As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at home builders stocks, starting with KB Home (NYSE: KBH).

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

The 12 home builders stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 14.9% since the latest earnings results.

KB Home (NYSE: KBH)

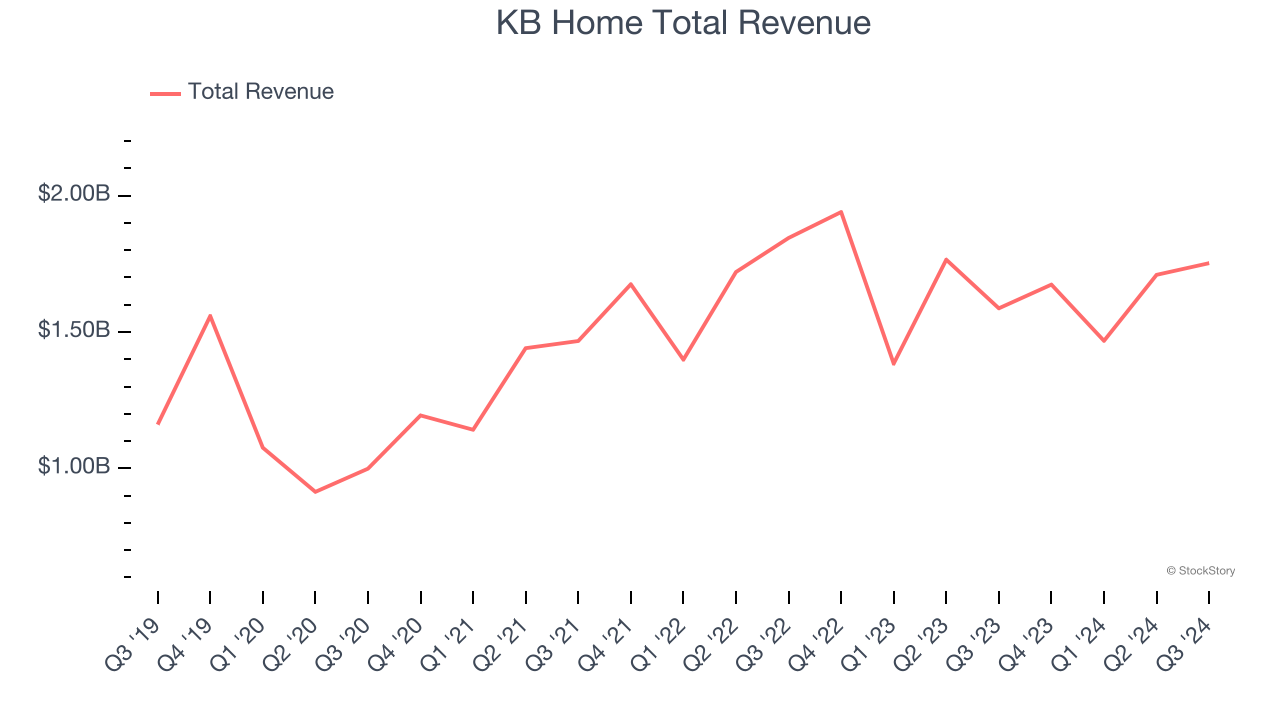

The first homebuilder to be listed on the NYSE, KB Home (NYSE: KB) is a homebuilding company targeting the first-time home buyer and move-up buyer markets.

KB Home reported revenues of $1.75 billion, up 10.4% year on year. This print exceeded analysts’ expectations by 1.4%. Despite the top-line beat, it was still a softer quarter for the company with full-year revenue guidance missing analysts’ expectations and a significant miss of analysts’ EBITDA estimates.

“In the third quarter, we achieved strong year-over-year growth in both revenues and diluted earnings per share,” said Jeffrey Mezger, Chairman and Chief Executive Officer.

KB Home delivered the weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 25% since reporting and currently trades at $65.58.

Read our full report on KB Home here, it’s free.

