Wrapping up Q3 earnings, we look at the numbers and key takeaways for the personal care stocks, including Olaplex (NASDAQ: OLPX) and its peers.

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 13 personal care stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.5% while next quarter’s revenue guidance was 10.6% below.

Luckily, personal care stocks have performed well with share prices up 11.1% on average since the latest earnings results.

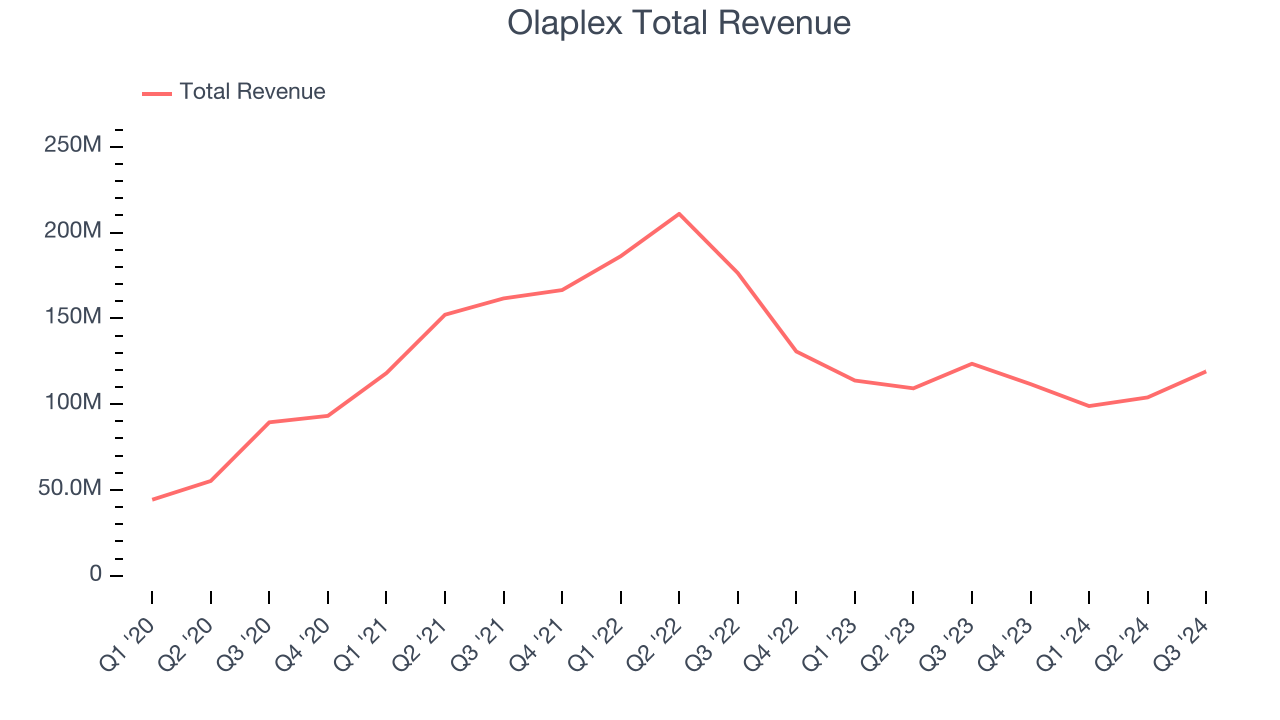

Olaplex (NASDAQ: OLPX)

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ: OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Olaplex reported revenues of $119.1 million, down 3.6% year on year. This print fell short of analysts’ expectations by 5.9%. Overall, it was a slower quarter for the company with full-year revenue guidance missing analysts’ expectations.

Amanda Baldwin, OLAPLEX’s Chief Executive Officer, commented: "This year has been dedicated to transformation and we continue to make strides on our plan to prioritize product innovation and the Professional community. While we have seen meaningful progress against our strategic goals, we have revised our outlook for fiscal year 2024 as the trajectory of our transformation has shifted, with a particular focus on the realignment of our international business. We continue to focus on initiatives aimed at building a healthier business, including new sales and marketing investments, and now with a best-in-class executive team at the helm. OLAPLEX remains an incredibly powerful brand, and we are more confident than ever in delivering consistent and sustained growth."

Olaplex delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. Interestingly, the stock is up 15.2% since reporting and currently trades at $2.05.

Read our full report on Olaplex here, it’s free.

