Blue Bird has gotten torched over the last six months - since June 2024, its stock price has dropped 24.1% to $38.64 per share. This may have investors wondering how to approach the situation.

Following the pullback, is now the time to buy BLBD? Find out in our full research report, it’s free.

Why Are We Positive On BLBD?

With around a century of experience, Blue Bird (NASDAQ: BLBD) is a manufacturer of school buses and complementary parts.

1. Elevated Demand Drives Higher Sales Volumes

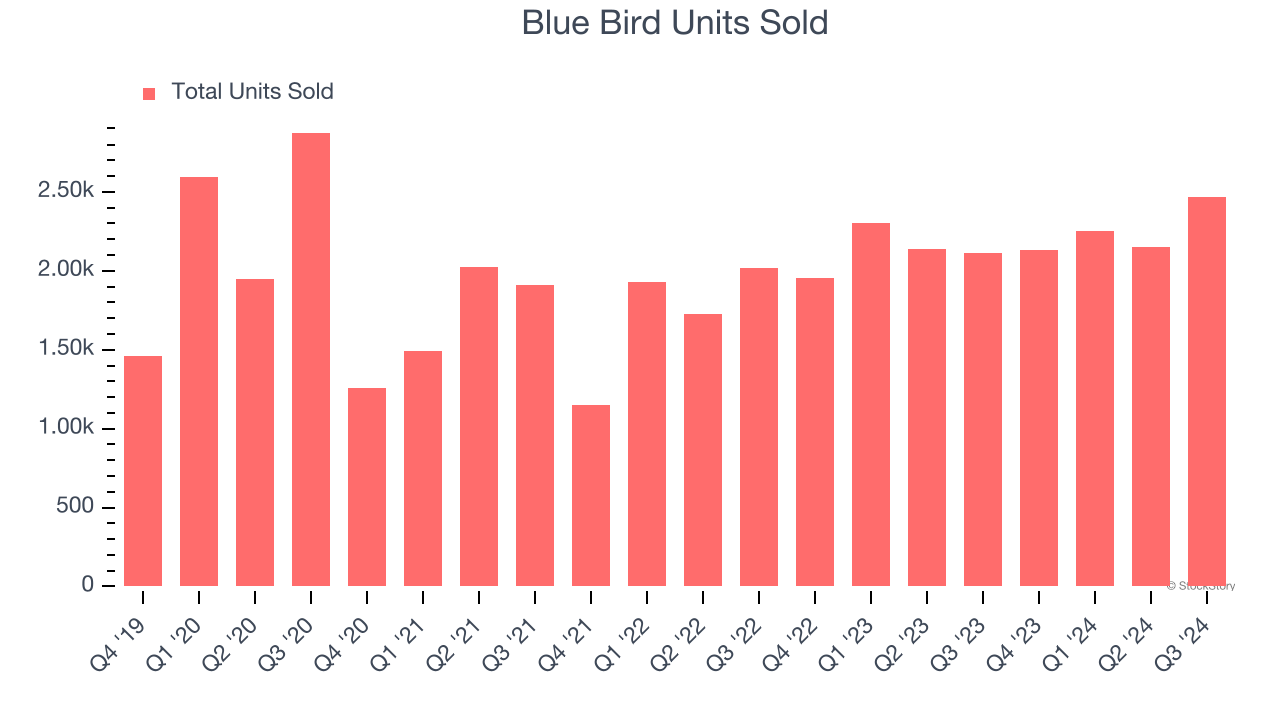

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Heavy Transportation Equipment company because there’s a ceiling to what customers will pay.

Blue Bird’s units sold punched in at 2,466 in the latest quarter, and over the last two years, averaged 17.8% year-on-year growth. This performance was fantastic and shows its products have a unique value proposition (and perhaps some degree of customer loyalty).

