Gorman-Rupp has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 5.5% to $37.86 per share while the index has gained 7.8%.

Is GRC a buy right now? Find out in our full research report, it’s free.

Why Are We Positive On GRC?

Powering fluid dynamics since 1934, Gorman-Rupp (NYSE: GRC) has evolved from its Ohio origins into a global manufacturer and seller of pumps and pump systems.

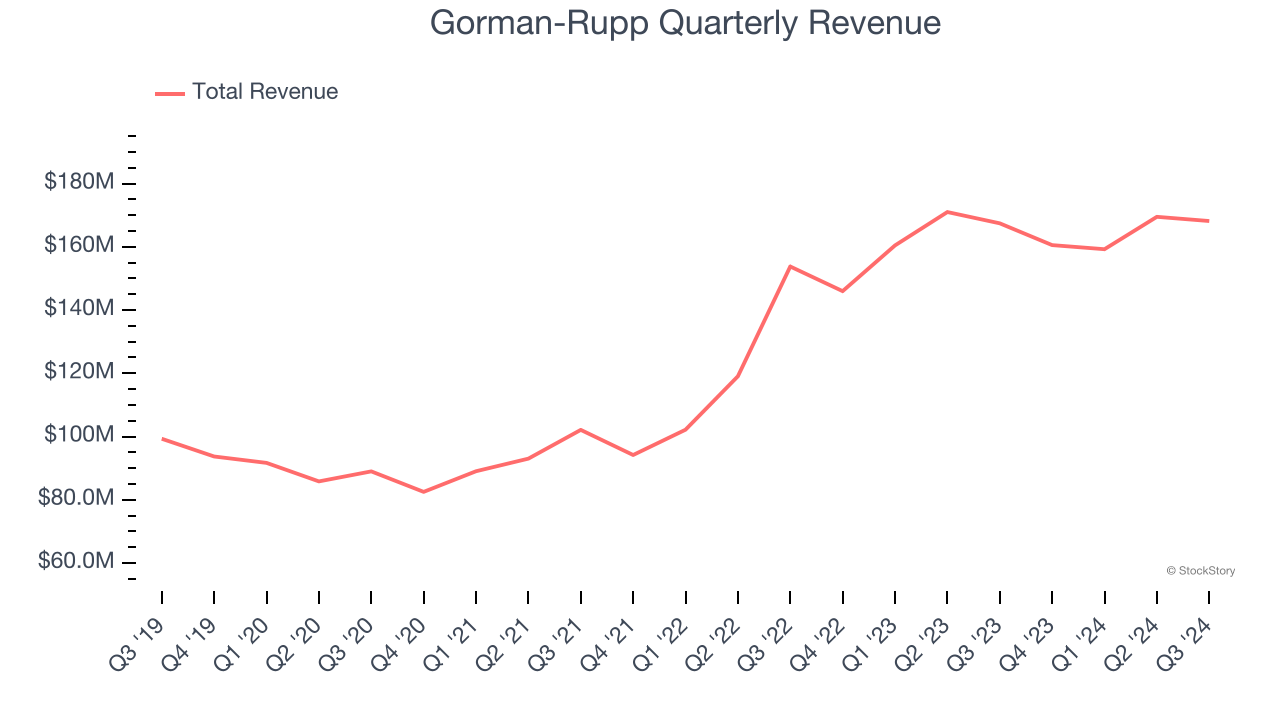

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Gorman-Rupp’s sales grew at a solid 10.3% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

