Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Analog Devices (NASDAQ: ADI) and the best and worst performers in the analog semiconductors industry.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was 3.2% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10% since the latest earnings results.

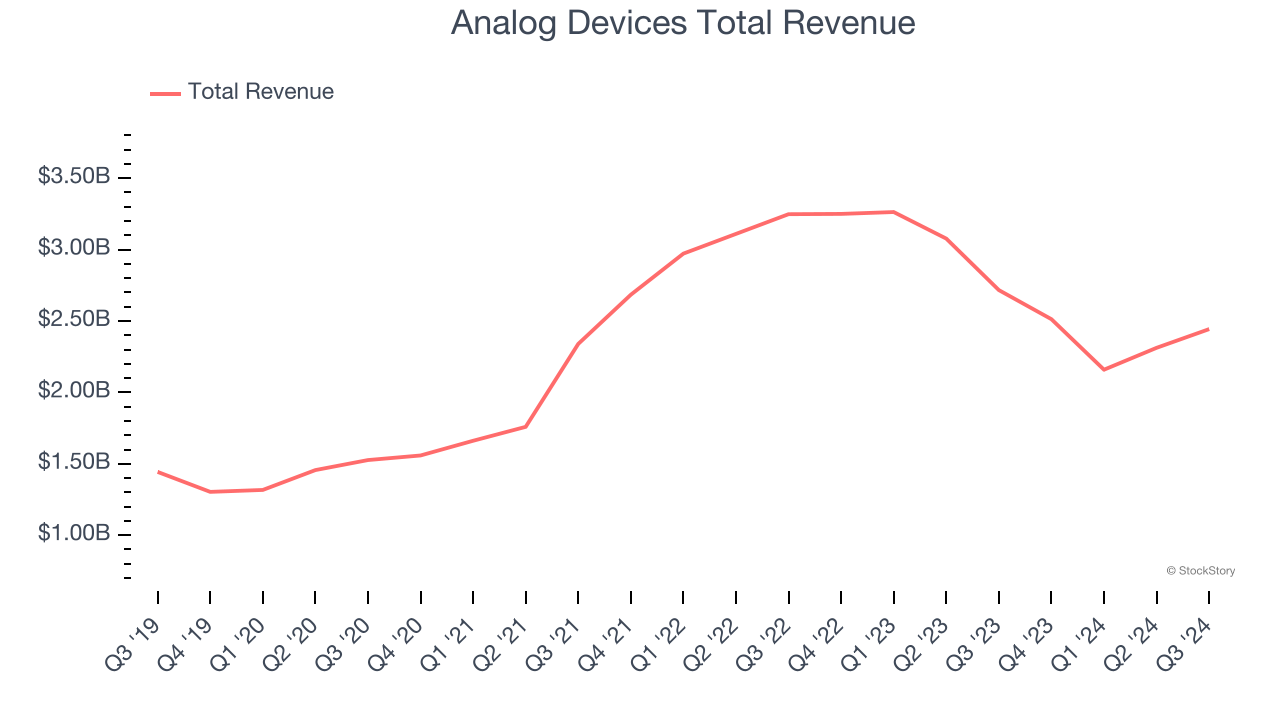

Analog Devices (NASDAQ: ADI)

Founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965, Analog Devices (NASDAQ: ADI) is one of the largest providers of high performance analog integrated circuits used mainly in industrial end markets, along with communications, autos, and consumer devices.

Analog Devices reported revenues of $2.44 billion, down 10.1% year on year. This print exceeded analysts’ expectations by 1.6%. Overall, it was a satisfactory quarter for the company with a decent beat of analysts’ EPS estimates.

"ADI's revenue, profitability, and earnings per share all finished above our guided midpoint, underscoring continued business momentum and solid execution," said Vincent Roche, CEO and Chair.

Unsurprisingly, the stock is down 4.9% since reporting and currently trades at $212.75.

Is now the time to buy Analog Devices? Access our full analysis of the earnings results here, it’s free.