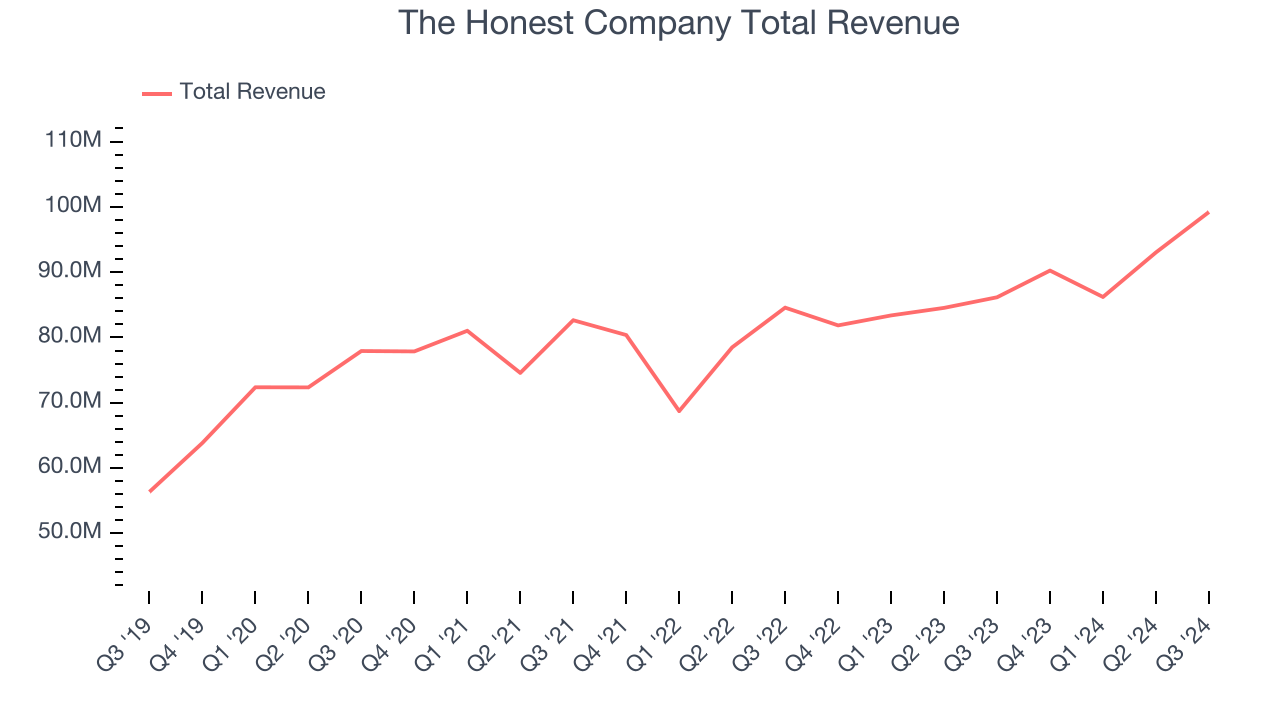

Best Q3: The Honest Company (NASDAQ: HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ: HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $99.24 million, up 15.2% year on year, outperforming analysts’ expectations by 6.9%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The Honest Company pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 77.1% since reporting. It currently trades at $8.50.

Is now the time to buy The Honest Company? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Nu Skin (NYSE: NUS)

With person-to-person marketing and sales rather than selling through retail stores, Nu Skin (NYSE: NUS) is a personal care and dietary supplements company that engages in direct selling.

Nu Skin reported revenues of $430.1 million, down 13.8% year on year, falling short of analysts’ expectations by 2.5%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Interestingly, the stock is up 17.2% since the results and currently trades at $7.55.

Read our full analysis of Nu Skin’s results here.

Herbalife (NYSE: HLF)

With the first products sold out of the trunk of the founder’s car, Herbalife (NYSE: HLF) today offers a portfolio of shakes, supplements, personal care products, and weight management programs to help customers reach their nutritional and fitness goals.

Herbalife reported revenues of $1.24 billion, down 3.2% year on year. This result missed analysts’ expectations by 1%. Zooming out, it was actually a strong quarter as it put up an impressive beat of analysts’ EPS and EBITDA estimates.

The stock is up 26.2% since reporting and currently trades at $8.63.

Read our full, actionable report on Herbalife here, it’s free.

Medifast (NYSE: MED)

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE: MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

Medifast reported revenues of $140.2 million, down 40.6% year on year. This result topped analysts’ expectations by 1.5%. Overall, it was a strong quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations.

Medifast had the slowest revenue growth among its peers. The stock is down 2.4% since reporting and currently trades at $18.32.

Read our full, actionable report on Medifast here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.