Knight-Swift Transportation has been treading water for the past six months, recording a small return of 4.8% while holding steady at $52.57. This is close to the S&P 500’s 7.8% gain during that period.

Is there a buying opportunity in Knight-Swift Transportation, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're sitting this one out for now. Here are three reasons why there are better opportunities than KNX and a stock we'd rather own.

Why Do We Think Knight-Swift Transportation Will Underperform?

Covering 1.6 billion loaded miles in 2023 alone, Knight-Swift Transportation (NYSE: KNX) offers less-than-truckload and full truckload delivery services.

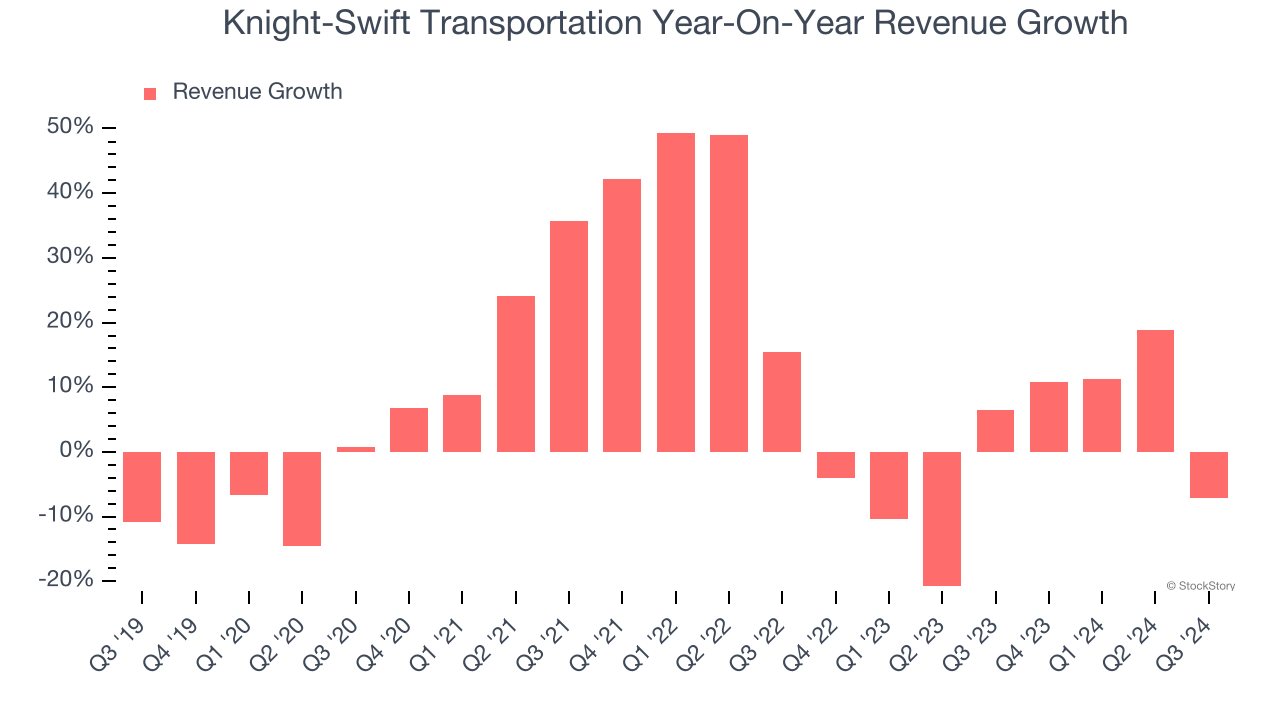

1. Revenue Growth Flatlining

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Knight-Swift Transportation’s recent history shows its demand slowed as its revenue was flat over the last two years. We also note many other Ground Transportation businesses have faced declining sales because of cyclical headwinds. While Knight-Swift Transportation’s growth wasn’t the best, it did perform better than its peers.