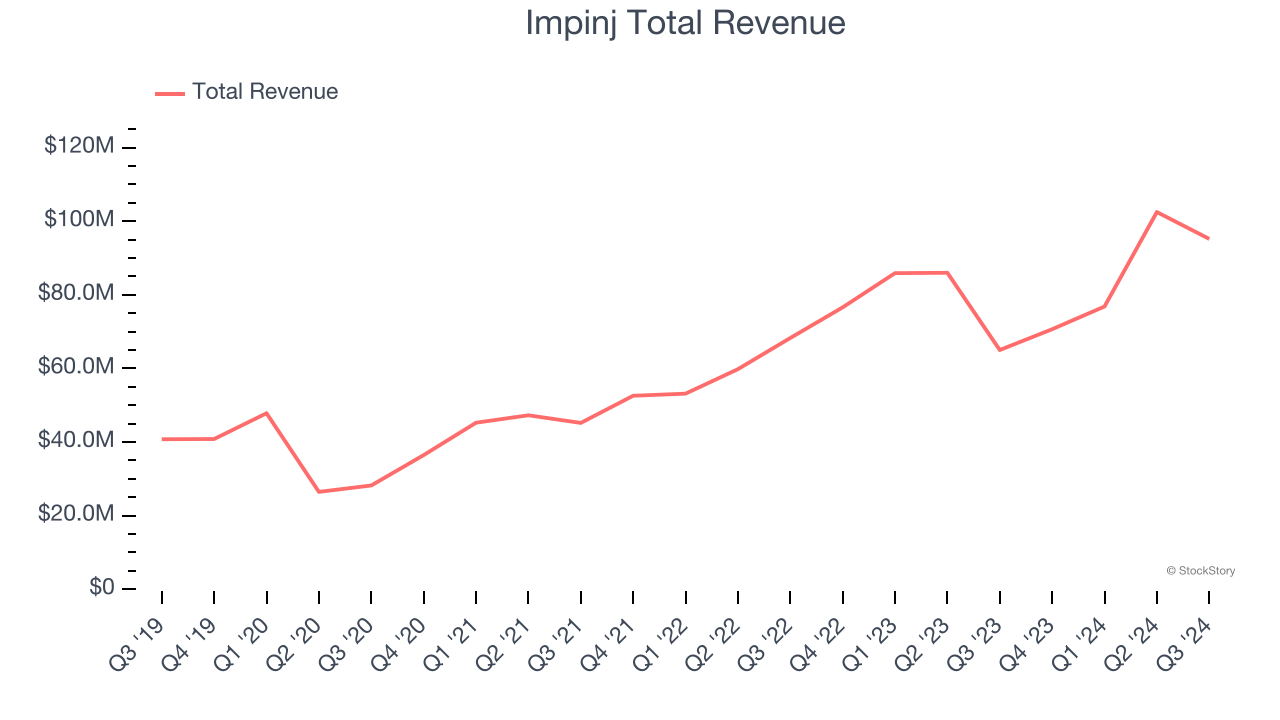

Best Q3: Impinj (NASDAQ: PI)

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ: PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $95.2 million, up 46.4% year on year, outperforming analysts’ expectations by 2.5%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Impinj pulled off the fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 34% since reporting. It currently trades at $145.99.

Is now the time to buy Impinj? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Vishay Intertechnology (NYSE: VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $735.4 million, down 13.9% year on year, falling short of analysts’ expectations by 1.8%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Vishay Intertechnology delivered the weakest full-year guidance update in the group. As expected, the stock is down 1.5% since the results and currently trades at $16.80.

Read our full analysis of Vishay Intertechnology’s results here.

Monolithic Power Systems (NASDAQ: MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $620.1 million, up 30.6% year on year. This result surpassed analysts’ expectations by 3.3%. It was a strong quarter as it also recorded a significant improvement in its inventory levels and a decent beat of analysts’ adjusted operating income estimates.

The stock is down 34.6% since reporting and currently trades at $601.05.

Read our full, actionable report on Monolithic Power Systems here, it’s free.

Himax (NASDAQ: HIMX)

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $222.4 million, down 6.8% year on year. This number topped analysts’ expectations by 1.1%. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ EPS estimates and an improvement in its inventory levels.

The stock is up 33.3% since reporting and currently trades at $7.94.

Read our full, actionable report on Himax here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.