EverQuote’s stock price has taken a beating over the past six months, shedding 22.1% of its value and falling to $19.16 per share. This may have investors wondering how to approach the situation.

Is now the time to buy EverQuote, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Even though the stock has become cheaper, we don't have much confidence in EverQuote. Here are two reasons why EVER doesn't excite us and a stock we'd rather own.

Why Is EverQuote Not Exciting?

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

1. Long-Term Revenue Growth Flatter Than a Pancake

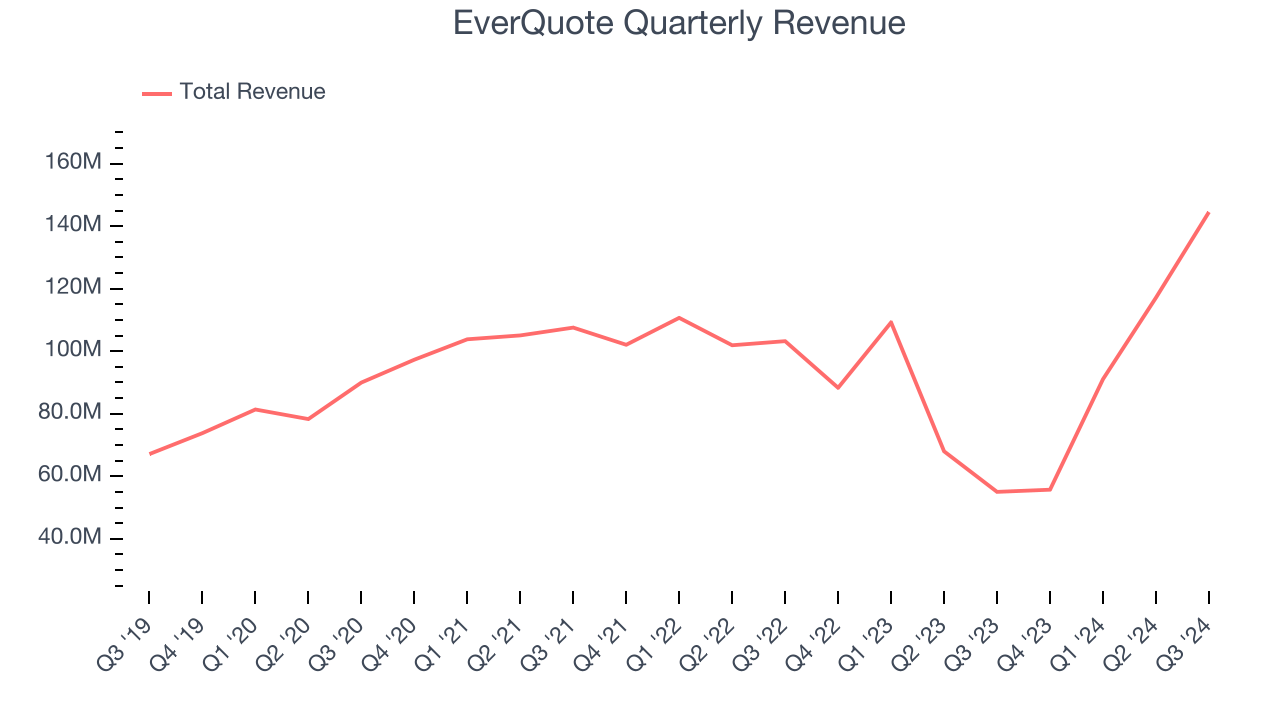

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, EverQuote struggled to consistently increase demand as its $408.4 million of sales for the trailing 12 months was close to its revenue three years ago. This fell short of our benchmarks and signals it’s a lower quality business.

2. Poor Marketing Efficiency Drains Profits

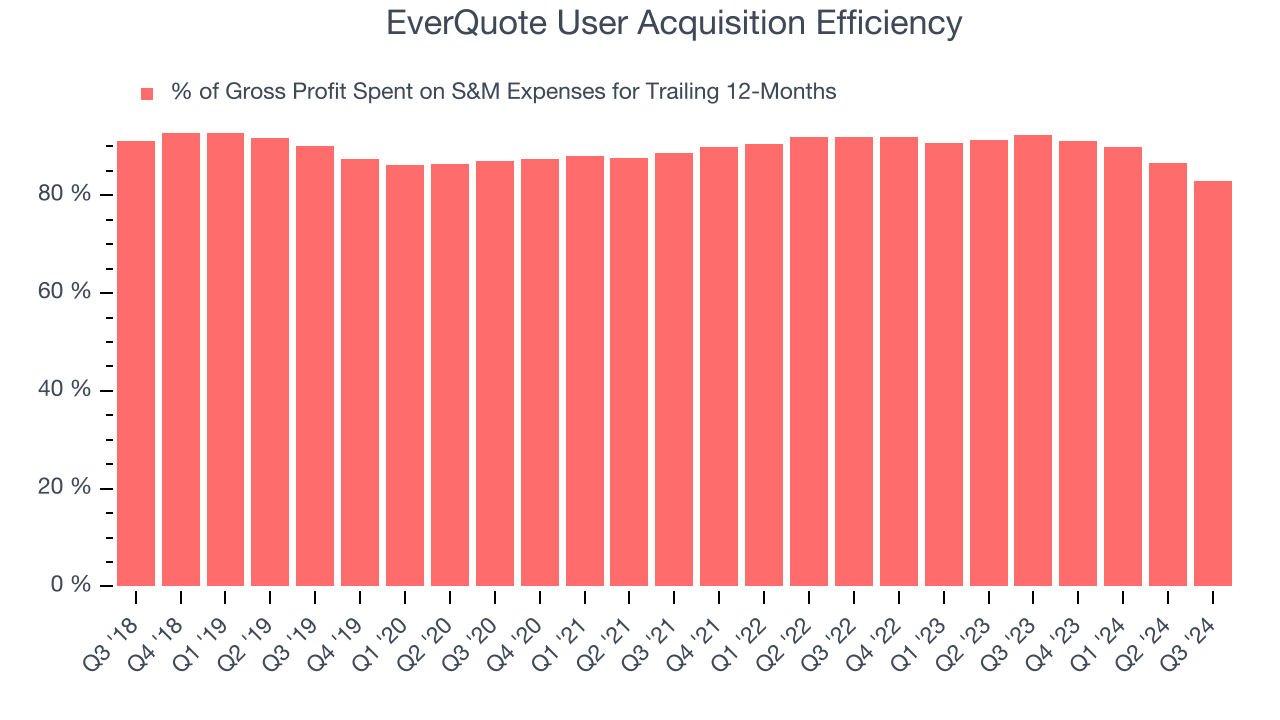

Consumer internet businesses like EverQuote grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s very expensive for EverQuote to acquire new users as the company has spent 82.9% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between EverQuote and its peers.

Final Judgment

EverQuote’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 11.6x forward EV-to-EBITDA (or $19.16 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. Let us point you toward MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Like More Than EverQuote

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.