2. Increasing Free Cash Flow Margin Juices Financials

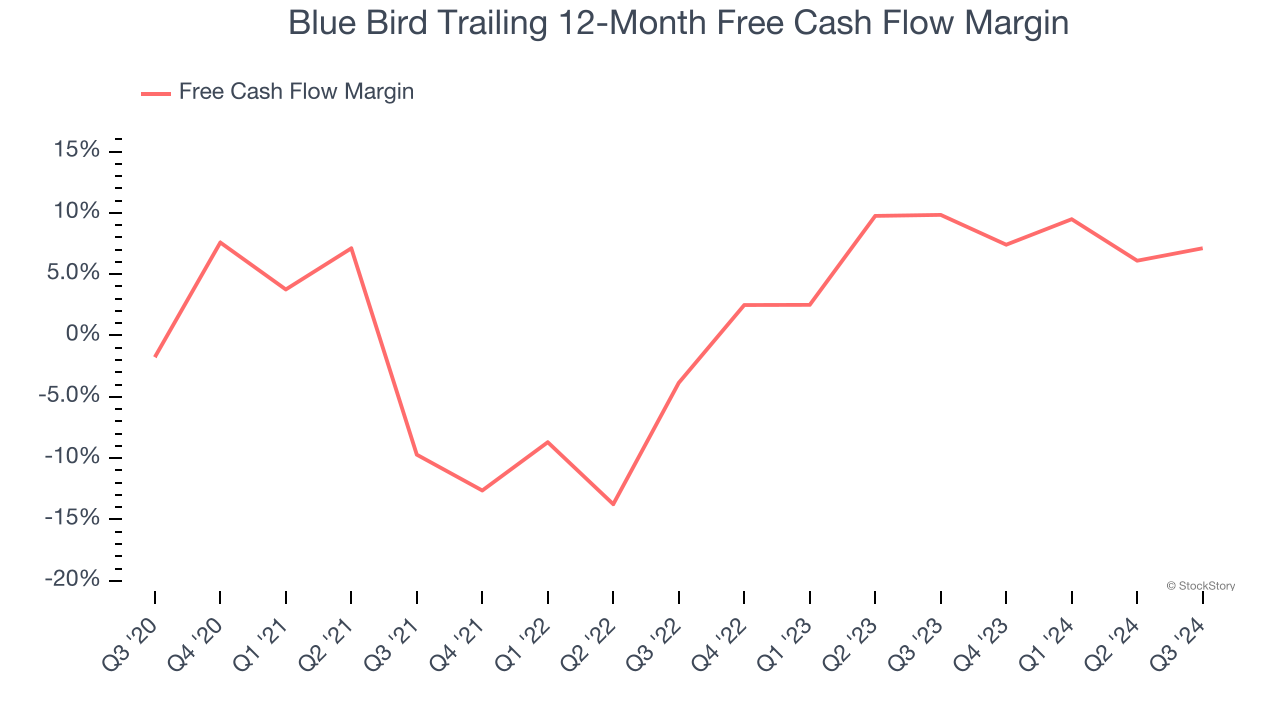

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Blue Bird’s margin expanded by 8.9 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose by more than its operating profitability. Blue Bird’s free cash flow margin for the trailing 12 months was 7.1%.

3. New Investments Bear Fruit as ROIC Jumps

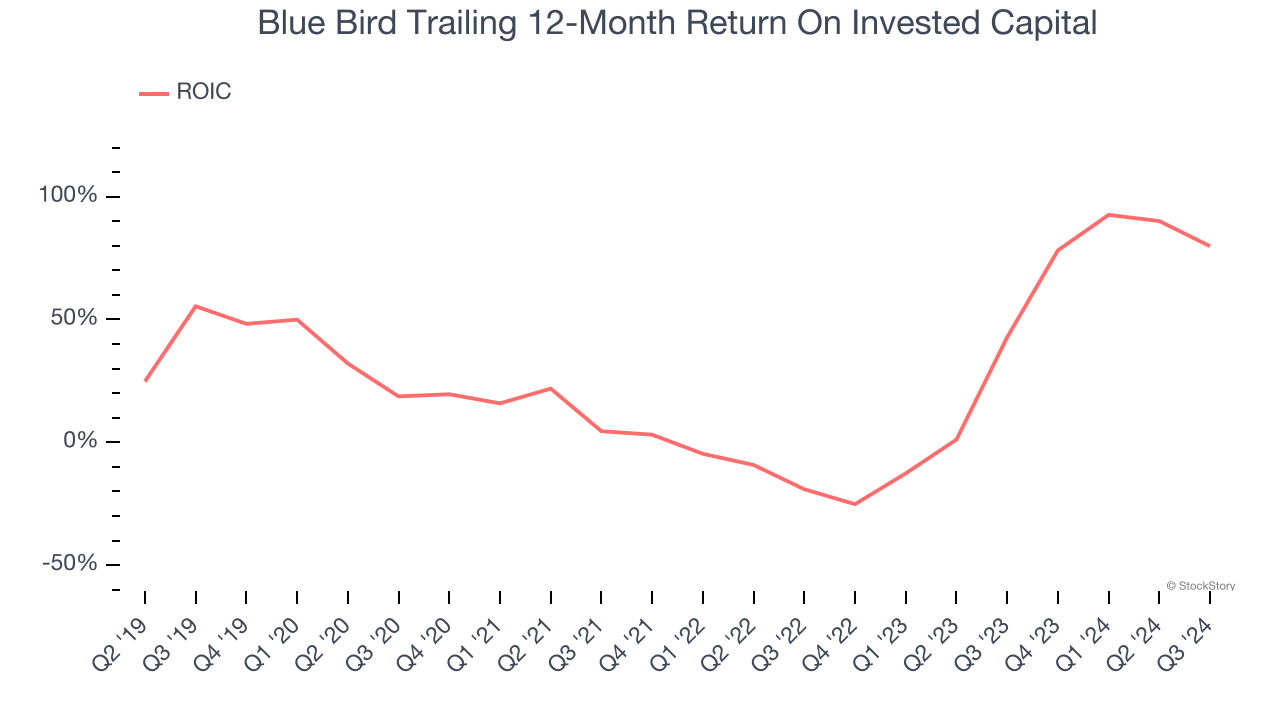

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, Blue Bird’s ROIC has increased significantly. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons Blue Bird is a high-quality business worth owning. After the recent drawdown, the stock trades at 10.2× forward price-to-earnings (or $38.64 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Blue Bird

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.