Cars.com has been treading water for the past six months, recording a small loss of 4.3% while holding steady at $18.50. The stock also fell short of the S&P 500’s 12.7% gain during that period.

Is there a buying opportunity in Cars.com, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're cautious about Cars.com. Here are three reasons why CARS doesn't excite us and a stock we'd rather own.

Why Is Cars.com Not Exciting?

Originally started as a joint venture between several media companies including The Washington Post and The New York Times, Cars.com (NYSE: CARS) is a digital marketplace that connects new and used car buyers and sellers.

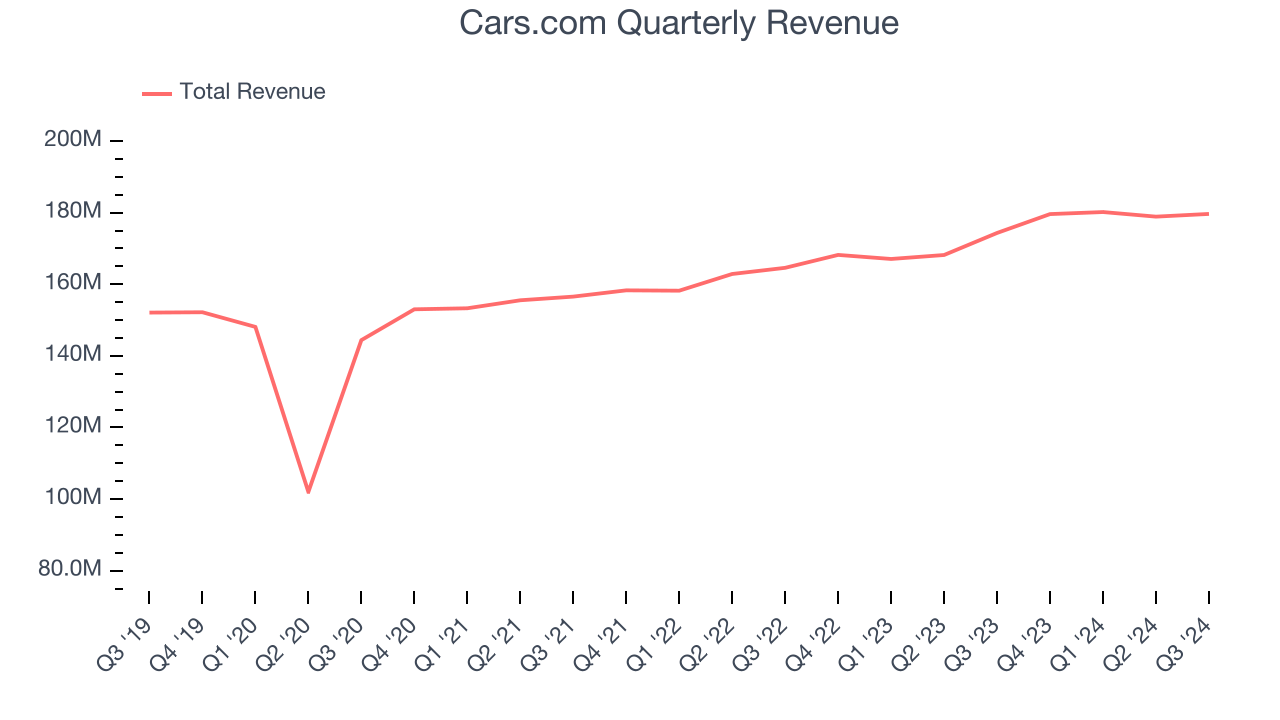

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Cars.com’s 5.1% annualized revenue growth over the last three years was sluggish. This fell short of our benchmark for the consumer internet sector.

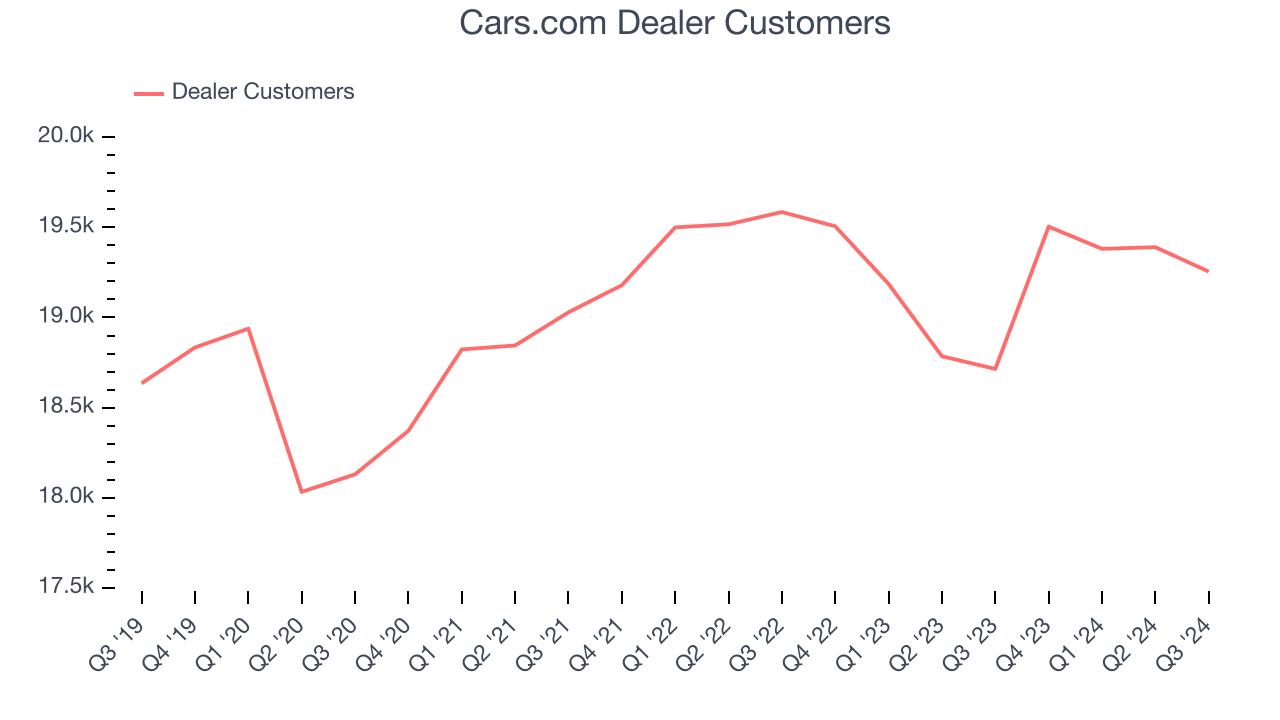

2. Dealer Customers Hit a Plateau

As an online marketplace, Cars.com generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Cars.com struggled to engage its dealer customers over the last two years as they have been flat at 19,255. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Cars.com wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Sell-side analysts expect Cars.com’s revenue to grow by 3.9% over the next 12 months, a slight deceleration versus its 5.1% annualized growth rate for the last three years. This projection is underwhelming and implies its products and services will face some demand challenges.

Final Judgment

Cars.com isn’t a terrible business, but it isn’t one of our picks. With its shares trailing the market in recent months, the stock trades at 6.2x forward EV-to-EBITDA (or $18.50 per share). While this valuation is optically cheap, the potential downside is still big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. Let us point you toward Wingstop, a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Cars.com

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.