Best Q3: Skyline Champion (NYSE: SKY)

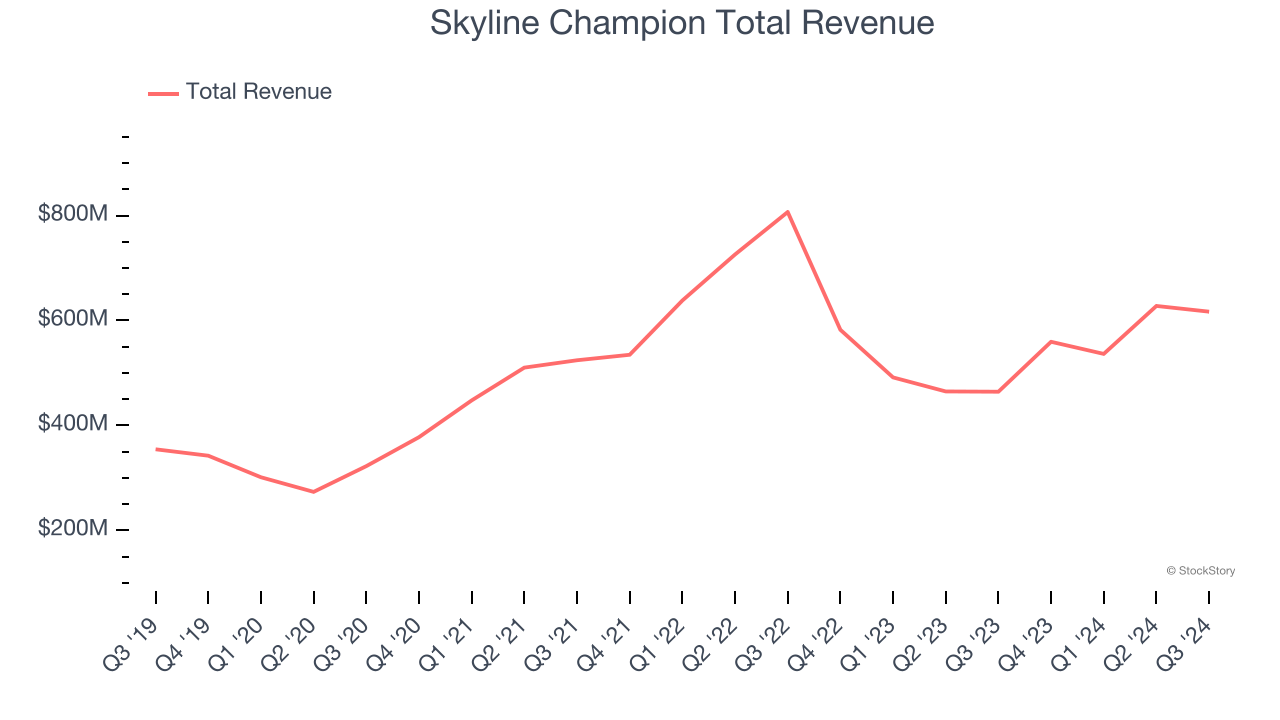

Founded in 1951, Skyline Champion (NYSE: SKY) is a manufacturer of modular homes and buildings in North America.

Skyline Champion reported revenues of $616.9 million, up 32.9% year on year, in line with analysts’ expectations. The business had an exceptional quarter with a solid beat of analysts’ sales volume estimates and an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3.1% since reporting. It currently trades at $88.12.

Is now the time to buy Skyline Champion? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: D.R. Horton (NYSE: DHI)

One of the largest homebuilding companies in the U.S., D.R. Horton (NYSE: DHI) builds a variety of new construction homes across multiple markets.

D.R. Horton reported revenues of $10 billion, down 4.8% year on year, falling short of analysts’ expectations by 1.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

D.R. Horton delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 22.9% since the results and currently trades at $139.15.

Read our full analysis of D.R. Horton’s results here.

NVR (NYSE: NVR)

Known for its unique land acquisition strategy, NVR (NYSE: NVR) is a respected homebuilder and mortgage company in the United States.

NVR reported revenues of $2.73 billion, up 6.4% year on year. This result topped analysts’ expectations by 1.2%. Zooming out, it was a satisfactory quarter as it also produced an impressive beat of analysts’ backlog estimates but a significant miss of analysts’ EBITDA estimates.

The stock is down 15.2% since reporting and currently trades at $8,176.

Read our full, actionable report on NVR here, it’s free.

Taylor Morrison Home (NYSE: TMHC)

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE: TMHC) builds single family homes and communities across the United States.

Taylor Morrison Home reported revenues of $2.12 billion, up 26.6% year on year. This print beat analysts’ expectations by 7.8%. It was a very strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates.

The stock is down 5.8% since reporting and currently trades at $61.10.

Read our full, actionable report on Taylor Morrison Home here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.