Crocs’s stock price has taken a beating over the past six months, shedding 26.8% of its value and falling to $108.22 per share. This may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy CROX? Find out in our full research report, it’s free.

Why Does CROX Stock Spark Debate?

Founded in 2002, Crocs (NASDAQ: CROX) sells casual footwear and is known for its iconic clog shoe.

Two Things to Like:

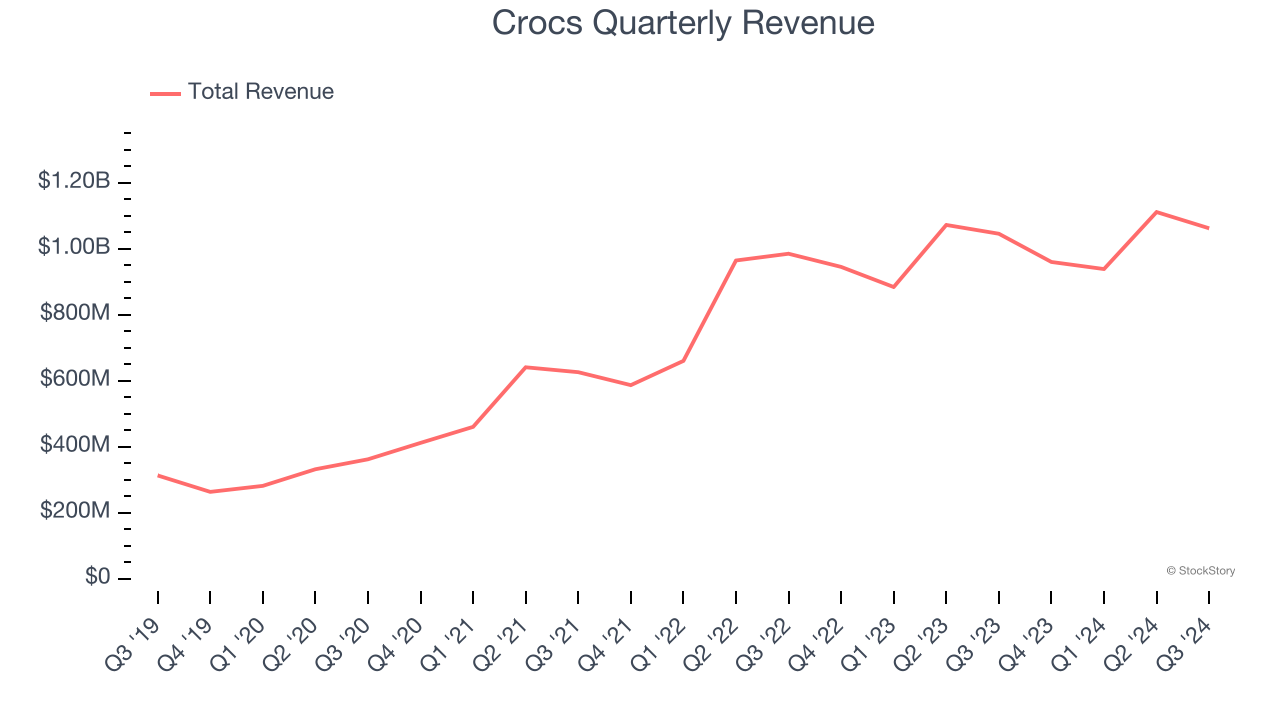

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Luckily, Crocs’s sales grew at an exceptional 28% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

