Stratasys has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 13.7% to $9.44 per share while the index has gained 8.8%.

Is there a buying opportunity in Stratasys, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We're swiping left on Stratasys for now. Here are three reasons why there are better opportunities than SSYS and a stock we'd rather own.

Why Do We Think Stratasys Will Underperform?

Born from the Founder’s idea of making a toy frog with a glue gun, Stratasys (NASDAQ: SSYS) offers 3D printers and related materials, software, and services to many industries.

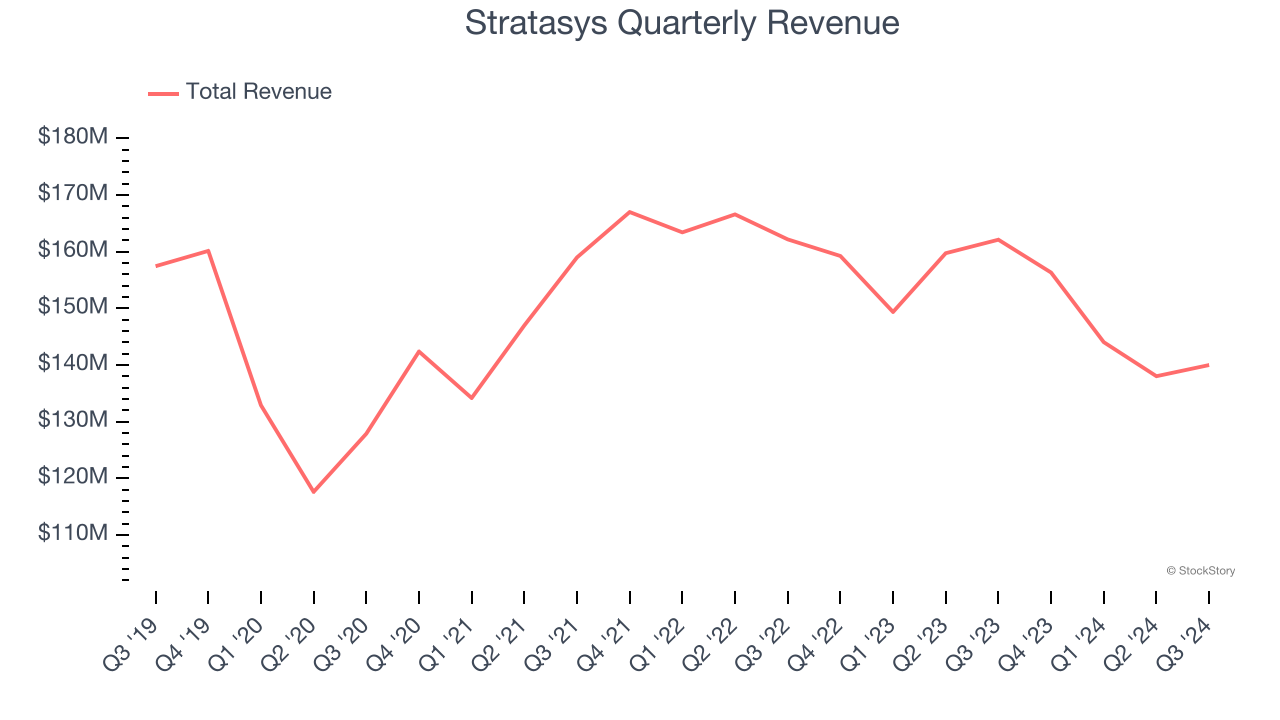

1. Revenue Spiraling Downwards

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Stratasys struggled to consistently generate demand over the last five years as its sales dropped at a 2.4% annual rate. This was below our standards and signals it’s a low quality business.

