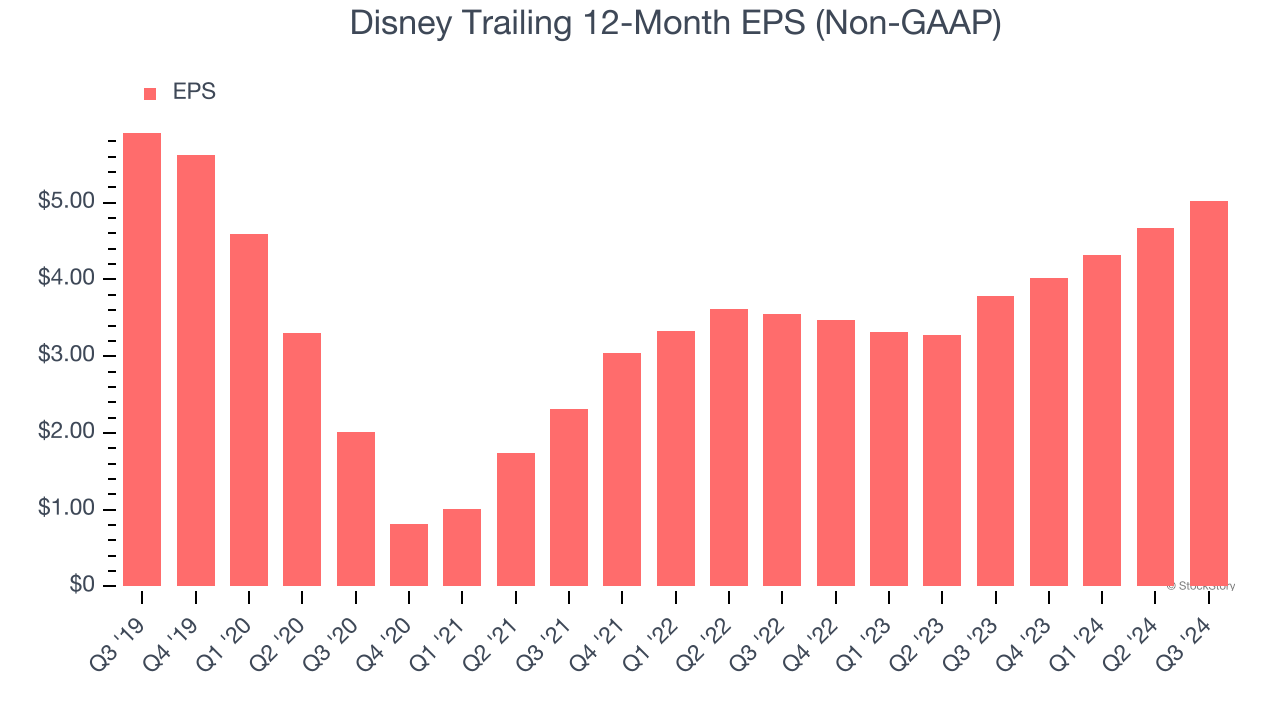

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Disney, its EPS declined by 3.2% annually over the last five years while its revenue grew by 5.6%. This tells us the company became less profitable on a per-share basis as it expanded.

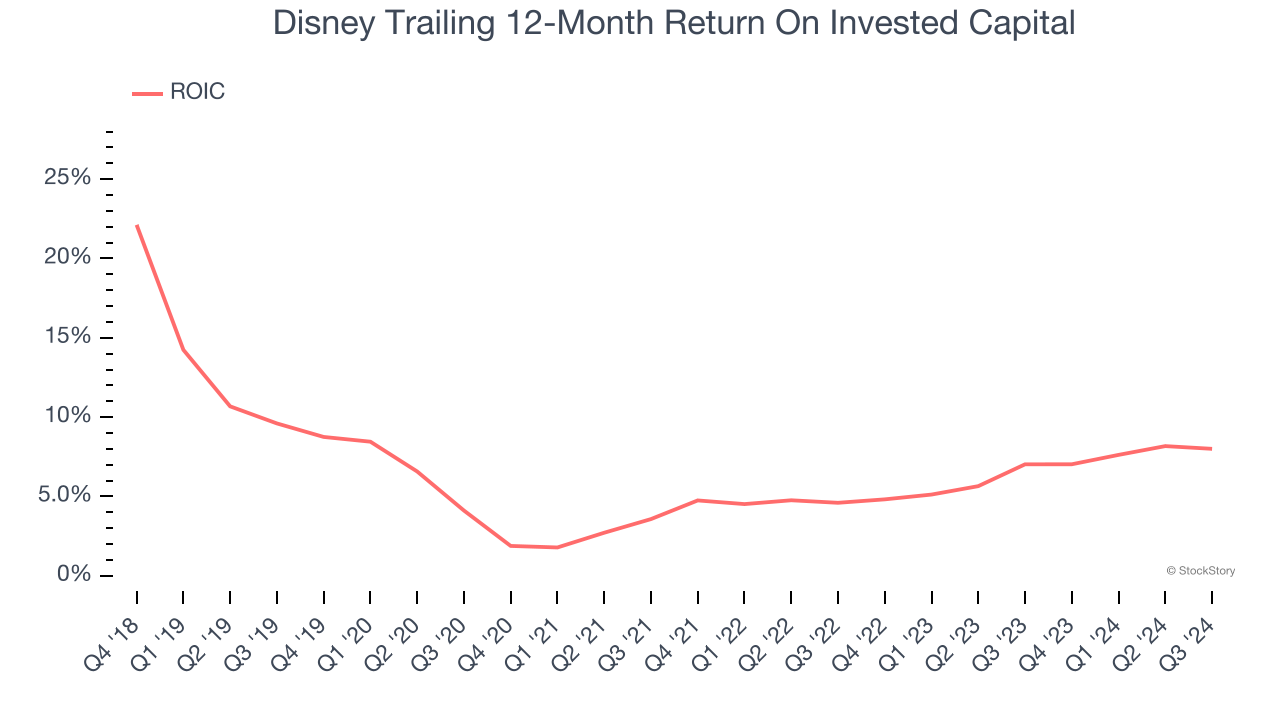

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Disney historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.5%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

We see the value of companies helping consumers, but in the case of Disney, we’re out. With its shares beating the market recently, the stock trades at 21.6× forward price-to-earnings (or $110.71 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d suggest looking at CrowdStrike, the most entrenched endpoint security platform.

Stocks We Like More Than Disney

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.