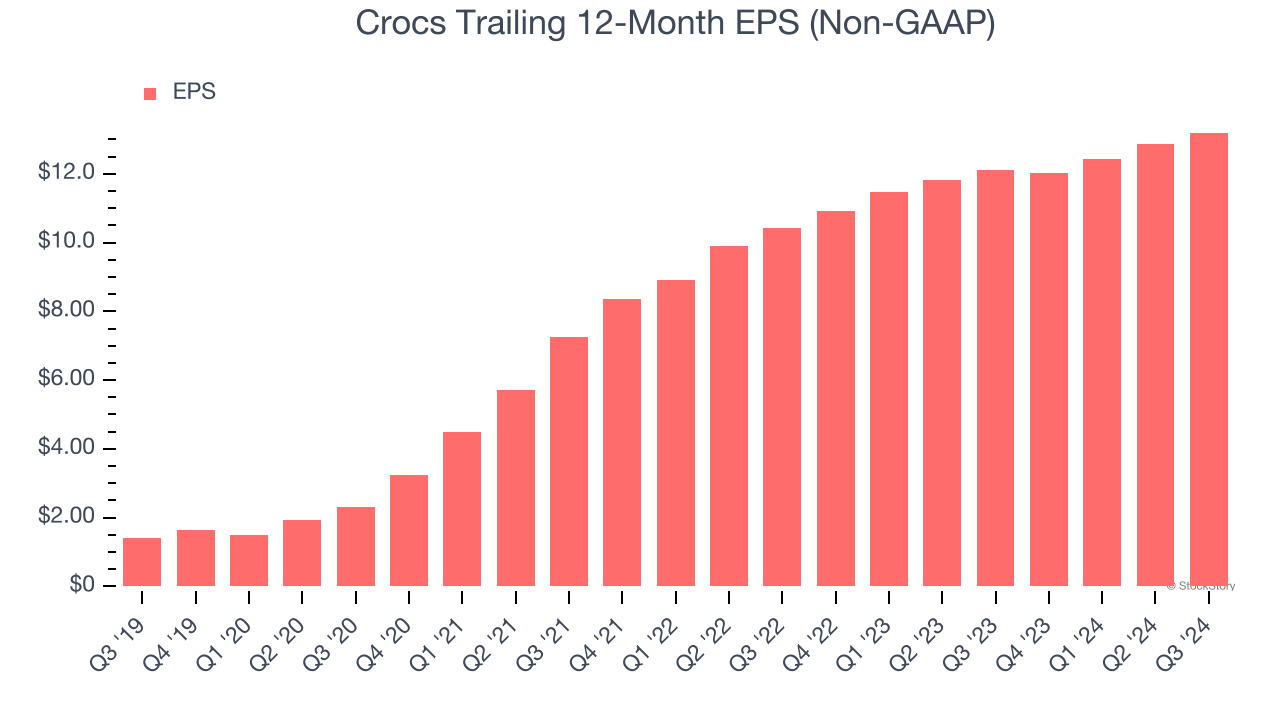

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Crocs’s EPS grew at an astounding 56.2% compounded annual growth rate over the last five years, higher than its 28% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

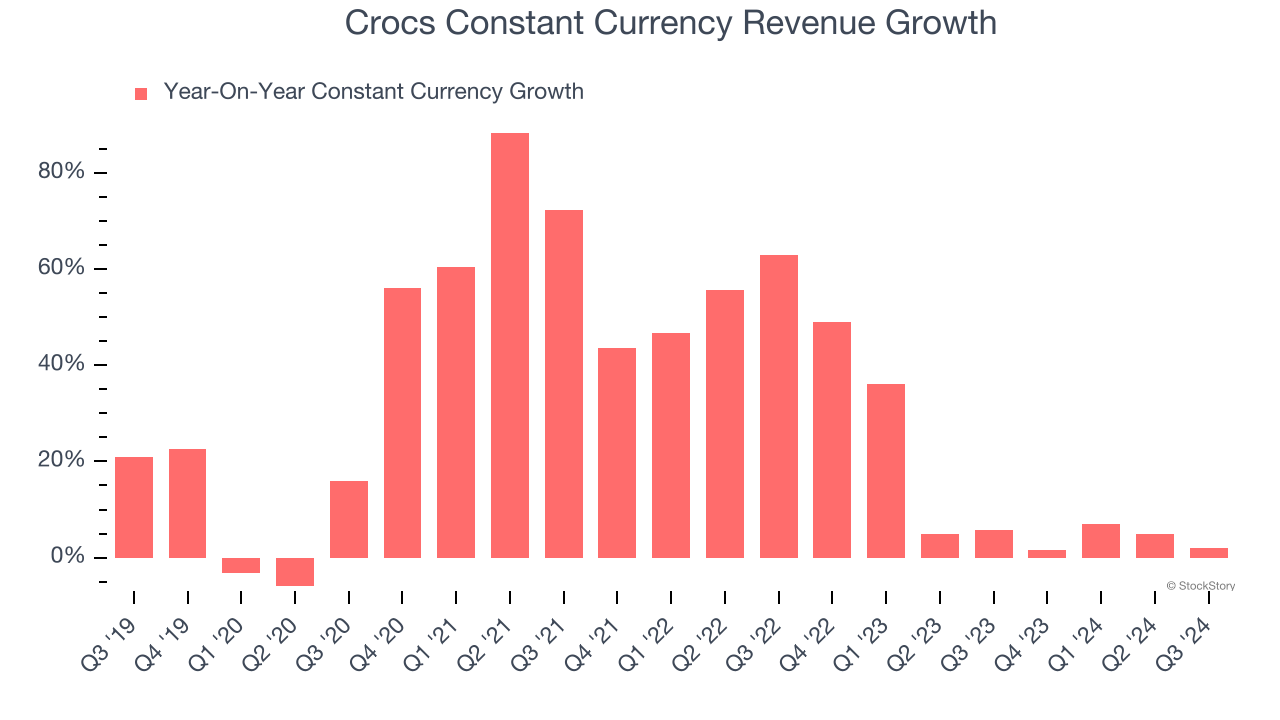

Weak Constant Currency Growth Points to Soft Demand

Investors interested in Footwear companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Crocs’s control and are not indicative of underlying demand.

Over the last two years, Crocs’s constant currency revenue averaged 13.9% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Crocs’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 7.9× forward price-to-earnings (or $108.22 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Crocs

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.