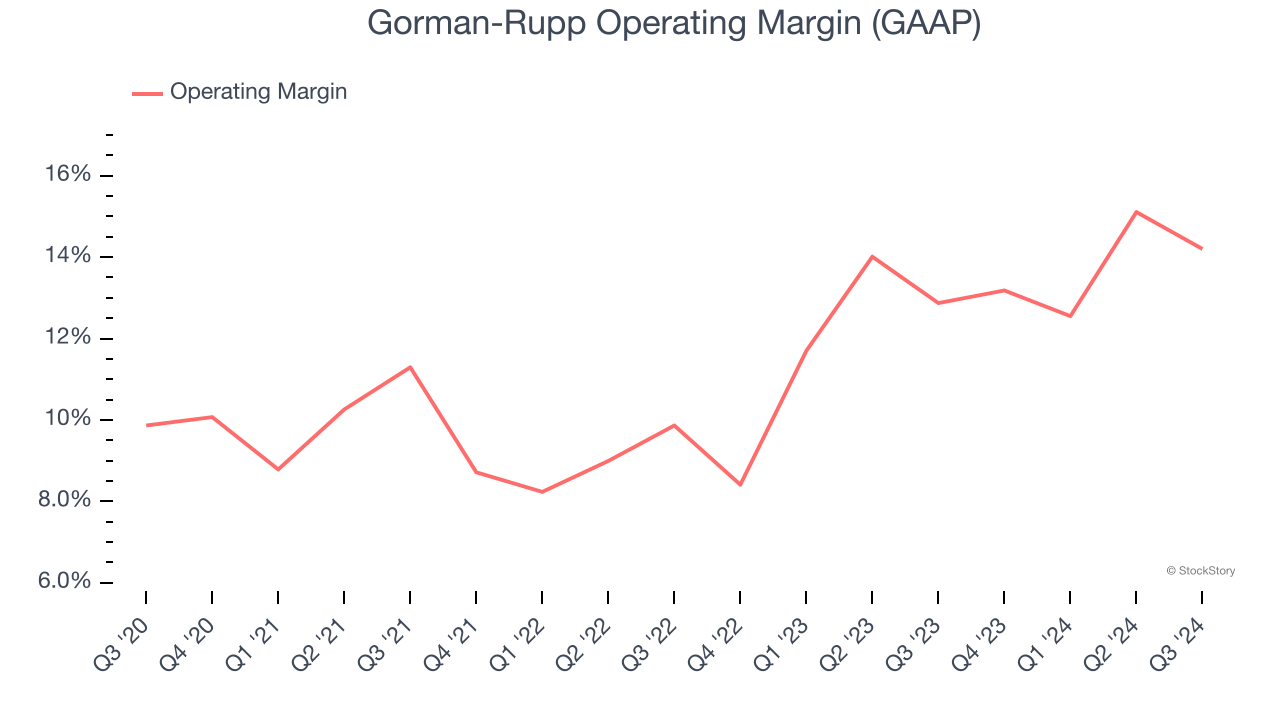

2. Operating Margin Rising, Profits Up

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Gorman-Rupp’s operating margin rose by 4.7 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 13.8%.

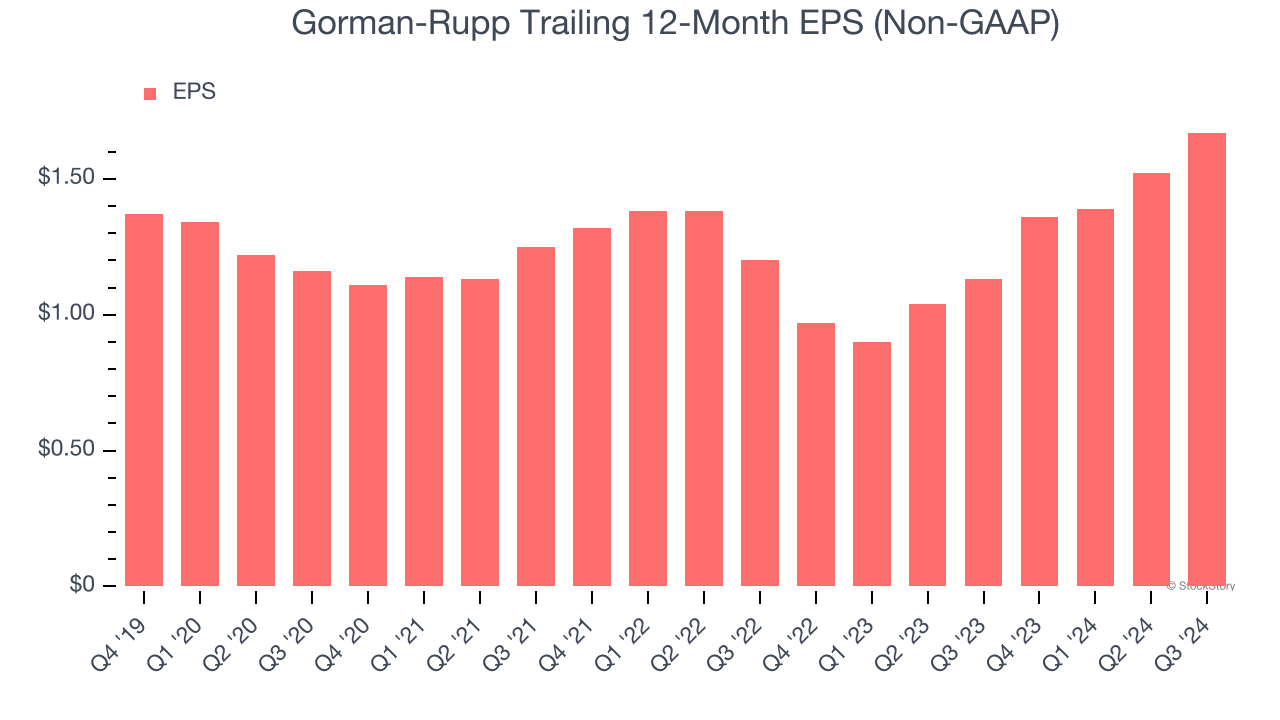

3. EPS Surges Higher Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Gorman-Rupp’s astounding 18% annual EPS growth over the last two years aligns with its revenue trend. This tells us its incremental sales were profitable.

Final Judgment

These are just a few reasons why we're bullish on Gorman-Rupp, but at $37.86 per share (or 19.4× forward price-to-earnings), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Gorman-Rupp

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.