2. EPS Trending Down

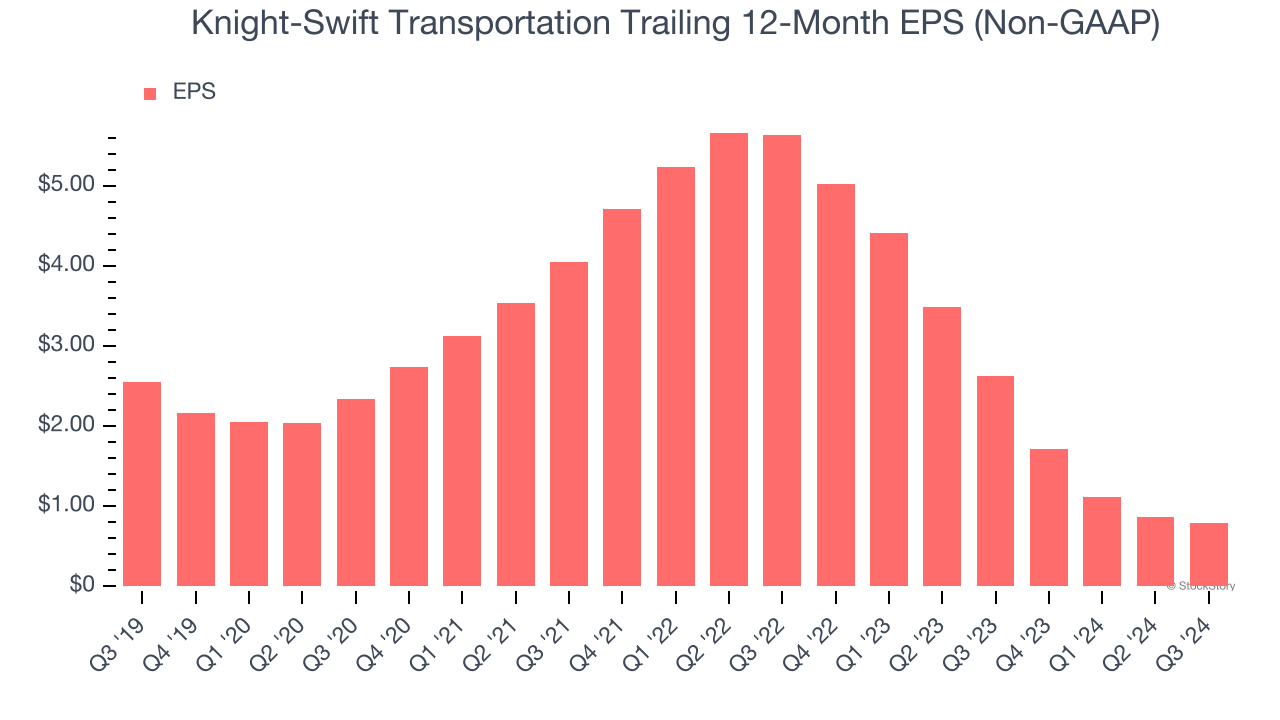

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Knight-Swift Transportation, its EPS declined by 20.9% annually over the last five years while its revenue grew by 8.2%. This tells us the company became less profitable on a per-share basis as it expanded.

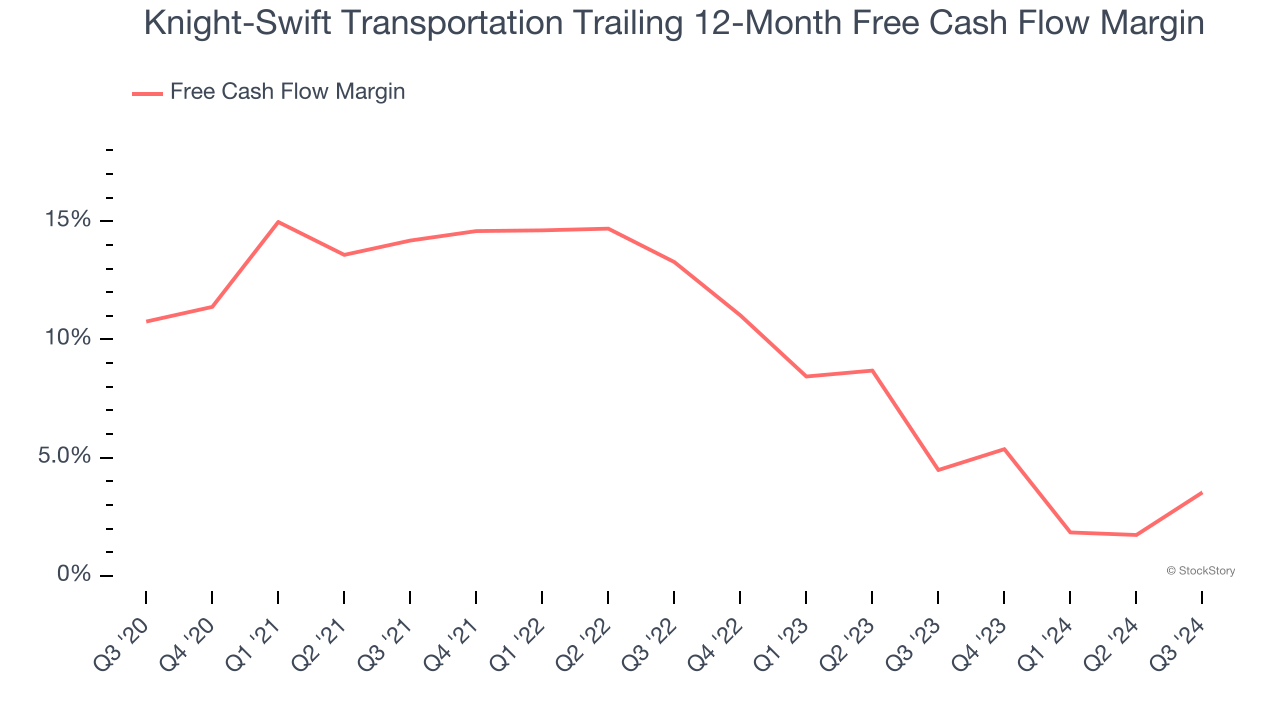

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Knight-Swift Transportation’s margin dropped by 7.2 percentage points over the last five years. Continued declines could signal it is in the middle of an investment cycle. Knight-Swift Transportation’s free cash flow margin for the trailing 12 months was 3.5%.

Final Judgment

Knight-Swift Transportation falls short of our quality standards. That said, the stock currently trades at 27× forward price-to-earnings (or $52.57 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d recommend looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of Knight-Swift Transportation

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.