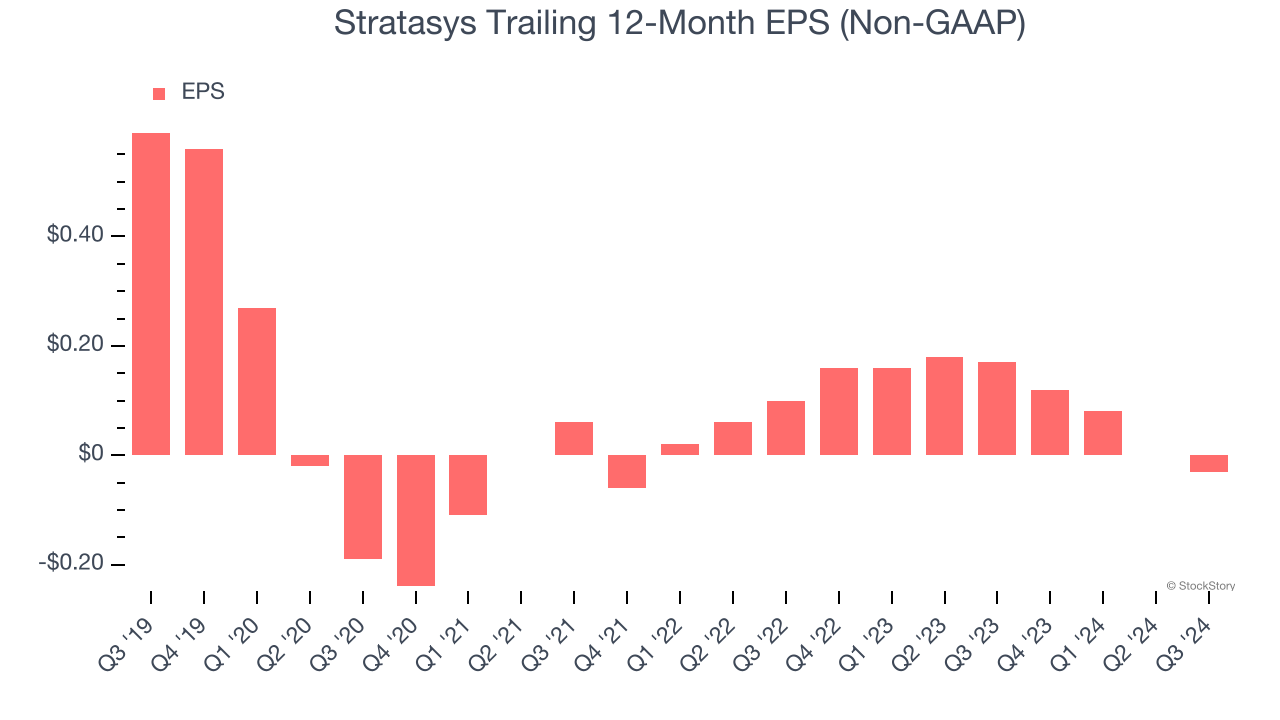

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Stratasys, its EPS declined by more than its revenue over the last five years, dropping 15.4% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

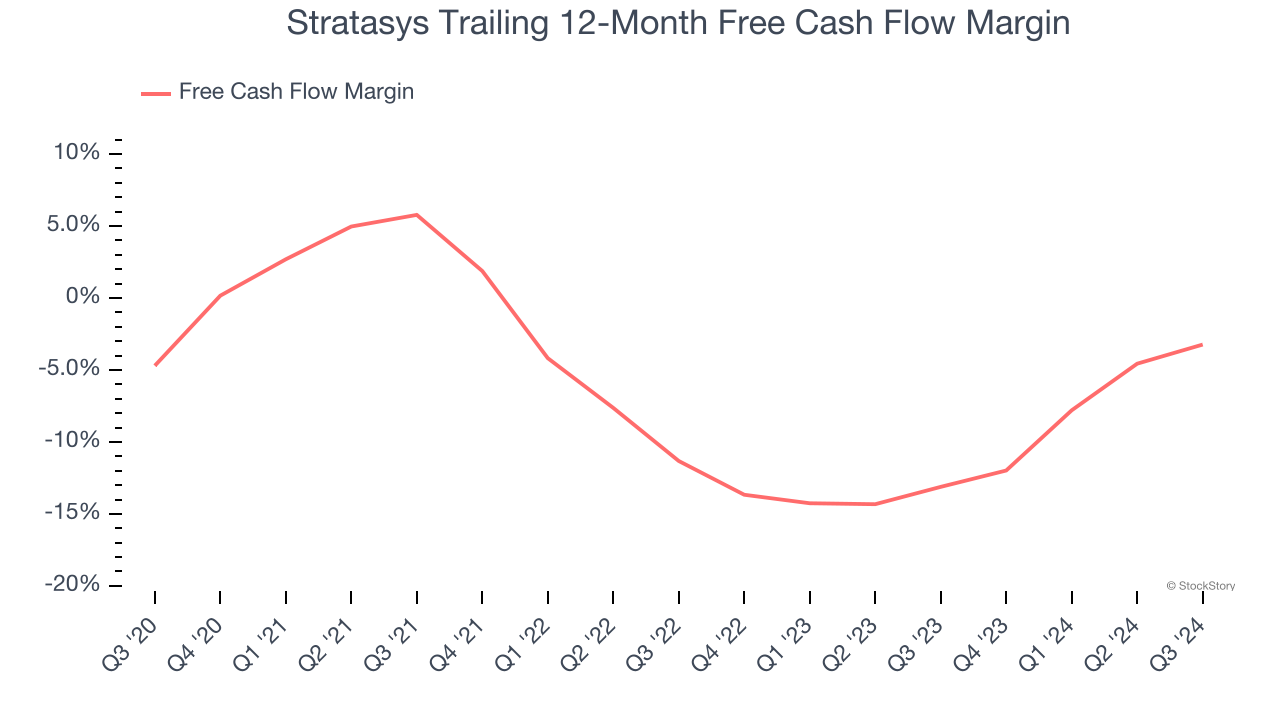

3. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Stratasys’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 5.6%, meaning it lit $5.61 of cash on fire for every $100 in revenue.

Final Judgment

Stratasys falls short of our quality standards. That said, the stock currently trades at 33.4× forward price-to-earnings (or $9.44 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Stratasys

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.